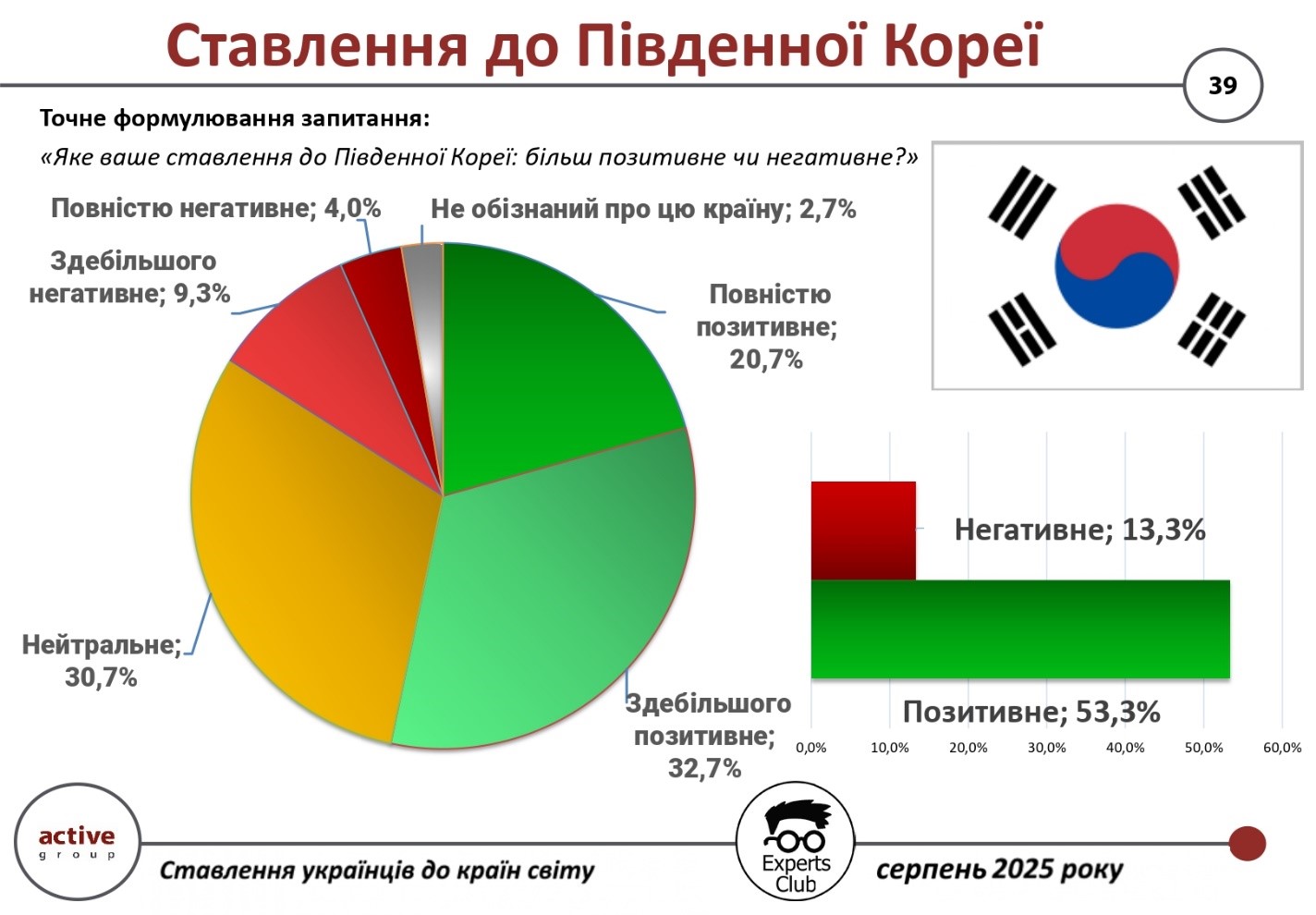

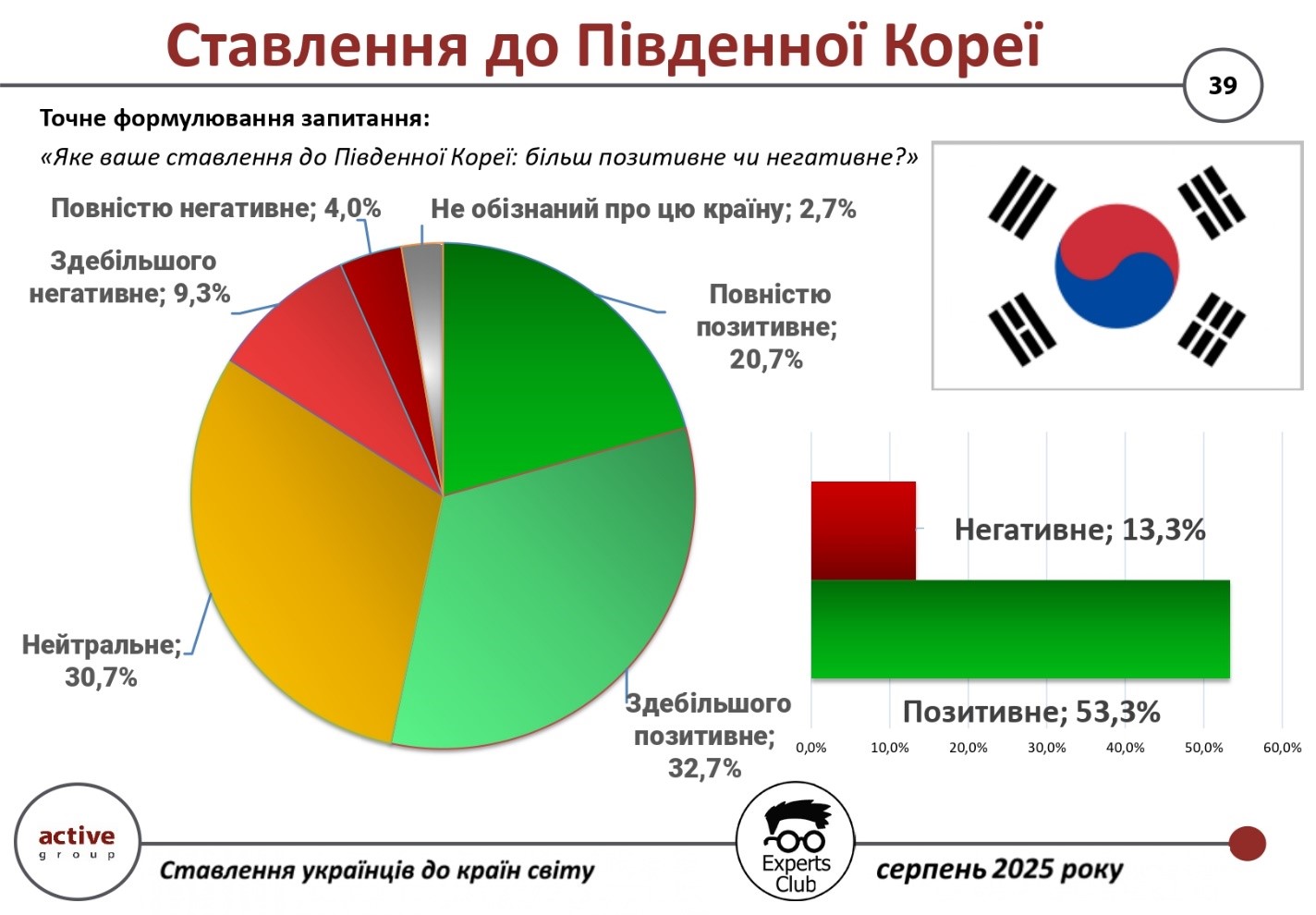

According to a survey conducted by Active Group in cooperation with Experts Club in August 2025, more than half of Ukrainians have a positive opinion of South Korea.

In total , 53.3% of respondents expressed favorable attitudes toward this country (32.7% – mostly positive, 20.7% – completely positive). A neutral attitude was recorded in 30.7% of respondents, and negative assessments amounted to 13.3%. Another 2.7% said they did not know enough about the country.

“South Korea is perceived by Ukrainians as a modern high-tech country that is developing dynamically and at the same time preserving its cultural identity. Ukrainians see it as a potential partner, especially in the field of technology, education, and innovation,” said Oleksandr Poznyi, CEO of Active Group.

At the same time, Maksym Urakin, co-founder of Experts Club, emphasized the economic dimension of bilateral relations:

“In the first half of 2025, the total trade turnover between Ukraine and the Republic of Korea amounted to more than $518 million. Exports of Ukrainian goods amounted to only $96.9 million, while imports amounted to more than $421 million. This resulted in a negative trade balance of $324 million. The situation demonstrates the need for more active promotion of Ukrainian goods to the Korean market, particularly in the agricultural and food sectors,” he emphasized.

The research is part of the systematic monitoring of Ukraine’s international relations and public opinion about its partners in the world.

The full video can be viewed here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, EXPERTS CLUB, Poznyi, SOCIOLOGY, SOUTH KOREA, TRADE, UKRAINE, URAKIN

1

1

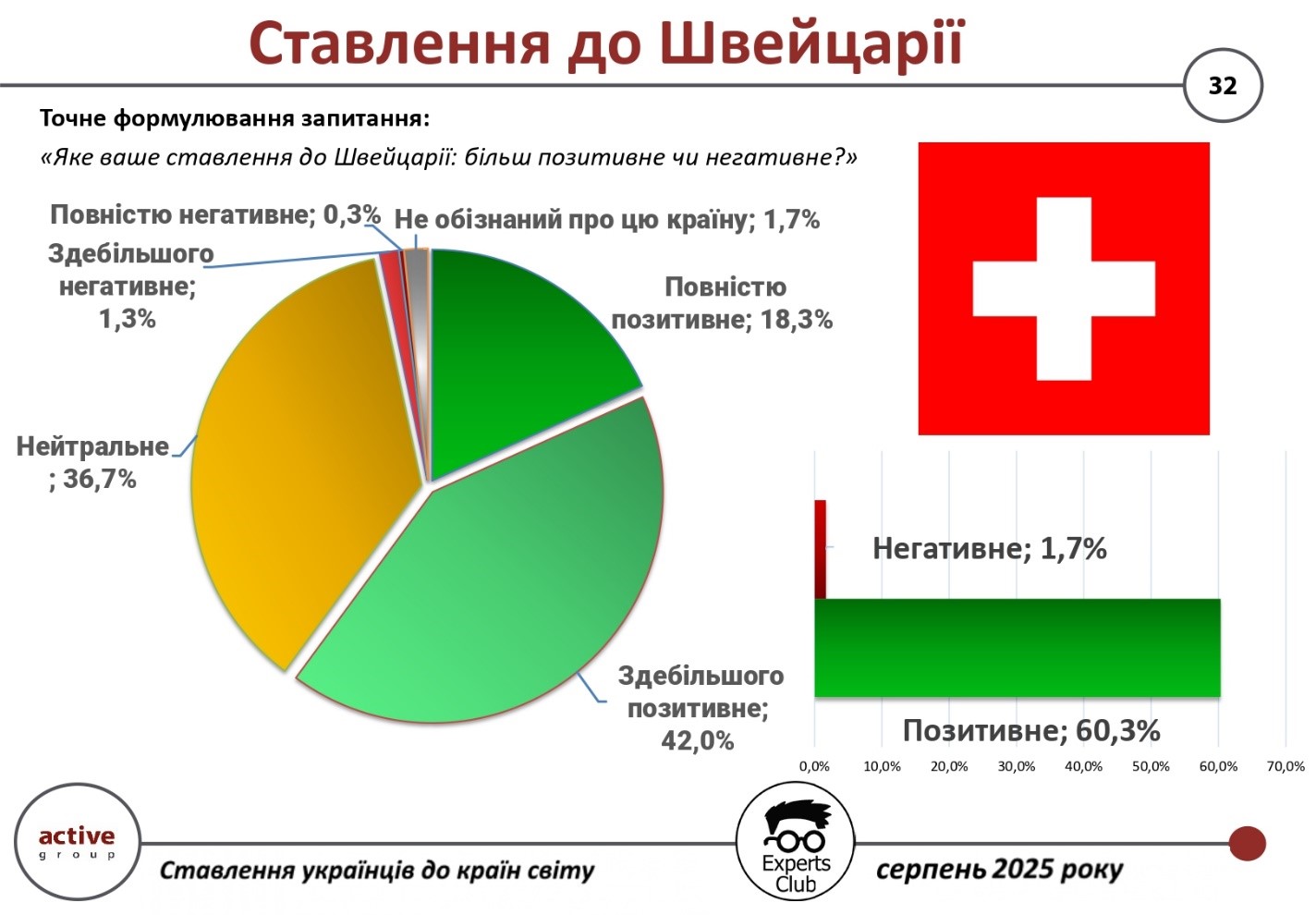

The majority of Ukrainians express a positive attitude towards Switzerland, although a significant number of respondents remain neutral. This is evidenced by the results of an all-Ukrainian sociological survey conducted by Active Group in cooperation with the Experts Club information and analytical center in August 2025.

According to the data, 60.3% of Ukrainians have a positive attitude towards Switzerland (42.0% – mostly positive, 18.3% – completely positive). Only 1.7% of respondents expressed a negative attitude (1.3% – mostly negative, 0.3% – completely negative). At the same time , 36.7% remain neutral, and 1.7% said they did not have enough information about the country.

“For Ukrainians, Switzerland is associated with reliability, stability and humanitarian support that the country provides in difficult times. The high level of trust reflects the positive image of Switzerland, despite its certain detachment from global politics,” commented Alexander Poznyi, co-founder of Active Group.

In his turn, Maxim Urakin, founder of Experts Club, focused on economic ties:

“In the first half of 2025, trade between Ukraine and Switzerland exceeded $928 million. At the same time, Ukrainian exports amounted to only $44 million, while imports from Switzerland reached almost $884 million. The negative balance of more than $839 million is significant, indicating Ukraine’s significant dependence on imports from this country,” he emphasized.

The survey was part of a broader program of research on international sympathies and antipathies of Ukrainians in the current geopolitical context.

The full video is available here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Poznyi, SOCIOLOGY, SWITZERLAND, TRADE, URAKIN

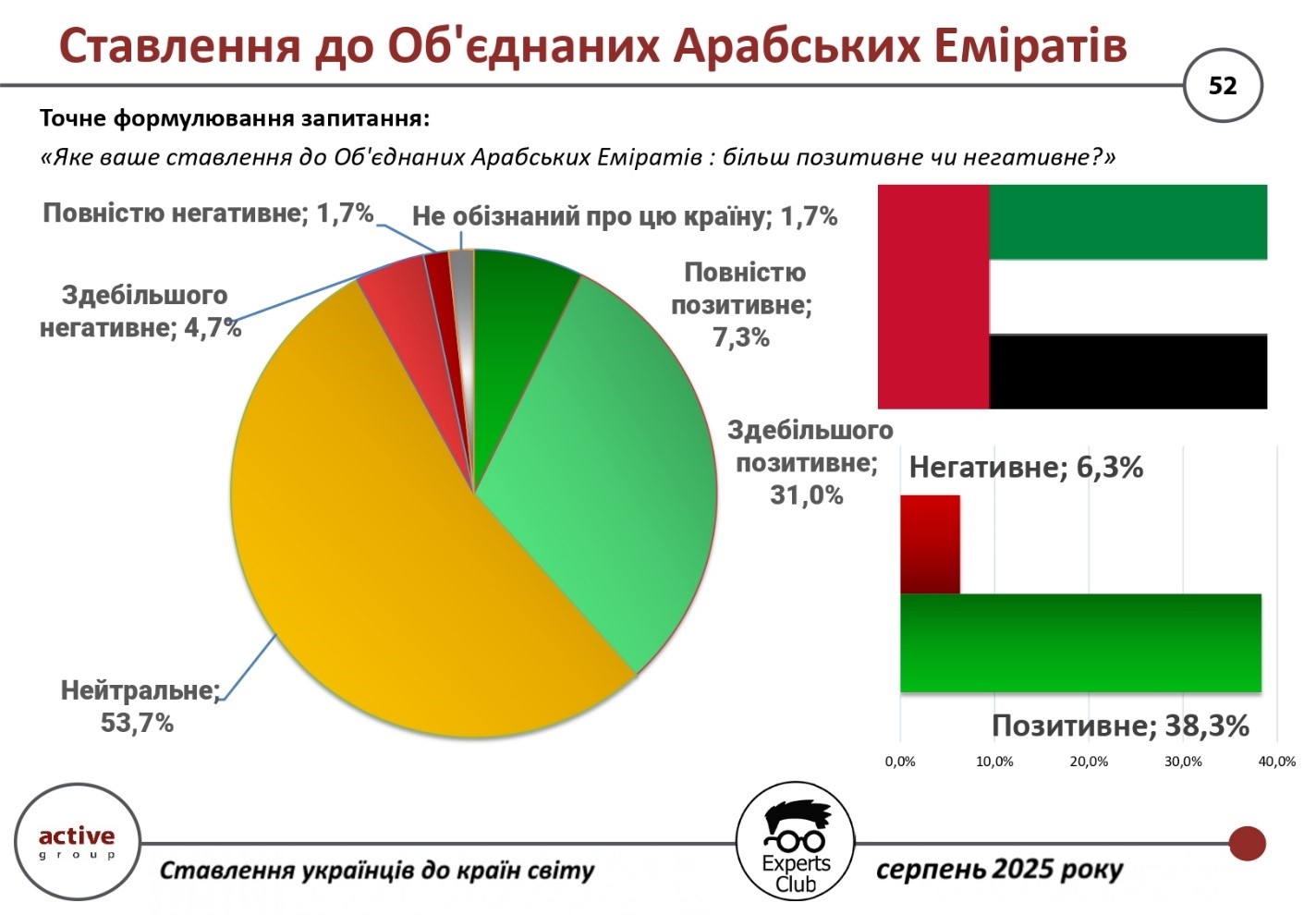

Ukrainians are mostly neutral about the United Arab Emirates (UAE), but among those who have a definite opinion, positive assessments significantly outweigh negative ones. This is evidenced by the results of a sociological study conducted by Active Group in collaboration with the analytical center Experts Club.

According to the survey, 53.7% of respondents took a neutral position on the UAE. At the same time, 38.3% of Ukrainians expressed a positive attitude (7.3% — completely positive, 31.0% — mostly positive). Only 6.3% of respondents had a negative opinion of the country (1.7% — completely negative, 4.7% — mostly negative). Another 1.7% responded that they were not familiar with this country.

“Ukrainians perceive the UAE as a modern country with a developed economy that attracts tourists and business. Despite the remoteness of the region, the country’s image remains consistently positive,” said Alexander Pozniy, head of Active Group.

In turn, Maksim Urakin, co-founder of Experts Club, emphasized the stability of trade and economic relations between Ukraine and the UAE:

“In January-August 2025, the total trade turnover between the countries amounted to $234.1 million. At the same time, exports from Ukraine to the UAE amounted to $173.2 million, while imports amounted to only $60.9 million. The positive balance for Ukraine reached $112.4 million, which makes cooperation with the Emirates beneficial for our economy.”

Thus, the United Arab Emirates remains a country with a moderately positive image among Ukrainians and demonstrates a stable surplus in trade relations with Ukraine.

The full video can be viewed at: https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here: https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, EXPERTS CLUB, Pozniy, SOCIOLOGY, TRADE, UAE, UKRAINE, URAKIN

A survey conducted by Active Group in collaboration with Experts Club in August 2025 revealed an exceptionally high level of positive sentiment among Ukrainians toward Sweden.

According to the results, 76.3% of respondents expressed favor toward this country: 41.3% rated it mostly positively, and another 35% rated it completely positively. A neutral position was taken by 21.3% of respondents, while negative assessments were minimal — only 2.3%.

“Ukrainians see Sweden as an example of stable democracy, a socially oriented state, and one of the most consistent allies in supporting Ukraine. This explains why this country is among the leaders in terms of positive perception,” emphasized Alexander Pozniy, head of Active Group.

At the same time, Maxim Urakin, co-founder of Experts Club, drew attention to the economic aspect.

“Despite the extremely high level of sympathy, trade between Ukraine and Sweden remains rather modest. At the end of the first half of 2025, bilateral trade amounted to only $418 million. Exports from Ukraine amounted to about $41 million, while imports of Swedish goods exceeded $376 million. This resulted in a significant negative balance of over $336 million. This means that Ukraine has the potential to intensify cooperation, especially in the fields of mechanical engineering and woodworking, where Sweden is one of the world leaders,” he stressed.

Thus, Sweden combines a high level of public support with new economic opportunities for Ukraine.

The full video can be viewed at:

You can subscribe to the Experts Club YouTube channel here:

ACTIVE GROUP, EXPERTS CLUB, Pozniy, SOCIOLOGY, SWEDEN, TRADE, UKRAINE, URAKIN

According to the results of a survey conducted by Active Group in collaboration with Experts Club in August 2025, more than half of Ukrainians have a positive opinion of South Korea.

In total, 53.3% of respondents expressed their favorability toward this country (32.7% — mostly positive, 20.7% — completely positive). A neutral attitude was recorded in 30.7% of respondents, while negative assessments accounted for 13.3%. Another 2.7% said they were not familiar enough with this country.

“South Korea is perceived by Ukrainians as a modern, high-tech country that is developing dynamically while preserving its cultural identity. Ukrainians see it as a potential partner, especially in the fields of technology, education, and innovation,” said Active Group CEO Oleksandr Pozniy.

At the same time, Maksim Urakin, co-founder of Experts Club, emphasized the economic dimension of bilateral relations:

“At the end of the first half of 2025, the total trade turnover between Ukraine and the Republic of Korea amounted to more than $518 million. Exports of Ukrainian goods amounted to only $96.9 million, while imports exceeded $421 million.

This resulted in a negative trade balance of $324 million. The situation demonstrates the need for more active promotion of Ukrainian goods on the Korean market, particularly in the agricultural and food sectors,” he stressed.

The study is part of the systematic monitoring of Ukraine’s international relations and public opinion regarding its partners in the world.

The full video can be viewed at: https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here: https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, EXPERTS CLUB, Pozniy, SOCIOLOGY, SOUTH KOREA, TRADE, UKRAINE, URAKIN

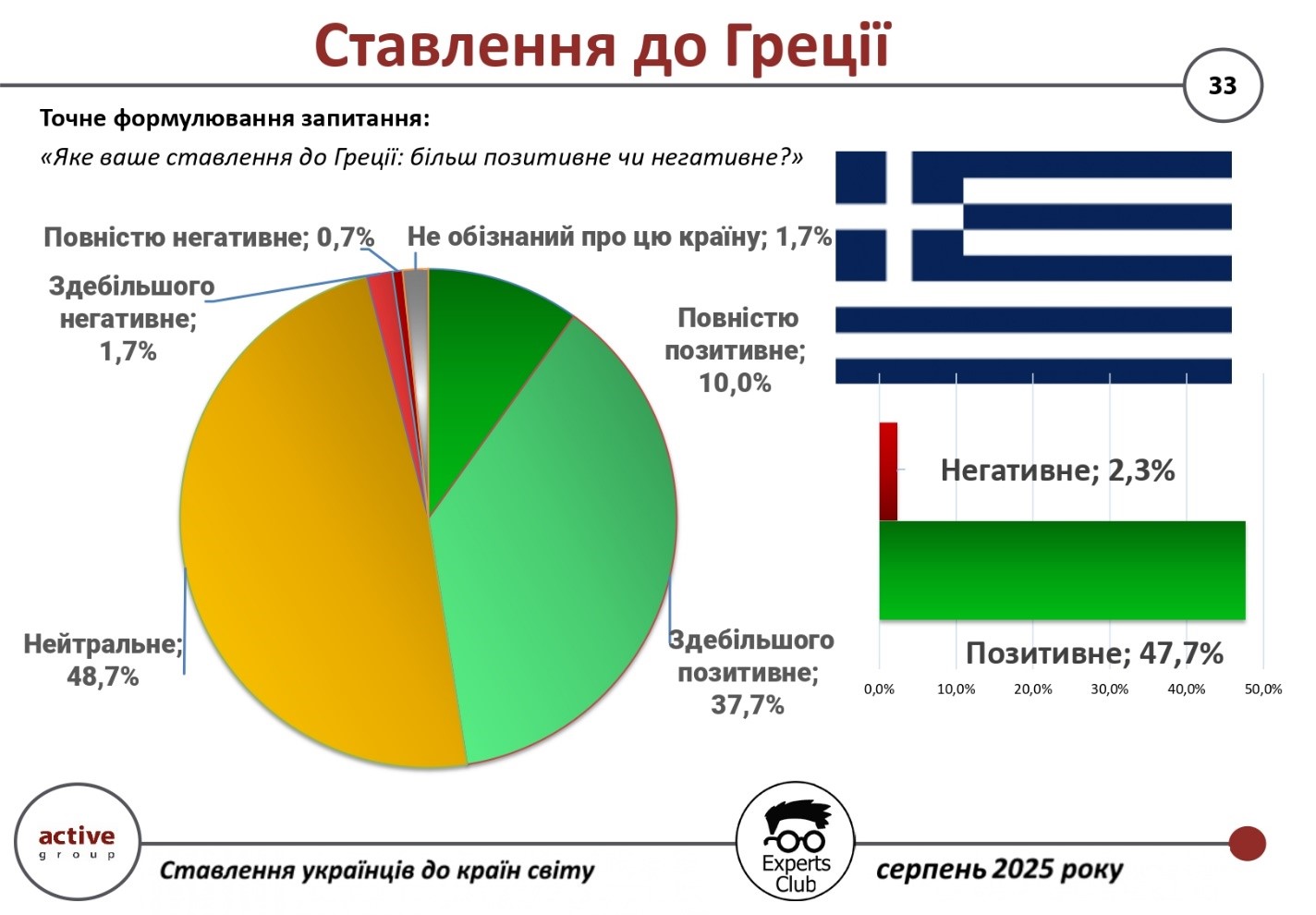

The attitude of Ukrainians towards Greece remains largely positive, although almost half of the respondents express a neutral position. This is evidenced by the results of a nationwide sociological survey conducted by Active Group in collaboration with the information and analytical center Experts Club in August 2025.

According to the study, 47.7% of Ukrainians have a positive attitude towards Greece (37.7% — mostly positive, 10.0% — completely positive). Only 2.3% of respondents rated the country negatively (1.7% — mostly negative, 0.7% — completely negative). At the same time, 48.7% of citizens remain neutral, and 1.7% admitted that they do not have enough information about this country.

“For Ukrainians, Greece is primarily associated with cultural heritage, tourism, and historical proximity to European traditions. This creates a generally positive image, although not as pronounced as in the case of Ukraine’s strategic partners,” commented Active Group co-founder Oleksandr Pozniy.

In turn, Maksim Urakin, founder of Experts Club, emphasized the economic aspect of the relationship:

“In the first half of 2025, trade turnover between Ukraine and Greece exceeded $784 million. At the same time, exports from Ukraine amounted to only $193.8 million, while imports from Greece reached over $590 million.

The negative balance of approximately $397 million indicates a significant trade imbalance, which is of strategic importance for the further development of bilateral economic relations,” he said.

The survey is part of a broader study analyzing the international sympathies and antipathies of Ukrainians in the current geopolitical context.

The full video can be viewed at: https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here: https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, GREECE, Pozniy, SOCIOLOGY, TRADE, URAKIN