Ukraine currently imports electricity from Europe around the clock at a maximum capacity of 1.6 GW during peak hours, which does not cover the maximum allowable import capacity due to grid restrictions.

This was announced by Anatoliy Zamulko, acting head of the State Energy Supervision Inspectorate of Ukraine (Derzhenergonadzor), on Thursday during the “Yedyni Novyny” telethon.

“The peak part of imports, depending on the situation, is 1.5-1.6 thousand MW, which is not yet the limit allowed to us by contracts with Europe. The only problem that remains today is network restrictions to push that electricity to eastern Ukraine,” he said.

As reported, the maximum agreed commercial capacity for imports from the EU from December 2024 is 2.1 GW. On average, in November 2025, the utilization of transmission capacity was 27.4%, but during peak evening consumption hours, it increases significantly.

“If we had the opportunity to restore that network infrastructure more quickly, we would certainly have much better opportunities to provide energy through imports,” said the head of the State Energy Regulatory Commission.

As he explained, with the current drop in temperature and the onset of frost in Ukraine, there has been an increase in energy consumption. To balance the energy system, transmission system operators (TSOs, regional power companies) together with regional military administrations are freeing up additional capacity for consumers by including facilities that were not previously subject to disconnection in consumption restriction schedules.

“We are fighting to mitigate the drop in temperature in various ways, including one of the effective tools that will be used throughout Ukraine, which is to take into account the facilities that are to be included in the schedules and increase the fairness that is being talked about in terms of distribution,” Zamulko said.

He stressed that the Ukrainian energy sector continues to function as a single entity.

“We remain a unified energy system, working in parallel with Europe, carrying out all transfers in accordance with the agreements reached with our partners, using import capacities and, if necessary, using emergency assistance,” said the head of the State Energy Regulatory Commission.

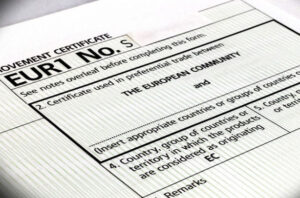

To support exports of Ukrainian goods, the State Customs Service issued 1.5 million EUR.1 certificates for transportation starting January 1, 2016, with exporters of agricultural products being the main recipients, according to the agency’s press service.

The State Customs Service reminded that the presence of a EUR.1 transport certificate exempts Ukrainian goods from import duties when imported into the EU, EFTA, Montenegro, the United Kingdom and Northern Ireland, Georgia, and Israel.

According to its data, during 2025, Ukrainian producers received EUR.1 certificates mainly for the export of goods of plant origin, sunflower oil, white sugar, chicken meat, and natural honey.

The largest number of such certificates was issued for the supply of products to Poland (24%), Germany (18%), Romania (8%), Italy (5%), and the Czech Republic (5%).

According to Serbian Economist, the next EU-Western Balkans summit is planned to be held in Montenegro on June 5, 2026, Montenegrin media reported, citing sources close to the country’s president’s office.

European Council President António Costa also said he expects the next meeting to take place in Montenegro in June 2026.

According to the Council of the EU, the EU-Western Balkans summits are attended by leaders of EU countries and EU institutions, as well as leaders of six partners in the region: Albania, Bosnia and Herzegovina, Kosovo, Montenegro, North Macedonia, and Serbia.

Commenting on the plans for 2026, Montenegrin President Jakov Milatović said that there are “high expectations” for the meeting in Montenegro in Brussels and that “it should be a summit of results,” first and foremost for Montenegro itself.

By that date, the European Union intends to begin work on an agreement on Montenegro’s accession to the EU.

Regular EU-Western Balkans summits have been held since 2018; the previous summit took place in Brussels in December 2024.

Source: https://t.me/relocationrs/1973

Transmission system operators (TSOs) of Ukraine, Slovakia, Hungary, and Romania launched the first monthly auctions for the allocation of cross-border capacity on Monday, according to Ukrenergo.

They are being held on December 15-17 on the Joint Allocation Office (JAO) platform with delivery in January 2026. The final results of the auctions are to be announced on December 23. According to information on the JAO, the capacity of the interconnection with Hungary is 460 MW, with Romania and Slovakia – 172 MW each. No interconnection capacity is offered from Ukraine.

“Long-term auctions for the allocation of cross-border transmission capacity are definitely beneficial for the Ukrainian electricity market. In the context of massive Russian attacks on our energy system, we really need confidence in a stable supply of electricity imports every month,” commented Vitaliy Zaychenko, chairman of the board of Ukrenergo, whose words are quoted in the company’s Telegram message.

“We are grateful to our partners at ENTSO-E and the JAO auction platform, as well as our colleagues from the energy system operators of neighboring EU countries for their effective cooperation. We hope that it will continue and that annual auctions will also be introduced in the future,” said Zaychenko.

According to NEC, the introduction of such auctions was made possible thanks to cooperation with TSOs of neighboring countries and with the support of the European Network of Transmission System Operators (ENTSO-E). Work on the rules for long-term allocation for the EU’s external borders has been ongoing for the past two years.

“After these rules were approved by the national regulators of Ukraine, Slovakia, Hungary, and Romania, it became possible to allocate free capacity at inter-state crossings through monthly long-term auctions. For Ukraine, this means more effective price forecasting and, in the long term, a reduction in the cost of imported electricity,” Ukrenergo explained.

As noted in the report, on a global scale, monthly auctions contribute to closer integration of the Ukrainian and European energy markets and ensure greater stability of Ukraine’s integrated energy system.

As reported, with the start of a full-scale invasion, given the military risks, ENTSO-E agreed only to daily auctions for the distribution of inter-state cross-border capacity for import and export operations with electricity.

At the same time, traders and energy companies have repeatedly pointed out that the absence of long-term auctions, in particular monthly and annual ones, hinders the effective attraction of imported electricity.

In early December, Vitaliy Zaychenko, Chairman of the Board of NEC Ukrenergo, told Energorforma that he expects the first long-term (monthly) auctions for the distribution of inter-state crossings with Romania, Hungary, and Slovakia since the start of the war to be successful.

“I think these auctions will take place. The market is definitely waiting for long-term auctions. Therefore, I think that the entire proposed cross-border capacity will be sold,” he said.

“Unfortunately, there will be no auctions in Poland because the Polish transmission system operator does not give its consent,” added the head of Ukrenergo.

It should be noted that the auctions launched today are joint, i.e., they are held simultaneously by both operators. The TSO agreed on this mechanism in 2023, and so far, daily auctions have been held under it. Monthly auctions were previously held in Moldova and Poland (Dobrotvir-Zamosc crossing), where unilateral auctions are still in place instead of joint ones.

December is traditionally one of the most successful months for Ukrainian cheese producers in terms of sales, but in 2025, not all companies in the industry will be able to boast positive dynamics, according to the analytical publication Infagro.

“Although cheese consumption in Ukraine has likely increased, the main growth has been in imported products,” analysts noted, adding that this is due to the significant price advantage of European cheeses.

Importers purchase products in EU countries at a significantly lower price than they are produced in Ukraine, and experts predict that their cost will not increase in the near future.

The agency noted that cheese imports to Ukraine increased in November, although not as much as predicted. Imports were up 10% compared to October. Imports of “white” cheeses increased by 4%. At the same time, imports of processed cheeses decreased by 18%.

Experts hope that imports will grow more actively in December, as was the case last year.

They recalled that cheese consumption in Ukraine has not yet returned to pre-war levels, which complicates competition for domestic producers. According to analysts’ estimates, in 2025, sales of semi-hard cheeses on the domestic market will be 17% lower than in 2021. At the same time, the average Ukrainian, as before the war, consumes about 2 kg of such cheese per year, and about a quarter of this volume is European-made cheese.

“Exports of semi-hard cheeses from Ukraine remain half the size of imports. At the same time, export prices exceed import prices. In November, exports of processed cheese products also fell sharply to their lowest level since the beginning of the year,” Infagro reported.

In January–November 2025, Ukraine increased its imports of electric generators and rotating electrical converters by 3.2 times compared to the same period in 2024, to $1.513 billion, according to data from the State Customs Service.

The most active suppliers were countries of the European Union. The leaders were Romania — $321.6 million (21.3% of total imports), the Czech Republic — $271.2 million (17.9%), and Poland — $189.1 million (12.5%). For comparison, a year ago, the largest exporters of generator equipment to Ukraine were China (24.2% or $115 million), Turkey (18.5%), and the Czech Republic (15.6%).

In November 2025, generator imports grew by 27.2% compared to November 2024, reaching $116.4 million, but were 38% lower than in October.

Exports of Ukrainian electric generators for 11 months amounted to only $3.6 million (a year earlier — $1.6 million), with the Czech Republic, Latvia, and Bulgaria being the main destinations.

The growth in imports is linked to ongoing programs to strengthen energy security and backup power supply, as well as the current exemption from customs duties and VAT on the import of electric generators, introduced by the Ukrainian government in the summer of 2024.