Interstellar object 3I/ATLAS, also designated comet C/2025 N1 (ATLAS), did not “disappear,” but became difficult to observe for several weeks due to its geometry: after a period of visibility for ground-based telescopes, it passed too close to the Sun in the sky, and then reappeared “on the other side of the Sun,” opening a new window for observation.

As noted by NASA and the European Space Agency (ESA), 3I/ATLAS is the third confirmed interstellar object discovered in the Solar System, after Oumuamua (2017) and 2I/Borisov (2019).

The comet was first recorded on July 1, 2025, by the ATLAS system in Chile.

The closest approach of 3I/ATLAS to Earth is expected on December 19, 2025, at a distance of about 270 million km (approximately 1.8 AU). ESA separately emphasizes that at the moment of maximum approach, the object will be on the other side of the Sun relative to Earth and will not pose a threat to the planet.

The key “latest” scientific highlights are related not so much to the trajectory as to the physics of the comet. According to ESA, James Webb’s observations have already detected a set of components typical for comets in the coma, including water and carbon-containing compounds, and in late November-early December, the XRISM and XMM-Newton X-ray observatories registered diffuse X-ray glow around the nucleus – ESA calls 3I/ATLAS the first interstellar comet observed in the X-ray range.

A separate line of discussion in scientific popularization concerns “anomalies” such as non-gravitational acceleration and the unusual structure of the tail. Some studies interpret this as a normal consequence of gas and dust ejection (outgassing), which creates a small reactive thrust – these effects are characteristic of active comets and are used in models of their motion.

3I/ATLAS is an interstellar active comet discovered on July 1, 2025. According to ESA data, its perihelion (maximum approach to the Sun) occurred on October 29, 2025, and its closest approach to Earth was on December 19, 2025. NASA estimates the upper limit of the nucleus diameter to be 5.6 km, although the actual size may be significantly smaller.

The leadership of the Ukrainian Red Cross (URC), the chairman of the board of ArcelorMittal, and representatives of the Luxembourg Red Cross discussed the issue of attracting resources for the implementation of joint humanitarian projects.

“During a working visit to Luxembourg, I met with Michel Würth, Chairman of the Board of ArcelorMittal, and representatives of the Luxembourg Red Cross at ArcelorMittal’s headquarters. We discussed opportunities for future cooperation in Ukraine and attracting resources for joint humanitarian and research initiatives,” UKK CEO Maxim Dotsenko said on Facebook on Thursday.

According to Dotsenko, for the Ukrainian Red Cross, international partnerships are about trust, shared responsibility, and real support for people affected by the war.

“It is thanks to such interactions that we can strengthen our assistance where it is most needed,” Dotsenko said.

The cost of 12 lean dishes for the 2025 Christmas table is 913.57 UAH, which is 11% more than last year, according to the Ukrainian Agribusiness Club (UACB)

“Food prices on the eve of the Christmas holidays show mixed trends: thanks to a record drop in vegetable prices, the cost of some traditional dishes has decreased, but the total cost of the Christmas table has increased due to the rise in prices for fruit, fish, and groceries,” the association explained.

Analysts noted that a distinctive feature of this winter season was “vegetable deflation.” Thanks to a good harvest, prices for vegetables used in borscht have fallen significantly: cabbage has fallen in price by 73%, carrots by 63%, onions by 58%, potatoes by 54%, and beets by 51%. This has led to significant savings in the preparation of dishes such as cabbage dumplings (their cost has fallen by 47%), potatoes with garlic (-40%), and vinaigrette (-18%). Even lean borscht will cost 18% less this year than last year.

At the same time, the main symbols of the Christmas table – kutia and uzvar – have noticeably increased in price, according to the UACB. The kutia index rose by 37%. This is due to the rise in prices of all its components: nuts jumped in price by 60%, honey by 40%, and poppy seeds and raisins by more than 30%. The ingredients for uzvar led the way in terms of price growth: prunes rose in price by 168%, dried pears by 140%, and apples by 110%, which led to a 150% increase in the price of the drink.

Fish dishes also became more expensive: the cost of herring rose by 24%, and fish (hake) for baking – by 25%. In addition, the final cost of dishes is influenced by sunflower oil, which is a basic element of the Lenten table and has risen in price by 22% over the year.

As for meat dishes (for those who do not observe Lent or are already preparing for the New Year), their preparation is more expensive than last year. Baked pork neck will cost 7% more (330 UAH/kg). Lard is outpacing the growth in meat prices – over the year, the product has increased in price by 16% and costs 272 UAH/kg. The cost of meat borscht has increased by 27%, reaching 196 UAH, with pork ribs accounting for over 60% of the price (119.5 UAH per 500 g). Chicken prices are rising due to the increase in feed costs, while pork prices are stabilizing due to imports.

Sliced cheese will be one of the most expensive items on the New Year’s table—700 UAH/kg, which is 40% more than last year. Despite the general trend of declining wholesale prices for raw milk, producers are maintaining high prices for cheese and butter due to expensive energy resources. Eggs, which are essential for Olivier salad, rose by 10% compared to the same period last year and reached 81.6 UAH per dozen, according to the UACB.

Members of the American Chamber of Commerce in Ukraine (AmCham Ukraine) have elected a new Board of Directors for 2026, the Chamber announced. The election results were published on the Chamber’s website.

Olena Kosharna (Horizon Capital) was elected Chair of the Board of Directors. The co-chairs are Alexander McWorter (Citi), Arvid Türkner (EBRD, Ukraine and Moldova), and Serhiy Martynchuk (Cisco). Andriy Tsymbal (KPMG) was appointed treasurer, and Serhiy Chorny (Baker McKenzie) was appointed legal advisor.

The Board of Directors also includes Yulia Badritdinova (McDonald’s in Ukraine, the Czech Republic, and Slovakia), Vasyl Bovdilov (Unilever), Natalia Chervona (Shield AI), Oleg Haidakyn (Carlsberg), Mykhailo Kharenko (Sayenko Kharenko), Olga Kosinova (Procter & Gamble), Taras Panasenko (Aurora multi-market chain), Petro Rondiak (Winner Group), Tetiana Stavytska (Coca-Cola), and Vasile Varvora (Cargill).

The AmCham Ukraine Board of Directors is elected annually in a two-stage process consisting of candidate nomination and electronic voting, with the newly elected members announced at the Chamber’s annual general meeting.

The American Chamber of Commerce in Ukraine has been operating since 1992 and brings together more than 600 member companies—American, international, and Ukrainian. According to the Chamber’s reports, member companies have invested more than $50 billion in Ukraine.

In 2025, the Ternopil cereal factory EKOR TZ LLC modernized its production and installed a line for the production of six types of instant cereals, the company’s press service reported on Facebook.

“The company is launching a line for the production of six types of cereals, which was implemented in cooperation with the Ukrainian equipment manufacturer OLIS with the support of partners from USAID Agro,” the statement said.

The new production line will produce wheat, buckwheat, barley, pea, and two types of oat cereals.

“For us, this is not just a new production line—it is a strategic step towards the development of the Ukrainian processing sector. We want to show that it is possible to manufacture European-level products in Ukraine using domestic raw materials and modern technologies,” said Volodymyr Didenko, director of EKOR TZ LLC, whose words are quoted in the press release.

Basis equipment is used at the cereal packaging stage. Additional equipment has been installed to control weight and a metal detector to prevent metal objects from entering the product. Product quality is checked at every stage of production.

The company intends to expand its cereal business in 2026 and will produce cereal mixes: “5 grains” and “7 grains.” In addition, the company is currently exploring the prospect of producing energy bars and muesli and researching the equipment supplier market.

EKOR TZ LLC was established in 2021 in Ternopil. It specializes in the production of cereals for the flour milling industry, which it sells under the Ekor trademark. According to information on its website, the company annually produces 8,000 tons of buckwheat groats, 5,000 tons of wheat, barley, and pea groats, which are sold in Ukraine and exported to Canada, the US, Argentina, Brazil, Africa, India, China, and other countries.

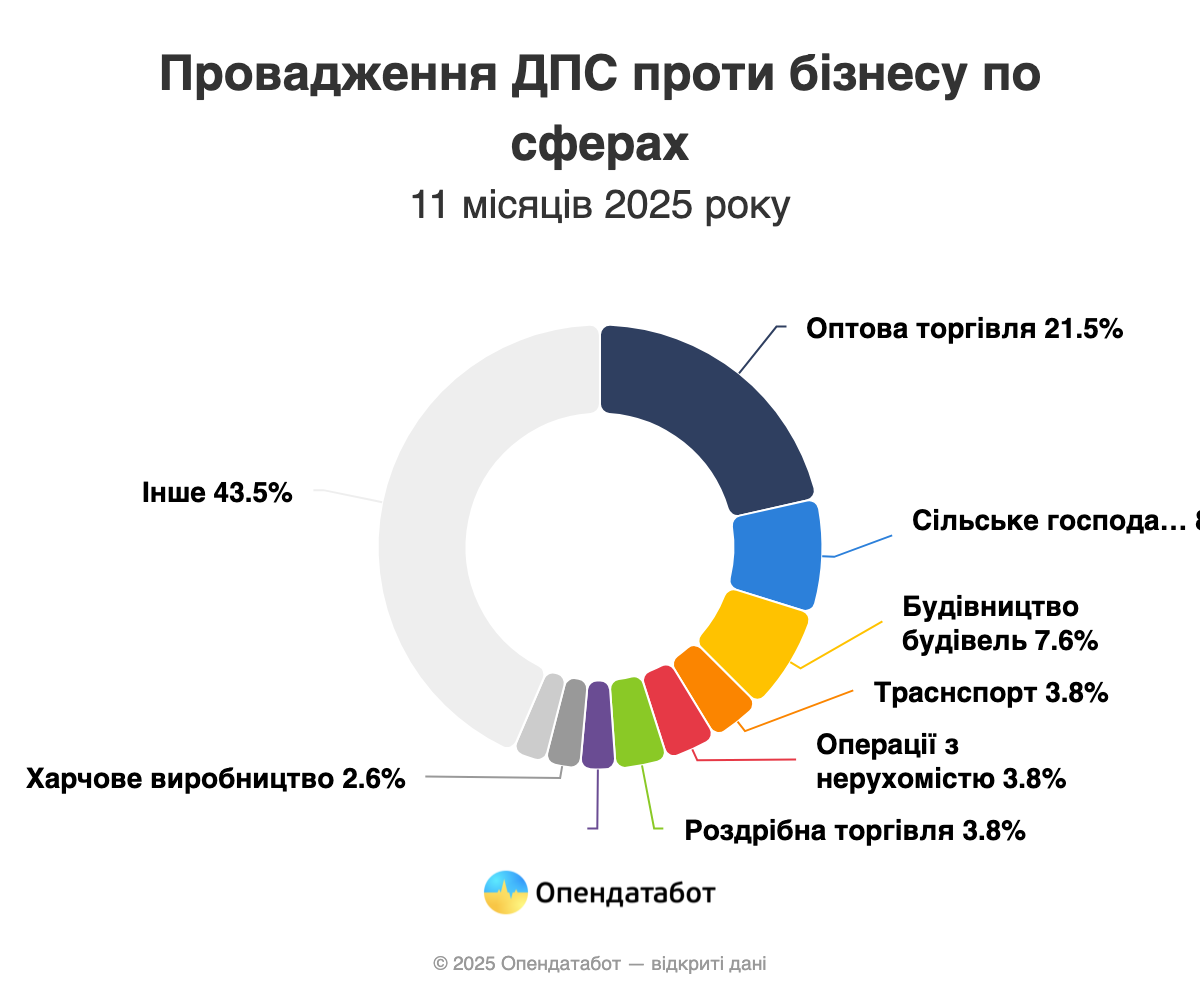

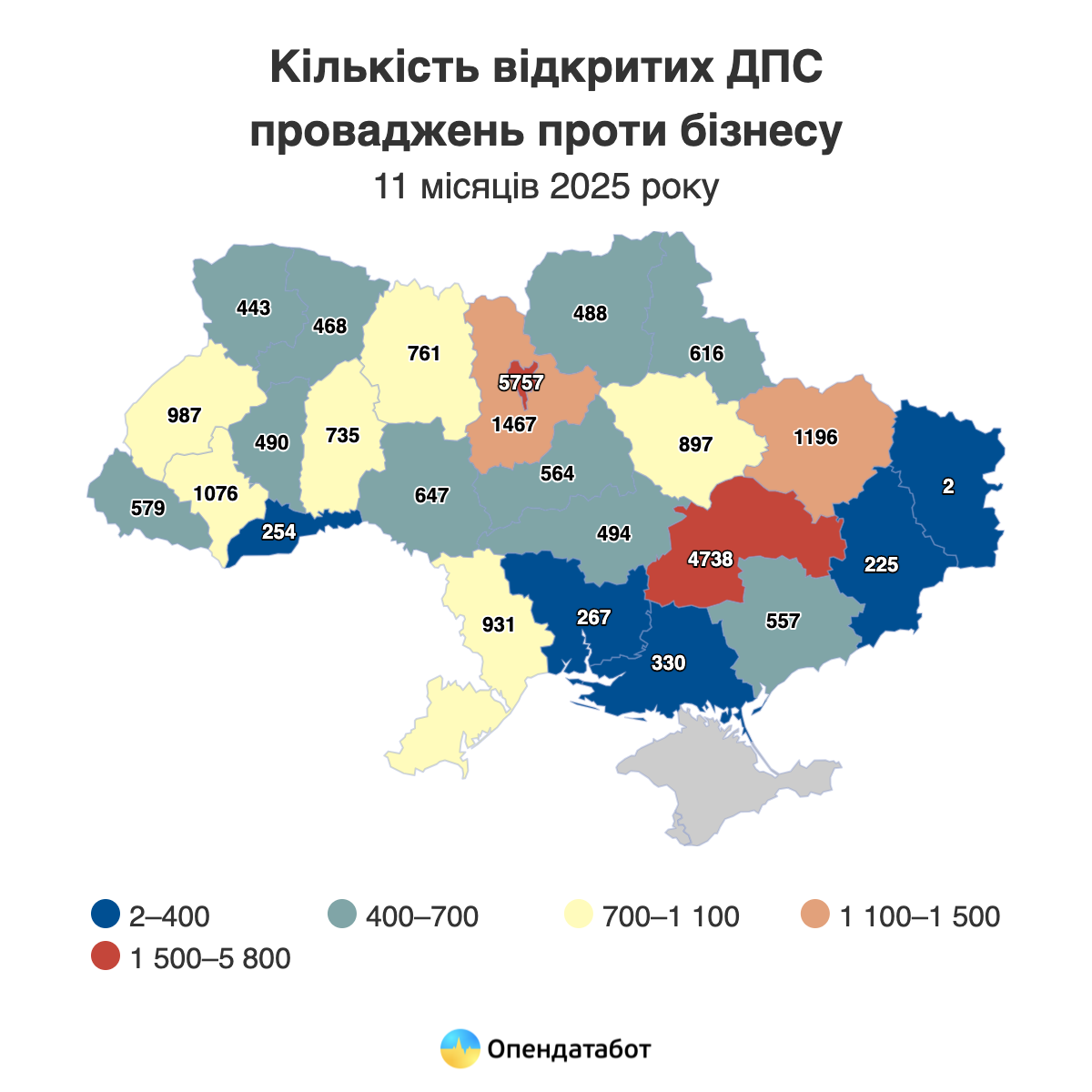

Over 25 thousand proceedings were opened by the State Tax Service against companies in 11 months of 2025. This is 35% more than before the start of the full-scale war. Most of these proceedings were opened in Kyiv, Dnipropetrovs’k and Kyiv regions. Every 5th proceeding this year was opened against businesses in the wholesale trade sector. Among the companies that have received comments from the State Tax Service are Derevtekhservice, Kravbud, the editorial office of the Kreminna city newspaper, and the Kryvbas football club. Myrhorod Bakery Plant No. 1 has accumulated the most proceedings over time.

The Tax Service opened 25,035 proceedings against companies this year. This is 1.7% less than last year, but 35% more than before the full-scale campaign. These are enforcement proceedings to collect fines, taxes and fees from businesses in favor of the State Tax Service.

One in four proceedings against businesses was opened in Kyiv this year – 5,757 cases from the Tax Service. Dnipropetrovs’k region is catching up with the capital: 4,738 proceedings. Kyiv region closes the top three with 1,467 proceedings.

The largest number of proceedings was opened by the Tax Service against businesses in the field of wholesale trade – 5,380 cases. The second place is taken by agriculture and hunting: 2,092 proceedings. The construction sector is next: 1,910 cases.

The leader among the companies against which the Tax Service has opened the most proceedings is the private enterprise Derevtechservice with 29 proceedings. It is followed by Kravbud (22), the editorial office of the city newspaper Kremin (20) and the Kryvbas football club (17).

It should be noted that not all proceedings are visible now – some have already been settled, so they have disappeared from the list. If we look at active proceedings, i.e. those that were opened a long time ago but have not yet been closed, the absolute leader here is Myrhorod Bakery No. 1 with 79 active proceedings. It is followed by Kvarsit (40) and Lers (39).

The highest number of active proceedings is currently in Kyiv (4,157), Dnipropetrovs’k region (3,931) and Kharkiv region (1,418).