Domestic prices for Ukrainian sugar continue to fall due to trade restrictions imposed by the European Union, and wholesale prices from factories may drop to 18-19 UAH/kg, according to the analytical cooperative “Pusk”, created within the framework of the All-Ukrainian Agrarian Council (AAC).

“Ukrainian sugar remains mostly on the domestic market due to limited exports. Attempts to supply products to Turkey, Macedonia and other countries have not yet allowed to significantly unload stocks. Due to trade restrictions with the EU, which will last until 2025, Ukraine is facing difficulties in exporting sugar,” the analysts explained and added that this trend is likely to continue in the coming months.

According to experts, some factories in Ukraine have already started to reduce prices from the previous 21.50-22 UAH/kg to 21 UAH/kg. They expect that in September-October, prices may fall to 18-19 UAH/kg due to the oversaturation of the domestic market.

At the same time, the global sugar market shows a significant increase in prices due to a number of factors.

“Among the key reasons is a significant drought in Brazil, which has seriously affected sugar cane yields. The situation was further aggravated by large-scale fires that damaged 5 to 8% of the acreage. This has led to a significant increase in the cost of sugar on world markets,” Pusk stated.

During his working visit to New York, Ukrainian President Volodymyr Zelenskyy met with Finnish President Alexander Stubb to discuss the situation on the battlefield, Ukraine’s defense needs, and international cooperation.

According to the press service of the Ukrainian president, “the meeting discussed Ukrainian-Finnish defense cooperation, specifically the joint production of drones and the exchange of experience in this area.”

Zelenskyy noted that Ukraine needs air defense systems, including man-portable air defense systems. He also briefed his interlocutor on the current stage of implementation of the agreements reached during the NATO summit in Washington.

“Volodymyr Zelenskyy emphasized that it is important for Ukraine to obtain permission from its partners and the means to strike deep into Russian territory,” the press service reports.

The parties also discussed what international efforts are needed to achieve a lasting and just peace for Ukraine, as well as the role of the Global South in this process.

Novus Ukraine LLC, which operates the Novus supermarket chain, has made its debut issue of corporate bonds totaling UAH 400 million, secured by its own real estate in Kyiv, the company’s press service reports.

“The issue of corporate bonds is an important step towards raising funds in the stock markets. We are becoming more open and public for potential investors. This product will contribute to the development of Ukraine’s securities market, as it has no analogues at present. The issue is unique in that it is secured by the commercial real estate of Novus Ukraine Group, which significantly minimizes the risks for potential investors,” Nina Orlovska, Deputy CEO of Novus Ukraine, said in a press release.

According to the report, the company will issue bonds with a nominal value of one thousand UAH maturing within three years with an annual redemption option. The yield is 15% per annum, and the interest rate can be revised within a year.

In addition, the bonds are secured by commercial real estate in Kyiv with an area of more than 10 thousand square meters.

Univer Investment Group is the underwriter of the issue, and Integrities Law Firm is the mortgagee and administrator.

Novus Ukraine LLC was established in 2008 and opened the first Novus supermarket in the country the same year. As of September 2024, the retailer’s network includes more than 80 Novus and 22 Mi Markets in Ukraine.

The Novus supermarket chain is developed by BT Invest (Lithuania), a company established in 2008 by former Sandora shareholders Raimondas Tumenas and the late Igor Bezzub.

According to Opendatabot, the owner of Novus Ukraine with a 100% share in the authorized capital was CJSC Consul Trade House (Vilnius, Lithuania). The ultimate beneficiaries are Marina Poznyakova, Agne Ruzgienė, and Raimondas Tumenas.

According to the company’s financial results, in 2023, its revenue increased by 47% to UAH 23.6 billion, while its net loss decreased by 87% to UAH 310.7 million.

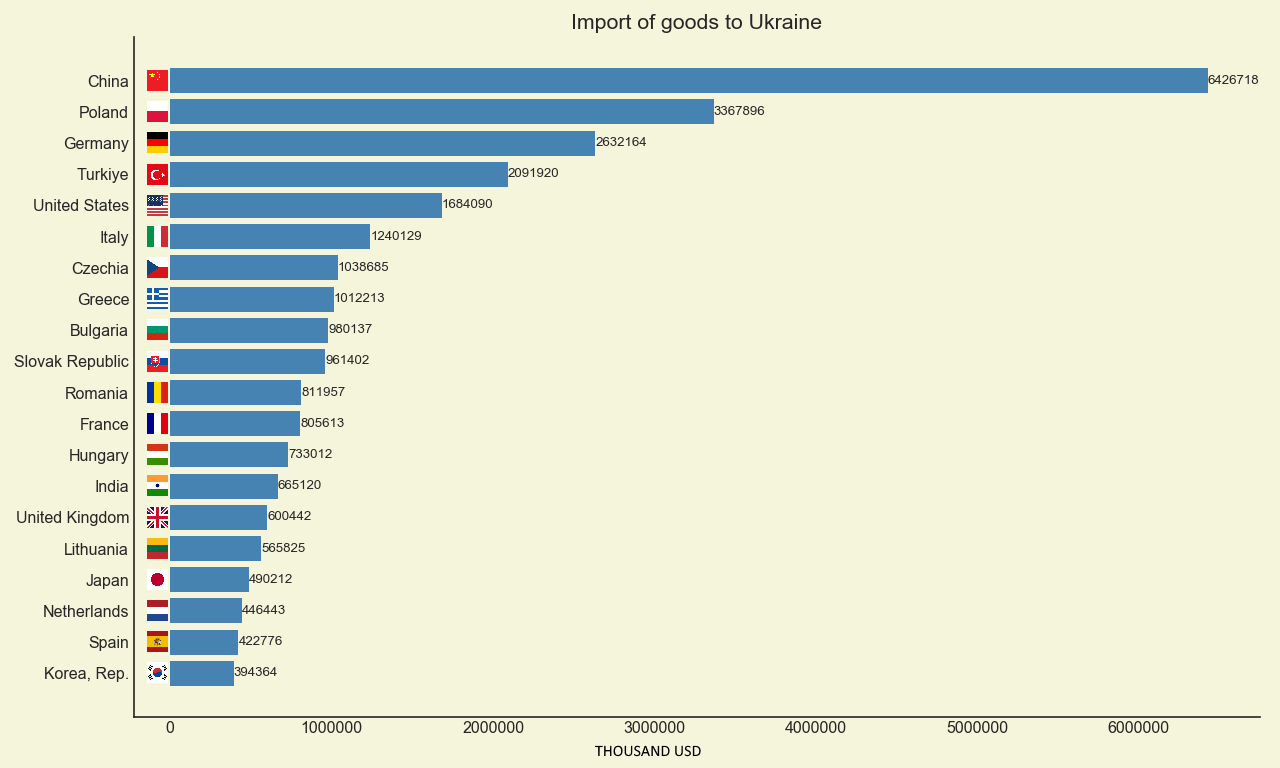

Geographical structure of Ukraine’s foreign trade (imports) in Jan-June 2024, thousand USD

Open4Business.com.ua

The Embassy of the Republic of Armenia in Ukraine hosted a reception on the occasion of the Independence Day of the Republic of Armenia at the Fairmont Hotel in Kyiv, which brought together representatives of diplomatic, cultural and business circles. This event not only emphasized the historical significance of the holiday, but also became an opportunity to discuss the current challenges and achievements of the country.

“While celebratingthe achievements of our past, we must also confront the current reality. Armenia is going through a difficult path, facing unprecedented challenges to regional peace and security, which remind us of the constant need for strength and unity,” said Ambassador Extraordinary and Plenipotentiary of the Republic of Armenia to Ukraine Vladimir Karapetyan.

The Ambassador also focused on Armenia’s economic achievements, emphasizing the growth of the economy and the increase in jobs, which is evidence of the country’s resilience.

“The Armenian economy has experienced significant growth in recent years. Economic growth is almost 30 percent, and state budget revenues have increased by more than 90 percent. In addition, about 200,000 new jobs have been created,” he said.

Mr. Karapetyan expressed optimism about the process of normalization of relations with neighboring countries, in particular with Azerbaijan and Turkey. He noted the importance of peace talks, emphasizing the importance of mutual recognition of territorial integrity.

“A week ago, Prime Minister Pashinyan made a clear statement about Armenia’s readiness to sign a peace agreement right now,” he emphasized.

In addition to political and economic issues, Mr. Karapetyan also paid attention to the role of the diaspora in Ukraine, calling it a “reliable bridge” between the two countries.

“The Armenian diaspora in Ukraine is distinguished by its loyalty and patriotism to both its historical homeland and Ukraine. More than ten thousand Ukrainian citizens of Armenian origin are currently at the front,” the ambassador emphasized.

He paid special attention to recognizing the contribution of famous Armenian figures to Ukrainian culture. In particular, the ambassador mentioned film director Roman Balayan, who was awarded the Oleksandr Dovzhenko State Prize.

At the end of his speech, Mr. Karapetyan invited the audience to visit an exhibition of Ukrainian Armenian artists that will open this week at St. Sophia Cathedral.

After Ukraine declared independence on August 24, 1991, Armenia recognized Ukraine on December 25, 1991. On December 25, 1991, Ukraine and Armenia established diplomatic relations.

New York retained its leadership in the list of the world’s largest financial centers, according to a review by financial consulting company Z/Yen Group Ltd. that calculates the Global Financial Centers Index (GFCI) indicator.

New York has held the first line in the ranking since the fall of 2018. Compared to the previous version of the rating, released in March this year, New York lost one point and received a score of 763 points, while London, occupying the second position, added three points, its score amounted to 750 points.

Hong Kong rounded out the top three, overtaking Singapore with 749 points against 747. San Francisco retained fifth place, Chicago moved up to sixth place from ninth, Los Angeles moved up to seventh from eighth, while Shanghai dropped two positions to eighth place.

Compared to the previous ranking, there were two changes in the top 10: Seoul and Geneva left the top 10, giving way to Shenzhen and Frankfurt.

At the top of the ranking, Dublin showed good dynamics, moving up to 14th place from 25th, and Lugano added 9 positions to 26th place. Meanwhile, Sydney fell 10 places to 28th place.

The most significant rise in the whole list was demonstrated by Bermuda (plus 27 places at once), as well as Doha and Riyadh (24 and 21 places respectively). Meanwhile, Rome fell back 22 places, Stockholm – 16 places.

The index of world financial centers was first published in 2007 and is updated every six months (the current issue is the 35th). The latest ranking was based on a survey of almost 8.5 thousand respondents.