During the first year of operation of the Ukrainian Sea Corridor, 64.4 million tons of cargo were transported, including 43.5 million tons of grain.

At the same time, 2,379 vessels used the “sea corridor” during this period, exporting products to 46 countries, the press service of the Ministry of Community Development, Territories and Infrastructure (Ministry of Reconstruction) reported on Friday.

“A strategic necessity for our country, which, despite all the risks, has shown its own alternative shipping route, is another step towards victory over Russia. Summarizing the results of the first year of operation of the temporary sea route, we thank those who made it possible – the Security and Defense Forces and civilian fleet workers,” the Ministry’s press service said on Facebook.

On August 16, 2023, the first vessel to use the sea route, commonly known as the “Ukrainian Corridor,” was the German container ship JOSEPH SHULTE, which had been blocked in the port of Odesa since the beginning of the full-scale invasion, the Ministry’s press service reminded.

According to the infographics of the Sea Ports Authority, in the second month of the corridor’s operation in September 2023, only 245 thousand tons of cargo were exported, including 34 thousand tons of grain, but in October the cargo turnover reached 1.4 million tons (582 thousand tons of grain cargo), in November – 2.9 million tons (1.14 million tons), in December – 4.9 million tons (1.89 million tons). In January 2024, cargo turnover reached 4.44 million tons (1.87 million tons of grain), in February – 5.2 million tons (2.65 million tons), in March – 5.14 million tons (2.57 million tons), in April – 5, 1 million tons (2.59 million tons), in May – 5.04 million tons (2.24 million tons), in June – 3.67 million tons (1.89 million tons), in July – 3.45 million tons (2 million tons), for two weeks of August – 1.73 million tons (938 thousand tons). t). t).

“The best greeting to the anniversary will be further development and support of the maritime infrastructure. This year, container traffic to the ports of Odesa and Chornomorsk has been restored. Further plans are to restore ferry service to seaports and involve seaports in the Mykolaiv region as soon as the security situation allows,” the Ministry of Reconstruction said in a statement.

Earlier, the spokesperson for the Ukrainian Navy, Captain Dmytro Pletenchuk, told Freedom TV channel that 2300 vessels used the grain sea corridor over the year and transported more than 60 million tons of cargo.

According to him, the “grain corridor” is actively used by European countries, with Spain and the countries of the global South leading the way.

JSC Slavic Wallpaper-KFTB (Koryukivka, Chernihiv region), a leading Ukrainian wallpaper producer, produced 9.9 million conventional pieces of wallpaper in January-July 2024, up 6.8% year-on-year.

According to statistics provided by UkrPapir Association to Interfax-Ukraine, the company’s production growth rate slowed in the first seven months of the year compared to the same period last year, which was 8.9% in the first half of the year.

At the same time, in monetary terms, the factory’s production volume in January-July increased by 5.3% to UAH 757.6 million.

In July, the company produced 1.57 million units of wallpaper, which is 3% less than in July 2023 and 8% less than in June this year.

The EBA has no data on the total production of wallpaper in Ukraine in January-July 2024, as the State Statistics Service has stopped providing it.

As reported, in 2023, Slavic Wallpaper-KFTP increased its wallpaper production by 19% compared to 2022, to 16.2 million meters, while production increased by 38.2% to UAH 1 billion 249 million, and net profit increased almost eightfold to UAH 47.7 million.

Earlier, the company noted that as a result of Russian aggression, sales volumes, especially through retail channels, had significantly decreased.

JSC Slavic Wallpaper-KFTB produces more than 10 types of wallpaper from the economy segment (paper, duplex, acrylic) to premium wallpaper (vinyl, non-woven, hot stamped).

In addition, the factory produces its own latex, water-dispersion paint under the Latex brand.

Three out of four orphans and children deprived of parental care in Ukraine live in families of guardians, or more than 45,000 children, the Ministry of Social Policy of Ukraine reported on Friday.

“This form of family care is the most common in Ukraine. It is usually arranged by relatives or friends of the child. The difference between guardianship and custody is that guardianship is established over children under 14 years of age, and custody is established over children from 14 to 18 years of age,” the statement said.

The Ministry emphasizes that if a child is left without parental care, there is no need to wait for the child to be granted orphan status or deprived of parental care to take him or her into a family. “Relatives or friends can use the mechanism of temporary placement and immediately take the child to their homes. Then they can apply for child status and guardianship,” the agency said.

During a full-scale war, the procedure for establishing guardianship or custody was simplified for relatives. “During martial law, a relative or godparent who baptized a child before he or she was left without parents must submit with the application: a copy of the passport, documents confirming family ties with the child, a certificate from a narcologist and psychiatrist, a certificate of presence/absence of a criminal record,” the agency said.

It is also emphasized that guardianship is not equal to adoption. “Adoption is a family for a child forever, and the rights of an adopted child are equal to the rights of a biological child,” the statement said.

According to the State Service for Children’s Affairs Facebook page, adoption during martial law is also possible.

“But, of course, there are exceptions. In particular, those with health problems (including mental health), alcohol and drug addiction, who do not have a permanent place of residence and permanent income, and who have a criminal history cannot adopt a child. The full list is set out in Article 212 of the Family Code of Ukraine. The presence of at least one of the factors in the wife or husband may cause a refusal to adopt,” the statement said.

In addition, the adopter must be over 21 years old. An exception is possible only for a relative of the child.

“First and foremost, we must take into account the rights and needs of the child who may be adopted. The principle of child-centeredness is fundamental in our work. That is why local services for children thoroughly check the documents of candidates for adoptive parents to make sure they can be admitted to the adoption process,” said Petro Dobromilsky, Head of the State Service of Ukraine for Children.

The repeat fight between boxers Oleksandr Usyk (Ukraine) and Tyson Fury (UK) will take place on December 21 in Saudi Arabia, the head of the Saudi Arabian General Authority for Entertainment Affairs, Turki Al-Al-Sheikh, has confirmed.

“Fury vs. Repeat… 21-12-2024,” Al-Ash-Sheikh wrote on Friday on the social network X.

As reported, on May 19, Usyk defeated Fury in the first-ever fight for the title of absolute world heavyweight champion in the four-belt era. Usyk defended the WBA, WBO, and IBF championship belts and took away the WBC title that belonged to Fury.

Already on May 21, promoter Frank Warren confirmed that Fury intends to rematch with Usyk after losing the fight for the absolute world heavyweight champion.

Against Fury, Usyk will defend his newly acquired WBC belt, which has belonged to the Briton since the beginning of 2020. He will be defending his WBA and WBO titles for the third time after moving up to the super-heavyweight category.

The IBF belt, which Usyk won in his first fight with Anthony Joshua, will be stripped from the Ukrainian because he failed to defend it in time as required by the organization. Filip Hrgovic of Croatia and Daniel Dubois of the United Kingdom will compete for the vacant title.

Until now, Usyk has only once made immediate rematches in professional boxing – against Anthony Joshua in the heavyweight division. The first fight in 2021 ended in a unanimous decision in favor of the Ukrainian, and the second fight in 2022 was a split decision.

In the first half of 2024, clients of PrivatBank (Kyiv) made payments using a bank card or its mobile application totaling UAH 451 billion, which is 27.3% more than in the first half of 2025.

According to the state bank’s statistics released on Thursday, the number of purchases during this time increased to 1.6 million from 1.3 million, thus the average cost of one purchase increased from UAH 269 to UAH 282, or 4.7%.

It is noted that the most popular item of expenditure during this time was the purchase of food: the share of payments in grocery stores and supermarkets in the total volume of non-cash payments was 44%, which is 1.5% percentage points less than in the first half of 2023.

The second place in terms of the share of card spending is occupied by the purchase of medicines and health products – 6.6%, and the third place is occupied by payments in public catering establishments – 6.4%.

The top five is rounded out by spending on clothing and footwear, as well as fuel – 4.5% and 4.2% of the volume of non-cash payments by Ukrainians, respectively.

In addition to the aforementioned goods, Ukrainians often paid for household goods (4%) and electronics and household appliances (3.8%). Expenditures on transportation and recreation amounted to 1.5% and 1.4%, respectively.

According to the National Bank of Ukraine (NBU), as of June 1, 2024, PrivatBank was the leader in total assets (UAH 872.40 billion) among 63 banks operating in Ukraine. Net profit for the previous year amounted to UAH 37.76 billion.

According to the NBU, as of June 1 this year, Privat had 28.5 million active cards, while the total number of cards in the market is about 53 million.

Scooter riders guilty of an accident are fined from 340 UAH to 17 thousand UAH and deprived of their driver’s license

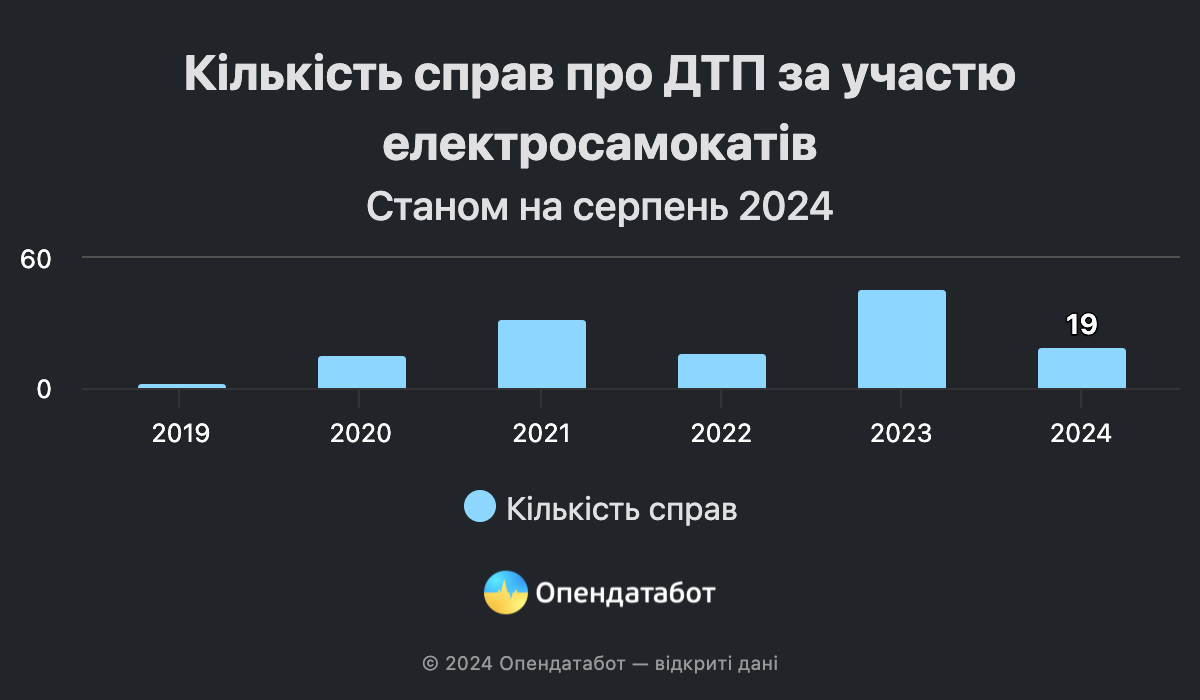

At least 130 cases of accidents involving electric scooters have been considered in courts over the past 5 years, according to the court register search engine Babusya. 34% of them were considered in 2023. Scooter drivers can be fined from UAH 340 to UAH 17,000 for violations and lose their driver’s license for a year.

111 administrative and 22 criminal cases related to accidents with electric scooters were found in the court register as of July 2024.

The largest number of accidents involving scooters was recorded last year: 36 administrative and 10 criminal cases. However, the number of such proceedings is only increasing from year to year: more criminal cases have already been opened this year than in the entire year of 2021. Since the beginning of this year, the courts have already heard at least 16 administrative and 3 criminal cases involving scooters.

The most common types of accidents where scooter drivers are to blame are pedestrian collisions or property damage. In such cases, drivers mostly get off with a fine of UAH 340 to 850.

At the same time, the number of cases when scooter drivers are caught driving while intoxicated is increasing. For example, last year, a driver of a rented scooter hit a woman on the sidewalk. During the test, he was found to have 0.9 ppm of alcohol, which is about the same as after drinking 250 ml of vodka. The offender was fined UAH 17 thousand and deprived of his driver’s license for a year.

However, violators cannot always be fully prosecuted: drivers may not have a driver’s license and simply do not know the traffic rules. For example, a courier on an electric scooter rushing to deliver an order with 0.33 ppm in his bloodstream argued in court that he was sober and that the scooter was not a vehicle. However, these arguments did not help him avoid a fine of UAH 17 thousand. The driver’s license could not be confiscated, as required by law, because the offender never had one.

Our editorial team asked how the scooter rental business reacts to such statistics. Bolt and Jet companies said that the law does not require scooter riders to have a driver’s license, but according to the rules of their services, the driver must be an adult. It is worth noting that the services do not require documentary proof of age: users must enter their date of birth during registration.

Both companies noted that all trips are insured against damage to life or property of third parties. At the same time, if a minor is involved in an accident and pretends to be older when registering (as in the case of a teenager who rammed a car in Kyiv), the consequences of the accident are either not covered by insurance at all (Jet) or, depending on the circumstances, the service reserves the right to make a final decision (Bolt).

“At themoment, it is very important to develop clear and understandable traffic rules for electric scooters and liability for their violation at the legislative level. We don’t track all incidents with electric scooters, but we do monitor insurance claims – this year it is less than 0.001% of all trips,” comments Anton Milka, Head of Sharing Services Development at Bolt in Ukraine.

Context

As a reminder, in 2023, scooter drivers were legally recognized as full-fledged road users – but special rules for them have not yet been approved. Drivers of electric scooters, monowheels, etc. must move as far to the right of the roadway as possible, use reflective elements and helmets. At the same time, such vehicles are prohibited from driving on sidewalks and pedestrian paths.

https://opendatabot.ua/analytics/scooters-dtp-2024