Oleksiy Chernyshov, the Minister for the Development of Communities and Territories of Ukraine, said that the heating season in 2022 will be the most difficult, but tariffs will not increase, the press service of the ministry reported. “The next heating season will start on time, tariffs will not grow and will be stable. It will be the most difficult in the history of Ukraine, but I am sure that we will cope with it. We are working together with local authorities to ensure that the heating season starts on time,” Chernyshov said.

According to him, now the heating industry faces many challenges due to the critical infrastructure destroyed as a result of full-scale Russian aggression in Ukraine. In particular, 331 boiler houses were destroyed or damaged, three heat communal enterprises in the cities of Okhtyrka, Kremenchuk and Chernihiv were destroyed.

“We must restore them before the start of the heating season, and we are determined to do this. Plans have already been developed to restore these enterprises, work is underway,” the minister said.

He also called on Ukrainians to be as careful as possible about keeping warm in their homes this winter.

“We must stop regulating the temperature in the premises by opening windows and prepare “in an adult way” for the next heating season. In particular, by introducing certain household preparation measures with windows, doors, roofs, porches and the like,” he said.

An official online store of Ukrposhta has opened on the American e-commerce platform Amazon, the press service of the national postal operator reported on Tuesday.

Ukrposhta notes that on Amazon you can buy the “Russian warship … Done!” set of stamps, envelope and postcard, as well as branded goods, namely a sweatshirt, a T-shirt or a cap.

The company added that it will transfer $5 from each order with the “Russian warship … Done!” stamp to the account of KSE Foundation. All funds raised will be used to help schools and kindergartens, organizing the logistics of humanitarian cargo, humanitarian aid.

In addition, the new stamp “Ukrainian Dream” is available for ordering in the online store in a set, which is issued on June 28 to the Day of the Constitution of Ukraine.

The development of the store and the launch of the Ukrposhta brand on Amazon was carried out by the Disqover Agency team.

Earlier, Ukrposhta also launched an official online store on eBay. In addition, you can officially buy philatelic products on Rozetka, Prom and Kasta.

Ukraine and Romania have agreed to strengthen cooperation in the Danube region and cooperation in the field of environmental protection, in particular, the countries are preparing to sign a bilateral agreement on the implementation of the Convention on Environmental Impact Assessment in a Transboundary Context (Espoo Convention).

The corresponding decision was made by Minister of Environment Protection and Natural Resources of Ukraine Ruslan Strelets and Minister of Environment, Water and Forests of Romania Barna Tanczos during an online meeting on June 27, according to the website of the Ukrainian ministry.

The Ukrainian minister also spoke about the harm done to the environment since the start of Russia’s large-scale invasion of Ukraine, and expressed hope for Romania’s support in recovering damages from the aggressor in the international court.

“About 260 cases of ecocide in the country and more than 2,000 cases of destruction of our ecosystems have already been recorded. The amount of damage exceeds UAH 200 billion. Such a war will definitely leave huge scars on the Ukrainian environment. Ukraine has joined the Life family, and we have great hopes that within the framework of the program, among other things, we will be able to restore our wildlife,” Strelets said.

He also recalled that Ukraine has introduced the EkoZahroza official application of the Ministry of Natural Resources, which allows every inhabitant of the planet to receive data around the clock on all changes in environmental indicators on the Ukrainian territory, including radiation pollution.

The Espoo Convention is an international agreement initiated by the United Nations Economic Commission for Europe that entered into force in 1997. According to the document, the procedure for assessing the environmental impact of potentially hazardous projects should be carried out not only within the state, but also in neighboring countries that may be affected by the impact of these facilities.

On June 24, Ukraine and the EU signed an agreement on joining the Life international environmental program, the budget of which for 2021-2027 for projects to protect the environment is EUR 5.43 billion.

Since the start of Russia’s full-scale invasion of Ukraine, the Kyivstar mobile operator has paid UAH 4.246 billion in taxes and fees to the state budget, including UAH 1.682 billion ahead of schedule, the company’s press service said on Tuesday.

According to the operator, today Kyivstar has connected more than 1,200 bomb shelters in different cities of the country to free wired Internet, and also transmitted more than 300 million State Emergency Service messages with vital information to the population.

In addition, the company transferred over UAH 33 million to the humanitarian needs of the military, hospitals, the elderly and those affected by the war. The operator’s subscribers, using short numbers and the Smart Money service, transferred more than UAH 3.2 million for humanitarian needs of hospitals and the military, the press service clarifies.

“More than 90% of the company’s network functions stably and provides subscribers with communication and high-speed Internet services. To do this, in the first quarter of 2022, the operator invested UAH 659 million in the development of communications. During the hostilities, the company built 110 new mobile communication facilities and improved 4G communications in 3,500 settlements,” the report says.

According to the operator, during the war, the company’s subscribers were provided with free services worth UAH 429 million. Subscribers in 30 countries of the world receive communication services at the same tariffs as in Ukraine.

In addition, Kyivstar provides doctors working in risk areas with free mobile communications.

227 out of 320 shopping centers in Ukraine have resumed their work, the press service of the Ukrainian Council of Shopping Centers (USTC) told Interfax-Ukraine.

According to a study by the USTTS conducted in early June, in general, work has been resumed on 4.12 million square meters of leased space. m, which is 72% of all retail space, including shopping centers located in the temporarily occupied territory.

14% of retail space (804,000 sq. m.) remains idle, a significant part of which is damaged. At the same time, some damaged shopping centers have already partially or completely resumed work, for example, Lavina Mall (Kyiv), Retail Park (Kyiv region), Nikolsky (Kharkiv) and others.

According to the USTTS, the largest part of non-working shopping centers is recorded in the east of the country. Here, only 12% of retail space receives visitors, 42% do not work and 46% are located in the occupied territory.

Less than half of the retail space operates in the south (45%). In the capital, 11% of retail space in the shopping center remains closed. Almost all shopping centers operate in the north, west and center of Ukraine.

Established in 2020, the USTC is a non-profit organization that unites key participants in the retail real estate market: owners and developers of shopping centers, as well as companies involved in the construction and maintenance of shopping malls.

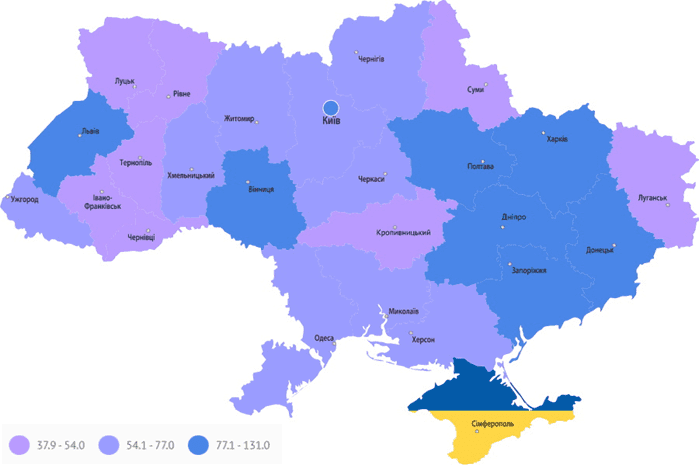

Ratio of the number of the unemployed in different regions of Ukraine in 2021 (thush people)

State employment center