On December 26, JSC NAEK Energoatom announced a tender for insurance of leased movable property.

According to the Prozorro electronic procurement system, the total expected cost of services is UAH 81,232 thousand. Applications for participation in the tender will be accepted until January 3.

According to Serbian Economist, the first Belgrade Film Festival (Beograd Film Festival, BFF) will be held in the Serbian capital from January 30 to February 6, 2026, which the organizers are positioning as a new platform for screening notable world premieres and festival films. The main venue will be the mts Dvorana cinema in the center of Belgrade.

The festival will open with a special screening of Jim Jarmusch’s new film Father Mother Sister Brother, and the program also includes other high-profile works, such as Fatih Akin’s Amrum and François Ozon’s Stranac (The Stranger) by François Ozon, which will be presented to the Belgrade audience as part of the BFF.

The concept of the festival is to combine auteur cinema, festival hits, and new works by masters in one program, making Belgrade one of the stops on the European festival calendar.

According to published information, festival films are being screened at mts Dvorana in the usual cinema format, with tickets sold at the cinema box office and online (including eFinity).

https://t.me/relocationrs/2010

The United States ranked first in the Travel & Tourism Development Index (TTDI) 2024, prepared by the World Economic Forum (WEF) in collaboration with the University of Surrey. The index assesses factors and policies that ensure sustainable and resilient development of the travel and tourism sector and covers 119 economies.

In addition to the US, the top ten leaders in the TTDI 2024 include Spain (2nd place), Japan (3rd), France (4th), Australia (5th), Germany (6th), the United Kingdom (7th), China (8th), Italy (9th), and Switzerland (10th).

The WEF materials note that Europe remains the most efficient TTDI region overall, while inflationary pressure and security factors, including the impact of Russia’s war against Ukraine, stand out among the risks to the region’s tourism dynamics.

UKRNAFTA, Ukraine’s largest network, has completed the rebranding of petrol stations that previously operated under the Shell brand, which is an important step for the company and the development of its retail infrastructure.

“The completion of the Shell rebranding is another important step in the formation of a modern, efficient, and competitive UKRNAFTA network,” Ukrnafta JSC said in a press release on Friday.

The stations have undergone a complete rebranding, including the interior, exterior, identity, retail space, and zoning. All gas stations have been brought up to UKRNAFTA’s uniform standards for floor plans, layout, service processes, and category management. The customer journey has been unified, coffee and food areas have been revamped, service has been standardized, etc.

“Today, all 663 UKRNAFTA gas stations operate as a single operating system — the largest fuel retail network in Ukraine,” the company noted.

Ukrnafta, in particular, has significantly strengthened its presence on key highways, in Kyiv, and in strategically important regions.

The company claims that stations that have undergone the transformation from Shell to UKRNAFTA are already showing growth in fuel sales and significant growth in non-fuel product groups, such as food, coffee, and non-food items.

“Today, UKRNAFTA is the most dynamically growing network of gas stations in the country: it is already in the top three in terms of fuel sales and is moving towards a leading position,” the statement said.

Full standardization makes the retail direction more structured and predictable in terms of operations and economic indicators, the company notes.

As reported, in January 2025, the Antimonopoly Committee of Ukraine granted PJSC Ukrnafta permission to purchase more than 50% of the shares of Alliance Holding LLC, which operates the Shell gas station network in Ukraine.

The joint venture between Shell and Mussa Bazhaev’s Russian Alliance Group to manage the gas station network in Ukraine began operations in August 2007. Shell owned a 51% stake in the joint venture, while Alliance owned 49%. Alliance transferred about 150 gas stations to the joint venture, while Shell contributed cash, licenses, and the brand.

In 2014, it became known that sanctioned Russian businessman Eduard Khudainatov had bought Bazhaev’s oil assets. In June 2022, he was sanctioned by the European Union, and in October 2022, by Ukraine.

In October 2023, the Ukrainian Ministry of Justice filed a lawsuit with the High Anti-Corruption Court of Ukraine to recover Khudainatov’s assets for the state. As a result of the proceedings, 49% of Alliance Holding was recovered for the state. In April 2024, this share was transferred to the State Property Fund.

In November 2024, Overseas Investments, part of the Shell group of energy and petrochemical companies, registered 51% of the authorized capital of Alliance Holding in accordance with the decision of the Appeals Chamber of the High Anti-Corruption Court.

Ukrnafta JSC is Ukraine’s largest oil producer and operator of the largest national network of gas stations, UKRNAFTA. In 2024, the company entered into an asset management agreement with Glusco. In 2025, it completed a deal with Shell Overseas Investments BV to purchase the Shell network in Ukraine. In total, it operates 663 gas stations.

The company is implementing a comprehensive program to restore operations and update the format of its network of gas stations. Since February 2023, it has been issuing its own fuel vouchers and NAFTAKarta cards, which are sold to legal entities and individuals through Ukrnafta-Postach LLC.

The largest shareholder of Ukrnafta is Naftogaz of Ukraine with a 50%+1 share. In November 2022, the Supreme Commander-in-Chief of the Armed Forces of Ukraine decided to transfer to the state the corporate rights of the company that belonged to private owners, which is now managed by the Ministry of Defense.

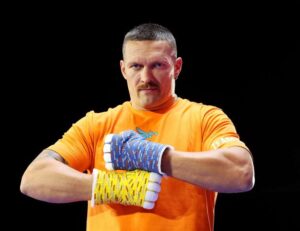

Ukrainian boxer Oleksandr Usyk tops the updated ranking of the world’s top 10 boxers published by The Ring.

It is noted that Usyk last entered the ring in July 2025, winning by knockout in the fifth round against Britain’s Daniel Dubois and becoming the undisputed world heavyweight champion. Later, in November, Usyk voluntarily vacated the WBO belt.

In the updated rankings, Usyk rose from second place to first after American Terence Crawford ended his career. In general, all boxers in the rankings moved up one position, while American Oscar Collazo, the WBA and WBO world champion in the minimumweight division, entered the top 10.

Thus, the top three boxers in the world are Ukrainian Oleksandr Usyk, who competes in the heavyweight division, Japanese Naoya Inoue, who competes in the featherweight division, and American Jesse Rodriguez, who competes in the lightweight division.

PJSC HC Kyivmiskbud received additional capitalization in the amount of UAH 2.56 billion and renewed its management team, according to the company’s press service.

As noted in the release, thanks to the support of the Kyiv City Council, the Kyiv City State Administration, and the mayor of Kyiv, PJSC HC Kyivmiskbud received additional capitalization in the amount of UAH 2.56 billion and is moving on to the next stage of its anti-crisis plan. In particular, the supervisory board has been strengthened, with Petro Panteleev, acting first deputy head of the Kyiv City State Administration, appointed as its new chairman.

The supervisory board also decided to change the company’s management board. Valery Zasutsky, a professional builder and member of the National Association of Builders of Ukraine, has been appointed as the new chairman of the management board.

“These steps are necessary for the further implementation of the company’s anti-crisis plan in 2026, in particular, to stabilize the company’s financial condition; establish more transparent communication and productive cooperation with investors; and gradually resume construction on the company’s facilities.

Communication with the government has also been strengthened to resolve the issue of compensating Kyivmiskbud PJSC with UAH 2.28 billion for the Ukrbud facilities transferred to the company,” the release said.