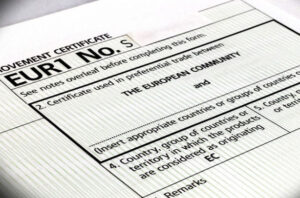

To support exports of Ukrainian goods, the State Customs Service issued 1.5 million EUR.1 certificates for transportation starting January 1, 2016, with exporters of agricultural products being the main recipients, according to the agency’s press service.

The State Customs Service reminded that the presence of a EUR.1 transport certificate exempts Ukrainian goods from import duties when imported into the EU, EFTA, Montenegro, the United Kingdom and Northern Ireland, Georgia, and Israel.

According to its data, during 2025, Ukrainian producers received EUR.1 certificates mainly for the export of goods of plant origin, sunflower oil, white sugar, chicken meat, and natural honey.

The largest number of such certificates was issued for the supply of products to Poland (24%), Germany (18%), Romania (8%), Italy (5%), and the Czech Republic (5%).

The US will impose tariffs on chip imports from China in connection with Beijing’s “unreasonable” attempts to secure dominance in the semiconductor industry, the administration of US President Donald Trump has announced. The size of the tariffs will be announced at least 30 days before their introduction, which has been postponed until June 2027.

“China’s focus on dominating the semiconductor industry is unreasonable and burdens or restricts US trade, and therefore warrants action,” said US Trade Representative Jamison Greer in a statement.

The US authorities have been investigating Chinese chip imports for unfair trade practices throughout the year and have concluded that China has been engaging in such practices.

Beijing could use its control over the global semiconductor industry to exert economic pressure on other countries, the trade representative’s release said.

In response, the Chinese Foreign Ministry criticized the US for abusing tariffs and suppressing sectors of the Chinese economy.

Ministry spokesman Lin Jian said that the American approach harms not only global supply chains, but also Americans themselves.

“If the US continues to do things its own way, China will resolutely take appropriate measures to protect its legitimate rights and interests,” the Financial Times quoted him as saying.

The Cabinet of Ministers has assigned the duties of the chairman of the State Service for Medicines and Drug Control to the deputy chairman of the service, Vladimir Korolenko.

The government adopted the relevant order on December 24 in connection with the removal of the head of the State Service, Roman Isaenko, from his duties.

Korolenko will perform the duties of the head of the service during Isaenko’s removal.

As reported, on December 24, the Cabinet of Ministers initiated disciplinary proceedings against Dmitry Isaenko. The Commission on Senior Civil Service Issues must carry out the relevant disciplinary proceedings by January 27, 2026.

In November, NABU conducted searches at the State Service’s main office, in particular, in Isaenko’s office. In February 2025, he became a subject of the Bihus.Info investigation. Journalists found out that people from Isaenko’s circle and the SBU’s curator of this area had created a private laboratory called Dobrobut-Likilab, which almost immediately after registration began receiving orders to test medicines from the State Service of Ukraine on Medicines and Drugs Control.

Isaenko has headed the State Service of Ukraine on Medicines and Drugs Control since 2018, first as acting chairman, and in early 2019, he won the competition for the position of head of the agency.

On November 28, 2025 the Supervisory Board of the Insurance Company “VUSO” has decided on early termination of powers of a member of the Board – Deputy Chairman of the Board for operational activities Marina Plastomak.

As reported in the information of the company, posted in the system of NCSSM, the decision was made on the basis of her application and comes into effect from December 31, 2025. Dismissal is carried out by transferring her to the position of Director of the Department of work with projects of PrivatBank from January 1, 2026.

It is also specified that she was in this position since July 1, 2019. Marina Plastomak owns a stake in IC “VUSO” in the amount of 4.928226%.

According to the information, Olga Levchenko was appointed by the Supervisory Board of the company on December 23, 2025 to the position of a member of the Management Board, Deputy Chairman of the Management Board of IC “VUSO”, by transferring her from the position of Director of Health Insurance. The appointment was made on the basis of the decision of the Committee for Supervision and Regulation of Non-banking Financial Services Markets of the National Bank of Ukraine dated December 19, 2025.

During the last five years Levchenko held the positions of Director on medical insurance of IC “VUSO”, Deputy Chairman of the Board on underwriting and personal insurance of IC ‘VUSO’, First Deputy Chairman of the Board of IC “Alfa Insurance”.

IC “VUSO” was founded in 2001. It is a member of ITSBU and UFS, a participant of Direct Loss Settlement Agreement and a member of Nuclear Insurance Pool.

PJSC National Energy Company Ukrenergo on December 24 announced a tender for compulsory insurance of civil liability of owners of land vehicles (MTPL). As reported in the system of electronic public procurement ProZorro, the expected cost of the purchase of services – 6.551 million UAH. The last day for submitting applications for participation is January 5.

NEC Ukrenergo is a state-owned company, the operator of the electricity transmission system (TSO) of Ukraine. Ukrenergo is responsible for dispatch control of the unified energy system of Ukraine, operation and development of backbone power grids, balancing of the system and ensuring stability of electricity transmission, as well as for interstate overflows and access to grids at the transmission level.

The National Bank of Ukraine has issued a new commemorative coin dedicated to the traditional sacred holiday – Christmas, the National Bank of Ukraine announced on Facebook.

“Our new commemorative coin, ”Spirit of Christmas,” embodies the deep traditions of this joyous family holiday, which have kept Ukrainians together for generations. It features a stylized image of a golden straw didukh, a traditional attribute of Ukrainian Christmas, and is filled with the warmth and comfort of a pre-Christmas meal of a Ukrainian family. And although many families are separated by distance today, we are still together in our hearts at the festive table,” the NBU press service quoted the head of the central bank, Andriy Pyshnyy.

The coin with a face value of 10 hryvnias is made of 925 silver, with a pure precious metal weight of 31.1 grams. The decorative elements include double-sided local gilding with a diamond insert (1.5 mm).

The obverse features a stylized image of a straw didukh in the center of the composition. Its base is decorated with a straw angel, symbolizing protection and good news. The background of the composition is divided into two planes resembling a window illuminated by the light of stars on Christmas Eve. One of the stars symbolizes the Star of Bethlehem (with a diamond shining in its center).

The reverse side depicts a traditional pre-Christmas meal of a Ukrainian family, where the images of the father, mother, and children are visually identified with celestial bodies: the halos around their heads symbolize the Sun (wife), the Moon (husband), and the stars (their children). In front of the family is a table with 12 dishes: kutia, varenyky, pampukhy, fish, and other traditional treats, as well as garlic heads—a talisman against evil spirits.

Artists Volodymyr Taran, Oleksandr Kharuk, Serhii Kharuk, and sculptors Anatolii Demianenko and Volodymyr Atamanchuk worked on the creation of the coin.

The mintage is up to 15,000 pieces.

The commemorative coin will be available in the NBU’s online numismatic store and through distributor banks starting in January 2026.