The Kyiv Metro has re-announced a tender for the purchase of 50 railcars as part of the Kyiv Urban Transport Modernization II project, funded by a loan from the European Bank for Reconstruction and Development (EBRD), the subway reported.

According to the report, the tender involves the purchase of 10 five-car trains with a free passage between cars (a “tube”), including the supply of spare parts, consumables, equipment and tools for rolling stock maintenance and repair.

The procurement will be conducted in the format of an open tender with prequalification. The deadline for submitting proposals for the first stage is May 2025.

As reported, the first similar tender in August 2023 was won by Kryukiv Carriage Works (KVSZ), which offered 10 trains for EUR79.2 million (including VAT), which was 37% cheaper than the offer of the second participant, Czech Skoda.

KVSZ proposed a 97-meter-long metro train with an asynchronous traction drive with three motorized and two trailed non-motorized cars, with domestic-made bogies, with a total passenger capacity of 1,650 people.

However, in November of the same year, Kyiv Metro canceled its decision to award the contract to KVSZ, and the carriage plant, in turn, tried to appeal the decision in the Kyiv Commercial Court, but to no avail.

The court’s decision dismissing KVSZ’s claim came into force in November 2024.

According to the court materials, Kyiv justified the decision to cancel the award of the contract by the fact that KVSZ tried to replace the supplier of the main equipment (in particular, control systems, traction power and equipment, traction gearboxes, subway control system) from the Spanish CAF (which was agreed with the EBRD) to a Polish or Japanese company.

At the same time, KVSZ pointed out that the change of supplier was due to the fact that CAF refused to supply the plant with equipment due to the workload of production lines. However, Metro refused to replace the supplier because it contradicted the terms of the tender.

As reported, in February 2021, the EBRD and Kyiv Metro signed a EUR 50 million loan agreement for the purchase of 50 new subway cars.

The subway trains are to be purchased for the Syretsko-Pecherska subway line towards the Vynohradar residential area, which will be resumed in 2024.

According to the Kyiv Metro, its inventory fleet currently includes more than 830 cars. At the same time, about 100 railcars will soon reach the end of their service life.

Passenger traffic across the Ukrainian border in the first week of spring, from March 1 to March 7, increased by 1.1% compared to the previous week, to 440 thousand, due to an increase in the number of people entering Ukraine.

According to the State Border Guard Service’s Facebook page, the number of exit crossings decreased from 225,000 to 222,000, while the number of entry crossings increased from 210,000 to 218,000.

The number of vehicles that crossed the checkpoints remained at 117 thousand, while the flow of vehicles with humanitarian cargo increased from 553 to 621, so the ban on the “Shlyakh” system for volunteers has not yet affected the statistics.

According to the State Border Guard Service, as of 9:00 a.m. on Sunday, there were small queues at the Uzhhorod checkpoint (15 vehicles) on the border with Slovakia, at the Ustyluh checkpoint (15 vehicles) on the border with Poland, and at the Luzhanka (20 vehicles), Vylok (10 vehicles), and Tisa (6 vehicles) checkpoints on the border with Hungary.

The total number of people crossing the border this week in 2025 is slightly higher than last year’s: 215 thousand people left and 210 thousand entered Ukraine in the same seven days, with a traffic flow of 110 thousand. Last year, passenger traffic remained at this level for another week before increasing during the spring school holidays.

As reported, on May 10, 2022, the outflow of refugees from Ukraine, which began with the outbreak of war, was replaced by an influx that lasted until September 23, 2022 and amounted to 409 thousand people. However, since the end of September, possibly under the influence of news about mobilization in Russia and “pseudo-referendums” in the occupied territories, and then massive shelling of energy infrastructure, the number of people leaving has been exceeding the number of people entering. In total, from the end of September 2022 to the first anniversary of the full-scale war, it reached 223 thousand people.

In the second year of the full-scale war, the number of border crossings to leave Ukraine, according to the State Border Guard Service, exceeded the number of crossings to enter by 25 thousand, while in the third year – by 187 thousand, and since the beginning of the fourth year – by another 21 thousand.

As Deputy Economy Minister Serhiy Sobolev noted in early March 2023, the return of every 100,000 Ukrainians home results in a 0.5% increase in GDP.

In its January inflation report, the National Bank estimated the outflow from Ukraine in 2024 at 0.5 million (0.315 million according to the State Border Guard Service). In absolute terms, the number of migrants staying abroad will increase to 6.8 million in 2024. The NBU also maintained its outflow forecast for 2025 at 0.2 million.

According to updated UNHCR data, the number of Ukrainian refugees in Europe as of February 19, 2025, was estimated at 6.346 million, and 6.907 million worldwide, which is 43 thousand more than as of January 16.

In Ukraine itself, according to the latest UN data, 3.665 million internally displaced persons (IDPs), including approximately 160 thousand people, were displaced from the frontline areas in the east and south between May and October 2024 due to the intensification of hostilities.

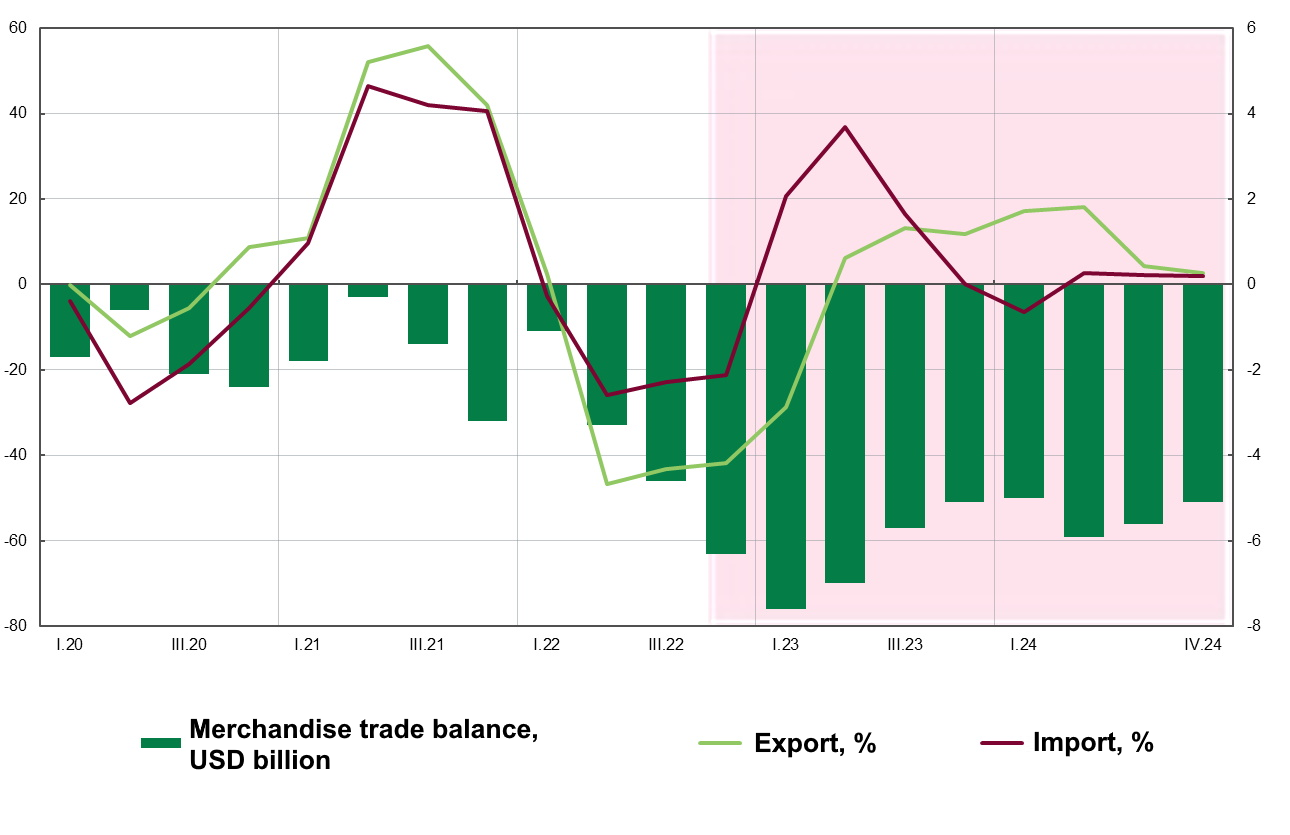

2022-2024 goods trade balance forecast (USD billion)

Source: Open4Business.com.ua

Ukrainian steelmakers increased production of rolled steel in January-February this year by 6.3% year-on-year, up to 957 thousand tons from 900 thousand tons, according to preliminary data.

According to Ukrmetallurgprom on Saturday, steel production during this period increased by 9.9% to 1.183 million tons, and pig iron production by 8.4% to 1.139 million tons.

In February, the company produced 476.9 thousand tons of rolled products, 571.8 thousand tons of steel, and 544.4 thousand tons of pig iron, compared to 480.2 thousand tons of rolled products, 610.8 thousand tons of steel, and 594.8 thousand tons of pig iron in the previous month.

As reported, in 2024, Ukraine increased production of rolled steel by 15.8% year-on-year to 6.222 million tons from 5.372 million tons. During this period, steel production increased by 21.6% to 7.575 million tons, and pig iron production by 18.1% to 7.090 million tons.

In 2023, Ukraine increased production of total rolled products by 0.4% compared to 2022, to 5.372 million tons, but reduced steel production by 0.6% to 6.228 million tons and pig iron by 6.1% to 6.003 million tons.

In 2022, the country reduced production of total rolled products by 72% compared to 2021 to 5.350 million tons, steel by 70.7% to 6.263 million tons, and pig iron by 69.8% to 6.391 million tons.

In 2021, the company produced 21.165 million tons of pig iron (103.6% compared to 2020), 21.366 million tons of steel (103.6%), and 19.079 million tons of rolled products (103.5%).

TAS Neil LLC (Khmelnytsky), a manufacturer of nails and various fasteners from the TAS Group of Sergey Tigipko, has issued B series bonds for a total nominal value of $0.5 million.

The National Securities and Stock Market Commission (NSSMC), which registered the report on the results of the issue on March 3, toldInterfax-Ukraine that the placement was closed, with the face value of one bond at $1,000.

The bonds have a maturity of October 22, 2026, and no information on the yield is available.

According to the NSSMC database, in early August last year, it registered two issues of TAS Neil bonds – series A and B for $0.5 million each. The report on the results of the Series A issue was registered on November 28 last year.

“TAS Nail (formerly Nail) was founded in 1994 as a nail manufacturer. In addition to traditional construction, carpentry and roofing nails, the company produces special types of nails – in coils and loose nails used in the production of wooden containers and pallets, as well as self-tapping screws, screws, confirmations, bolts, nuts, washers, threaded rods, anchors, drills, etc.

TAS Group announced its intention to acquire Neil in early 2022.

According to the YouControl system, in 2024, TAS Neil increased its revenue by 9.3% to UAH 362.86 million, but its loss increased 5 times to UAH 46.78 million.

In 2025, Agrotrade Agroholding will plant 24.32% of its acreage under corn, given its profitability in 2024, and refused to grow spring wheat, the company’s press service reported on Facebook.

“Last season, favorable weather conditions allowed us to minimize the cost of corn processing. This year, we expect high profitability of the crop again, so we have increased the area under its sowing. Traditionally, we allocate significant areas for soybeans, as they show consistently high profitability. At the same time, this year we refused to plant spring wheat, as we sowed enough winter wheat, so we focused on other crops,” said Oleksandr Ovsyanyk, Director of Agrotrade’s Agricultural Department.

In 2025, the agroholding allocated 25.2% of its acreage for winter wheat, 24.32% for corn, 23.58% for soybeans, 17.84% for sunflower, 7.4% for winter rapeseed, 1.02% for mustard, 0.56% for industrial hemp, etc.

“We continue to work to optimize the structure of crops for sustainable development and efficient use of the land bank,” the agricultural holding assured.

Agrotrade Group is a vertically integrated holding company with a full agro-industrial cycle (production, processing, storage and trade of agricultural products). It cultivates over 70 thousand hectares of land in Chernihiv, Sumy, Poltava and Kharkiv regions. The company’s main crops are sunflower, corn, winter wheat, soybeans and rapeseed. It has its own network of elevators with a one-time storage capacity of 570 thousand tons.

The group also produces hybrid seeds of corn and sunflower, barley, and winter wheat. In 2014, a seed plant with a capacity of 20 thousand tons of seeds per year was built on the basis of Kolos seed farm (Kharkiv region). In 2018, Agrotrade launched its own brand Agroseeds on the market.

The founder of Agrotrade is Vsevolod Kozhemiako.