1

1

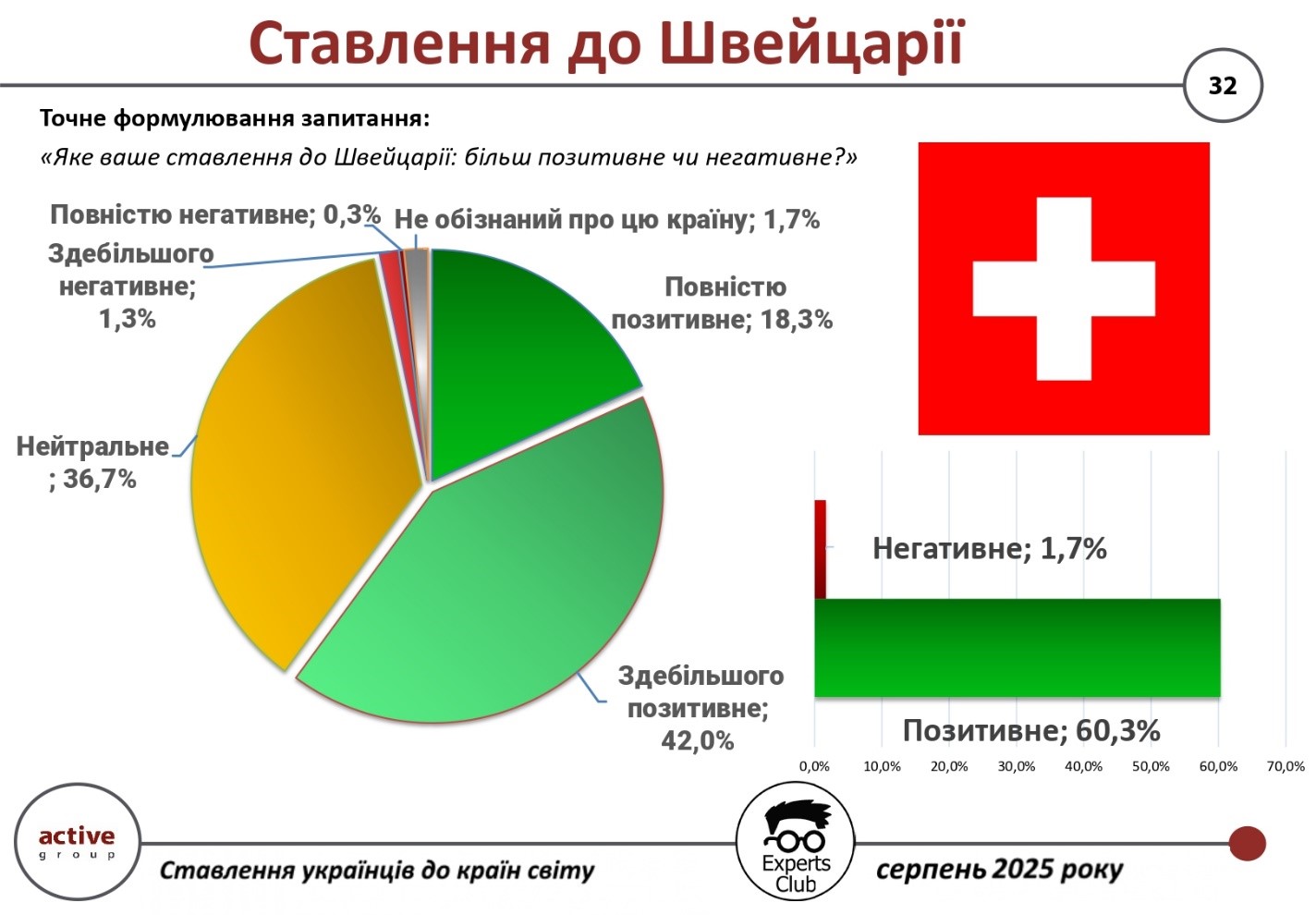

The majority of Ukrainians express a positive attitude towards Switzerland, although a significant number of respondents remain neutral. This is evidenced by the results of an all-Ukrainian sociological survey conducted by Active Group in cooperation with the Experts Club information and analytical center in August 2025.

According to the data, 60.3% of Ukrainians have a positive attitude towards Switzerland (42.0% – mostly positive, 18.3% – completely positive). Only 1.7% of respondents expressed a negative attitude (1.3% – mostly negative, 0.3% – completely negative). At the same time , 36.7% remain neutral, and 1.7% said they did not have enough information about the country.

“For Ukrainians, Switzerland is associated with reliability, stability and humanitarian support that the country provides in difficult times. The high level of trust reflects the positive image of Switzerland, despite its certain detachment from global politics,” commented Alexander Poznyi, co-founder of Active Group.

In his turn, Maxim Urakin, founder of Experts Club, focused on economic ties:

“In the first half of 2025, trade between Ukraine and Switzerland exceeded $928 million. At the same time, Ukrainian exports amounted to only $44 million, while imports from Switzerland reached almost $884 million. The negative balance of more than $839 million is significant, indicating Ukraine’s significant dependence on imports from this country,” he emphasized.

The survey was part of a broader program of research on international sympathies and antipathies of Ukrainians in the current geopolitical context.

The full video is available here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Poznyi, SOCIOLOGY, SWITZERLAND, TRADE, URAKIN

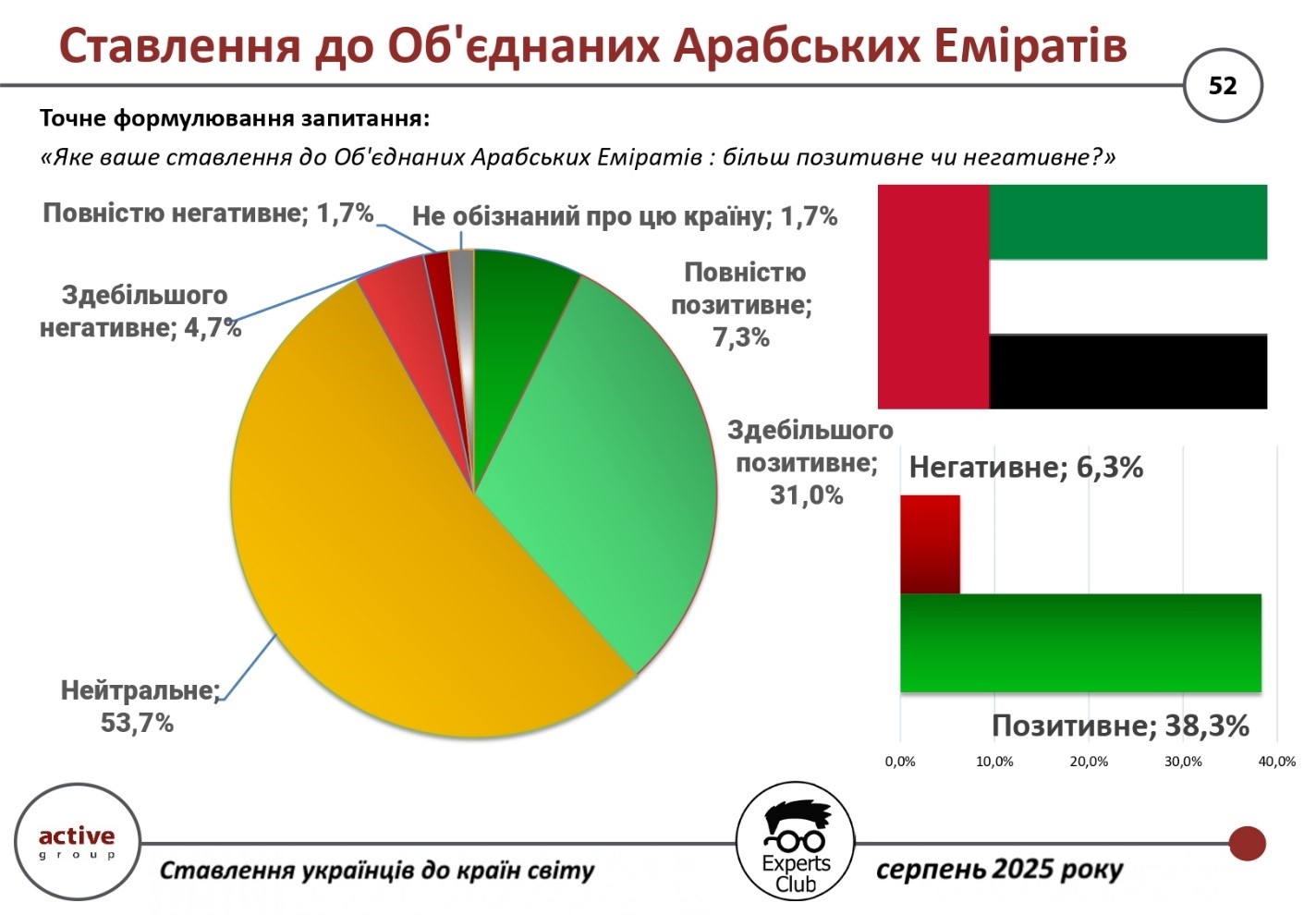

Ukrainians are mostly neutral about the United Arab Emirates (UAE), but among those who have a definite opinion, positive assessments significantly outweigh negative ones. This is evidenced by the results of a sociological study conducted by Active Group in collaboration with the analytical center Experts Club.

According to the survey, 53.7% of respondents took a neutral position on the UAE. At the same time, 38.3% of Ukrainians expressed a positive attitude (7.3% — completely positive, 31.0% — mostly positive). Only 6.3% of respondents had a negative opinion of the country (1.7% — completely negative, 4.7% — mostly negative). Another 1.7% responded that they were not familiar with this country.

“Ukrainians perceive the UAE as a modern country with a developed economy that attracts tourists and business. Despite the remoteness of the region, the country’s image remains consistently positive,” said Alexander Pozniy, head of Active Group.

In turn, Maksim Urakin, co-founder of Experts Club, emphasized the stability of trade and economic relations between Ukraine and the UAE:

“In January-August 2025, the total trade turnover between the countries amounted to $234.1 million. At the same time, exports from Ukraine to the UAE amounted to $173.2 million, while imports amounted to only $60.9 million. The positive balance for Ukraine reached $112.4 million, which makes cooperation with the Emirates beneficial for our economy.”

Thus, the United Arab Emirates remains a country with a moderately positive image among Ukrainians and demonstrates a stable surplus in trade relations with Ukraine.

The full video can be viewed at: https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here: https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, EXPERTS CLUB, Pozniy, SOCIOLOGY, TRADE, UAE, UKRAINE, URAKIN

Ukraine’s real gross domestic product (GDP) grew by 0.8% in the second quarter of 2025 compared to the second quarter of 2024, while in the first quarter of this year the same indicator was 0.9%, according to the State Statistics Service.

According to its data, compared to the previous quarter, taking into account seasonal factors, real GDP increased by 0.2%.

As reported, in July, the NBU once again lowered its expectations for Ukraine’s economic growth this year to 2.1% from 3.1% in its April macroeconomic forecast, while the Ministry of Economy and the government maintain their forecast of 2.7%.

The National Bank of Ukraine estimated real GDP growth in the second quarter of 2025 at 1.1% compared to the same period last year, while previously forecasting it at 1.6%. According to its updated forecast, real GDP growth in the third quarter of this year has been revised down to 2.4% from 3.5%, and in the fourth quarter to 3.5% from 5.9%.

According to the State Statistics Service, Ukraine’s GDP growth slowed to 2.9% in 2024 from 5.5% in 2023, following a 28.8% decline in 2022, the first year of full-scale Russian aggression. In the fourth quarter of last year, GDP fell by 0.1% after growing by 2.2% in the third quarter, 4.0% in the second quarter, and 6.8% in the first quarter.

The NBU forecasts GDP growth of 2.3% for next year, while the government forecasts 2.4%.

Earlier, Experts Club analyzed the state of the economy in Ukraine and leading world countries. For more details, see the video at https://www.youtube.com/watch?v=kQsH3lUvMKo&t

You can subscribe to the Experts Club YouTube channel here: https://www.youtube.com/@ExpertsClub

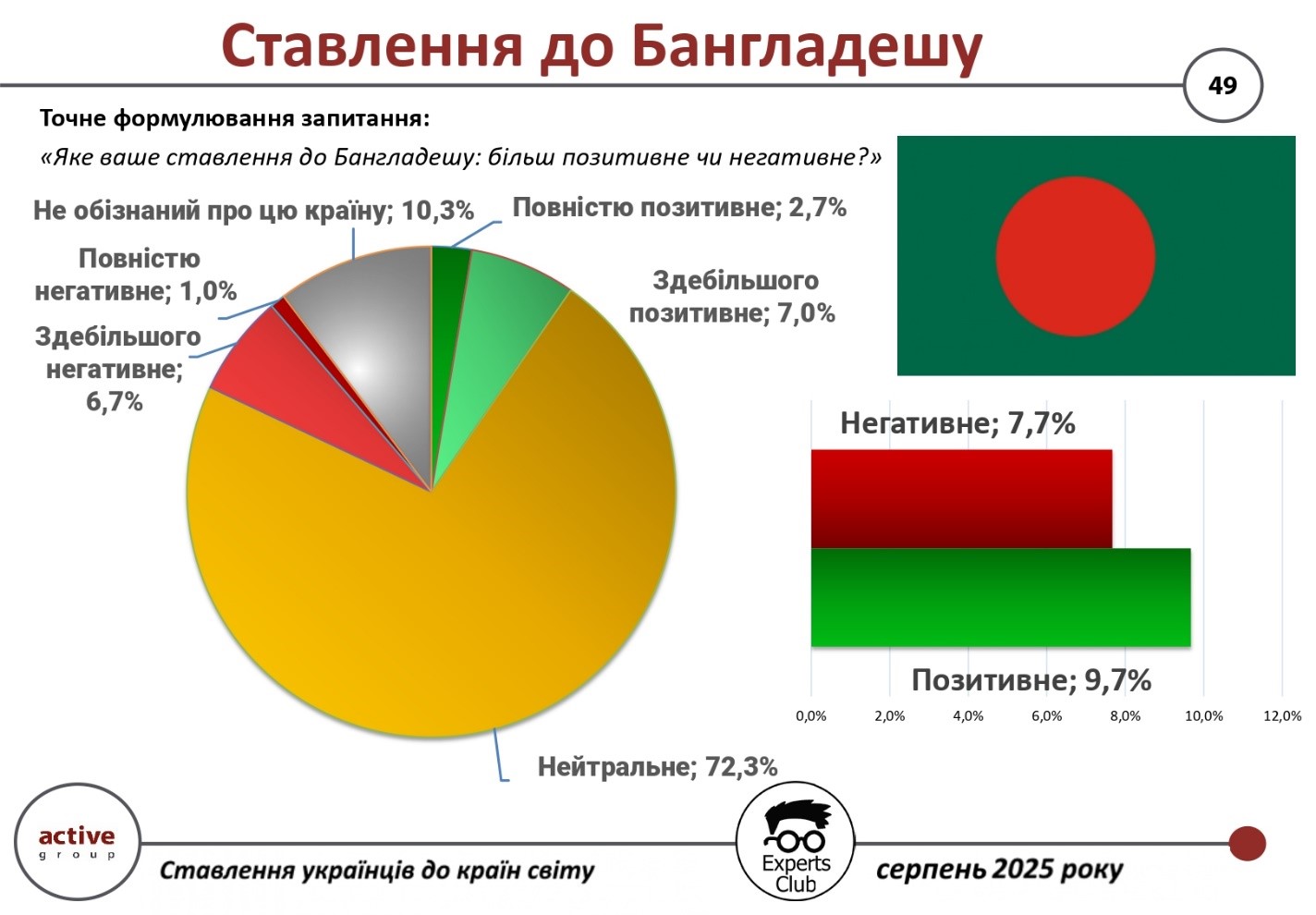

The vast majority of Ukrainians do not have a clearly formed attitude towards Bangladesh. This is evidenced by the results of a sociological survey conducted by Active Group in cooperation with the Experts Club analytical center.

According to the data, 72.3% of respondents chose the “neutral attitude” option. 9.7% of respondents expressed a positive opinion (2.7% — completely positive, 7.0% — mostly positive). A negative attitude was declared by 7.7% of Ukrainians (1.0% — completely negative, 6.7% — mostly negative). At the same time, 10.3% responded that they did not have sufficient information about this country.

“For most Ukrainians, Bangladesh remains a relatively distant country about which there is a lack of information. This explains the high level of neutral responses,” said Alexander Pozniy, head of Active Group.

At the same time, Experts Club co-founder Maksim Urakin emphasized the importance of economic relations.

“According to the results of the first eight months of 2025, Ukraine’s trade turnover with Bangladesh amounted to $226.9 million. Exports from Ukraine reached $127.9 million, while imports amounted to $99.1 million. The positive balance of $28.8 million indicates balance and potential for expanding bilateral trade.”

Thus, despite Ukrainians’ lack of awareness about Bangladesh, economic cooperation is developing dynamically, creating the conditions for strengthening mutual interest.

The full video can be viewed at: https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here: https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, BANGLADESH, EXPERTS CLUB, Pozniy, SOCIOLOGY, TRADE, UKRAINE, УРАКИН

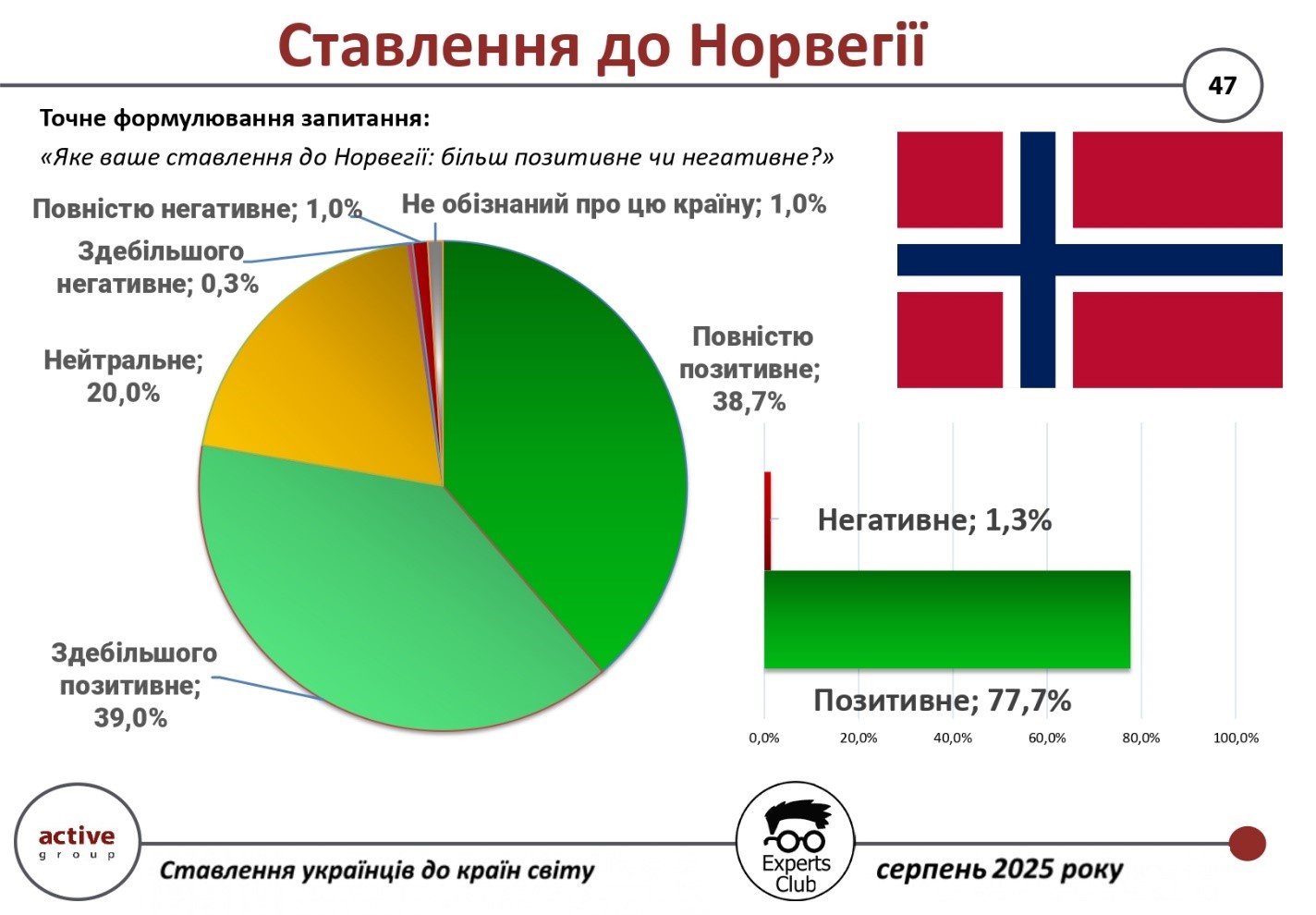

Most Ukrainians express a positive attitude toward Norway. This is evidenced by the results of a sociological survey conducted by Active Group in cooperation with the Experts Club think tank.

According to the survey, 77.7% of Ukrainians have a positive attitude towards Norway (38.7% — completely positive, 39.0% — mostly positive). Only 1.3% of respondents expressed a negative attitude (1.0% — completely negative, 0.3% — mostly negative). A neutral position towards Norway was expressed by 20.0% of respondents, while another 1.0% admitted that they were not familiar with this country.

“The high level of sympathy for Norway is explained not only by Ukraine’s traditional support in the context of the war, but also by the country’s stable image with high social standards, a developed economy, and one of the highest standards of living in the world,” emphasized Active Group CEO Oleksandr Pozniy.

Experts Club co-founder Maksim Urakin emphasized the importance of economic cooperation between the two countries.

“Despite a significant trade imbalance, Ukraine actively cooperates with Norway. In the first six months of 2025, trade turnover amounted to $231.9 million. At the same time, Ukrainian exports amounted to only $16.5 million, while imports amounted to $215.4 million. The negative balance exceeded $198.9 million, but the presence of Norwegian energy and technology goods is of great importance to the Ukrainian economy.”

Thus, Ukrainian society highly values Norway’s role as a reliable partner, and trade dynamics confirm mutual interest in developing relations.

The full video can be viewed at: https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here: https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, EXPERTS CLUB, NORWAY, Pozniy, SOCIOLOGY, TRADE, UKRAINE, УРАКИН

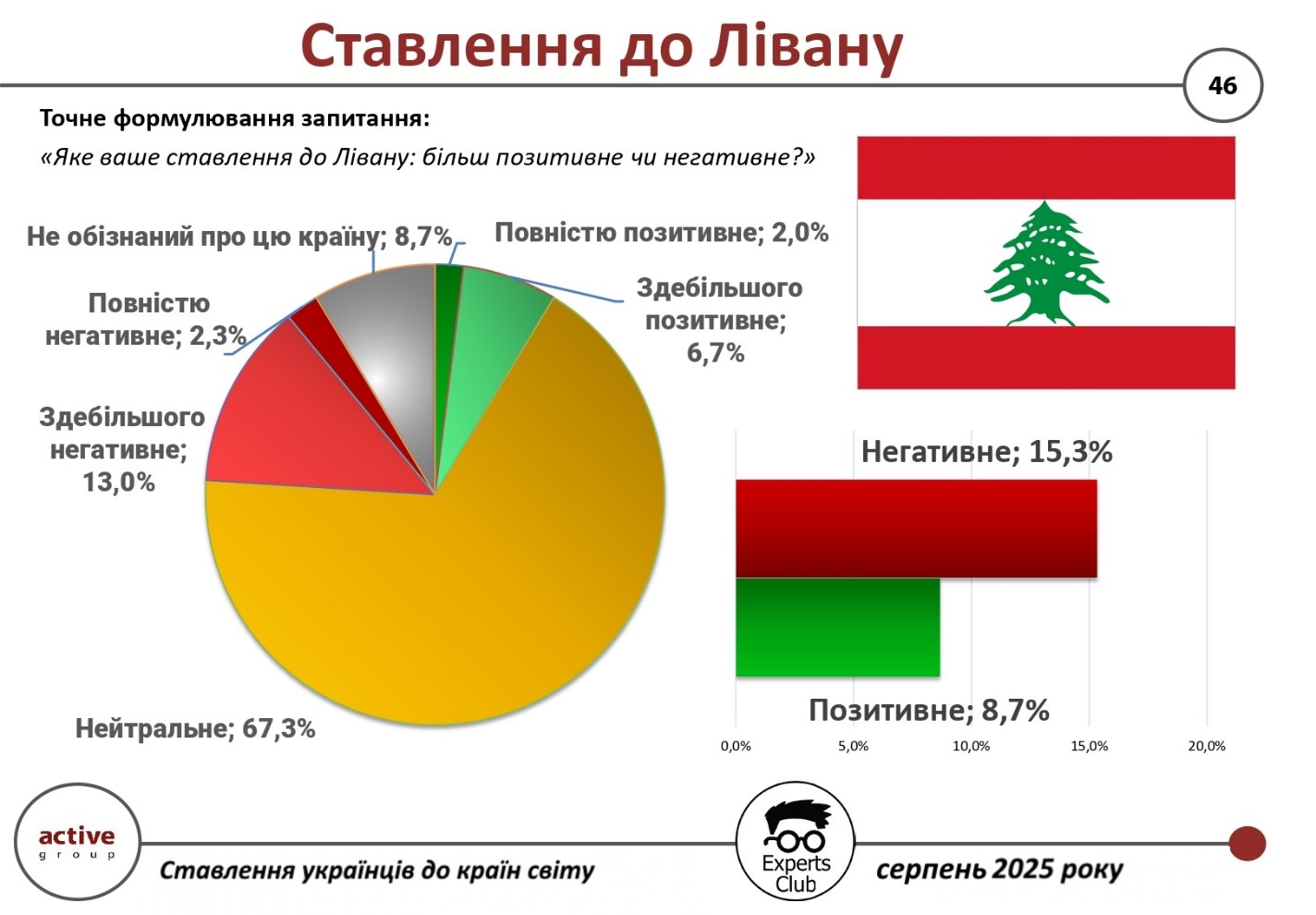

The vast majority of Ukrainians express a neutral attitude towards Lebanon. This is evidenced by the results of a sociological survey conducted by Active Group in cooperation with the Experts Club think tank.

According to the survey, 67.3% of respondents said they had a neutral attitude towards Lebanon. Only 8.7% of respondents expressed a positive attitude (2.0% — completely positive, 6.7% — mostly positive). On the other hand, 15.3% of Ukrainians demonstrated a negative attitude (2.3% — completely negative, 13.0% — mostly negative). Another 8.7% admitted that they were not familiar with this country.

“These results can be explained by the lack of significant historical or cultural ties between Ukraine and Lebanon, as well as Lebanon’s weak informational presence in Ukrainian society,” said Alexander Pozniy, head of Active Group.

In turn, Experts Club founder Maksim Urakin emphasized the economic aspect.

“In the first six months of 2025, trade turnover between Ukraine and Lebanon amounted to $249.3 million. At the same time, exports from Ukraine amounted to $246.5 million, while imports amounted to only $2.7 million. Thus, the positive balance exceeded $243.8 million, which indicates Lebanon’s unilateral interest in Ukrainian products.”

Thus, relations between Ukraine and Lebanon remain predominantly economic, and public perception of this country in Ukraine is still neutral.

The full video can be viewed at: https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here: https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, EXPERTS CLUB, LEBANON, Pozniy, SOCIOLOGY, TRADE, UKRAINE, УРАКИН