Ukraine’s export logistics entered 2026 in a new configuration, where Ukrzaliznytsia’s transition to a fixed tariff for grain car rental reduced cost volatility, according to the information and analytical agency UkrAgroConsult.

According to analysts, the main cargo flows are currently concentrated in the direction of the ports of Greater Odessa, where terminal utilization has stabilized at 50%. In early February, the number of grain cars heading for ports exceeded 9,000 units, which is associated with the active fulfillment of contracts and the need for working capital for farmers before spring field work.

“The dynamics of grain car traffic demonstrates continued pressure on infrastructure capacity. This situation indicates a resumption of activity by exporters, but at the same time leaves minimal margin for the logistics system,” experts noted.

The agency noted a shift in the competitive balance between modes of transport: railways retain a key role in mass shipments, while road transport is increasing its share due to faster turnover.

“This model of coexistence will become a long-term reality for Ukrainian exports,” UkrAgroConsult predicts.

EXPORTS, GRAIN, LOGISTICS, RAILWAYS, ROAD TRANSPORT, TARIFFS, УЗ

Logistical constraints related to the war are leading to a redistribution of corn imports to the European Union in favor of alternative suppliers, with Ukraine’s share in the 2025/26 season declining significantly, according to a review by S&P Global Commodity Insights (Platts).

According to S&P Global Market Intelligence Global Trade Analytics Suite (GTAS), corn imports to the EU in the 2024/25 marketing year amounted to 18.79 million tons, compared to 19.83 million tons in 2023/24, and GTAS forecasts an increase in imports to 21 million tons in 2025/26.

S&P notes that, on average over five years, Ukraine remained the dominant supplier of corn to the EU, supplying about 9.7 million tons per year (53.5% of imports), but in the 2025/26 marketing year (July-June), the structure of supplies changed: Brazil’s share grew to 40%, the US’s share rose to 28.3%, while Ukraine’s share fell to 22.4%.

Market participants reported delays in receiving contracted Ukrainian corn, which led buyers to switch more actively to Brazil and the US. Market participants cited the EU-Mercosur trade agenda as an additional factor in choosing the origin of products.

Spain, the Netherlands, and Italy remain among the largest corn importers in the EU. According to the European Commission, Spain imported 7.2 million tons in 2024/25 MY (7.6 million tons in 2023/24), the Netherlands imported 3.3 million tons (2.6 million tons), and Italy imported 2.8 million tons (2.1 million tons).

At the same time, Spain, as a price-sensitive market, has recently switched to more competitively priced American corn, while Ukrainian corn was relatively expensive amid high demand from Turkey, the review says.

Platts price benchmarks for February 3: feed corn ex-works Tarragona (Spain) – €213/t with loading between February 3 and March 5, Ukrainian corn – $223/t FOB POC (Odessa-Pivdenny-Chernomorsk ports) with loading between March 3 and 17, Brazilian corn – $210.81/t FOB Santos with loading in August.

The difficult situation in the ports of Odessa and logistics problems are limiting activity in the oilseed sector in Ukraine, according to the information and analytical agency APK-Inform.

“Russian army missile attacks on Ukrainian ports, damage to terminals, warehouses, and other infrastructure will cause a reduction in shipments in the coming months and may destabilize the situation on the global agricultural market,” analysts explained.

They noted that last week, price growth on the Ukrainian soybean export market stalled, which was due to both missile attacks on ports and pressure from the global market, despite the fact that demand for Ukrainian soybeans remained quite high and export rates grew in the first half of December.

Experts added that demand prices for GM soybeans in Ukrainian ports remained at their highest levels since August 2024 – $420-425 per ton (CPT port).

“The European Union has finally postponed the implementation of the EUDR regulation for another year, which will allow companies to increase supplies of soybeans and soybean meal in this direction,” APK-Inform predicts.

According to Serbian Economist, Serbia’s commercial real estate market will develop around Belgrade and expressway and railway corridors over the next decade, with the most dynamic growth expected in the office and industrial-logistics segments, according to the analytical report “Serbia real estate & construction outlook 2025–2035.”

According to the document, by 2035, Belgrade’s high-quality office stock could increase to 1–1.2 million square meters. The main demand will be provided by IT companies, engineering centers, the financial sector, and international service centers, while in Novi Sad and Niš, more compact clusters of office space focused on technology and research are forming.

The report identifies industrial and logistics real estate as the fastest-growing segment. Experts predict that by 2035, the total volume of modern warehouse space in Serbia could double or triple, with key logistics hubs forming in the Belgrade–Pancevo–Simanovci, Novi Sad–Ruma–Inđija, Kragujevac–Kraljevo, and Niš–Leskovac, as well as along international corridors X and XI.

Individual industry reviews confirm the stability of the industrial segment: according to consulting company iO Partners, in the first quarter of 2025, there were more than 1.2 million square meters of Class A warehouse space on the Serbian market, with vacancy rates remaining at around 6.5% and base rental rates at €5 per sq m per month, indicating a balanced supply and demand structure.

The report identifies potential delays in infrastructure projects, high financing costs, and political cycles that could affect the timing of major development programs as risks for commercial real estate. As strategic recommendations, investors are advised to focus on energy-efficient offices and industrial parks linked to international transport corridors, while the authorities are advised to accelerate the harmonisation of building standards with EU requirements and the digitisation of procedures for commercial projects.

The Ukrainian Grain Association (UGA) forecasts that the harvest of grain and oilseeds in 2025 will reach 81.4 million tons, compared to 79 million tons (+3%) a year earlier, the association’s press service reported.

“With such a harvest, exports in the current 2025/26 season could potentially reach 49 million tons (last season – 46.7 million tons). However, this is an optimistic scenario, the implementation of which depends on the resolution of serious logistical problems,” the UGA noted.

The association recalled that Ukraine is currently experiencing significant problems in grain export logistics due to constant Russian terrorist attacks on critical infrastructure: energy, railways, and seaports of Ukraine. As a result of Russian shelling of civilian infrastructure, railways and ports cannot operate at full capacity due to damage to their infrastructure, power shortages, and constant power outages.

“It is obvious that the inability to export significant volumes of the harvested crop due to logistical problems will not only have an extremely negative impact on Ukrainian agricultural producers and the price situation on the domestic market, but may also deal a severe blow to Ukraine’s economy and its balance of payments,” the UGA noted.

The UGA estimated the wheat harvest in 2025 at 22.5 million tons, compared to 22.4 million tons (+0.45%) a year ago. With this in mind, potential wheat exports in 2025/26 MY could reach 16.5 million tons, the UGA suggested.

The barley harvest in 2025, according to the association’s estimates, is 4.9 million tons, compared to 5.6 million tons (-2.5%) a year ago, and the likely export in 2025/2026 MY is forecast at around 2.3 million tons.

The UGA expects the corn harvest to reach 32 million tons, compared to 25.9 million tons (+23.6%), and experts believe that potential exports in the current season could reach 25 million tons, provided that logistics are unhindered.

The UGA forecasts the sunflower harvest in 2025 at 11.5 million tons, compared to 12.8 million tons (-10.2%) a year ago. Traditionally, almost all sunflowers will be processed in Ukraine – 11.4 million tons, while exports will reach no more than 50 thousand tons.

The rapeseed harvest in 2025 will be 3.2 million tons, compared to 3.8 million tons (-15.8%) a year ago, while exports in 2025/26 MY may reach only 2.1 million tons, with the rest being processed in Ukraine.

According to the UGA, the soybean harvest in 2025 will be about 5 million tons, compared to 6.8 million tons (-26.5%) in 2024, which is explained by a significant reduction in the area sown with this crop and poorer yields. Nevertheless, potential exports could reach 2.5 million tons in 2025/26 MY, with the rest being processed in Ukraine, as legislative restrictions make its export difficult, as is the case with rapeseed.

“As for next year’s harvest, since the acreage under winter crops is already known and taking into account the forecast for spring crops, next year’s potential harvest could amount to 84.5 million tons of grains and oilseeds, of which Ukraine could potentially export about 50 million tons of grains and oilseeds,” the UGA predicts.

The Ukrainian Grain Association (UGA) is an association of producers, processors, and major grain exporters, which annually export about 90% of Ukrainian grain products.

Due to Russia’s full-scale invasion and its desire to use food as a weapon, transporting grain and oilseeds from Ukraine to other countries has become extremely difficult. Since 2022, logistics issues have had to be significantly revised in order to find safer shipping routes and options. Despite the dire circumstances created by the Russian Federation, Ukrainians are ensuring food security for many countries, particularly in Europe.

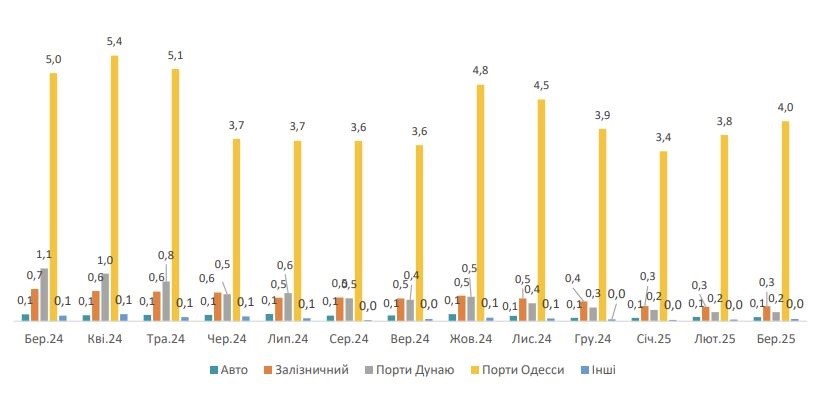

In March 2025, Kyiv exported a total of 4.7 million tons of grain and oilseeds and their processed products. This is 7% more than in the previous month.

“How does Ukraine transport grain and oilseeds, as well as products made from them? The lion’s share goes to the seaports of the Odesa region. This figure is 4 million tons. By rail – 300,000 tons, through the river ports of the Danube – 200,000 tons. It is also exported by road. The volume reaches 100,000 tons,” said grain market analyst Oleksandr Korenitsyn.

Exports of grain crops, oilseeds, and processed products, million tons

Let’s look at the prices of the main agricultural crops that Ukraine exports to world markets. In April 2025, the price of wheat (France, FOB) was 244 USD/ton. Note that this is 3 USD more than in March of this year and 29 USD more than in the same period of 2024. The price of wheat (Ukraine, 2nd class, CPT) in April 2025 was USD 211/t (central regions), which is USD 4 more than in March 2025 and USD 75 more expensive than a year ago. In ports, the price was 229 USD/t, which is 7 USD higher than in the previous month and 65 USD more expensive than in April 2024, according to the International Grains Council.

As for corn (USA, FOB), the price as of April 2025 was USD 211/t. This amount is USD 4 higher than in the previous month and USD 19 higher than in April 2024. The price of corn (Ukraine, CPT) in the central regions is 206 USD/t, thus increasing by 11 USD over the month and by 89 USD over the year; ports – 222 USD, which is 12 USD more than in March 2025 and 78 USD higher than in April 2024.

As noted by Oleksandr Korenitsyn, the price of barley (France, FOB) was 229 USD in April 2025, which is 1 USD less than in March of this year and 26 USD more than in the same period last year. The price of barley (Ukraine, CPT) was USD 195 in the central regions, which is USD 8 more than in March 2025 and USD 102 higher than in April 2024; in ports, it was USD 215 (the price rose by USD 5 per month and USD 85 over the year).

“Another important crop for Ukraine and the world that should be mentioned is sunflower. The price of its seeds in the EU (Rotterdam, FOB) in April this year was 730 USD/t. There has been an increase in price over the last month – by 7 dollars, as well as an increase over the year – by 273 dollars. Meanwhile, the cost of sunflower seeds (Ukraine, CPT) for the central regions was 537 USD/t. The price rose by 10 USD per month and 221 USD per year. For ports, the cost is $512 per ton, which is $6 more than last month and $194 more than last year,” said expert Oleksandr Korenitsyn.

We would like to add that the cost of sunflower oil (Ukraine, FOB) in April was $1,140 per ton. It should be noted that among the key factors that could destabilize further pricing on the world market and affect food security in Europe and the world are Russia’s military actions on the territory of Ukraine.

EUROPE, full-scale Russian invasion, grain exports, Korenitsyn, LOGISTICS, Odessa ports, OILSEEDS, PRICES, UKRAINE, VOLUME