According to Serbian Economist, Serbia’s commercial real estate market will develop around Belgrade and expressway and railway corridors over the next decade, with the most dynamic growth expected in the office and industrial-logistics segments, according to the analytical report “Serbia real estate & construction outlook 2025–2035.”

According to the document, by 2035, Belgrade’s high-quality office stock could increase to 1–1.2 million square meters. The main demand will be provided by IT companies, engineering centers, the financial sector, and international service centers, while in Novi Sad and Niš, more compact clusters of office space focused on technology and research are forming.

The report identifies industrial and logistics real estate as the fastest-growing segment. Experts predict that by 2035, the total volume of modern warehouse space in Serbia could double or triple, with key logistics hubs forming in the Belgrade–Pancevo–Simanovci, Novi Sad–Ruma–Inđija, Kragujevac–Kraljevo, and Niš–Leskovac, as well as along international corridors X and XI.

Individual industry reviews confirm the stability of the industrial segment: according to consulting company iO Partners, in the first quarter of 2025, there were more than 1.2 million square meters of Class A warehouse space on the Serbian market, with vacancy rates remaining at around 6.5% and base rental rates at €5 per sq m per month, indicating a balanced supply and demand structure.

The report identifies potential delays in infrastructure projects, high financing costs, and political cycles that could affect the timing of major development programs as risks for commercial real estate. As strategic recommendations, investors are advised to focus on energy-efficient offices and industrial parks linked to international transport corridors, while the authorities are advised to accelerate the harmonisation of building standards with EU requirements and the digitisation of procedures for commercial projects.

The Ukrainian Grain Association (UGA) forecasts that the harvest of grain and oilseeds in 2025 will reach 81.4 million tons, compared to 79 million tons (+3%) a year earlier, the association’s press service reported.

“With such a harvest, exports in the current 2025/26 season could potentially reach 49 million tons (last season – 46.7 million tons). However, this is an optimistic scenario, the implementation of which depends on the resolution of serious logistical problems,” the UGA noted.

The association recalled that Ukraine is currently experiencing significant problems in grain export logistics due to constant Russian terrorist attacks on critical infrastructure: energy, railways, and seaports of Ukraine. As a result of Russian shelling of civilian infrastructure, railways and ports cannot operate at full capacity due to damage to their infrastructure, power shortages, and constant power outages.

“It is obvious that the inability to export significant volumes of the harvested crop due to logistical problems will not only have an extremely negative impact on Ukrainian agricultural producers and the price situation on the domestic market, but may also deal a severe blow to Ukraine’s economy and its balance of payments,” the UGA noted.

The UGA estimated the wheat harvest in 2025 at 22.5 million tons, compared to 22.4 million tons (+0.45%) a year ago. With this in mind, potential wheat exports in 2025/26 MY could reach 16.5 million tons, the UGA suggested.

The barley harvest in 2025, according to the association’s estimates, is 4.9 million tons, compared to 5.6 million tons (-2.5%) a year ago, and the likely export in 2025/2026 MY is forecast at around 2.3 million tons.

The UGA expects the corn harvest to reach 32 million tons, compared to 25.9 million tons (+23.6%), and experts believe that potential exports in the current season could reach 25 million tons, provided that logistics are unhindered.

The UGA forecasts the sunflower harvest in 2025 at 11.5 million tons, compared to 12.8 million tons (-10.2%) a year ago. Traditionally, almost all sunflowers will be processed in Ukraine – 11.4 million tons, while exports will reach no more than 50 thousand tons.

The rapeseed harvest in 2025 will be 3.2 million tons, compared to 3.8 million tons (-15.8%) a year ago, while exports in 2025/26 MY may reach only 2.1 million tons, with the rest being processed in Ukraine.

According to the UGA, the soybean harvest in 2025 will be about 5 million tons, compared to 6.8 million tons (-26.5%) in 2024, which is explained by a significant reduction in the area sown with this crop and poorer yields. Nevertheless, potential exports could reach 2.5 million tons in 2025/26 MY, with the rest being processed in Ukraine, as legislative restrictions make its export difficult, as is the case with rapeseed.

“As for next year’s harvest, since the acreage under winter crops is already known and taking into account the forecast for spring crops, next year’s potential harvest could amount to 84.5 million tons of grains and oilseeds, of which Ukraine could potentially export about 50 million tons of grains and oilseeds,” the UGA predicts.

The Ukrainian Grain Association (UGA) is an association of producers, processors, and major grain exporters, which annually export about 90% of Ukrainian grain products.

Due to Russia’s full-scale invasion and its desire to use food as a weapon, transporting grain and oilseeds from Ukraine to other countries has become extremely difficult. Since 2022, logistics issues have had to be significantly revised in order to find safer shipping routes and options. Despite the dire circumstances created by the Russian Federation, Ukrainians are ensuring food security for many countries, particularly in Europe.

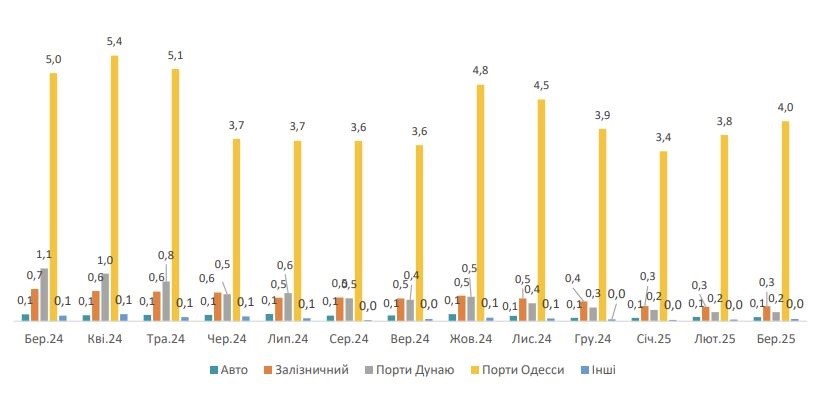

In March 2025, Kyiv exported a total of 4.7 million tons of grain and oilseeds and their processed products. This is 7% more than in the previous month.

“How does Ukraine transport grain and oilseeds, as well as products made from them? The lion’s share goes to the seaports of the Odesa region. This figure is 4 million tons. By rail – 300,000 tons, through the river ports of the Danube – 200,000 tons. It is also exported by road. The volume reaches 100,000 tons,” said grain market analyst Oleksandr Korenitsyn.

Exports of grain crops, oilseeds, and processed products, million tons

Let’s look at the prices of the main agricultural crops that Ukraine exports to world markets. In April 2025, the price of wheat (France, FOB) was 244 USD/ton. Note that this is 3 USD more than in March of this year and 29 USD more than in the same period of 2024. The price of wheat (Ukraine, 2nd class, CPT) in April 2025 was USD 211/t (central regions), which is USD 4 more than in March 2025 and USD 75 more expensive than a year ago. In ports, the price was 229 USD/t, which is 7 USD higher than in the previous month and 65 USD more expensive than in April 2024, according to the International Grains Council.

As for corn (USA, FOB), the price as of April 2025 was USD 211/t. This amount is USD 4 higher than in the previous month and USD 19 higher than in April 2024. The price of corn (Ukraine, CPT) in the central regions is 206 USD/t, thus increasing by 11 USD over the month and by 89 USD over the year; ports – 222 USD, which is 12 USD more than in March 2025 and 78 USD higher than in April 2024.

As noted by Oleksandr Korenitsyn, the price of barley (France, FOB) was 229 USD in April 2025, which is 1 USD less than in March of this year and 26 USD more than in the same period last year. The price of barley (Ukraine, CPT) was USD 195 in the central regions, which is USD 8 more than in March 2025 and USD 102 higher than in April 2024; in ports, it was USD 215 (the price rose by USD 5 per month and USD 85 over the year).

“Another important crop for Ukraine and the world that should be mentioned is sunflower. The price of its seeds in the EU (Rotterdam, FOB) in April this year was 730 USD/t. There has been an increase in price over the last month – by 7 dollars, as well as an increase over the year – by 273 dollars. Meanwhile, the cost of sunflower seeds (Ukraine, CPT) for the central regions was 537 USD/t. The price rose by 10 USD per month and 221 USD per year. For ports, the cost is $512 per ton, which is $6 more than last month and $194 more than last year,” said expert Oleksandr Korenitsyn.

We would like to add that the cost of sunflower oil (Ukraine, FOB) in April was $1,140 per ton. It should be noted that among the key factors that could destabilize further pricing on the world market and affect food security in Europe and the world are Russia’s military actions on the territory of Ukraine.

EUROPE, full-scale Russian invasion, grain exports, Korenitsyn, LOGISTICS, Odessa ports, OILSEEDS, PRICES, UKRAINE, VOLUME

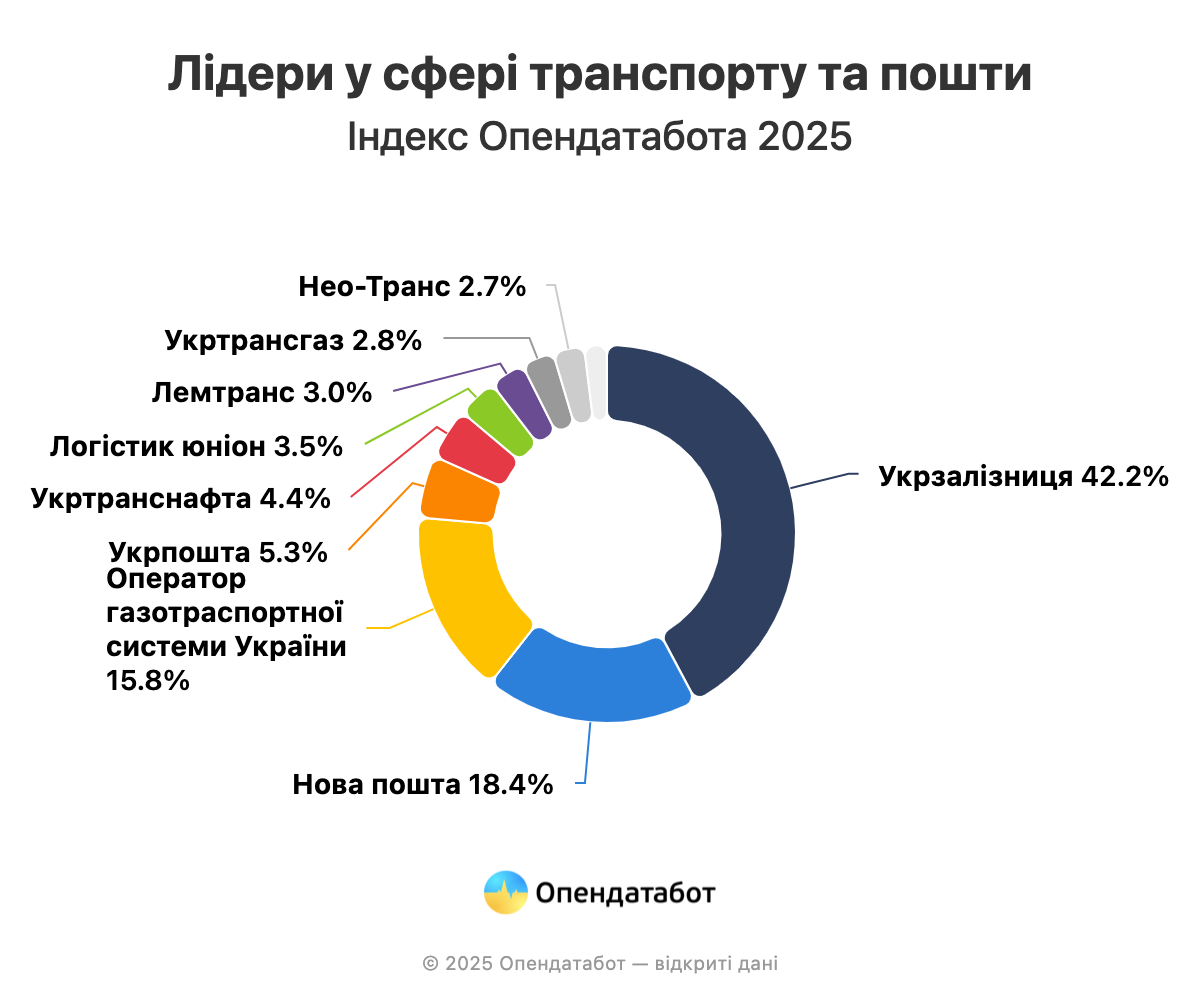

The total revenue of the top ten companies in this sector increased by 12%

According to the Opendatabot Index, the top ten companies in the transportation and logistics sector generated more than UAH 243 billion in total revenue last year. This is 12% more than in 2023. Only 5 out of 10 companies managed to make a profit that year.

According to the Opendatabot Index, the leading companies in the field of transport and postal services earned UAH 243.67 billion in revenue. Their total revenue grew by 12% over the year.

Not everyone had a good year: 8 companies saw their revenues grow, but only 5 of the top ten managed to make a net profit. The total profit of the top five was UAH 8.16 billion, while the losses of the other four companies amounted to UAH 12.1 billion. Another company broke even last year.

Despite the fact that half of the leading companies are state-owned, they account for more than 70% of the total income of the top five: UAH 171.89 billion.

Ukrzaliznytsia, the permanent leader of the Index, received UAH 102.87 billion in revenue last year (+11% yoy). However, the company still made a loss at the end of the year: UAH 4.19 billion. Ukrtransgaz had a similar situation: its revenue decreased by almost a third, and its losses reached UAH 7.44 billion.

Ukrposhta had a more successful year. Despite the fact that the company ended the year in the red, it managed to reduce its losses by almost 2 times. Overall, Ukrposhta increased its revenue by 12% to UAH 12.98 billion last year.

“For us, this rating and its results are not just numbers on the screen. These are years of hard work by tens of thousands of people who have been implementing reforms step by step and turning Ukrposhta into a modern and successful business. Despite the challenges of the war and the fact that we are a business with a human face, guided not only by short-term financial gain but also by the welfare of Ukrainians, we succeed,” comments Igor Smelyansky, CEO of Ukrposhta.

Another state-owned company, the Ukrainian Gas Transmission System Operator, increased its revenues by 7% to UAH 38.53 billion over the year. Although net profit decreased by 8.7 times to UAH 1.27 billion, the company still ended the year in the black.

“Ukraine’s GTS operator operates stably and reliably despite numerous challenges caused by the full-scale war. The company clearly and timely fulfills its obligations to internal and external customers of natural gas transportation services. This approach ensures the financial sustainability of the Company’s development,” said Vladislav Medvedev, acting CEO of GTSOU.

The revenue of the state-owned Ukrtransnafta decreased insignificantly, but its profit dropped by 16 times to UAH 1.22 billion. It is worth noting that in the previous Index, this company was the leader in terms of profit among the top ten.

For the second year in a row, Nova Poshta, which belongs to the NOVA group, has been ranked second in the Index, with its revenue up 23% to UAH 44.78 billion. But profit, on the contrary, decreased by 1.6 times to UAH 2.5 billion.

“In 2024, Nova Poshta became the world’s best postal operator according to the World Post & Parcel Award, expanding its network to more than 37,000 service points in Ukraine and more than 87,000 in 16 European countries by the end of the year. Last year, we opened the first barrier-free post office in Ukraine and donated more than UAH 4.8 billion for humanitarian needs and support of the army. 2024 was about movement and the challenges we managed to overcome,” the company commented.

This year, another NOVA Group company, Neo-Trans, was included in the Index for the first time. It showed the fastest revenue growth among the top ten: +100% (UAH 6.5 billion). Its profit also doubled to UAH 116.55 million. Together, the two NOVA companies account for 21% of the total revenue of the leaders.

Logistician Union of the ATB group is not far behind. Thus, the company moved up several positions in the ranking, increasing its revenue by 29% and earning the largest profit of all – UAH 3.06 billion (+40%).

Lemtrans, a company of Akhmetov’s SCM Group, demonstrates stability and remains in the seventh position for the third year in a row. Its revenue increased by only 3% to UAH 7.3 billion.

This year’s Index includes another new company, Ukrainian Helicopters. Despite a 17% increase in revenue (up to UAH 872 million), which allowed it to break into the top, the business recorded a loss of UAH 52.5 million.

At the same time, two companies from Oleksandr Radavsky’s agricultural holding, Promvagontrans and Berehove Grain Receiving Enterprise, dropped out of the 2025 Index. In 2024, their revenues decreased by 2.5 and 3 times, respectively, but both of them turned a profit: +UAH 2 million and +UAH 36 million in profit.

https://opendatabot.ua/analytics/index-transport-and-mail-2025

Logistics remains one of the most difficult problems for Ukrainian exporters of processed grain products since the beginning of Russia’s full-scale invasion of Ukraine in 2022, said Rodion Rybchynskyi, Director of the PU “Millers of Ukraine” Rodion Rybchynskyi at the Baltic Grains & Oils Conference in Riga on April 16.

“The commonwealth routes, i.e. the open routes provided by European countries to their railways, including here to the Baltic ports and to Polish ports, helped us a lot. But this still does not allow us to fully compensate for the losses we have suffered since the beginning of the war,” APK-Inform news agency quoted him as saying.

According to him, there is a possibility to ship products to the port of Constanta via the Danube, but there are still military risks, insurance companies assess these risks as high, and the cost of logistics remains significant.

“The Baltic ports are interesting, on the one hand, because they have direct container lines and the possibility of shipping to North America, South Asia, and so on. But this is a very large circle for the goods to get there… In fact, we see that compared to 2021, only the port of Ventspils transshipped slightly more Ukrainian products, while all other ports have decreased. For example, the port of Klaipeda actually halved its transshipment volumes in 2023,” Rybczynski said.

At the same time, Polish ports have significantly increased transshipment volumes of Ukrainian products, in particular grain products.

According to Rybczynski, Baltic ports remain important alternative routes for exports from Ukraine. The main advantages include access to Northern and Western Europe, delivery times, climate stability, modern infrastructure, less congestion and, most importantly, safe navigation. The disadvantages include logistics costs that are 2-3 times higher compared to the Danube ports, higher cargo handling costs, and railroad bottlenecks.

The agro-industrial group of companies NOVAAGRO UKRAINE (Kharkiv) has purchased the first 20 hopper cars with an increased body volume of 124.5 m³ from Karpaty, the company’s press service reports on Facebook.

“This is an important step towards the realization of our plans to invest in the development of operational efficiency, namely to reduce logistics costs and ensure the stability of the supply chain of sunflower meal to European countries,” the statement said.

The purchased hoppers will be used to minimize logistics costs for sunflower meal exports.

NOVAAGRO Group has been operating in the Ukrainian and international markets since 2009. It comprises four operating companies specializing in trading, exporting grains and oilseeds, growing, warehousing, as well as production and sale of mixed fodder, wheat flour, granulated bran and chicken meat.

“NOVAAGRO owns five elevators with a total storage capacity of over 310 thousand tons. It has a feed mill in Chkalovske (Kharkiv region) that produces 200-300 tons of products per day.

According to the Unified State Register of Legal Entities and Individual Entrepreneurs, the ultimate beneficiary of Novaagro Limited is Sergiy Polumysnyi.

As reported, in October, NOVAAGRO Group completed the purchase of a 56.9% stake in AgroGeneration S.A.

Karpaty DMZ has been producing chemical and mining equipment, tanks and reservoirs for gas stations for the storage and transportation of petroleum products, hydraulic lifts, and spare parts for chemical and mining equipment for over 40 years. The plant switched to railcar production in 2012. It is one of the top three freight car builders in the grain carrier segment.

The company owns a 20-hectare land plot with 24 buildings and structures. The plant operates its own 35 kW power substation and a 5.7 km network of access railways. Production facilities process about 2.5 thousand tons of rolled metal products, castings and components per month. The company employs 800 people. The company’s beneficiaries are Yevhen Pogrebnyak (80% of shares) and Anatoliy Oleksiyenko (20%).