The fruit harvest in the 2025 season is about 60% of the pre-war level, and fruit storage facilities are loaded at 50% of pre-war volumes, so consumers should not expect the low fruit prices that existed before the war, said Taras Minko, head of the Ukrsadprom association.

“When fruit cost pennies, it was good for consumers, but for the industry itself, it was a huge minus, as it led to the bankruptcy of enterprises. If this trend had continued to this day, there would be no orchards left in Ukraine. We would be importing Polish, German, and other apples at European prices, which currently stand at EUR 2.603 per 1 kg,” he said at the Agro2Food exhibition.

The head of the industry association explained that low fruit prices in the pre-war period were due to high orchard productivity and intensive industrial horticulture in Ukraine.

According to him, 2022 was a lost production season for Ukrainian horticulture. Part of Ukraine was occupied, and a number of fruit storage facilities and horticultural farms were destroyed and looted.

“The main factors driving up fruit prices in recent years have been the cost of energy, labor shortages, and labor costs. There is a shortage of people—they are leaving the country. Those who remain want to work less and earn more. The discrepancy between wages and productivity is currently incomparable,” Minko emphasized.

He added that 250 people are needed to harvest a 25-hectare orchard. As a result, in 2022, many enterprises harvested 30% of their crops, in 2024 – 60%, and the current situation is no better.

In addition, according to the head of Ukrsadprom, a significant amount of fruit storage capacity has been destroyed in Ukraine. As an example, he cited statistics from association members who collectively cultivate 10,000 hectares of orchards. Before the war, they had about 110-120 thousand tons of storage in refrigerators.

“Currently, about 60% remains (of fruit storage facilities – IF-U). Some have closed, and some have lost their apple harvest due to climate change. This season, refrigerators with a capacity of about 50-60 thousand tons are in use,” Minko stated.

He noted that Ukraine currently lacks a culture of consuming jams and preserves, which hinders the development of the processing industry. At the same time, he predicts that in the next five years, Ukraine will see a boom in the construction of processing enterprises specializing in the manufacture of such products.

“If you look at today’s market, those who will look at such processing will have great prospects regardless of the number of enterprises existing today. While our parents were busy making preserves, our children will buy ready-made products. Therefore, this is a very promising and interesting industry, which will boom in 3-5-7 years,” concluded the head of Ukrsadprom.

The buckwheat harvest in Ukraine in 2025 is 15% lower than a year earlier, which is not a problem for the domestic market, but will lead to price increases due to frenzied demand provoked by the media, said Rodion Rybchinsky, director of the Ukrainian Flour Millers Association.

“As far as I understand, this year’s buckwheat harvest is already 15% lower than last year’s. Questions about its availability should be addressed not to processors, but to farmers engaged in agribusiness,” he said at the Agro2Food Profit forum in Kyiv on Wednesday.

The expert explained that farmers themselves decide what is profitable for them to sow—sunflowers, soybeans, rapeseed— and then defend their rights to export soybeans and rapeseed to the Ministry of Economy and the State Tax Service without paying a 10% export duty, or to sow buckwheat, which yields 1.3-1.5 tons/ha, and then sell it for UAH 20,000 per ton.

Responding to a question about the reasons for the rise in buckwheat prices this year, Rybchinsky said that there were no reasons, but prices would still rise.

“Some newspaper or Telegram channel started shouting this week that buckwheat is getting more expensive. People listened and rushed to the supermarket. They see that buckwheat is selling for 25 UAH/kg, and tomorrow it will be 30 UAH/kg. They bought it all up. The warehouses of processing plants are empty. Retailers are starting to ask the authorities, ‘Where is the buckwheat? ’ And it’s with the farmers, who are waiting for prices to rise to 40 UAH/kg and are not releasing the product. They are doing this because consumers have bought up all the product at 25 UAH/kg,” explained the head of the industry association.

Rybchinsky recalled that the rush demand for buckwheat, rye, and other products occurs steadily every three to four years.

“Ukrainians do not eat buckwheat in such quantities as the media try to portray. Buckwheat is primarily needed by people with diabetes. Other consumers can do without it, because Ukraine produces more corn and wheat groats than it needs for domestic consumption,” emphasized the head of the Ukrainian Flour Millers Association, urging Ukrainians not to react to the artificially created hype.

As reported, in the 2025 season, Ukrainian farmers reduced the area under buckwheat to 69,100 hectares, compared to 90,300 hectares a year earlier. As of October 24, buckwheat has been harvested from 86% of the production areas with a yield of 14 tons/ha, yielding 83.3 thousand tons, compared to 126.9 thousand tons a year earlier.

As of October 17, farmers harvested 34.749 million tons of grain and legumes from 7.979 million hectares, which is 69% of the area sown with these crops, according to the website of the Ministry of Economy, Environment, and Agriculture.

Last year, on the same date, 42.8 million tons of grain were harvested from 9.4 million hectares, meaning that this year’s figures are 18.8% and 15% lower, respectively, mainly due to the later start of corn harvesting.

As noted by the Ministry of Economy, 4.91 million tons of corn have been harvested from 895,200 hectares, while last year at around this date, 13.2 million tons were harvested from 2.4 million hectares.

As for wheat, its harvest is slightly higher than last year’s – 22.78 million tons from 5.05 million hectares compared to 22.30 million tons from 4.9 million hectares, while barley is slightly lower – 5.36 million tons from 1.35 million hectares compared to 5.50 million tons from 1.41 million hectares.

This year’s pea harvest is significantly higher – 658,300 tons from 271,100 hectares compared to 465,300 tons from 212,200 hectares last year, while buckwheat and millet are still significantly lower – 82.4 thousand tons versus 124.8 thousand tons and 59.9 thousand tons versus 158.9 thousand tons, respectively.

The harvest of other cereals and legumes this year reached 896,200 tons from 304,700 hectares as of October 17, while last year it amounted to 1 million tons on the same date.

It is noted that among the leaders are, in particular, the Odesa region – 3.78 million tons from an area of 1.13 million hectares, Poltava – 2.66 million tons from 564,200 hectares, Khmelnytskyi region – 2.48 million tons from 356,900 hectares, and Vinnytsia region – 2.45 million tons from 440,100 hectares.

The harvest of wheat, barley, and peas has been completed, according to the Ministry of Economy.

As for oilseeds, the rapeseed harvest is only slightly less than last year’s – 3.31 million tons compared to 3.5 million tons from almost equal areas of about 1.3 million hectares.

However, the harvest of soybeans and sunflowers is still ongoing, and there is a significant lag: 3.08 million tons of soybeans have been harvested from 1.34 million hectares, compared to 5.2 million tons from 2.3 million hectares on the same date last year, while sunflower seeds – 7.19 million tons from 3.91 million hectares compared to 9.3 million tons from 4.5 million hectares.

In addition, the harvest of sugar beets is also lagging behind: 4.72 million tons have been harvested from an area of 90,000 hectares, compared to 6.5 million tons on the same date last year.

According to the Ministry of Economy, sunflower has been harvested from 76% of the sown area, soybeans from 62%, and sugar beets from 45%, while rapeseed harvesting has been completed.

In its Inflation Report published at the end of July, the National Bank of Ukraine lowered its forecast for this year’s grain harvest from 61.7 million tons to 57.9 million tons, and for oilseeds from 22 million tons to 21 million tons.

The NBU recalled that last year, the grain harvest in Ukraine fell to 56.2 million tons from 59.8 million tons in 2023, while oilseeds fell from 21.7 million tons to 20 million tons.

According to forecasts by Deputy Minister of Economy Taras Vysotsky, this year’s grain harvest will be around 56 million tons, the same as last year.

As of September 19, farmers harvested 29.77 million tons of early grain and leguminous crops from 7.09 million hectares, which is 62% of the area sown with these crops, according to the Ministry of Economy, Environment, and Agriculture on its website.

Last year, as of September 20, 31.90 million tons of grain were harvested from 7.53 million hectares, meaning that the current figures are 6.7% and 5.9% lower, respectively, mainly due to the later start of the corn harvest.

As noted by the Ministry of Economy, 388,700 tons have now been harvested from 90,300 hectares, while last year at around this date, 2.40 million tons were harvested from 514,500 hectares.

As for wheat, its harvest is slightly higher than last year’s – 22.48 million tons from 5.02 million hectares compared to 22.30 million tons from 4.9 million hectares, while barley is slightly lower – 5.33 million tons from 1.35 million hectares compared to 5.50 million tons from 1.41 million hectares.

This year’s pea harvest is significantly higher – 626,600 tons from 266,000 hectares compared to 465,300 tons from 212,200 hectares last year, while buckwheat and millet are still significantly lower – 57,100 tons versus 99,400 tons and 45,400 tons versus 132,000 tons, respectively.

The harvest of other cereals and legumes this year reached 844,300 hectares as of September 19, compared to 1,000,000 tons as of September 20 last year.

It is noted that among the leaders, in particular, the Odessa region harvested 3.68 million tons from an area of 1.09 million hectares, the Vinnytsia region with 2.41 million tons from 434,400 hectares, the Kirovograd region with 2.21 million tons from 538,400 hectares, and the Khmelnytskyi region with 2.13 million tons from 306,700 hectares.

As for oilseeds, the rapeseed harvest is only slightly less than last year’s – 3.30 million tons compared to 3.4 million tons from the same area of 1.27 million hectares.

However, the harvest of soybeans and sunflowers is still ongoing, and there is a significant lag: 944,900 tons of soybeans have been harvested from 483,700 hectares, compared to 2.6 million tons from 1.3 million hectares on a similar date last year, while 2.41 million tons of sunflowers have been harvested from 1.37 million hectares, compared to 4.90 million tons from 2.4 million hectares.

In addition, sugar beet harvesting is also lagging behind: 632,500 tons have been harvested from an area of 12,700 hectares, compared to 1.7 million tons on the same date last year.

According to current data, the yields of wheat, barley, peas, rapeseed, and soybeans are roughly the same as last year, while corn and sunflower yields are lower so far, at 4.3 tons/ha versus 4.7 tons/ha and 1.8 tons/ha versus 2 tons/ha, respectively.

As reported, in its Inflation Report published at the end of July, the National Bank of Ukraine lowered its forecast for this year’s grain harvest from 61.7 million tons to 57.9 million tons, and for oilseeds from 22 million tons to 21 million tons.

The NBU recalled that last year, the grain harvest in Ukraine fell to 56.2 million tons from 59.8 million tons in 2023, while oilseeds fell from 21.7 million tons to 20 million tons.

According to forecasts by Deputy Minister of Economy Taras Vysotsky, this year’s grain harvest will be about 56 million tons, the same as last year.

Ukrainian farmers will harvest about 56 million tons of early grain crops and 21 million tons of oilseeds in the 2025 season, according to Deputy Minister of Economy, Environment, and Agriculture Taras Vysotsky.

“In principle, in terms of early grain crops, production is expected to be around 26 million tons, which is slightly less than last year. The decrease is due to the fact that in the southeastern regions, the yield of winter wheat and rye is, unfortunately, lower due to drought,” he said on Ukrainian Radio.

Speaking about the corn harvest, which will begin in September, the deputy minister noted that the harvest is also expected to be good. At the same time, corn crops in the southeast — parts of Dnipropetrovsk, Kirovohrad, Mykolaiv, and Odesa regions — have been virtually lost. However, the main corn belt of Ukraine — Sumy, Chernihiv, Poltava, Kyiv regions and further west, despite late sowing and late emergence, thanks to precipitation and optimal temperature conditions, has produced good plants.

“Ultimately, the corn harvest will be quite good on a national scale. We can talk about about 28 million tons, which is more than last year,” Vysotsky said, adding that the final forecast figure of 56 million tons of gross grain harvest is in line with last year’s level.

According to him, farmers will receive about 21 million tons of oilseeds in 2025, which corresponds to the 2024 figure. The production structure will include slightly more sunflower and less soybeans.

The deputy minister also noted favorable purchase prices for agricultural products.

“From a farmer’s point of view, prices are high, really good. Even now, at the time of harvest, they are not falling and are holding steady. Where there were no force majeure circumstances and no losses, these prices are really worthy as a result of working the land,” he stressed.

Speaking about livestock products, Vysotsky noted the stable situation with the production of all types of meat, eggs, and milk.

He recalled that due to the cold spring, horticulture suffered losses in the 2025 season.

“Yes, there were losses in orchards, in the early group, but for late varieties, the indicators may be slightly better and at the level of last year. In the domestic market of Ukraine, a decrease in apple prices is expected in the near future. Currently, they are holding steady because last year’s harvest is being sold. The cost includes long-term storage. But starting in September, the situation will change and stabilize by the end of October. Depending on the final harvest, the prices will be completely different,“ Vysotsky said.

According to him, the situation with vegetables is similar.

”We are approaching the mass harvest (of vegetables – IF-U). We see that the price is reacting and will decline. But there are no prerequisites for it to fall below cost. Vegetables will be more affordable for consumers, but with a normal economic effect for the producer,” Vysotsky concluded.

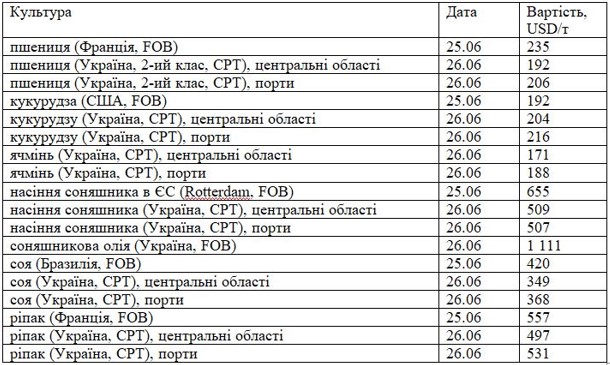

Let’s track the prices as of the end of June 2025 for the main grain and oil crops exported from Ukraine, as well as fluctuations in their value on the world market.

The price of wheat (France, FOB) was 235 USD/t, according to market operators on June 25, 2025. This is 1 USD less than last week, 6 USD more than the previous month, and 3 USD more than the previous year. The price of wheat (Ukraine, 2nd grade, CPT) for the central regions (June 26) was 192 USD/t. This figure remained unchanged during the week, decreased by 15 USD over the month, and increased by 45 USD over the year. For ports, the amount was 206 USD/t, which is 3 USD less than a week ago and 18 USD less than a month ago, but 19 USD more than a year ago.

According to the International Grains Council, the price of corn (USA, FOB) as of June 25 was 192 USD/t. This is USD 8 less per week and USD 16 less per month, but USD 3 more per year. The price of corn (Ukraine, CPT) on June 26 for the central regions was USD 204/t. It did not change during the week, but decreased by USD 4 per month and increased by USD 73 per year. For ports, it was 216 USD/t (also unchanged from the previous week, down 16 USD from the previous month, and up 3 USD from 2024).

“Let’s pay attention to the forecast for global corn production in 2025/26 MY. It has been reduced by 1 million tons to 1,276 million tons, compared to 1,225 million tons in the current season. However, the forecast for global consumption has been increased by 1 million tons to 1,269 million tons. Therefore, the estimate of final corn stocks has been lowered by 2 million tons (to 282 million tons). This will exceed the current season’s figure by 7 million tons,” said grain market analyst Alexander Korenitsyn.

As for the price of barley (France, FOB) as of June 25, it stood at USD 216/t. This is USD 6 less than a week ago and USD 5 less than a month ago, but USD 11 more than a year ago. Let’s analyze the price changes for barley (Ukraine, CPT). As of June 26, the price was (central regions) – 171 USD/t. This is 3 USD more per week and 46 USD more per year, but 30 USD less per month. For ports, the price is 188 USD/t, which is 6 USD more per week, 40 USD more per year, but 2 USD less per month.

Prices for major grain and oil crops exported from Ukraine, end of June 2025

According to Oleksandr Serhiyovych Korenitsyn, the price of sunflower seeds in the EU (Rotterdam, FOB) as of June 25 was USD 655/t. The changes are as follows: +5 USD per week, -14 USD per month, and +170 USD per year. The price of sunflower seeds (Ukraine, CPT) on June 26 (central regions) was 509 USD/t. This is 8 USD less per week and 16 USD less per month, but 109 USD was added to the price per year. For ports, the cost is 507 USD/t. The price fell by 6 USD per week and rose by 9 USD per month and 148 USD per year. A ton of sunflower oil (Ukraine, FOB) costs 1,111 USD as of June 26.

The cost increased by $8 per week and by the same amount per month.

The calculation of price fluctuations for soybeans is based on its cost as of June 25 (Brazil, FOB) – $420/t. It decreased by $10 per week and by $16 per year, but increased by $15 per month.

“The price of soybeans (Ukraine, CPT) in the central regions was 349 USD/t on June 26, which is 8 USD less than a week ago, 4 USD less than a month ago, and 23 USD less than in 2024. The price for ports is 368 USD/t. It decreased by 14 USD, 13 USD, and 10 USD over the week, month, and year, respectively,” said analyst Alexander Korenitsyn.

The price of rapeseed (France, FOB) on June 25 was $557/t. Price changes: down $9 per week, up $7 per month, and up $55 per year. The cost of rapeseed (Ukraine, CPT) on June 26 for central regions is 497 USD/t (up 106 USD per year), for ports – 531 USD/t (up 110 USD per year).

agricultural sector, COST, DOLLAR, EXPORT, HARVEST, Oleksandr Korenitsyn, PORT, PRICE, SOYBEANS