Which regions submitted the fewest financial reports

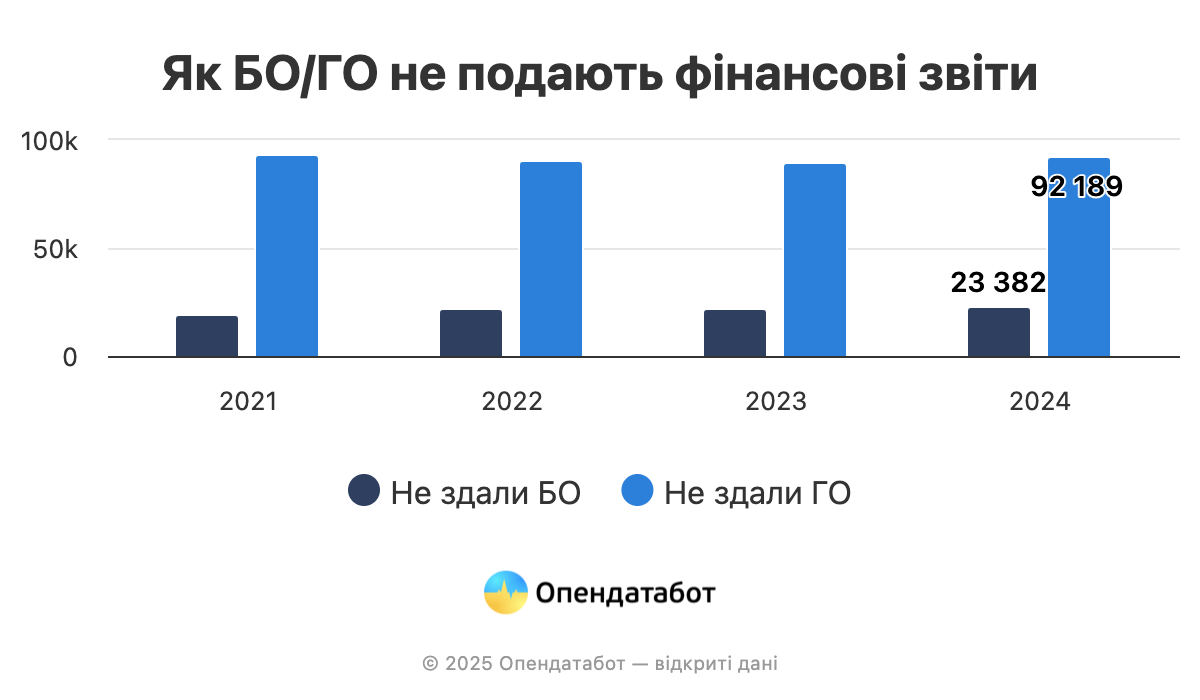

According to the State Statistics Service, 92,189 public organizations (POs) and 23,382 charitable organizations (COs) did not submit their financial reports for 2024. This trend began long before the full-scale war. Among the regions that are not occupied or where there is no fighting, the most frequent evaders of reporting are in the Kyiv and Chernivtsi regions.

89% (92,000) of public organizations in Ukraine did not submit financial reports for 2024. This is 2,225 more NGOs than in 2023. In general, the number of such organizations gradually decreased from 2021 to 2023, and last year’s figure can be attributed to statistical error.

The same trend can be observed among charitable reports. Last year, their number increased by 965 charitable foundations, or 4%. In total, 77% of the total number, or 23,000 foundations, did not submit financial reports.

The trend of ignoring reporting did not arise during the full-scale invasion, but is rather an established tradition. 97% and 94% of CSOs and CFs did not submit financial reports despite the legal requirement in 2021. In other words, with the start of the large-scale war, the number of non-transparent organizations actually decreased.

You can check the financial reports of foundations and CSOs using the services of OpenDataBot.

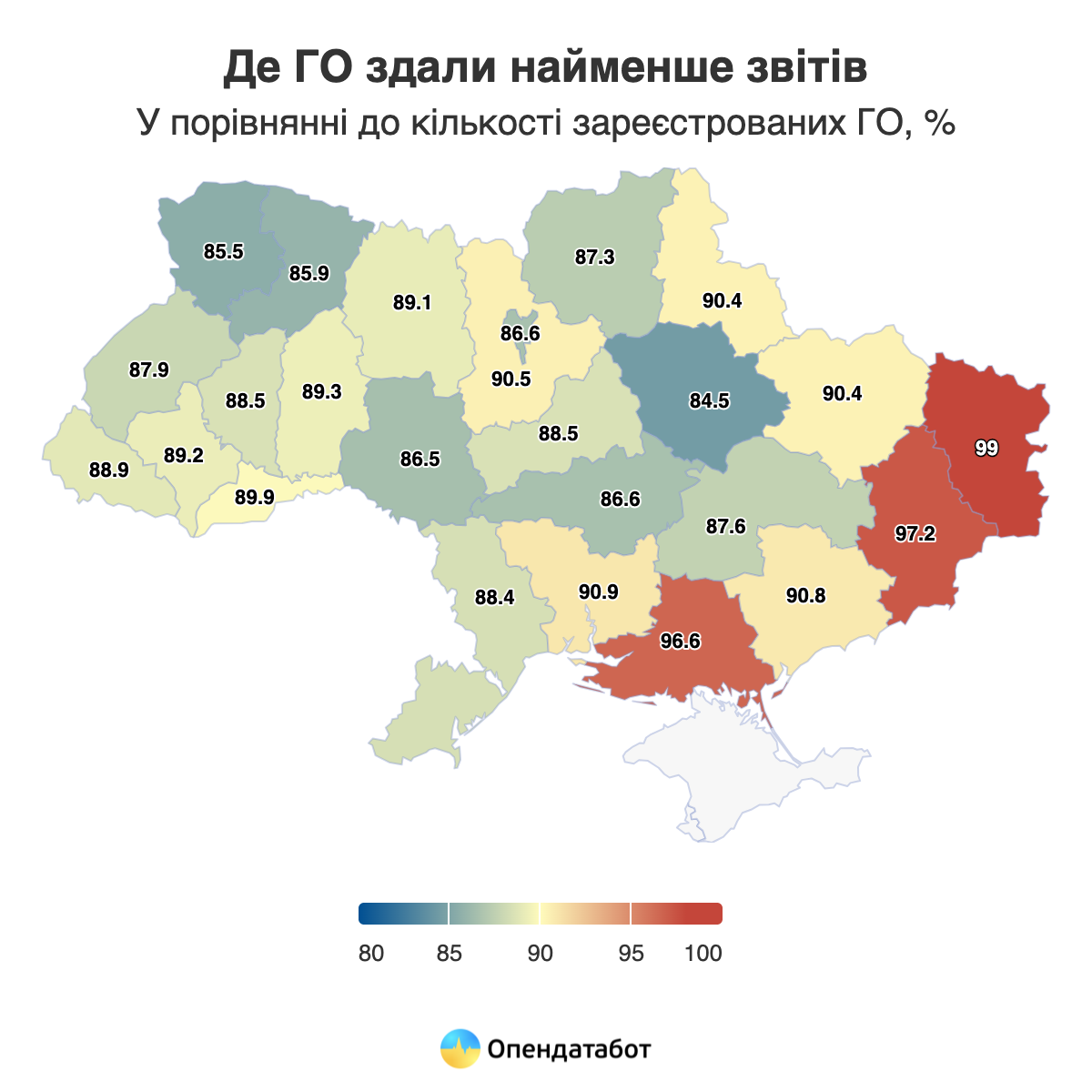

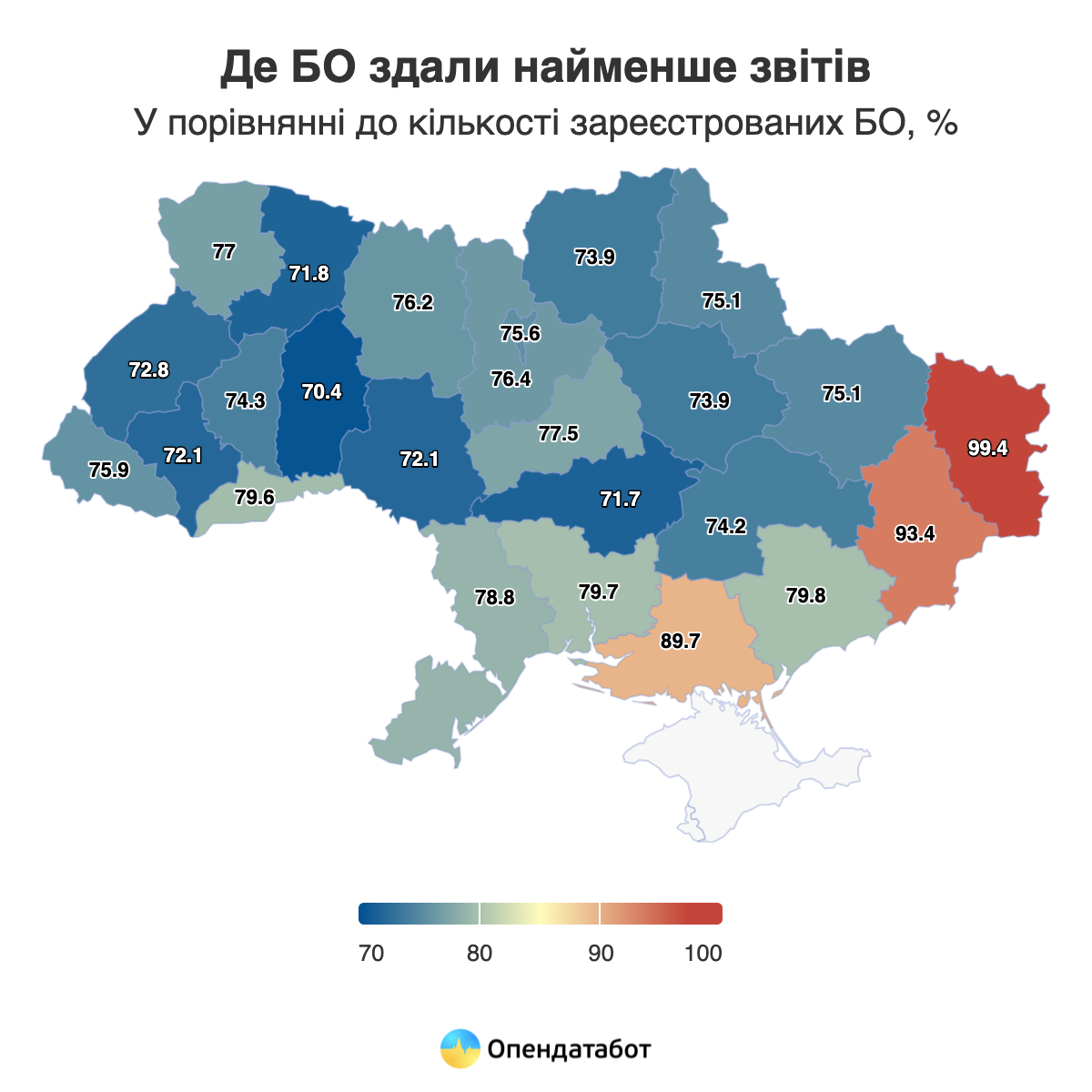

Most of the organizations that did not submit reports are located in regions whose territories are temporarily occupied. Among the regions that are completely controlled by Ukraine, the largest number of CSOs did not submit reports in the Kyiv region – 90.5%. The largest number of charitable foundations that did not report are registered in the Chernivtsi region – 80%.

The five leading public organizations by income in 2024:

● Ukraine is Invincible – 2023 (Mykolaiv region) – UAH 6.1 billion;

● Against Corruption (Cherkasy region) – UAH 3.5 billion;

● Security and Welfare (Zaporizhzhia region) – UAH 2 billion;

● Together Against Corruption (Kyiv city) – UAH 1.8 billion;

● 68 Brigade 3 Battalion (Ivano-Frankivsk region) – UAH 1.7 billion.

The five leading charitable organizations by income in 2024:

● Come Back Alive (Kyiv) – UAH 4.9 billion;

● Kyiv Center for Support of Children and Youth (Kyiv) – UAH 2.7 billion;

● Caritas Ukraine (Lviv region) – UAH 2.6 billion;

● Plast Endowment in Ukraine (Kyiv) – UAH 2.5 billion;

● 100 Percent Life (Kyiv) – UAH 2.3 billion.

The Come Back Alive Foundation is the largest charitable organization in Ukraine among those that reported their income. Despite the fact supporting the organization’s activities at this level requires significant resources, the fund states that it is guided not by bureaucratic ideas, but by the criterion of transparency before the state, partners, and donors, building relationships based on integrity and openness — therefore, it publishes even more data than required by law.

Come Back Alive strives to maintain and develop trust in charitable activities in Ukraine by providing access to information about its economic activities and implementing unique projects that often require high-quality accounting and legal support in order to best promote Ukraine’s defense and mobilization readiness and protect its population.

Supporting and developing accounting and financial reporting is a constant and mandatory task for a charitable organization. We work strategically and for the long term, so our open reporting on the website helps to improve the results of cooperation and activities by minimizing the risks that arise when access to essential information is restricted,” comments Lesya Melnyk, Financial Director of the Foundation.

In May 2025, Naftogaz group companies paid over UAH 7.8 billion in taxes, fees, and mandatory payments to the budget, the company reported.

“Of these funds, UAH 7.2 billion was transferred to the state budget and UAH 640 million to local budgets,” the company said in a statement on its website on Wednesday.

According to the group’s estimates, total tax revenues from its companies since the beginning of this year amounted to UAH 38.1 billion.

“Naftogaz remains one of Ukraine’s largest taxpayers, ensuring the country’s financial stability amid war and difficult economic challenges. The amount of taxes paid is not just a number for us. These are real actions that support our state,” commented Naftogaz CEO Serhiy Koretsky.

As reported, in April 2025, Naftogaz paid UAH 7.1 billion in taxes, of which the group transferred UAH 6.4 billion to the state budget and UAH 692 million to local budgets.

According to the latest data from Eurostat, EU countries’ purchases of Russian gas increased significantly between January and April 2025. Despite efforts to abandon supplies from Russia, significant volumes of both pipeline and liquefied natural gas (LNG) continued to flow into the European Union.

Imports of Russian pipeline gas to Europe in the first four months of 2025 increased by approximately 5–10% compared to the same period last year.

Russian LNG supplies also showed growth — at the end of January, this figure exceeded 17% compared to December 2024.

In January 2025, the EU spent about €1.9 billion on Russian gas: ≈€833 million on pipeline supplies and ≈€1.07 billion on LNG, which was the highest level in two years.

The suspension of Russian gas transit through Ukraine on January 1, 2025, prompted EU countries to increase purchases through alternative routes, such as TurkStream, and through LNG supplies.

Advantageous contracts and cheaper prices for Russian LNG are being used, especially in the context of energy shortages.

Energy dependence: Despite the goal of completely abandoning Russian gas by 2027, the EU bloc remains dependent on it for ≈19% of its total gas imports.

Diversification in progress: The EU is actively trying to offset the risks by finding new suppliers (the US, Norway, Algeria, Azerbaijan) and increasing the role of LNG, but ending Russian supplies will take time.

European authorities are discussing the possibility of transferring contracts to Force Majeure status, which would facilitate their termination by 2027.

The state-owned Ukrgasbank (Kyiv) has granted Zaporizhia a loan of UAH 300 million for the creation of distributed energy generation facilities and other energy-saving measures, according to a statement posted on its website on Monday.

The bank told the Interfax-Ukraine news agency that the loan is for a period of seven years.

According to a statement on the bank’s website, the funds will be used to build distributed energy generation facilities in the city and implement energy-saving measures at key critical infrastructure facilities.

It is also noted that the loan, which will be received by municipal enterprises and institutions of the city, will enable them to ensure their own electricity production for technological and domestic needs, to function stably during power outages, to power critical infrastructure facilities and social institutions, and to use the heat energy produced for the needs of residents within the created energy islands.

According to Boris Rozsokha, deputy director of the economic development department of the Zaporizhzhia City Council and head of the energy management and investment department, whose words are quoted in the report, the use of cogeneration plants will ensure more efficient use of fuel, reduce carbon and other harmful emissions into the atmosphere, and will also minimize losses inherent in traditional electricity generation.

As reported, state-owned Ukreximbank, Oschabank, and Ukrgasbank (all based in Kyiv) issued loans ranging from two to five years for approximately UAH 2.04 billion in the equivalent of five city councils at floating rates, including UAH 200 million to the Zaporizhzhia City Council.

Algeria has officially launched a national initiative to attract foreign students, opening the country to those who wish to pursue higher education in the North African state. In April 2025, the Algerian government launched the digital platform STUDY IN ALGERIA — studyinalgeria.dz, which is part of an ambitious strategy to modernize and internationalize higher education.

University system and infrastructure

As of 2025, there are over 130 public and private higher education institutions in Algeria, evenly distributed throughout the country. They offer:

Studies are available in Arabic, French, or English, depending on the field of study and the institution chosen.

The Algerian education system (LMD)

The Algerian higher education system is based on the European LMD model, which includes:

Social protection and living conditions

Foreign students are provided with:

Simplified visa application

Algeria guarantees flexible visa procedures for foreign students, allowing them to complete the admission process as quickly as possible.

The platform studyinalgeria.dz allows you to:

Reference: the state of Algeria

Algeria has clearly established itself as a new educational destination on the global map. The STUDY IN ALGERIA program is an attempt to combine affordable quality education, cultural diversity, and a strategic geographical location for the future generation of professionals from around the world.

ALGERIA, higher education institution, STUDY, UNIVERSITY, СТУДЕНТ

The total area of residential buildings for which construction permits were issued (new construction) in January-March 2025 increased by 53.4% compared to the same period in 2024, reaching 1 million 409.8 thousand square meters, according to the State Statistics Service (Gosstat).

According to the statistics agency, in January-March 2025, the total area of new construction of apartment buildings increased by 54% compared to last year, to 1 million 360.2 thousand square meters.

The number of apartments registered for construction in the first quarter of 2025 reached 22,700, which is 36% more than in the first quarter of 2024. Of these, the number of apartments registered in apartment buildings increased by 64.4% to 16,200.

According to State Statistics Service data, the Kyiv region led in terms of new housing construction in January-March 2025, with 594,600 square meters, which is 4.3 times higher than in January-March last year. At the same time, 7,700 apartments were registered in multi-apartment buildings in the capital, and 1,500 in single-family homes.

Significant volumes of new housing construction were also recorded in the Lviv region – 248,000 square meters (2,200 apartments in multi-apartment buildings and 848 in single-family homes), which is 15.8% higher than last year.

In Kyiv, in the first quarter of 2025, the total area of new housing construction increased by 17% to 145,300 square meters (a total of 1,700 apartments).

The State Statistics Service reminds that the figures do not include territories temporarily occupied by the Russian Federation and parts of territories where hostilities are ongoing (or have been ongoing).

As reported, the total area of new housing construction in Ukraine in 2024 decreased by 7.2% compared to 2023, to 3.9 million square meters, while in 2023 it amounted to 4.2 million square meters, in 2022 – 6.67 million square meters, and in 2021 – 12.7 million square meters.