Ukraine’s international reserves in March, according to preliminary estimates of the National Bank of Ukraine (NBU), increased by 18%, or $6.7 billion – to $43 billion 762.7 million.

“Such dynamics is due to significant (more than $9 billion) volumes of receipts from international partners, which exceeded the net sale of currency by the National Bank and the country’s debt payments in foreign currency,” the NBU website explained on Friday.

In addition, the National Bank noted that $9.32 billion was transferred to foreign currency accounts of the Cabinet of Ministers in March, while $363.5 million was paid for servicing and repayment of the state debt.

As the regulator noted, Ukraine also paid $728.5m to the International Monetary Fund.

Among other factors determining the volume of reserves, the NBU named operations on the foreign exchange market: in March, the regulator’s net sale of foreign currency amounted to $1.79bn, which is 18.5% more than in the previous month.

According to balance sheet data, the NBU sold $1.81 bln on the foreign exchange market and bought $25.9 mln in reserves.

The central bank also indicated that the current volume of reserves was positively affected by the revaluation of the value of financial instruments, adding $266.3 million.

“The current volume of international reserves provides funding for 5.8 months of future imports,” the regulator stated.

As reported, the NBU in January reduced the forecast of Ukraine’s international reserves at the end of 2024 to $40.4 billion from $44.7 billion and to $42.1 billion from $45 billion at the end of 2025. Earlier, Experts Club analytical center and Maxim Urakin released a video analysis of how the GDP of the world’s countries has changed in recent years, more detailed video analysis is available here – https://youtu.be/w5fF_GYyrIc?si=BsZmIUERHSBJrO_3 Subscribe to Experts Club YouTube channel here – https://www.youtube.com/@ExpertsClub

EXPERTS CLUB, GDP, International reserves of Ukraine, MACROECONOMICS, NATIONAL BANK OF UKRAINE, NBU, URAKIN

Metinvest Mining and Metallurgical Group is expected to increase its payments to budgets of all levels by 60% year-on-year to over UAH 4 billion from UAH 2.5 billion in January-March this year.

Metinvest’s CFO Yulia Dankova told dsnews.ua that the dynamics of payments is positive, although it is negative compared to the first quarter of 2022, when the company paid UAH 6.9 billion in taxes, but this accrual was based on the results of the pre-war fourth quarter of 2021.

At the same time, she clarified that, in particular, the group’s enterprises in Pokrovsk, located a few tens of kilometers from the front line, paid more than UAH 261 million in taxes and fees in 2023, which is a third of all tax revenues to the local budget. The largest items of deductions are personal income tax in the amount of over UAH 245 million, rent for subsoil use – UAH 8.5 million, property tax – UAH 4.5 million, land payment – over UAH 3 million, and environmental tax – over UAH 2.3 million.

“We believe that this is a significant contribution to the development of local communities and support of the country’s defense capability in general,” said the CFO.

Answering the question about the need to improve tax legislation to enable businesses to operate more efficiently in the war, Dankova explained that Ukraine is still discussing the possibility of introducing tax consolidation.

“For some time it was not in focus. But, given the current realities, we believe that this issue should be revisited, because it is a high-quality tax civilized practice. For example, our coal mining company UCC in the US consolidates taxes and reports for the entire list of legal entities – coal mining companies,” the CFO said.

Another important issue is tax duplication. For example, the group’s mining and processing plants pay several types of taxes for one facility: environmental tax, land tax, waste disposal fee and subsoil tax. Plus income tax.

“These all seem to be different taxes, but we pay a lot of them for just one quarry. It does not seem fair to us, and we believe that taxes are duplicated. We could use this resource for investments that will create new jobs. In addition, this is also budget revenues in the form of import VAT and customs duties. This is an increase in our efficiency, which in turn will generate more income tax,” the top manager is convinced.

As for the situation with VAT refunds for exported products, Metinvest, as an export-oriented company, expects VAT refunds, “and the mechanism is generally working, but there are some important issues that are not being resolved.” For example, some of the counterparties from whom the company purchases services or goods are considered risky by the tax authorities. These counterparties withdraw VAT, and it does not go to the budget, as it should according to the law.

Instead of targeting these risky taxpayers, the tax authorities deny VAT refunds to companies like Metinvest that operate in a formal and transparent manner. In essence, the tax authorities are punishing such companies because their unscrupulous counterparties do not pay VAT to the budget. This practice has been going on for many years.

Now, in the context of military operations, the importance of this problem is growing because it affects working capital. The company does not receive VAT refunds because the government has not learned how to deal with risky taxpayers. Ultimately, the state will see an increase in tax revenues if this issue is resolved. In addition, the tax office will not divert so many resources that can be directed to more useful things, Dankova believes.

The CFO expressed concern about the impossibility of reconstructing enterprises by 2026 as part of the EU’s increased requirements for environmental friendliness and emissions reduction due to the war.

“This is a challenge for Metinvest’s Ukrainian operations. We planned to rebuild our plants to produce low-carbon steel. However, we will not be able to complete the green transformation of our enterprises by 2026 because of the war. We cannot invest in large-scale projects in Ukraine right now. Therefore, there are two options: Ukraine’s accelerated accession to the EU and joining the European Emissions Trading System (EU ETS) or postponing CBAM requirements for Ukraine,” the CFO summarized.

“Metinvest is a vertically integrated group of steel and mining companies. The group’s enterprises are located mainly in Donetsk, Luhansk, Zaporizhzhia and Dnipropetrovs’k regions.

The main shareholders of the holding are SCM Group (71.24%) and Smart Holding (23.76%), which jointly manage it.

Metinvest Holding LLC is the management company of Metinvest Group.

In January-March 2024, the State Enterprise “Forests of Ukraine” increased its revenue from timber sales by 30.8% compared to the same period in 2023, up to UAH 5.1 billion, said the company’s CEO Yuriy Bolokhovets.

“Tax payments increased by more than UAH 850 million. Pre-tax profit increased to almost UAH 1 billion,” he wrote on Facebook.

Bolokhovets mentioned the blockade of the western borders as one of the negative factors that affected the company’s performance, which led to a rise in the cost of export logistics. This, in turn, affected both processors and foresters.

Among the positive factors, the CEO of Forests of Ukraine mentioned the closure of forestry processing shops, which were not cost-effective to maintain.

“The denationalization of the processing market has increased competition, transparency, and significantly reduced corruption risks,” Bolokhovets said, adding that the abandonment of forestry processing will have a more significant impact on the economic performance of the second and third quarters.

As reported, Ukraine launched a forestry reform in 2016. It has already introduced the sale of unprocessed timber at electronic auctions. Since 2021, an interactive map of wood processing facilities has been operating in a test mode in a number of regions.

The industry has implemented the Forest in a Smartphone project, which contains a list of logging tickets for timber harvesting and allows you to check the legality of logging on the agency’s online map.

On June 1, 2023, Ukraine launched a pilot for the electronic issuance of logging tickets and certificates of origin of timber. In addition, the State Enterprise “Forests of Ukraine” has launched a pilot project to procure timber harvesting services through the electronic platform Prozorro.

Metinvest Group’s Kametstal plant, which was set up at the facilities of Dnipro Metallurgical Plant (DMK, Kamianske, Dnipro Oblast), produced the first 2,957 railcar axles in March 2024 to meet the orders of Ukrainian railcar manufacturers.

According to a press release, Kametstal’s axle rolling mill continues to operate under martial law and fulfill operational tasks to produce axles for domestic customers. Last year, more than 3,500 tons of railcar axles were produced and shipped.

Long-term plans to increase production volumes using this unique equipment were disrupted in 2022 due to the full-scale Russian invasion. Now the plant’s specialists are using alternative sources of steel billets for axle production, which used to come from Azovstal.

At the end of March, the rollers completed the first stage of the program to produce axles for customers. They produced more than 1,600 tons of these products for the construction of domestic railcars and gondola cars for Ukrainian railways. These cost-effective products are important for the efficient operation of the enterprise and are also necessary for the renewal of the Ukrainian railway fleet.

“Kametstal’s axle rolling mill is the only mill in the world that produces axles using the cross-helical rolling method. In pre-war times, Kametstal’s axles were supplied to customers from Ukraine, Europe and North America,” the press release states.

“KAMETSTAL was established on the basis of Dnipro Coke and Chemical Plant (DKKhZ) and Centralized Steel Mill of Dnipro Metallurgical Plant (DMK).

According to the 2020 report of Metinvest Group’s parent company, Metinvest B.V. (Netherlands) owned 100% of the shares in DCCP.

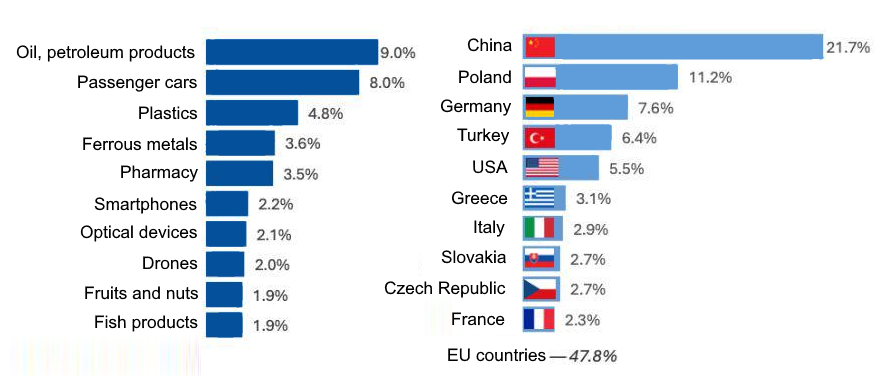

Import of goods to Ukraine in January 2024

Source: Open4Business.com.ua and experts.news

Ukraine has resumed container transportation through the Black Sea: a ship with containers entered one of the ports of Greater Odesa, Chornomorsk, on April 3, the Odesa-based Dumskaya newspaper reported.

According to the report, the pioneering vessel was the T Mare, which flies the Panamanian flag. It is not classified as a container ship, but a vessel for the transportation of general cargo.

The publication noted that this is not yet a full-fledged specialized vessel, but a so-called feeder, which will be loaded with containers and then sent to a foreign hub for further transshipment to ocean container ships of global container lines.

According to MarineTraffic, a provider of ship tracking and maritime analytics, the vessel left Chornomorsk for the Romanian port of Constanta.

The T MARE is a containerized cargo vessel flying the Panamanian flag. Its total length (LOA) is 105 meters and width is 17 meters.

As reported, in March, the Ministry of Community Development, Territories and Infrastructure announced that in early April, Odesa ports would receive the first container ship since the beginning of the war.