In January-September 2025, Respect Insurance Company (Odessa) collected UAH 67.672 million in net premiums, which is 68% more than in the same period of 2024.

According to the company’s interim report posted on the information disclosure system of the National Securities and Stock Market Commission (NSSMC), its gross premiums for this period amounted to UAH 68.123 million (+64.4%). UAH 451 thousand was transferred to reinsurance (2.5 times less).

During the period, the company paid out UAH 11.967 million, which is 4.3 times more than during the same period a year ago. At the same time, administrative expenses amounted to UAH 313,000, which is 2.2 times higher than in January-September 2024.

The financial result from the operating activities of IC Respect for nine months amounted to UAH 5.538 million (3.8 times less), net profit – UAH 8.601 million (2.7 times less).

According to the NSSMC, as of the first quarter of 2025, LLC “AMC” YUG-Invest“ (Closed-end non-diversified venture investment fund ”Industrial”) owned 67.935% of the insurer’s shares, LLC “Ulyublenoe Misto” – 9.646%, LLC “Bereg Stroy Service 2017” – 9.242%.

Insurance company “Respect” has been operating in the Ukrainian market since March 1995. The company’s main risk portfolio is related to the transport sector.

PJSC “Centerenergo” on October 29 announced a tender for voluntary insurance of motor vehicles (CASCO), according to the system of electronic public procurement Prozorro.

The expected cost of the purchase is UAH 176,791 thousand.

The deadline for submitting tender documents is November 5.

The rental market in Prague in 2025 remains one of the most dynamic in Central Europe. Demand exceeds supply, especially in the central districts of the city — Prague 1, Prague 2, and Prague 3, which traditionally attract both locals and foreigners, according to analysts at Relocation.com.ua, citing data from Global Property Guide and the Czech Statistical Office.

The average asking rent for a one-bedroom apartment in Prague in 2025 is around CZK 26,500 (≈ €1,050) per month. This is 8-10% higher than in 2024, when the average was around CZK 24,000.

Two-bedroom apartments in central areas (Prague 1, 2, 5) cost between €1,300 and €1,900 per month, while in residential areas such as Prague 9 or Prague 10, rents for similar accommodation range from €850 to €1,200.

According to the Sreality.cz portal, during the first half of 2025, the average rent in the capital rose by 5.7%, and compared to 2023, by more than 15%. The main drivers are the rising cost of new construction, high mortgage interest rates (which keep people in the rental market), and a steady influx of foreign workers.

The share of renters in Prague continues to grow and already exceeds 25% of households, which is the highest figure in the Czech Republic. Young professionals under the age of 35 account for more than half of all renters, while among foreigners, the most active groups are Ukrainians, Slovaks, Indians, and EU citizens.

The profitability of renting in Prague remains attractive to investors: according to Global Property Guide estimates, the average gross yield ranges from 4.8% to 5.4%, depending on the area and type of property.

Among the trends for 2025 is increased discussion around the regulation of short-term rentals (Airbnb): the municipality is considering options for limiting the duration of apartment rentals in tourist areas in order to balance the interests of local residents and the tourism business.

Experts predict that the housing shortage and growth in rental demand will keep the market buoyant until at least mid-2026. New construction in the center remains limited, with most growth in supply expected on the outskirts of the city, particularly in Prague 9, 10, and 13.

Source: http://relocation.com.ua/prague-rental-housing-market-analysis-by-relocation/

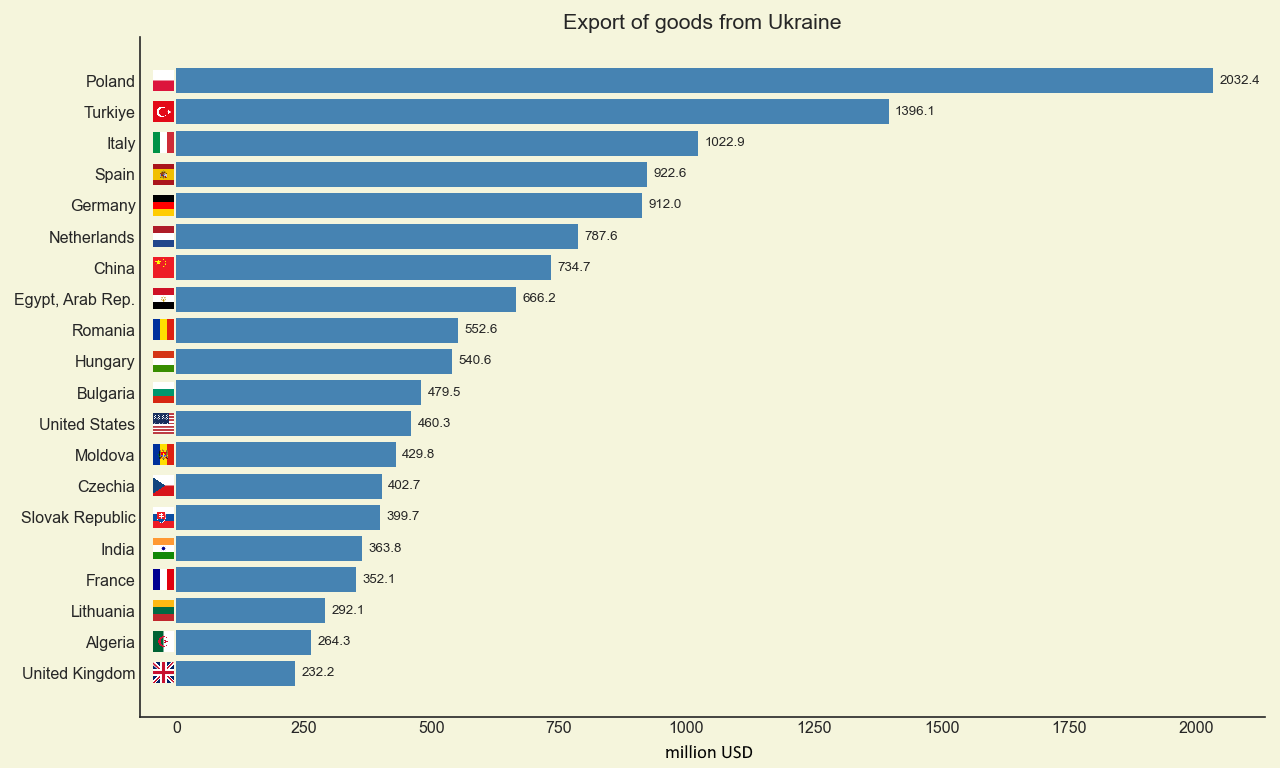

Geographical structure of Ukraine’s foreign trade (exports) in January-May 2025, million USD

Source: Open4Business.com.ua

Retail trade turnover in Ukraine increased by 6% in January-September 2025 compared to the same period in 2024, according to the State Statistics Service (SSS).

According to its data, in nominal terms, retail trade turnover in January-September of this year amounted to UAH 1.892 trillion.

Retail trade turnover in September decreased by 4.8% compared to August of this year, but in annual terms, it increased by 7.1% compared to September 2024.

The State Statistics Service specifies that the turnover of retail trade enterprises (legal entities) in January-September 2025 increased by 5.5% compared to January-September 2024 and amounted to UAH 1.310 trillion.

At the same time, in September compared to August of this year, the retail turnover of enterprises decreased by 4.6%, and compared to September of the previous year, it increased by 6.4%.

According to the statistics agency, Ukraine’s retail trade turnover in the first half of 2025 grew by 6.3% and amounted to UAH 1.213 trillion in nominal terms.

The State Statistics Service notes that the data does not include territories temporarily occupied by the Russian Federation and parts of territories where hostilities are (were) ongoing.

Deputy Head of the Department for Financial Technologies, Digitalization and Artificial Intelligence of the Presidential Administration of Uzbekistan Hikmatilla Ubaidullaev said that the first working meeting with OpenAI representatives was held. Valerie Fokke, Dips Patel, Shaig Ali, and Carlotta Serrano, Heads of Education and Partnerships, participated in the meeting.

The main topic of the talks was the introduction of ChatGPT EDU platform for teachers and students. This tool will allow using powerful OpenAI language models in a secure environment, creating personalized learning materials and own AI assistants.

The parties paid special attention to personalized learning, where artificial intelligence helps to adapt the educational process to the individual characteristics of each student, such as their pace, level of knowledge, and interests. Such a system will allow teachers to quickly identify gaps, create individualized assignments, automate work checking, and reduce bureaucratic procedures.

It was agreed that OpenAI will not create a separate program but will join the national initiative 1 Million AI Leaders, supplementing it with its own courses and expertise. This will allow Uzbek schoolchildren, students, and teachers to master artificial intelligence technologies at the level of world standards.

A separate area of discussion was the support of local startups. OpenAI expressed its readiness to consider providing preferential access to APIs and loans, as well as participation in hackathons and acceleration programs in Uzbekistan. This will create additional opportunities for young teams developing their own AI products in education and business.

The Uzbek side also presented plans to create a GPU cluster and an Uzbek-language data corpus for localization and adaptation of AI models. OpenAI representatives noted that their systems already demonstrate a high level of understanding of the Uzbek language and expressed interest in further cooperation in this area.

Following the meeting, the parties agreed to prepare a roadmap for cooperation in three key areas:

1) implementation of ChatGPT EDU at universities;

2) development of mass AI education;

3) support for startups and hackathons.