The Verkhovna Rada adopted as a basis the European integration bill No. 6480, which implements the provisions of EU Regulation No. 2019/787 in the field of geographical indications of alcoholic beverages and the production of alcoholic beverages according to EU standards into Ukrainian legislation.

The corresponding bill, submitted by the Cabinet of Ministers of Ukraine, was adopted at a parliament meeting on Friday by the votes of 266 people’s deputies (with the minimum required 226), Taras Melnichuk, representative of the Cabinet of Ministers in the Verkhovna Rada, said.

“This bill establishes general rules for the definition, description, presentation and labeling of alcoholic beverages, the rules for using the official names of alcoholic beverages; defines the features of the use and protection of geographical indications of alcoholic beverages; introduces a system for controlling geographical indications of alcoholic beverages,” the deputy wrote in his Telegram channel.

According to the text of the document, Ukrainian alcoholic beverages with geographical indications have significant potential in the European market, however, their sale and legal protection in the EU is possible only after successful state registration in Ukraine, the procedure for which currently does not exist due to the absence of the concept of legal protection of geographical indications of spirits.

To solve this problem, bill No. 6480 legislates the concept of “alcoholic beverage” and establishes a unified classification list of categories of alcoholic beverages and requirements for them; introduces requirements for ethyl alcohol and distillates used for the production of alcoholic beverages; ensures compliance with the rules for the definition, description, presentation and labeling of alcoholic beverages, including alcoholic beverages with geographical indications; ensures compliance with the requirements for the official names of alcoholic beverages.

“The implementation of the law will have a positive impact on the market environment, the state – by ensuring that Ukraine fulfills its obligations under the Association Agreement by bringing national legislation closer to the EU acquis in the field of legal protection of geographical indications; consumers – by ensuring transparency and fair competition in the alcohol market and providing information on alcoholic beverages,” is indicated in the explanatory note to the document.

Turkish presidential spokesman Ibrahim Kalin said on Sunday that the first ship with grain on board could leave the Black Sea ports of Ukraine on Monday.

“Negotiations are ongoing. There is a possibility that the first ship will set off tomorrow morning,” Turkish TV channel TRT Haber quotes him as saying.

In Istanbul on July 22, with the participation of the UN, Russia, Turkey and Ukraine, two documents were signed on the creation of a corridor for the export of grain from three Black Sea ports – Chernomorsk, Odessa and Yuzhny.

At a session at the end of this week, the Transcarpathian Regional Council decided to increase the authorized capital of the Uzhgorod airport located near the border with the EU by UAH 26 million in order to resume its work without waiting for the end of the war.

“We have significantly raised the funding of the Uzhgorod airport … in order to carry out the necessary procedures, obtain permits, build the necessary buildings and, finally, start earning, and not count losses,” Volodymyr Chubirko, head of the Transcarpathian Regional Council, wrote on Facebook.

“The former minus – the runway, which starts abroad, has become its plus. We must use it,” he said.

The international airport “Uzhgorod” is located in a mountainous area in such a way that the threshold of the runway 10 is located a few hundred meters from the Ukrainian-Slovak border. Therefore, Slovak airspace is used for instrument landings at this aerodrome.

In September 2020, Ukraine and Slovakia signed an intergovernmental agreement, and a year later, the airport accepted the first flight using a certain part of the Slovak airspace.

Local media also report Chubirko’s words, who expressed confidence that the airport will be launched “in a month or two”, and Ukrainian companies based in Europe today will use it.

As part of a new project to announce the events that should take place in the next seven days, a video material with an analysis of the planned events in Ukraine and in the world was released on the Expert Club YouTube channel.

In the new issue, the founder of the club of experts Maxim Urakin, together with the host Olga Levkun, analyzed the most important events in Ukraine and the world from August 1 to August 7, 2022.

In particular, a number of round tables, press conferences and seminars will be held in Ukraine on the development of the country’s economy in the post-war period, doing business on international marketing platforms, as well as the security of citizens in the current conditions. Also, residents of our country will be able to visit a number of cultural events.

On the world stage, by far the main event of the next week is the tour of the third person in the US hierarchy, Speaker of the US House of Representatives Nancy Pelosi, to Southeast Asia, as well as her possible visit to the island of Taiwan and the reaction of the Chinese authorities to this trip.

In addition, a number of the largest EU economies will publish data from statistical services on the state of their economy, and the Bank of England will publish a decision to change the base interest rate.

Watch these and many other events in a new video on the Club of Experts channel at the link:

You can subscribe to the Expert Club channel here – https://www.youtube.com/channel/UC4plQ0XBaoLOKPIXrb1aMGQ

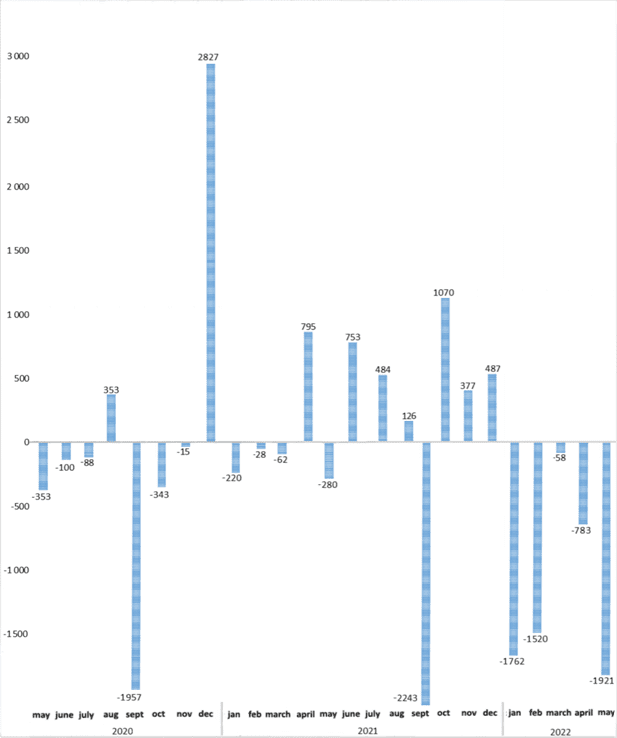

Dynamics of balance of payments of Ukraine in 2020-2022 (USD mln)

NBU

International research conducted at the University of South Florida has shown that caffeine affects what we buy and how much we spend on shopping.

An international team of researchers conducted three experiments in shopping malls.

Caffeine is a powerful mind and body stimulant by releasing dopamine into the brain. It can cause a surge in energy levels, making the body more irritable and reducing self-control. And as a result, being overly impulsive, people make rash purchases and spend more money than planned, explains study lead author Deepayan Biswas, a professor at the University of South Florida.

As part of the study, one coffee machine was placed near the entrance to a home goods store, the second was placed near a chain retailer in France, and the third was installed in Spain in a large shopping center. More than 300 participants in the experiment received their drink and went shopping.

After the subjects had made their purchases, they had to give all receipts to the researchers. According to the data obtained, it turned out that those who drank the caffeinated drink spent and bought more goods.

Scientists have also found that caffeine affects what people buy. Those who drank coffee were more likely to spend money on non-essential items, such as scented candles or perfumes.

The scientists conducted another experiment in the lab, only this time the participants had to shop online. 200 business school students were divided into two groups. One drank coffee with caffeine, the other without. All participants had to choose goods from the proposed list, consisting of 66 items. Those who drank caffeinated drinks were much more likely to make impulse purchases, like a neck massage machine, while others were more likely to make more practical purchases, like a laptop or a washing machine.

“Caffeine can indeed have a beneficial effect on a person’s well-being, but it can cause disappointing consequences after shopping. Anyone who wants to control their spending should limit their coffee intake before going to the store,” says Biswas.