One of the largest operators in the Ukrainian grain market, Nibulon LLC, invested $2 million in the digitization of production processes in 2024, which was directed toward the creation of a digital copy of the elevator and a mobile application, according to the company’s owner and CEO Andriy Vadatursky.

“We have about 100 people (working in the field of digitalization – IF-U). We recruited many of them from the market and provided them with work. We have detailed plans for the implementation of projects for three years. We know the detailed plan for the month, for the year, and we know the prospects for three years. We also plan to provide services specifically for the projects we are doing for Nibulon. We believe that if it is necessary for Nibulon, then it will also be necessary for the market,” he said at the Forbes Agro conference in Kyiv last Friday.

Among the main projects in which funds were invested, Vadatursky named a digital copy of the elevator, in particular, the purchase and installation of modern equipment that determines the quality of grain. The software is installed at all of the grain trader’s elevators and is connected to a common network. Thanks to this, responsibility at the elevators has been strengthened, the quality of raw materials is clearly determined, the influence of the human factor has been minimized, and reporting has been streamlined.

In addition, Nibulon has developed a mobile application—a company account where you can receive news, prices, information about the location of transport, the quality of grain in it, funds received, discounts, bonuses, etc.

According to Vadatursky, this application will be refined and transformed into an information platform in the near future.

Before the war, Nibulon cultivated 82,000 hectares of land in 12 regions of Ukraine and exported agricultural products to more than 70 countries around the world. In 2021, the grain trader exported a record 5.64 million tons of agricultural products and delivered record volumes to foreign markets in August (0.7 million tons), in the fourth quarter (1.88 million tons), and in the second half of the year (3.71 million tons).

After the war began, the company was forced to move its headquarters from Mykolaiv to Kyiv.

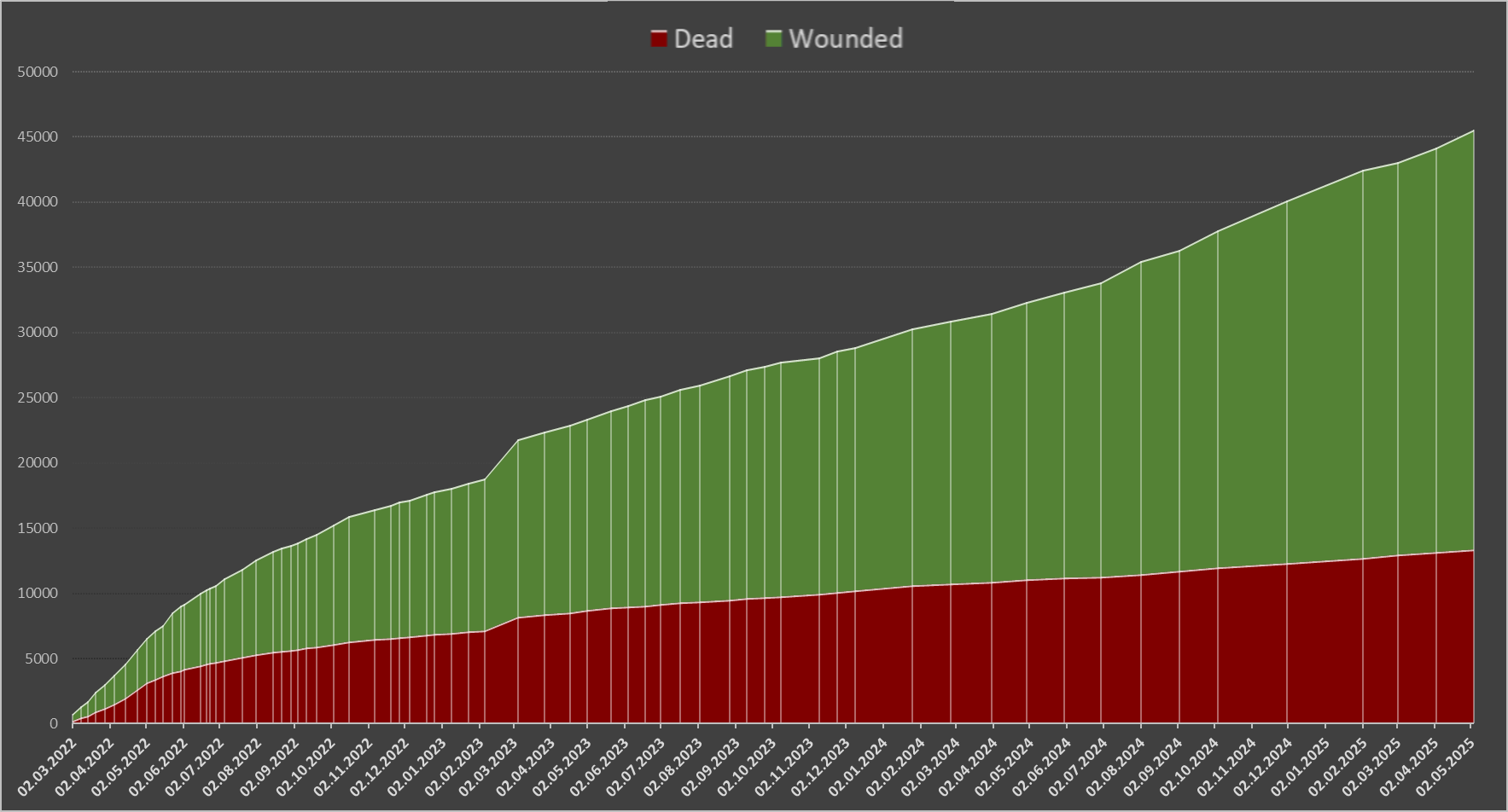

Number of dead and wounded civilians in Ukraine from 24.02.2022 till 31.05.2025 un data

Source: Open4Business.com.ua

In January-June 2025, PJSC Insurance Company VUSO (Kyiv) collected UAH 2.129 billion in gross premiums, which is 52.6% more than in the same period of 2024, net premiums grew by 54.18% to UAH 1.886 billion, while net earned premiums increased by 40.98% to UAH 1.764 billion.

These figures are provided in the information from Standard-Rating on the confirmation of the company’s financial stability rating at “uaAA” on the national scale for the specified period.

According to the data on the rating agency’s website, the insurer’s revenues from individuals for the specified period increased by 55.36% to UAH 1.374 billion, and from reinsurers – by 17.67% to UAH 21.652 million. Thus, the share of individuals in the insurer’s gross premiums for the first half of 2025 was 64.54%, and the share of reinsurers was 1.02%.

RA notes that accrued reinsurance premiums transferred to reinsurance for the first half of 2025 increased by 41.37% compared to the same period in 2024, to UAH 243.143 million. The reinsurers’ share in insurance premiums decreased by 0.91 percentage points to 11.42%.

In the first six months of 2025, VUSO Insurance Company paid out UAH 787.863 million to its clients, which is 9.08% higher than the volume of insurance payments and reimbursements for the same period in 2024. The payout ratio decreased by 14.77 percentage points to 37.01%.

Based on the results for January-June 2025, operating profit increased by 34.13% compared to the same period in 2024, to UAH 135.494 million, while net profit grew 2.95 times to UAH 102.332 million.

As of July 1, 2025, the company’s assets grew by 20.21% to UAH 2.305 billion, equity increased by 7.59% to UAH 813.212 million, liabilities increased by 28.43% to UAH 1.491 billion, cash and cash equivalents increased by 24.43% to UAH 944.106 million.

According to RA data, as of the beginning of the third quarter of 2025, the company had a capitalization level of 54.52% and a cash coverage ratio of 63.30%. In addition, as of the reporting date, IC “VUSO” had formed a portfolio of investments in government bonds in the amount of UAH 326.025 million, which together covered 85.16% of the company’s liabilities. In addition, the balance of funds in centralized insurance reserve funds (MTIBU) amounted to UAH 522.123 million, which also had a positive impact on the company’s liquidity.

VUSO Insurance Company was founded in 2001. It has 50 insurance licenses, 34 representative offices, 2 branches, and more than 20 agency sales centers throughout Ukraine, with over 700 professionals. It is a member of the MTIBU, NASU, and the Nuclear Insurance Pool.

China will launch a new K visa category for young professionals in science, technology, engineering, and mathematics (STEM) who will be able to enter, reside, and work in the country without a mandatory job offer. The program will be effective from October 1, 2025.

The new decision does not require a sponsoring employer — applicants for a K visa are not required to provide an invitation or contract with a Chinese company when applying.

The authorities also promise more flexible conditions of stay — multiple entries, long validity, and a simplified application process.

The innovation is aimed at attracting young foreign talent, especially in the context of the tightening of US visa policy and the proposed $100,000 fee for H-1B visas.

According to media reports, some young STEM professionals are eligible for housing subsidies and signing bonuses of up to 5 million yuan (~$702,000) as part of a comprehensive recruitment policy.

The United States recently raised the fee for an H-1B visa to $100,000, creating additional barriers for foreign professionals. The Chinese government, on the contrary, is trying to enhance its attractiveness amid competition for talent.

A Chinese government document dated August 14, 2025, states that as part of the reform of regulations governing the entry and exit of foreigners, a K visa will be introduced as a new category for young professionals in the fields of science and technology.

Experts note that this initiative is part of China’s strategy to strengthen international competition in the fields of AI, quantum technology, and biotechnology.

The details of the selection criteria (age, minimum education, experience requirements) remain vague.

There is no clarity on issues of family sponsorship, permanent residence, or transition to other visa regimes.

According to the Serbian Economist, the Swiss company SSWISS GROUP AG, owner of the Swiss Solar brand, has announced plans to invest 50 million euros in the construction of solar power plants with a capacity of up to 50 MW in Serbia.

The project is being realized together with local partners and state structures, B92 news agency reported.

Serbia receives more than 2,000 hours of sunshine per year and is seeking to diversify its energy mix. According to the government, the share of solar energy in the electricity production structure is still around 4-5%, but significant growth is planned in the coming years through private and public investments.

Serbia’s solar energy market is actively developing:

– South Korean KHNP signed a memorandum of cooperation in the field of renewable sources;

– French EDF is preparing a study on the potential of green generation;

– Chinese and Italian companies are negotiating the construction of solar parks in Vojvodina and Central Serbia.

Experts say that the new projects will reduce the country’s dependence on imported gas and oil and make Serbia one of the regional centers of green energy in the Balkans.

https://t.me/relocationrs/1495

In an interview with journalist Lex Friedman, Telegram founder Pavel Durov expressed confidence that the price of bitcoin will eventually rise to $1 million per coin.

The entrepreneur previously said that in 2013 he bought 2,000 bitcoins at a price of about $750 each, investing approximately $1.5 million.

In the interview, he described the purchase as a strategic investment, calling Bitcoin “digital gold.”