The President of Ukraine, Volodymyr Zelenskyy, accepted credentials from the newly appointed ambassadors of Cyprus, Michalis Firillas, Latvia, Andrejs Pildegovičs, and Pakistan, Kanwar Adnan Ahmed Khan, according to the press service.

“Volodymyr Zelenskyy and Michalis Firillas discussed increasing sanctions pressure on Russia, food security, joint projects within the European Union, the security situation in the region, and cooperation with partners, particularly in multilateral formats,” the statement said.

In addition, Zelensky and the Cypriot ambassador discussed Ukraine’s future membership in the European Union and priorities during Cyprus’ presidency of the Council of the European Union in the first half of 2026.

The president also discussed with Pildegovičs the development of the PURL initiative, increasing pressure on Russia, and humanitarian aid. The ambassador assured that Latvia would actively promote Ukraine’s interests at the UN next year when the country becomes a non-permanent member of the organization.

Zelensky discussed with the Pakistani ambassador the development of bilateral cooperation, particularly in the defense and military-technical spheres, as well as partnership in trade and food.

The attitude of Ukrainians toward China remains complex and controversial: a neutral position prevails, but among those who have decided, negative assessments significantly outweigh positive ones. This is evidenced by the results of an all-Ukrainian survey conducted by Active Group in cooperation with the Experts Club information and analytical center in August 2025.

According to the survey, 44.7% of Ukrainian citizens expressed a neutral attitude toward China. At the same time, 40.7% of respondents indicated that their assessment was negative (30.0% – mostly negative, 10.7% – completely negative). Only 12.0% of Ukrainians have a positive attitude toward China (8.3% – mostly positive, 3.7% – completely positive). Another 3.0% of respondents admitted that they did not know enough about the country to express their own opinion.

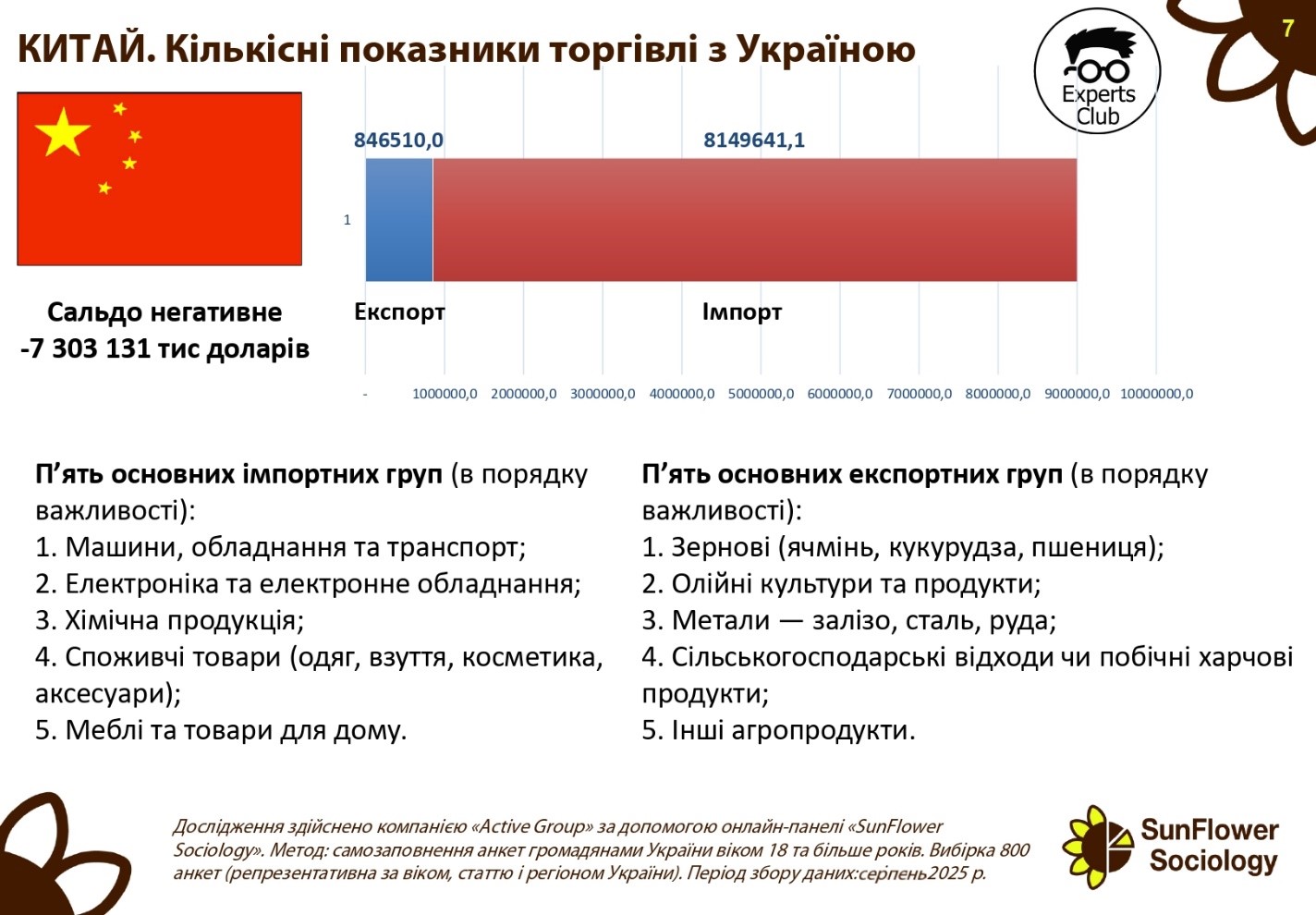

“Negative attitudes toward China among Ukrainians are primarily related to its foreign policy stance, which many people find ambiguous in the context of global events. However, the economic factor is extremely important: in the first half of 2025, China remained Ukraine’s No. 1 trading partner. Our exports to China amounted to more than $846 million, while imports exceeded $8.1 billion. This means that China’s influence on the Ukrainian economy is extremely significant, and it is simply impossible to ignore it,” said Maksym Urakin, founder of Experts Club.

In his turn, Oleksandr Poznyi, co-founder of Active Group, drew attention to the importance of separating economic interests from public perception.

“The survey shows that Ukrainians are not ready to unequivocally perceive China as an ally. For many, it remains an alienated state, and a significant share of negative assessments is explained by the global political context and lack of trust. At the same time, economic cooperation is so extensive that it could become the basis for a gradual change in public opinion in the future,” he added.

The poll is part of a broader study that analyzes international sympathies and antipathies of Ukrainians in the current geopolitical environment.

The full video can be viewed here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, CHINA, DIPLOMACY, EXPERTS CLUB, Poznyi, SOCIOLOGY, TRADE, URAKIN

There are currently around 28,000 Ukrainian refugees in Cyprus, which is one of the highest figures in the world in relation to the island’s population. This was stated by the newly appointed Ambassador Extraordinary and Plenipotentiary of the Republic of Cyprus to Ukraine, Michalis Firillas, during a meeting with a representative of Interfax-Ukraine.

“We understand that the war has forced many Ukrainians to leave their homes. Cyprus has become a safe haven for them, and we are proud to be able to provide them with support,” the diplomat said.

According to him, Ukrainian refugees in Cyprus have access to free medical care, can use the state education system, and also receive support in employment and social benefits. “Our government is doing everything possible to ensure that Ukrainians integrate into Cypriot life as quickly and comfortably as possible,” Firillas emphasized.

He stressed that Cyprus will continue to support Ukraine and the Ukrainian people by providing both humanitarian aid and political support on the international stage.

Ukrainian startup Swarmer, which develops artificial intelligence-based solutions for drone autonomy, has announced a $15 million Series A funding round, which it says is the largest investment in a Ukrainian defense technology company since the start of the war.

According to the company’s press release, the round is led by Broadband Capital Investments with participation from R-G.AI, D3 Ventures, Green Flag Ventures, Radius Capital, and Network VC.

“Our software has proven its effectiveness in real combat conditions during tens of thousands of missions,” said Swarmer founder and CEO Serhii Kuprienko in the press release.

“Swarmer’s technologies have already proven their effectiveness on the battlefield. This historic investment will enable the company to provide swarm capabilities to every UAV — it will be possible to deploy an unlimited number of drones and robots, regardless of the number of trained pilots,” First Deputy Prime Minister and Minister of Digital Transformation Mykhailo Fedorov wrote on Telegram on Tuesday.

The release also states that using data from more than 82,000 of its own combat missions and millions of others, the system is trained to replicate the results of the best pilots and make accurate tactical decisions in real time.

The company emphasizes that Swarmer has successfully demonstrated the operation of swarms of 25 drones working together in the absence of GNSS. In the near future, it plans to demonstrate operations using various types of weapons, involving more than 100 drones of different types working in coordination to seamlessly integrate UAS, USV, UGV, and stationary launchers into a single swarm that will function as a single unit.

The company was founded by Sergey Kuprienko and Alex Fink in May 2023.

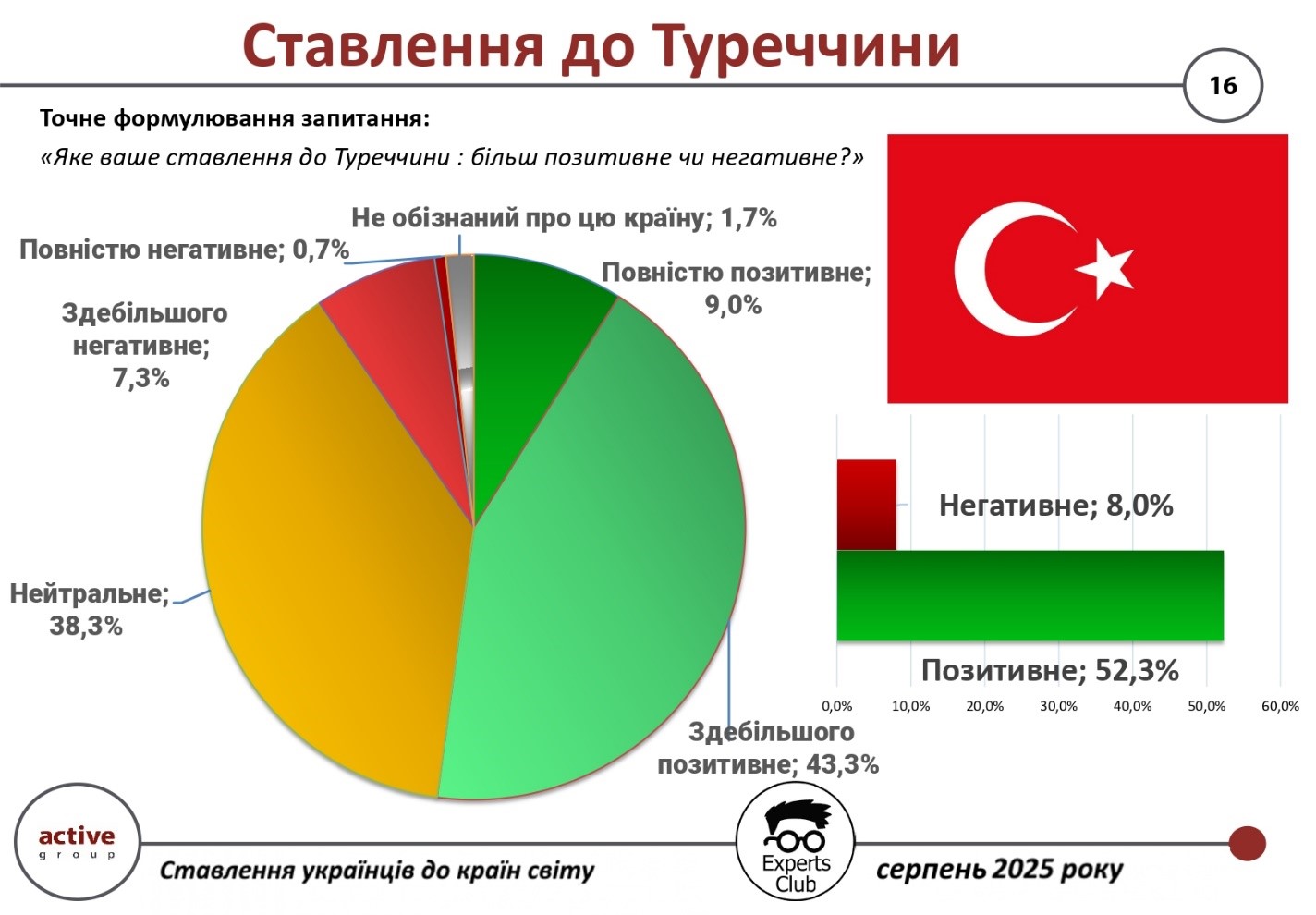

Turkey remains one of the most positively perceived countries in the region for Ukrainians, driven by both political and economic factors. This is evidenced by the results of an all-Ukrainian survey conducted by Active Group in cooperation with the Experts Club information and analytical center in August 2025.

According to the survey, 52.3% of Ukrainian citizens have a positive attitude towards Turkey (43.3% – mostly positive, 9.0% – completely positive). Only 8.0% of respondents expressed a negative attitude (7.3% – mostly negative, 0.7% – completely negative). Another 38.3% of Ukrainians are neutral, and 1.7% admitted that they do not know enough about this country.

“For Ukraine, Turkey is not just a neighbor across the Black Sea, but a strategic partner with whom we have established close trade and economic ties. In the first half of 2025, the volume of bilateral trade exceeded $4.66 billion, of which exports from Ukraine amounted to more than $2.58 billion and imports from Turkey amounted to about $2.08 billion. The positive balance of more than $500 million shows that these relations are beneficial for the Ukrainian economy,” said Maksym Urakin, founder of Experts Club.

In his turn, Oleksandr Poznyi, co-founder of Active Group, noted that the high level of positive assessments is explained not only by economic factors.

“Turkey is actively supporting Ukraine, which cannot be ignored by society. At the same time, the tourist destination, cultural contacts, and historical proximity through the Black Sea region create an additional level of sympathy among Ukrainians. This allows Turkey to occupy a consistently high position among the countries friendly to Ukraine,” he added.

The survey was part of a broader study of international sympathies and antipathies of Ukrainians in the current geopolitical context.

The full video can be viewed here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Poznyi, SOCIOLOGY, TRADE, TURKEY, URAKIN

Poland remains one of the most positively perceived countries by Ukrainians, despite some controversies in bilateral relations. This is evidenced by the results of an all-Ukrainian survey conducted by Active Group in cooperation with the Experts Club information and analytical center in August 2025.

According to the survey, 56.7% of Ukrainian citizens have a positive attitude towards Poland (44.3% – mostly positive, 12.3% – completely positive). Only 12.7% of respondents expressed a negative attitude (11.3% – mostly negative, 1.3% – completely negative). Another 30.0% of Ukrainians are neutral, and 1.0% said they are not sufficiently aware of this country.

“For Ukrainians, Poland is not only a neighbor, but also one of their key economic partners. In the first half of 2025, total trade between Ukraine and Poland exceeded $6.66 billion. At the same time, exports from Ukraine amounted to $3.03 billion, and imports from Poland exceeded $3.62 billion. The negative balance of $591 million does not seem critical, given the scale and strategic nature of cooperation,” said Maksym Urakin, founder of Experts Club.

In turn, co-founder of Active Group Oleksandr Poznyi emphasized that the positive attitude of Ukrainians towards Poland has deeper reasons than just the economy.

“We are talking about historical proximity, support for Ukrainian refugees, and Warsaw’s political solidarity in important international issues. At the same time, the economic dimension only strengthens these relations, making Poland one of Ukraine’s leading partners both in the EU and globally. It is the combination of political, humanitarian and economic components that explains the high level of sympathy in society,” he added.

The survey was part of a broader study of international sympathies and antipathies of Ukrainians in the current geopolitical context.

The full video can be viewed here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, POLAND, Posniy, SOCIOLOGY, TRADE, URAKIN