French President Emmanuel Macron will receive Ukrainian President Volodymyr Zelensky on December 1, according to BFMTV.

“Just two weeks after his last visit to Paris, Volodymyr Zelensky will be received by Emmanuel Macron in the French capital this Monday, December 1, 2025,” BFMTV was told at the Élysée Palace on Saturday, November 29.

The two leaders are expected to discuss, in particular, “the conditions for a just and lasting peace, in accordance with the Geneva talks” and the American “peace plan,” the French presidency said.

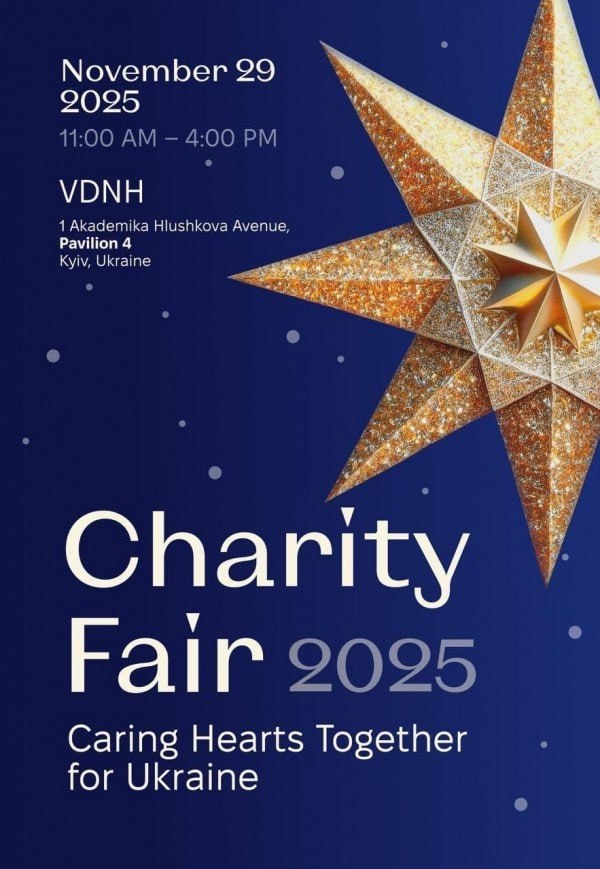

The annual Charity Fair 2025, traditionally organized by the Association of Ukrainian Diplomats’ Spouses with the support of the Ministry of Foreign Affairs of Ukraine, took place in Kyiv on Saturday.

According to a correspondent from Interfax-Ukraine, this year’s event was attended by representatives of diplomatic missions from 29 countries, who presented their national traditions and culture. Ukrainian artists, traditional craftsmen, craft producers, designers, and public organizations also joined the joint charity initiative.

The event was personally attended by Ukrainian Foreign Minister Andriy Sibiga and his wife Tetyana Sibiga, who is a co-founder of the Association of Spouses of Ukrainian Diplomats.

As noted by the Ministry of Foreign Affairs, all funds raised will be used for charitable purposes, in particular: the purchase of chemical warmers for military personnel as part of the “Warm the Defender” project; support for internally displaced children; assistance to children and people with disabilities; support for the elderly; assistance to animal shelters; other joint projects of the Association of Spouses of Ukrainian Diplomats, the Club of Spouses of Ambassadors in Kyiv, and the IWCK.

Guests had the opportunity to purchase holiday gifts or create them together with their children at themed master classes.

Each ticket purchase counts as a charitable contribution to the total Charity Fair 2025 collection.

CHARITY, Charity Fair 2025, Christmas fair, KYIV, Spouses of Ukrainian Diplomats

The Cabinet of Ministers is transferring State Enterprise “Forests of Ukraine” to the status of a joint-stock company, but 100% of the shares will remain in state ownership, Prime Minister Yulia Svyrydenko announced.

“Today, at a government meeting, a number of decisions were made that are important for the stability and development of the forestry industry. State Enterprise ”Forests of Ukraine” is transitioning to the status of a joint-stock company. We are doing this to ensure a more effective corporate governance model with transparent reporting and to increase the competitiveness of the enterprise,” Svyrydenko wrote on Telegram following the results of Friday’s government meeting.

According to her, the transformation of the enterprise into a joint-stock company does not imply privatization—100% of the shares remain in state ownership.

Subsequently, the prime minister’s message was edited, and information about this decision was removed.

Metinvest Shipping, the logistics division of Metinvest Group, earned a net profit of UAH 114.146 million in January-September this year, compared with a net loss of UAH 16.227 million in the same period last year.

According to the company’s interim report, which is available to Interfax-Ukraine, its profit in the third quarter of 2025 amounted to UAH 81.299 million. Revenue for this period decreased by 13% to UAH 1 billion 752.366 million. Undistributed profit at the end of September amounted to UAH 1 billion 367.237 million.

The company ended 2024 with a loss of UAH 67.393 million, compared to UAH 729.472 million in 2023.

Metinvest Shipping LLC has been part of the Metinvest Group since 2006. The company has branches in Mariupol (operations temporarily suspended) and Odesa. The company’s activities cover the entire range of freight transport services: organization of road and rail transport, customs clearance, forwarding, ship agency, and chartering of the maritime fleet.

Since 2019, the company has been inspecting metal products of Metinvest Group enterprises. Between 2010 and 2024, Metinvest Shipping handled over 364 million tons of cargo, provided agency services for over 9,000 vessels, and transported approximately 896 million tons of cargo by rail. The company owns more than 2,300 units of rolling stock, including 11 diesel locomotives.

As of December 31, 2024, the average number of employees in the company was 220.

Metinvest Holding LLC owns a 100% stake in Metinvest Shipping LLC ”

The LLC’s authorized capital is UAH 25.012 million.

Metinvest is a vertically integrated group of mining and metallurgical enterprises. Its enterprises are located in Ukraine, in the Donetsk, Luhansk, Zaporizhia, and Dnipropetrovsk regions, as well as in European countries.

The main shareholders of the holding company are SCM Group (71.24%) and Smart Holding (23.76%). Metinvest Holding LLC is the managing company of the Metinvest Group.

In January-October 2025, Ukraine increased imports of tomatoes by 4.3% to 81.82 thousand tons and cucumbers by 13.6% to 109.56 thousand tons compared to the same period last year, according to the State Customs Service.

According to the published statistics, in monetary terms, tomato imports increased by 18.2% to $16.92 million during the reporting period, and cucumber imports increased by 30% to $23.39 million.

The main imports of tomatoes at this time came from Turkey (64.3% of all supplies), Poland (11.7%), and the Netherlands (11.18%). The top three suppliers of cucumbers to Ukraine were Turkey (88.2%), Spain (3.7%), and Finland (2%).

A year ago, the main suppliers of tomatoes to Ukraine in January-October were Turkey (73.6%), Poland (12.3%), and Morocco (5.9%), while the main suppliers of cucumbers were Turkey (85.2%), Poland (4%), and the Netherlands (3.1%).

Tomato exports in January-October this year amounted to 393 tons, compared to 301 tons a year ago. This year, they were purchased by Moldova (60.6%), Poland (36.4%), and Singapore (0.8%), while last year they were purchased by Moldova (87.4%), Lithuania (7.6%), and Malaysia (1%).

In the first 10 months of 2025, 2.44 thousand tons of Ukrainian cucumbers were supplied to foreign markets, compared to 1.01 thousand tons in the same period last year. They were most actively purchased by Poland (52.3%), Estonia (37.5%), and Moldova (8%). A year ago, the top three were the same, but their shares in the procurement structure differed: Estonia accounted for 54.7% of supplies, Poland for 26.3%, and Moldova for 10.5%.

As reported, in July 2025, Ukraine introduced anti-dumping duties on imports of fresh cucumbers and tomatoes from Turkey at 20.1% and 26.9%, respectively, for a period of five years. These measures were applied to protect Ukrainian producers from dumped imports, which caused damage to domestic greenhouse farms.

The Kryvyi Rih Mining and Metallurgical Plant PJSC ArcelorMittal Kryvyi Rih (AMKR, Dnipropetrovsk region) has purchased and commissioned a new gantry crane in the repair shop (RC) of the mining department (MD).

According to information from the company in the corporate newspaper Metallurg, the use of the new crane has made the movement of goods safer.

It is specified that the crane replacement project was implemented as part of the work to achieve FPS corporate standards for occupational safety.

Lyubov Yevseyanko, lead engineer of the GD project implementation department, noted that such cranes are manufactured individually to meet the needs of those who will use them.

“First, together with experts from the repair shop, we specified what equipment they needed. Based on this, a drawing was made, describing the parameters of the future crane. Then we worked with companies that are capable of manufacturing such a crane with high quality, in accordance with standards and within a timeframe that would satisfy us. From several options, we chose the one that best met the criteria. Work began on the manufacture of the equipment,” she said.

Igor Maly, head of the RC GD, highly praised the work of the contractors who manufactured the crane and then participated in its installation and commissioning.

“Our workshop performs repairs and manufactures metal structures, spare parts, assemblies, and mechanisms. We really needed this crane. It replaced the old one, which was no longer safe to use. There was also an urgent need for more powerful equipment: the old crane had a lifting capacity of 5 tons, but recently we have been working more often with heavier products and materials,” explained the workshop manager.

He added that the contractor, the Kyiv Lifting and Transport Equipment Plant, manufactured the crane quickly, efficiently, and in accordance with the requirements. Along with the crane, the rail track on which it moves was also replaced.

ArcelorMittal Kryvyi Rih is the largest manufacturer of rolled steel in Ukraine. It specializes in the production of long products, in particular, rebar and wire rod. The enterprise has a full production cycle, and its production capacity is designed for an annual output of over 6 million tons of steel, more than 5 million tons of rolled products, and over 5.5 million tons of pig iron.

ArcelorMittal owns Ukraine’s largest mining and metallurgical complex, ArcelorMittal Kryvyi Rih, and a number of small companies, including ArcelorMittal Beryslav.