Who received the largest fine for riding a scooter last year?

According to the court registry search engine “Babushka,” 71 court cases involving electric scooters were recorded in 2024. Such violations are usually punishable by fines ranging from 340 to 34,000 hryvnia and sometimes by the revocation of driving privileges. The largest fine was imposed on a man who was driving an electric scooter while intoxicated in Odesa.

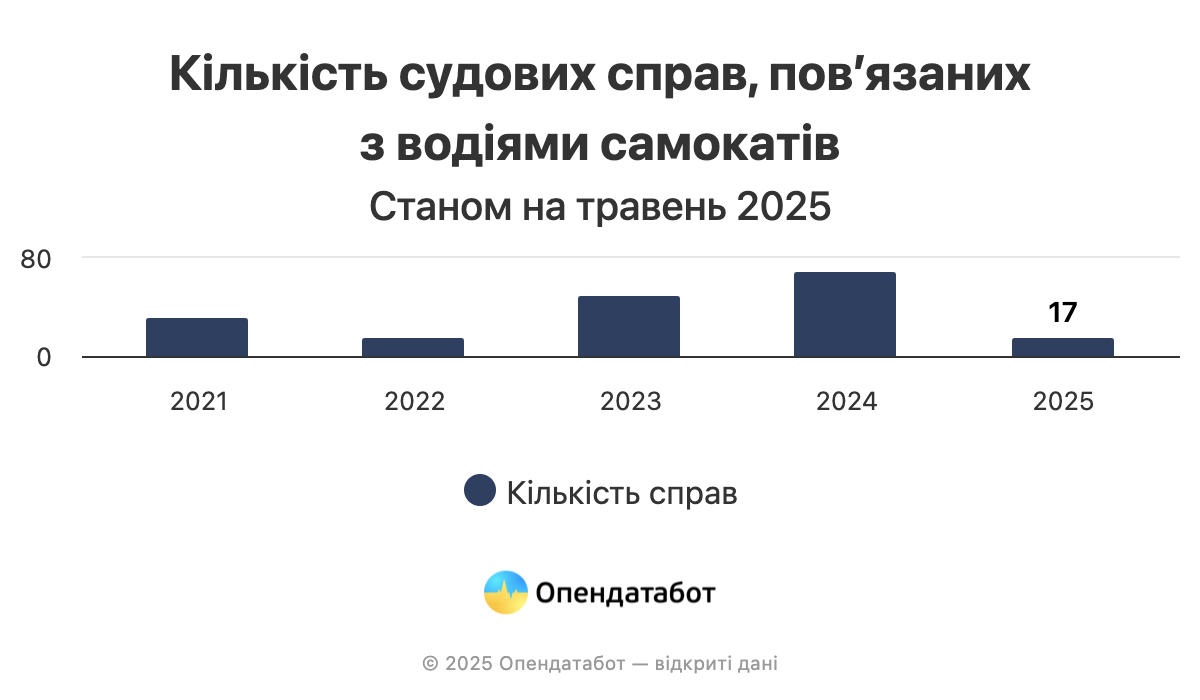

Last year, 71 offenses involving electric scooter enthusiasts were recorded in Babushka. Over the course of the year, such cases increased by 42%. Already this year, the court registry has recorded at least 17 such cases.

Scooter drivers usually appear in administrative offenses. For example, this year, 13 administrative and 4 criminal cases have been recorded. For comparison, last year there were 64 administrative and 7 criminal cases, respectively.

The maximum fine for drunk driving was imposed on an electric scooter driver in Odesa in June 2024. It turned out that the man did not have a driver’s license and was not riding a scooter while drunk for the first time. The court fined him 34,000 hryvnias and ordered him to pay court costs. It should be noted that if the defendant had a driver’s license, he would have been deprived of his driving privileges for such a violation.

Another 17 people have been fined 17,000 hryvnia over the past two years. Fifteen of them were driving a scooter while intoxicated, and two were under the influence of drugs. Three people were banned from driving for a year.

Since 2023, all electric scooters (monowheels, Segways, etc.) have been recognized as vehicles, which has allowed the police and courts to hold electric scooter drivers administratively liable on the same basis as car drivers. However, there are still no specific rules and responsibilities for electric scooter drivers. This conflict could be resolved by draft laws 3023 of 2020 and 10441 of 2024, which have been pending in the Verkhovna Rada for a long time, according to Mykola Polyukhovych, a member of the traffic safety council of the NGO U-Cycle (Kyiv Cyclists Association).

“Electric scooter drivers are not allowed to ride on sidewalks, and there is currently no bicycle infrastructure for them, which can only be used by cyclists, which would be appropriate given the similarity of their characteristics. Therefore, scooter riders must ride exclusively on the roadway, following the traffic rules on a general basis, for violation of which they are held liable — after all, a vehicle equipped with an electric motor is a source of increased danger to other road users. “Given the almost unrestricted access to electric scooters, as well as the growing number of cases of such drivers being held liable by the police and courts, this issue needs to be regulated by law,” comments Mykola Polyukhovych.

Source: https://opendatabot.ua/analytics/electroscooters-courts-2024

On June 4, the Parkovy Exhibition Center hosted the Ukrainian Construction Congress (UBC), one of the main industry events of the year, which brought together representatives of the development market, government agencies, the banking sector, and specialized organizations. Iryna Mikhailova, Marketing Director at Alliance Novobud, was a participant in the event. The expert not only spoke at the discussion on the state program “eOselia,” but also moderated one of the key panel discussions on “Affordable housing: how to make real estate accessible to Ukrainians.”

The panel speakers included representatives of development companies, financial institutions, and the public sector: Pavlo Somov, founder of EcoBud Building Group; Alla Dubrovyk-Rokhova, head of communications at Ukrfinzhytlo, partner at PGR Consulting Group, Ivan Parukh, deputy chairman of the board of the State Fund for Youth Housing Construction, Volodymyr Chornenkyi, director of retail business at Sky Bank, and Anna Laievska, commercial director at Intergal-Bud.

Participants discussed comprehensive approaches to creating an affordable housing market, ranging from state support programs to innovative development models, financial instruments, and cross-sector cooperation. Particular attention was paid to the challenges of wartime, which have significantly affected the purchasing power of the population, construction rates, and the financing of new projects.

A separate highlight was the participation of Iryna Mikhalova in the discussion panel “eOselya — a state investment in recovery,” moderated by Alla Dubrovyk-Rokhova. The panel brought together developers and bankers who shared their experiences with the program, its impact on the market, and prospects for development.

Ms. Irina answered several key questions about the program’s role in the company’s sales, its readiness to change the traditional model of construction financing, and its investments in additional buyer support tools:

“The єОселя program is not just a mortgage product; it is a marker of the state’s trust in the industry and its support for Ukrainians. For our company, this program has become an important factor in stabilizing sales in 2024–2025. We see a real impact on buyer activity and are ready to invest in partnership formats with banking institutions to support buyers,” said Irina Mikhaleva.

Alliance Novobud thanks the organizers of the Ukrainian Construction Congress 2025 for the high level of the event and for creating a space for constructive dialogue that moves the industry forward.

ukrainian_construction_congress irina_mikhalova ubc alliance_novobud

The income of Ukrainian publishers in 2024 increased by 31% compared to 2023, according to a report by the Ukrainian Book Institute (UBI).

“The annual report ‘Indicators of the Book Industry in Ukraine-2024’ was presented, during which the Ukrainian Book Institute presented the main indicators of the book industry for 2024, along with proposals for the development of the ‘Books on the Market’ catalog as a monitoring tool,” the report said.

The UIC notes that last year, Ukrainian book publishing showed signs of recovery: publishers’ revenues grew by 31% compared to 2023, and the total annual circulation increased by 21%; the Ukrainian book market saw a 31% increase in revenues and 33 million copies sold per year.

“There are over 350 publishing houses operating in Ukraine. Books can be purchased in almost 800 offline bookstores and 80 online stores. The total market volume is estimated at UAH 8 billion, which is about $200 million,” the report said.

According to the UIC, in 2024, 15,601 thousand book titles were published with a total circulation of 33.315 million copies.

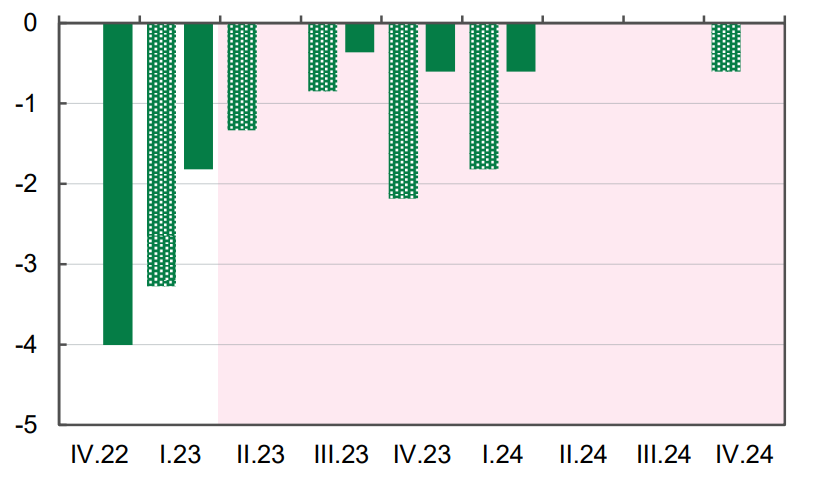

Impact of electricity deficit on real GDP vs no deficit, % (forecast up to 2024)

Most parents and guardians in Ukraine are aware of their key role in protecting children’s rights, but more than a third admit that they sometimes violate these rights, and 89% of parents surveyed do not have a clear understanding of the rights of the child as defined by the UN Convention on the Rights of the Child, which covers the civil, political, economic, social, and cultural rights of children, according to the results of a new UNICEF survey.

“Although 35% of parents and 38% of adolescents have heard of the convention, only 11.3% of all respondents can say that they are familiar with its provisions. At the same time, almost 20% of parents and 15% of adolescents are not familiar with it at all,” the publication states at the beginning of International Parenting Month.

According to the survey, the best-known rights are the right to education (known to 80% of parents and 76% of adolescents), the right to health (76% and 67%), and the right to protection from violence (66% and 63%), while less well known are the right to privacy (known to 35% of parents and 45% of adolescents) and the right to identity (44% of teenagers).

“People are more aware of ‘visible’ or material rights, while ‘psychosocial’ rights are neglected,” UNICEF reports.

It is noted that educational institutions are the main source of knowledge for adolescents, and social networks are the main source for parents. Among adolescents, 34% learn about children’s rights at school, and 39% from their parents. Among parents, 41% obtain such information from social networks, and 33% from traditional media.

“The responses of parents in our survey show that they are determined to better protect their children’s rights and provide them with all the necessary support and care. At the same time, they are genuinely concerned about how their actions affect their children in such stressful times,” commented Munir Mammadzade, UNICEF Representative in Ukraine.

The teenagers who participated in the survey noted that their rights were most often violated through psychological or physical abuse, ignoring their opinions, or violating their privacy.

“We must do everything possible to protect and ensure the rights of children everywhere, including at home. Parents and guardians are going through extremely difficult times and trying to cope with the consequences of the war, so we are committed to doing everything possible to help them raise their children,” said Daria Gerasymchuk, Advisor to the President of Ukraine on Children’s Rights and Rehabilitation.

Currently, 67% of adolescents aged 14 to 18 said they would turn to their parents for protection if their rights were violated, while 24% consider teachers to be their second most important source of support.

“Parents are the main support for a child’s development and well-being, but it is difficult for them to cope alone, especially in wartime. A solid foundation for children’s rights is laid at home, but it must be reinforced by policies and services that help parents and guardians care for the next generation,” Mammadzade noted.

The survey revealed a number of characteristics, such as gender differences in perception: 81% of women believe that shouting or using abusive language is a form of violence against children, while only 68% of men share this view.

Other findings include limited family dialogue about children’s rights and well-being: only 22% of parents and 17% of adolescents reported that children’s rights are discussed in their family on a monthly basis or more often.

Another finding is that adolescents demonstrate more autonomous views of their rights. For example, 15% believe that children have the right to refuse any medical treatment, and 12% believe that it is acceptable not to attend school. In addition, 34% of adolescents value freedom of opinion, compared to 27% of parents.

It is noted that Telegram is a universal channel for both parents and teenagers: it is chosen by more than 70% of the audience as the most convenient source of information. TikTok is popular among young people (66%), while Facebook is popular among parents (56%). YouTube is used by both parents and teenagers (47% and 64%, respectively), and Instagram is used by 37% and 47%, respectively.

UNICEF has announced that it is launching a campaign to strengthen knowledge of children’s rights and calls for children to be respected and given the opportunity to defend their rights.

The survey, “Perceptions of Children’s Rights: Knowledge, Attitudes, and Experiences in Ukrainian Families,” was conducted by Gradus Research and includes responses from 600 parents aged 19 to 55 and 400 teenagers aged 14 to 18 across Ukraine.

The turnover of retail trade in Ukraine in January-March 2025 increased by 5.1% compared to the same period in 2024, according to the State Statistics Service (Derzhstat).

According to its data, in nominal terms, retail trade turnover in January-March of this year amounted to UAH 577.932 billion.

Retail trade turnover in March compared to February of this year increased by 11.5%, and in annual terms compared to March 2024, by 5.3%.

Derzhstat specifies that the turnover of retail trade enterprises (legal entities) in the first quarter of 2025 compared to January-March 2024 increased by 4.8% and amounted to UAH 400.757 billion.

At the same time, in March compared to February this year, the retail turnover of enterprises increased by 11.6%, and by March 2024 – by 4.9%.

According to the statistics office, Ukraine’s retail trade turnover in 2024 grew by 11.5%, amounting to UAH 2.172 trillion in nominal terms.

The State Statistics Service reminds that the data does not include the territories temporarily occupied by the Russian Federation and parts of the territories where hostilities are (were) ongoing.