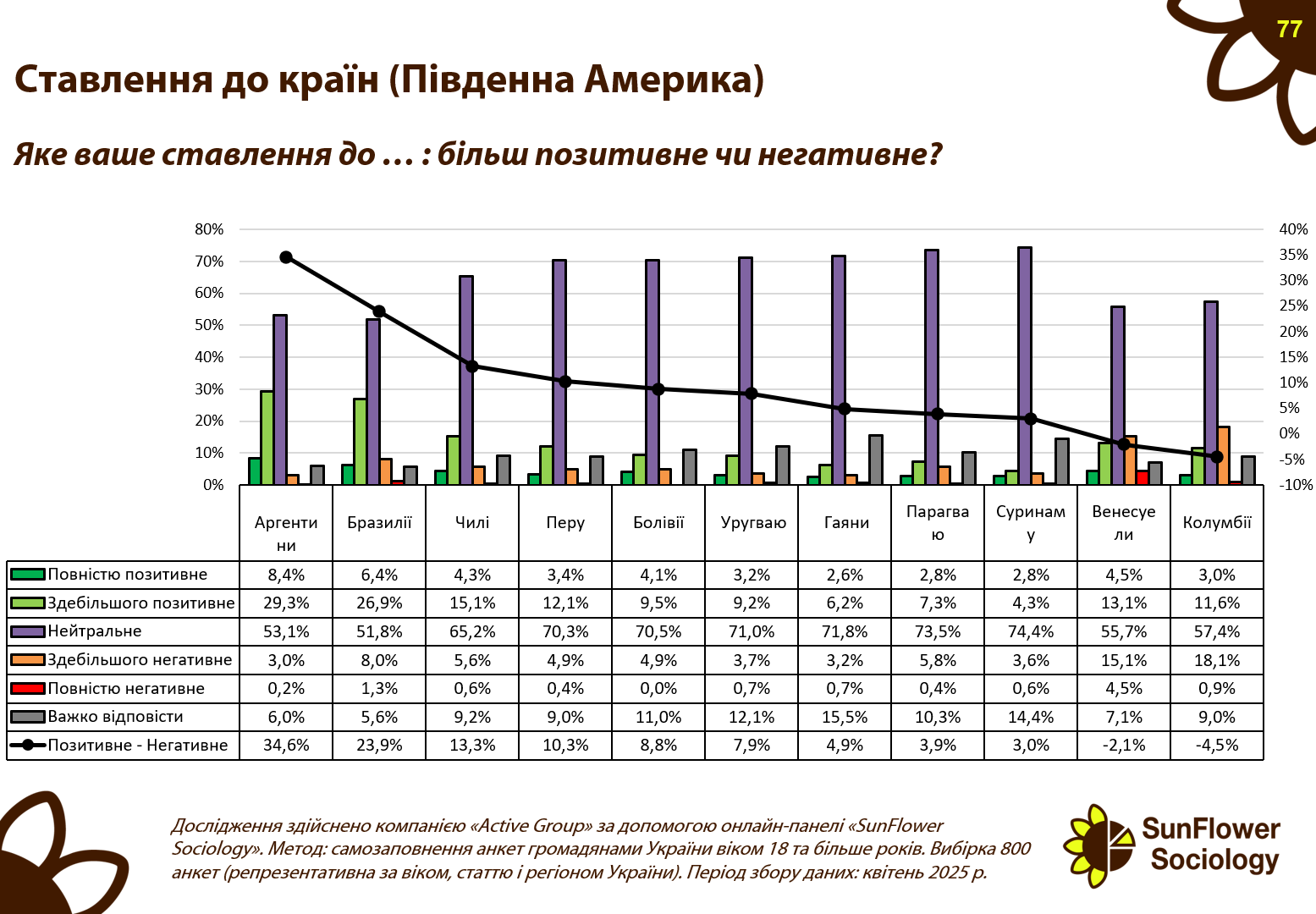

A survey conducted by Active Group in partnership with Experts Club found that among South American countries, Ukrainians have the highest level of sympathy for Argentina. According to data published in April 2025, 8.4% of respondents expressed a completely positive attitude toward this country, and another 29.3% expressed a mostly positive attitude. Thus, Argentina has the highest positive balance in the region — 34.6%.

Brazil came in second place in terms of support, with a total of 33.3% positive ratings (6.4% completely positive, 26.9% mostly positive) and a balance of 23.9%. Chile shows rather restrained sympathy: 4.3% of respondents were completely positive, 15.1% mostly positive, giving a balance of 13.3%. Peru, Bolivia, and Uruguay were at or slightly above 10% positive balance.

It is particularly noteworthy that for Bolivia this figure is 8.6%, despite a fairly high level of neutral attitudes — 70.5%.

The situation is much worse for Colombia, which has the lowest balance in the region — minus 4.5%. 18.1% of respondents expressed a mostly negative opinion, which significantly outweighs the total 14.6% of positive perceptions. Venezuela also has a negative balance of minus 2.1%, mainly due to political instability and negative associations in the media.

Most South American countries are perceived by Ukrainians as mostly neutral. In Paraguay, Suriname, Guyana, and Uruguay, the level of neutrality ranges from 71% to 74%. This indicates weak emotional contact and insufficient presence of these countries in Ukraine’s information space.

“Latin American countries remain largely outside the scope of active Ukrainian interest, which creates both challenges and opportunities. Where the level of neutrality is high, there is room for diplomacy, cultural exchange, and building a positive image,” comments Maxim Urakin, PhD in Economics and founder of Experts Club.

On May 22, 2025, the P. L. Shupyk National Medical Academy of Postgraduate Education hosted the National Healthcare Forum of Ukraine – 2025.

The event was attended by the Minister of Health of Ukraine, Viktor Lyashko, the Chairman of the Verkhovna Rada Committee on Health, Medical Assistance and Medical Insurance, Mykhailo Radutsky, the Commander of the Medical Forces of the Armed Forces of Ukraine, Anatoliy Kazmirchuk, and the Acting President of the National Academy of Medical Sciences of Ukraine, Director of the National Institute of Cardiovascular Surgery named after Mykola Amosov of the National Academy of Medical Sciences of Ukraine, Academician of the National Academy of Medical Sciences of Ukraine, Academician of the National Academy of Sciences of Ukraine, Academician of the National Academy of Medical Sciences of Ukraine, Academician of the National Academy of Sciences of Ukraine, Academician of the National Academy of Medical Sciences of Ukraine, Academician of the National President of the National Academy of Medical Sciences of Ukraine, Director of the State Institution “National Institute of Cardiovascular Surgery named after Mykola Amosov of the National Academy of Medical Sciences of Ukraine” Vasyl Lazoryshynets, Head of the National Health Service of Ukraine Natalia Gusak, Mayor of Lviv Andriy Sadovyi, international and Ukrainian experts, directors of health departments and institutions, rectors of higher medical education institutions.

The forum, organized by the Ukrainian Federation of Professional Medical Associations, became a platform for open dialogue between government representatives, experts, and the medical community on key challenges in the healthcare system.

“The forum is a space where the right questions are asked and answers are sought together. We often talk about reform, but we rarely stop to look back at what has been achieved and what needs to be reviewed. It is precisely such discussions that lead to important changes. We have strategic documents, the main one being the Health Care System Development Strategy for the period up to 2030. It is important that they do not remain on paper. My request to the community is to work according to these documents,” said Minister of Health Viktor Lyashko.

“We propose to create a permanent discussion platform within the National Forum to develop proposals for improving the Strategy and ensuring the protection of the interests of both doctors and patients. We call on everyone to join forces for a healthy future for Ukraine,” said Vyacheslav Kaminsky, Rector of the P. L. Shupyk National Medical Academy of Postgraduate Education.

Financial protection for both patients and medical workers became one of the key focuses of the Forum. According to the Minister, these two areas should be given equal priority in state policy.

The Forum included a ceremony to award young doctors under the age of 40. Twenty-eight talented specialists from different regions of Ukraine received the “Future of the Medical Profession” award from the Ukrainian Federation of Professional Medical Associations.

The awards were presented by the rector of the P. L. Shupyk National Medical Academy of Postgraduate Education, Vyacheslav Kaminsky, the chair of the board of the NGO MedGlobal Ukraine, Oleksandra Kozlovska, and the secretary general of the UFPMO, Igor Shkrobanets. Each nominee received a commemorative plaque and the opportunity to attend a master class from experienced mentors to improve their professional skills.

The forum was an important step towards deepening the dialogue between all participants in the healthcare system, with a focus on patient needs, support for healthcare workers, and the implementation of solutions that will truly change medicine in the country. Following the forum, the participants agreed to draft a resolution.

Source: https://interfax.com.ua/news/press-release/1074188.html

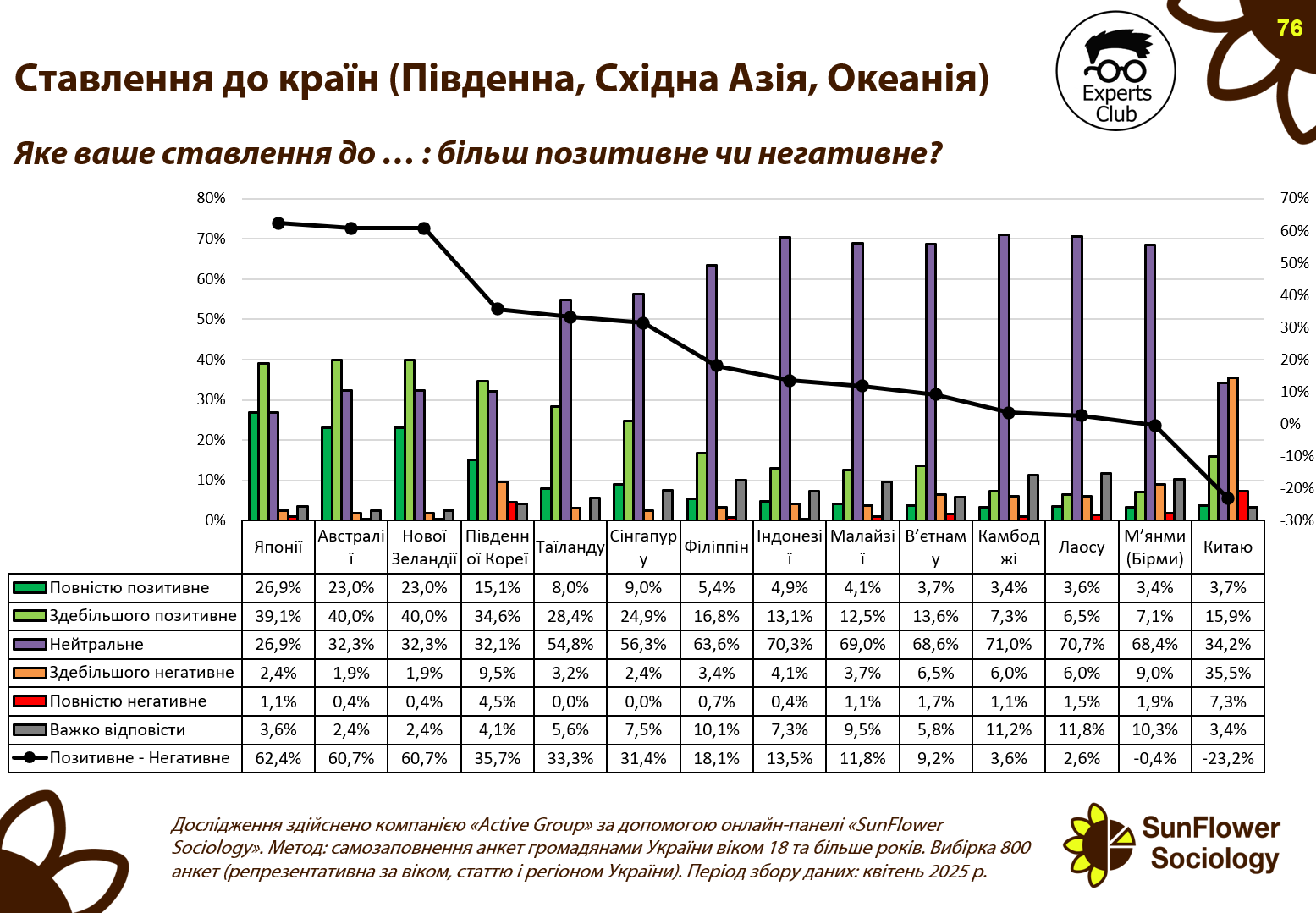

According to new sociological data published by Active Group in collaboration with Experts Club in April 2025, Ukrainian public opinion on South and East Asian countries and Oceania varies significantly. Japan, Australia, and New Zealand are in favor, while China and some countries in Southeast Asia show either a negative or neutral balance.

Japan received the highest positive rating among the countries in the region, with 62.4% of Ukrainians having a positive attitude towards it, including 26.9% who are completely positive and 39.1% who are mostly positive. It is followed by Australia and New Zealand with an identical net balance of 60.7%. In Australia, 23% of respondents chose the completely positive option, in New Zealand — the same, while more than 40% in each country gave a “mostly positive” rating.

South Korea, with 15.1% completely positive ratings and 34.6% mostly positive, has a respectable balance of 35.7%, although lower than the leaders. Thailand (36.4% positive perception) and Singapore (33.8%) also hold relatively high positions thanks to their stable image associated with tourism and development.

In contrast, countries such as Indonesia, Malaysia, Vietnam, Cambodia, Laos, and Myanmar are dominated by neutral assessments — over 60% — indicating limited awareness or an information vacuum. In all these countries, the positive balance does not exceed 10%.

Despite its economic weight, China has one of the worst images among Ukrainians in the region: 15.9% expressed a mostly positive opinion, but 35.5% rated China neutrally, and the negative balance was -23.2%. This reflects a certain distrust that has formed against the backdrop of geopolitical events and the information background.

“It is particularly interesting that even Ukraine’s economically important partners, such as China (its largest trading partner), receive low support ratings among Ukrainians. This indicates that Ukrainian society values moral support above real trade and does not recognize “neutrality” if it is not accompanied by humanitarian gestures,” comments Maxim Urakin, PhD in Economics and founder of Experts Club.

Thus, the results indicate that there is significant potential for countries in the region, particularly Southeast Asia, to improve their image in Ukraine through cultural diplomacy, tourism marketing, and economic cooperation.

On May 22, the State Customs Service of Ukraine announced a tender for compulsory motor third-party liability insurance services for owners of land vehicles (OSAGO). According to the Prozorro electronic public procurement system, the expected cost of the services is UAH 70,000. The deadline for submitting bids is May 30.

compulsory motor third-party liability insurance, CUSTOMS SERVICE, INSURER

Ukrainian tour operator Join UP! plans to launch franchising in the Baltic States and Kazakhstan in 2024, according to Marina Dayneko, head of the Join UP! sales office, in an interview with the Interfax-Ukraine news agency.

“Currently, more than 100 agencies are operating under this model in Ukraine, and four in Moldova, two of which opened this year. We are continuing to develop franchising in Poland and are currently signing agreements with both Polish and Ukrainian partners. This year, we are launching franchising in Kazakhstan and the Baltic states,” she said.

As reported, the travel company Join UP! LLC was established in 2013 with a registered capital of UAH 72.671 million. The ultimate beneficiaries are Yuriy and Oleksandr Alby. According to the OpenDataBot service, at the end of 2024, the tour operator’s revenue decreased to UAH 376,000 from UAH 16,639,000 in 2023, and its net loss decreased to UAH 217,451,000 from UAH 233,341,000, respectively.

The brand’s international expansion covers eight markets: the Baltic states, Kazakhstan, Moldova, Poland, Romania, and the Czech Republic. Preparations are underway to launch operations in Slovakia and Hungary. Last year, the brand also opened its first franchise agency on the international market in Katowice, Poland.

A large glass container manufacturer, Kostopil Glassworks (KZS, Rivne region), is in the process of acquiring Khmelnytsky Regional Brewery (Khmelpyvo, Proskurivske, Khmelnytske brands), a regional beer producer.

As reported by the Antimonopoly Committee of Ukraine (AMCU) on Thursday, it has granted KZS permission to acquire control over PJSC Khmelpyvo.

According to the disclosure system of the National Securities and Stock Market Commission (NSSMC), the main shareholder of Khmelpyvo, with a 78.0286% stake, is the company’s director, Oleksandr Lysyuk.

The company has convened an extraordinary shareholders’ meeting on June 13, at which the supervisory board headed by Lysyuk will be dismissed and replaced by a new one headed by the chairman of the Federation of Employers of Ukraine, Dmytro Oliynyk, who owns 19.46% of KZS and, together with his family, 49.53%.

It was proposed to keep Oleksandr Mazur on the supervisory board and replace Nadiya Kravets with Yuriy Matsak.

In 2024, Khmelpyvo increased its revenue by 2.8% to UAH 146.41 million and reduced its net profit by 3.9% to UAH 76.86 million. At the meeting on April 8 this year, the issue of allocating all profits to the technical re-equipment of the company was raised.

Its equity capital at the beginning of this year amounted to UAH 547.97 million, cash – UAH 326.04 million, assets – UAH 559.4 million, and the number of employees – 125.

Kostopil Glass Factory is one of the largest industrial enterprises in the Rivne region and is one of the five largest manufacturers of glass containers in Ukraine. The company ended 2024 with a net profit of UAH 76.5 million, which is 6.6 times less than in 2023, and its net income decreased by 18% to UAH 1 billion 467.8 million.

The main products of KSZ are beverage containers (91% of last year’s production), with bottles accounting for 9%. According to the plant, last year 51% of its products (UAH 755.3 million) were exported, in particular to Poland, Hungary, Romania, Bulgaria, Slovakia, Moldova, Lithuania, Latvia, and Estonia.

KZS reported that it plans to increase glass container production by 10-15% annually and increase sales accordingly. As of early 2025, the plant employed 503 people.

According to YouControl, Oliynyk owns 19.46% of KZS LLC, his family members Tetyana, Kyrylo, and Ivan Oliynyk own 16.27% and 6.9% respectively, Another 22% is owned by the Bulgarian company Fisherman Investments, 9.06% by Andriy Rybitsky, 4.85% each by Anatoliy Kucheruk, Leonid Smilyants, Andriy Filimonuk, and a private enterprise, the company Sava.