Ukraine’s top-ranked player Elina Svitolina won the WTA 250 ASB Classic in Auckland, New Zealand, beating China’s Wang Xinyu 6-3, 7-6(6).

Svitolina won her 19th WTA singles title. According to the organizers, the total balance of the Ukrainian in the finals of WTA tournaments is 19 wins and 4 losses.

Svitolina is ranked 13th in the WTA rankings.

The UK intends to transfer advanced weapons to Ukraine in the form of powerful Nightfall long-range ballistic missiles capable of hitting Russian targets at a distance of over 300 miles, according to the Daily Mail.

“Nightfall missiles are equipped with warheads weighing about 200 kg, can be launched in series, and have a range that allows them to reach Moscow, among other targets. The UK Ministry of Defense is currently looking for British companies to develop, build, and supply the first three test missiles as part of a £9 million contract,” the report says.

The announcement of the Nightfall project coincided with the defense minister’s announcement of the UK’s plans to spend GBP 200 million.

As reported, The Independent, citing British Defense Minister John Gilli, said that the United Kingdom of Great Britain and Northern Ireland would spend GBP 200 million to prepare British troops for deployment in Ukraine in the event of a ceasefire with Russia.

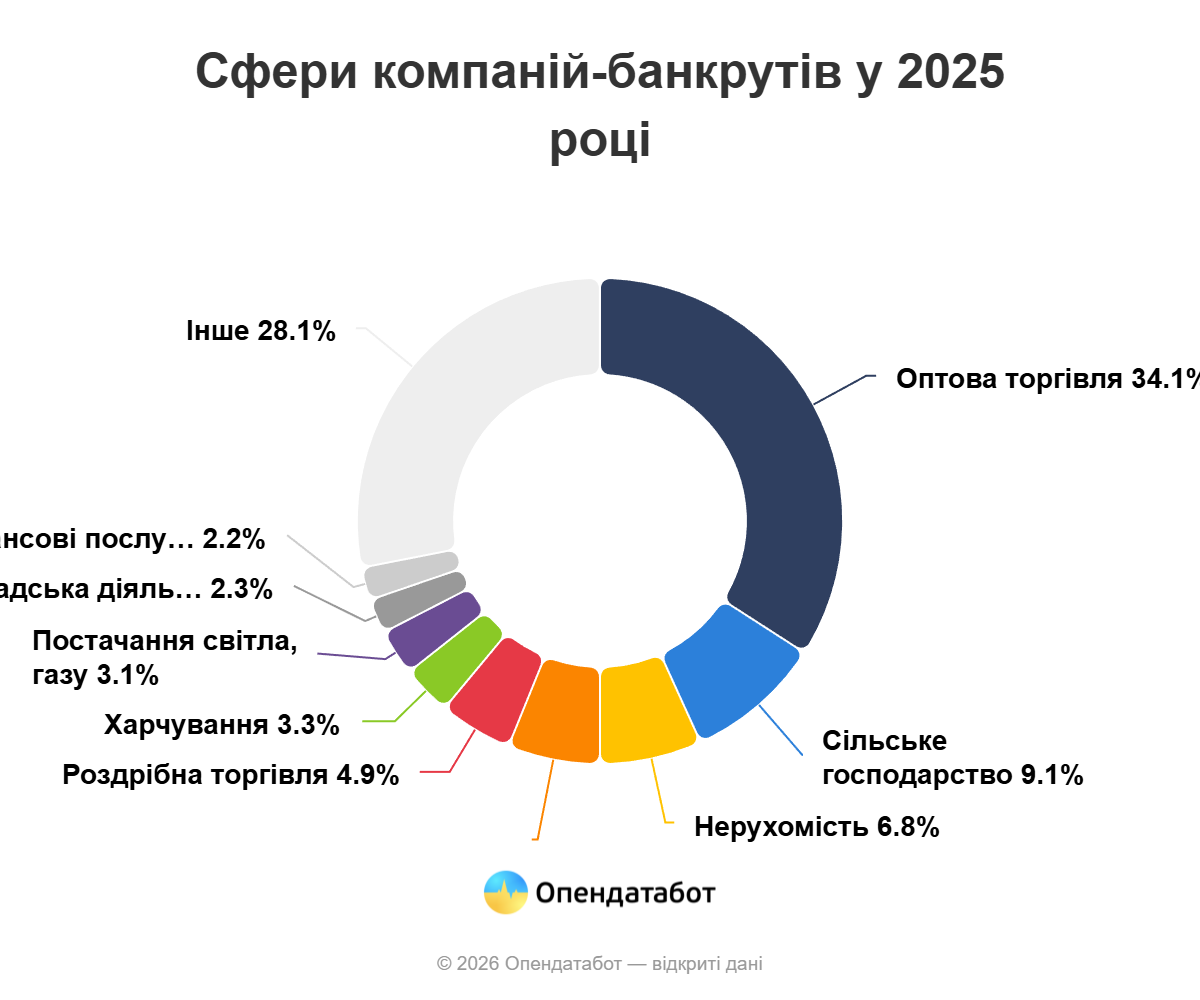

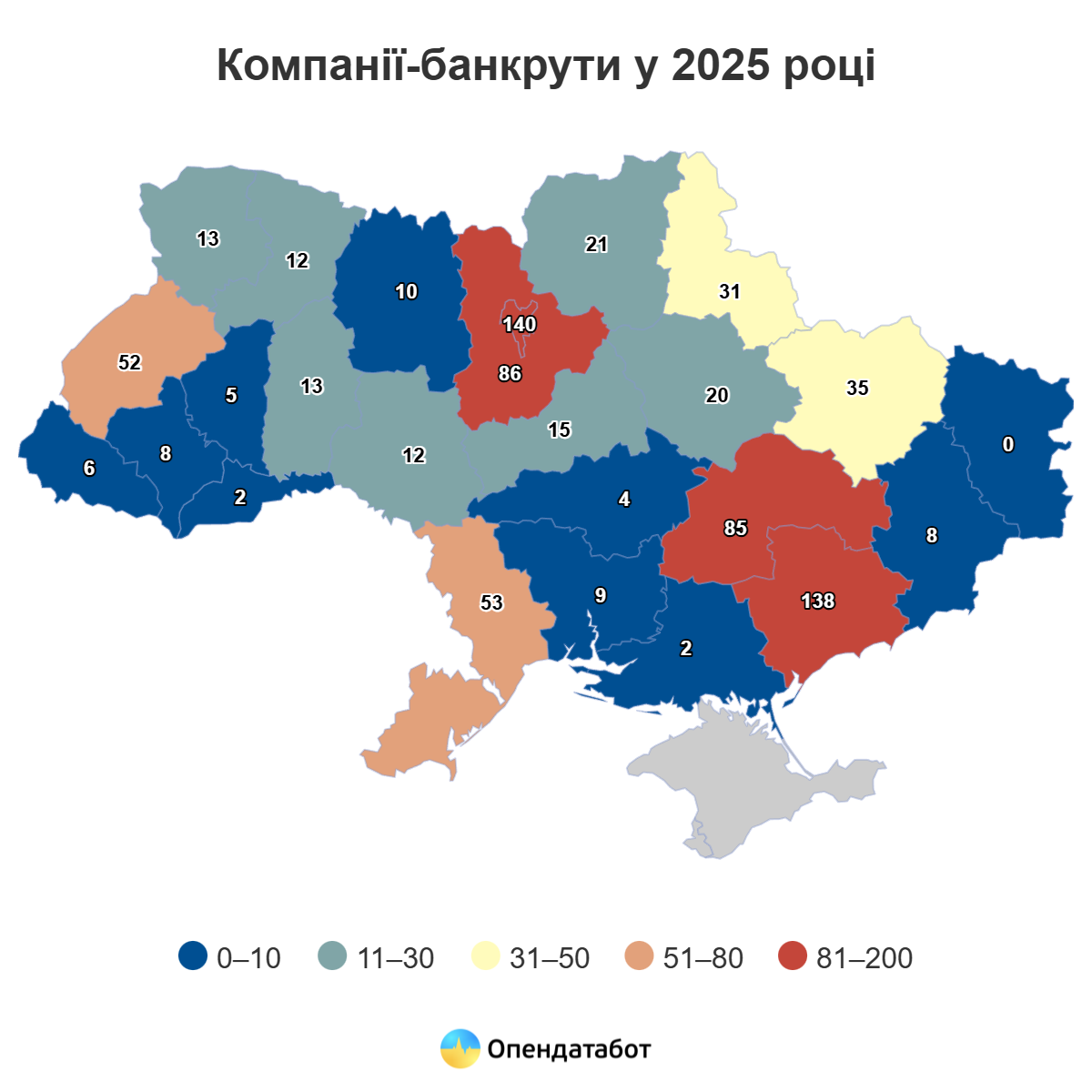

Which companies go bankrupt most often in Ukraine?

780 companies began bankruptcy proceedings in 2025, according to data from the Supreme Court of Ukraine. This is about 10% of the total number of business closures. The turnover of the largest bankrupt companies ranges from UAH 3.4 to 7.7 billion. Most often, limited liability companies go bankrupt. Last year, companies engaged in wholesale trade and agriculture became insolvent. Kyiv leads in terms of the number of bankrupt businesses.

780 companies began bankruptcy proceedings in 2025. This is only 10% of the total number of business closures. Most companies in Ukraine go through the process of voluntary closure — this is 60% of cases. A total of 8,191 companies undergoing procedures related to the termination or change of business operations were recorded in Ukraine last year.

Most often, LLCs go bankrupt — 84% of cases in 2025.

Only in 48 cases do bankrupts try to stay afloat: to restore solvency and continue working through a reorganisation procedure. However, this is less than 1% of cases.

Currently, owners are increasingly opting for preventive restructuring: 8 cases in 6 companies were opened in 2025. These are cases where a business begins restructuring before it becomes insolvent, trying to avoid bankruptcy.

Most often, wholesale companies go bankrupt: 266 enterprises. In second place is agriculture: 71 companies. Next are real estate operations — 53 companies, construction — 48 companies, and retail trade — 38 companies.

Most bankruptcy proceedings against businesses are opened in Kyiv — 140 companies (18%). Almost as many are in the frontline Zaporizhzhia region — 138 companies (17.7%). Next are Kyiv region — 86 companies (11%), Dnipropetrovsk region — 85 (10.9%) and Odesa region — 53 companies (6.8%).

The top 10 companies against which bankruptcy proceedings have been initiated include enterprises that until recently had revenues ranging from 3.4 to 7.7 billion hryvnia. The largest case concerns DEGS HOLDING, which was engaged in gas trading and had revenues of over 7.7 billion hryvnia in 2024. Next are PRIDE SOLUTIONS UKRAINE with revenues of UAH 6.08 billion and OPT-SYSTEMS with UAH 5.46 billion.

Over the past month, BETS held 117 trading sessions for the purchase and sale of natural gas on the medium- and long-term market, as well as four trading sessions each day on the short-term market.

A total of 304 starting positions were formed at the BETS trading platform for trading resources in December 2025, January 2026, and subsequent months, in the gas transmission system and underground gas storage facilities. A total of approximately 156 million cubic meters of natural gas was sold on the medium- and long-term market. 9.08 million cubic meters of natural gas were sold on the short-term market.

On the medium- and long-term market in December, quoted prices in the section of the same name ranged from UAH 19,140 to UAH 21,250 excluding VAT. There was a downward trend in prices throughout the month. The initiators of the auctions formed starting positions mainly for sale.

Last month, transactions were concluded in the “Cross-border” section on the terms of delivery at the border point. The total volume of these transactions amounted to 1.3 million MWh at prices ranging from €34.65 to €36.55.

On the short-term market, exchange rates fluctuated daily in the range of UAH 19,227-20,416.26 excluding VAT, with a downward trend. In addition to the intraday market, transactions were concluded on the UEB day-ahead market with a total volume of 360,000 cubic meters.

” December confirmed the consistently high demand for UEB exchange instruments. We will continue to focus on improving the efficiency of trading procedures in general and developing medium-term standardized products in particular, so that participants receive transparent prices and guaranteed execution of transactions,” said UEB CEO Alexander Kovalenko.

Fixygen identifies three basic scenarios for the cryptocurrency market in 2026. The baseline scenario for the cryptocurrency market at the beginning of the year looks like broad consolidation with periodic “spikes” on news about rates, ETF flows, and regulation.

A more positive scenario is the acceleration of institutional integration (access via ETP/ETF and platforms), the growth of stablecoin adoption and asset tokenization, as reported by Grayscale and Coinbase Institutional.

A negative scenario would be tightening financial conditions, risk-off sentiment in global markets, and increased regulatory risks, which could put pressure on high-risk assets even with strong fundamentals.

Global crypto market capitalization at the beginning of 2026 fluctuates around $3.1-3.2 trillion, with Bitcoin trading at around $90-91 thousand and Ethereum at around $3.1 thousand, according to industry aggregators and current quotes.

Ukraine’s total elevator capacity at the end of 2025 increased to 52.67 million tons of simultaneous grain storage, compared to 52.1 million tons in October 2024, according to the industry online publication Elevatorist.com.

“The increase in elevator capacity over the year amounted to about 0.5 million tons (1.1%), despite infrastructure losses due to hostilities and the difficult economic situation in the industry,” the publication noted.

The growth was driven by the commissioning of new elevators, the expansion of existing capacities, and the implementation of investment projects, mainly in the central and western regions of Ukraine.

Currently, the top three regions in terms of elevator capacity are Poltava with 5.58 million tons, Odesa with 5.45 million tons, and Vinnytsia with 4.45 million tons, Elevatorist.com noted.