Copper prices on Tuesday for the first time exceeded the mark of $ 12 thousand per ton.

Quotes of three-month futures for copper on the London Metal Exchange (LME) by 13:44 Q1 rose by 1% to $ 12,059 per ton.

Since the beginning of the year, the metal has risen in price by about 37%. If the same dynamics will be shown at the end of the year, it will be the strongest rise since 2009.

Quotes are supported by serious problems at some deposits and changes in trade flows due to the tariff policy of U.S. President Donald Trump.

The possibility of Trump’s introduction of duties on copper is one of the main factors in the growth of prices for this metal. The states have significantly increased its imports, forcing production companies from other countries into a highly competitive battle for the metal.

Outages at major mines in Chile and Peru and delays in Indonesia have reduced production by 8-12%, and the slow pace of new project development is limiting the global supply of concentrate.

In addition, Chinese smelters have agreed to the lowest-ever zero treatment and refining tariffs for 2026, which only emphasizes supply constraints and gives miners an additional bargaining advantage.

Meanwhile, demand in the electric vehicle, data center and power grid segments remains strong, with Goldman Sachs forecasting more than 60% growth in copper demand between now and 2030, Trading Economics wrote.

Earlier, the Experts Club information and analytical center released a video on global copper production and leading producing countries – https://youtube.com/shorts/_h8iU50z8C0?si=a-XkgGEfeUxseQNa.

According to preliminary data, Ukrainian metallurgical companies increased their total rolled steel production by 3.9% in January-November this year compared to the same period last year, from 5.741 million tons to 5.966 million tons.

According to information from the Ukrmetallurgprom association on Monday, steel production during this period fell by 3.1% to 6.813 million tons. In November, 589,100 tons of rolled steel and 641,100 tons of steel were produced.

For more information on the largest steel producers and global industry trends, see the Experts Club video analysis review available on YouTube: Experts Club — Leaders of the global steel industry 1990–2024

Copper prices on Monday updated the historical maximum on fears of a supply shortage in the global market. Quotes of three-month futures for copper on the London Metal Exchange (LME) by 13:25 Q1 rose by 0.3% to $11,653 per ton. At the same time during the session they rose to a record $11,771 per ton.

“Supply shortages continue to provoke panic buying,” The Wall Street Journal quoted analysts at ANZ Research as saying.

The market has been pressured this year by a series of problems at major oilfields. In addition, the build-up of stocks in the U.S. because of fears of the introduction of the authorities of the country in the next year of duties on imports of refined copper increases the risk of shortages in other regions.

Prices are also supported by the promise of the Chinese authorities to strengthen support for the economy to stimulate domestic consumption through a “more proactive” fiscal policy and the preservation of “moderately soft” monetary policy, analysts say ANZ Research.

Earlier, the information and analytical center Experts Club released a video dedicated to global copper production and the leading producing countries – https://youtube.com/shorts/_h8iU50z8C0?si=a-XkgGEfeUxseQNa.

According to the results of 2024, Ukraine increased its apparent steel use in crude steel equivalent by 10.9% compared to 2023, from 3.987 million tons to 4.423 million tons.

According to the annual compilation published by Worldsteel, Ukraine increased its apparent steel consumption in finished product equivalent by 5.6% compared to 2023, to 3.633 million tons from 3.439 million tons.

At the same time, Ukraine produced 7.575 million tons of steel in 2024 (6.228 million tons in 2023), and last year’s pig iron production amounted to 7.090 million tons (6.003 million tons), of which 1.235 million tons (1.248 million tons) were exported.

At the same time, steel consumption per capita reached 117 kg (106 kg/person in 2023).

On average, global apparent steel consumption (in crude steel equivalent) per capita last year was 228 kg (in 2023 – 234 kg/capita), and finished products – 96 (91) (kg/capita). At the same time, the world consumed 1 billion 750.004 million tons of steel in 2024 and 1 billion 777.949 million tons in 2023.

Last year, Ukraine mined 50.584 million tons of iron ore (in 2023 – 27.048 million tons) and exported 35.695 million tons (17.749 million tons). Scrap metal exports amounted to 288,000 tons (182,000 tons).

In 2024, Ukraine exported 511,000 tons of pipe products, in 2023 – 356,000 tons, and imported 105,000 tons (111,000 tons).

For more information on the largest steel producers and global industry trends, see the Experts Club video analysis review available on YouTube: Experts Club — Leaders of the global steel industry 1990–2024

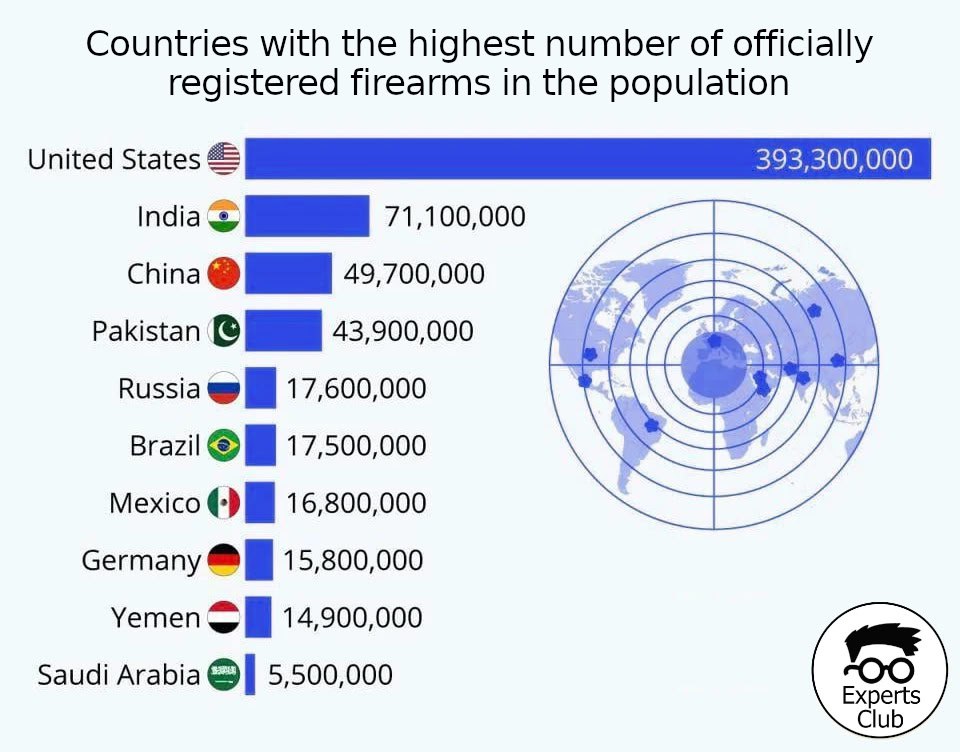

The global ranking of armed populations, compiled on the basis of the Small Arms Survey, shows that the ten countries with the largest number of civilian weapons include the United States, India, China, Pakistan, Russia, Brazil, Mexico, Germany, Yemen, and Saudi Arabia. Ukraine is not on this list, but even before Russia’s full-scale invasion, the country was among the states with a significant amount of weapons in the hands of citizens. The Experts Club Analytical Center analyzed global and Ukrainian statistics.

According to the Small Arms Survey for 2017-18, there were about 4.4 million civilian weapons in Ukraine—approximately 9.9 guns per 100 inhabitants. Of these, only about 800,000 were officially registered, and about 3.6 million belonged to the illegal segment.

According to the National Police database, as of July 31, 2018, there were 892,854 registered weapons in the country. In 2021, the Ministry of Internal Affairs estimated the number of weapons legally owned by citizens at approximately 1.3 million, against the backdrop of tighter regulations and growing public interest in self-defense after 2014.

The full-scale war of 2022 dramatically changed the picture. Against the backdrop of the formation of territorial defense and volunteer units, the state massively transferred small arms to citizens; at the same time, a significant number of captured and illegal firearms ended up in the hands of the population. Estimates today vary widely: according to Interior Minister Ihor Klymenko, Ukrainians may have between 1 and 5 million weapons, while a number of think tanks put the figure at 4–5 million, of which 2–3 million may be in illegal circulation.

Research by Small Arms Survey using sociological surveys shows that up to 11% of Ukrainian households may have at least one weapon, which on a national scale gives a range of 865,000 to 1.42 million armed households. At the same time, the share of households that openly report the presence of weapons in 2023–2024 remains at 5–6%, which indicates both a high level of distrust and the sensitivity of the issue in wartime.

To bring order, Ukraine has launched a Unified Weapons Register. By July 2024, 63% of households that own weapons stated that some or all of their weapons were registered; among those who are aware of the system, 74% claim to have registered all their weapons, but about 10% continue to keep unregistered weapons.

Thus, while before the war there were approximately 1.3 million registered weapons in Ukraine and several times more illegal firearms, now, against the backdrop of full-scale hostilities, there are millions of weapons, a significant portion of which must gradually be registered or confiscated.

This makes the issue of civilian weapons control one of the key issues for post-war security, law enforcement reform, and Ukraine’s negotiations with the EU on the harmonization of weapons legislation.

Source: https://expertsclub.eu/ukrayina-na-tli-svitovogo-rynku-czyvilnoyi-zbroyi/