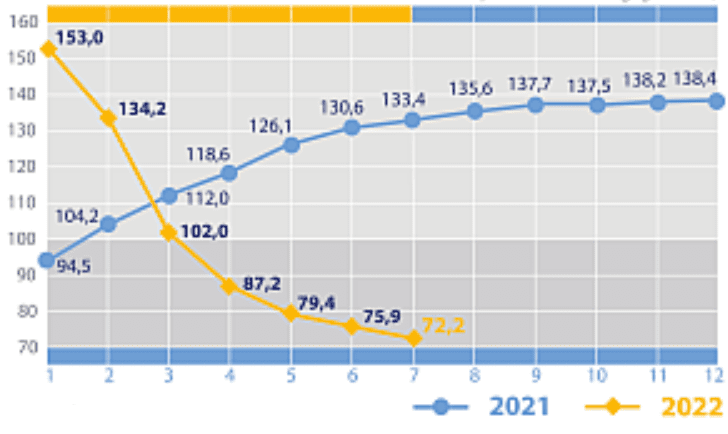

Exports of goods in % to the previous period in 2021 and 2022

SSC of Ukraine, graphics of the Club of Experts

Ukraine in January-September this year reduced the export of pig iron in kind by 55.9% compared to the same period last year – up to 1 million 77.356 thousand tons.

According to statistics published by the State Customs Service (SCS), over the specified period, the export of pig iron in monetary terms decreased by 56.5% – to $550.490 million.

At the same time, exports were carried out mainly to the USA (41.75% of deliveries in monetary terms), Poland (34.1%) and Turkey (8.7%).

In January-September 2022, Ukraine imported 15 tons of pig iron from Germany for $25,000, while in 9 months-2021 it imported 149 tons of pig iron for $163,000 from Germany (64.42%), Russia (28.22%) and Slovakia (7.36%).

As reported, in 2021 Ukraine increased the export of pig iron in physical terms by 4.2% compared to 2020 – up to 3 million 235.772 thousand tons, the export of pig iron in monetary terms increased by 78.1% – up to $1 billion 642.596 million At the same time, exports were carried out mainly to the USA (53.61% of deliveries in monetary terms), Italy (22.08%) and Turkey (9.74%).

In 2021, Ukraine imported 185 tons of pig iron worth $226 thousand from Germany (74.34%), the Russian Federation (20.35%) and Slovakia (5.31%), while in 2020 it imported 593 tons worth $417 thousand.

Another seven ships with 177,500 tonnes of foodstuffs left the Ukrainian ports of Odesa, Pivdenny and Chornomorsk on Tuesday for the countries of Africa, Asia and Europe, the Ministry of Infrastructure of Ukraine has reported.

“In particular, among the ships leaving the Ukrainian ports is the bulk carrier Sea Pearl J, which will deliver 30,000 tonnes of wheat to Tunisia,” the ministry said on its Facebook page.

Five ships were sent from the port of Chornomorsk: Hazar S, Sea Pearl J, Ince Evrenye, Milina, Magnum Power, while Lucky Trader and Erdek departed from Odesa and Pivdenny, respectively.

In general, since the launch of the first ship with Ukrainian food, 7 million tonnes of foodstuffs have been exported, and the number of ships with food sent to Asia, Europe and Africa has reached 316.

On Friday, the UK announced its decision to expand sanctions against Russia in the field of IT technologies, audit services, and engineering.

The government’s message notes that, in particular, in the IT sector, consulting services for the Russian Federation will now be prohibited. It is also prohibited “to provide legal services for transactions in a number of commercial areas.” Restrictive measures apply to the advertising sector, auditing.

“The UK also bans the export to Russia of approximately 700 items of goods that are important for Russian industry and technology development,” the statement said.

It also notes that the British authorities have decided to summon Russian Ambassador to London Andrey Kelin to the British Foreign Office.

Mining enterprises of Ukraine in January-August of this year reduced the export of iron ore raw materials (IORM) in kind by 32.8% compared to the same period last year, to 20 million 10.602 thousand tons.

According to statistics published by the State Customs Service (STS), for the specified period, foreign exchange earnings from the export of iron ore decreased by 53.8% – to $ 2 billion 529.275 million.

Iron ore was exported mainly to Slovakia (19.82% of deliveries in monetary terms), Poland (16.49%) and the Czech Republic (15.95%).

During the reporting period, IORM was imported to Ukraine for $26 thousand in a total volume of 47 tons, while in January-August 2021, iron ore for $158 thousand was imported in a total volume of 1.175 thousand tons. Imports for January-August 2022 were carried out from Norway (46.15%), Great Britain (42.31%) and Italy (7.69%).

As reported, Ukraine in 2021 reduced the export of iron ore raw materials (IORM) in physical terms by 4.2% compared to 2020 – up to 44 million 357.727 thousand tons, but increased revenue by 62.8% – up to $6 billion 899.816 million The export of iron ore was carried out mainly to China (41.90% of supplies in monetary terms), the Czech Republic (9.65%) and Poland (7.99%).

Last year, IORM was imported to Ukraine for $184 thousand in a total volume of 1.202 thousand tons, while in 2020 123 tons of iron ore for $75 thousand were imported. Imports for 2021 were carried out from Egypt (55.98%), the Netherlands ( 21.2%) and Poland (7.07%).

In January-August 2022, Ukraine increased its revenue from electricity exports by 1.7 times (by $115.664 million) compared to the same period in 2021, to $278.75 million, according to the State Customs Service.

According to Interfax-Ukraine estimates, over eight months electricity was supplied to Poland for $92.689 million, Slovakia – for $59.364 million, Hungary – for $44.688 million, other countries – for $82.009 million.

In August this year, electricity export revenue amounted to $73.112 million compared to $27.474 million in August 2021.

In addition, in January-August 2022, Ukraine imported electricity for $119.067 million against $59.394 million for the same period last year. Including from Belarus – by $100.414 million (in January-February), Belgium – by $12.259 million, Moldova – by $4.695 million, other countries – by $1.698 million.

Last month, Ukraine imported electricity for $11.135 million compared to $0.336 million in August 2021.

As reported, Ukraine in 2021 reduced its revenue from electricity exports by 8.5% (by $23.89 million) compared to 2020, to $256.941 million. In addition, Ukraine imported electricity by $87.345 million in 2021 against $131.605 million for 2020th.

Ukraine in 2021 reduced the export of electricity by 26.5% (by 1 billion 258.7 million kWh) compared to 2020 – to 3 billion 495.4 million kWh, import – by 25.9% (by 591.3 million kWh), up to 1 billion 693.6 million kWh.