According to Serbian Economist, regular rail service between Belgrade and Budapest will start on February 20: passengers will once again be able to travel between the two capitals by train without changing trains. After modernization, the line is designed for train speeds of up to 160 km/h, which significantly reduces travel time and makes the train competitive with road transport.

In fact, this is not only about the “return of the train” between the two capitals, but also about Serbia’s inclusion in the wider Central Europe-Balkans-Aegean Sea transport corridor. Belgrade is gaining a stronger role as a transit hub for freight and passenger flows, and the route is becoming more attractive for logistics and industrial projects.

https://t.me/relocationrs/1894

Russian aggression on the territory of Ukraine has caused unprecedented destruction of the natural environment, destruction of ecosystems, and large-scale pollution of the air, soil, and water resources. Since the start of the full-scale invasion, the amount of damage caused to the environment has reached 6.01 trillion hryvnia, according to the Ministry of Economy, Environment, and Agriculture, citing data from the State Environmental Inspection.

“These are the largest environmental losses recorded in Europe in modern history,” the Ministry of Economy emphasized.

According to the State Environmental Inspection’s estimates, the total amount of damage includes UAH 1.29 trillion in damage to soil, UAH 967 billion in damage to atmospheric air, UAH 117.8 billion in pollution and contamination of water resources, and UAH 3.63 trillion in destruction of nature reserve areas.

One of the most destructive incidents was the fires at oil depots, according to the State Environmental Inspection. For example, after a strike on an oil depot in the village of Kryachky in the Kyiv region, toxic emissions into the atmosphere reached more than 41,000 tons, and soil pollution exceeded permissible limits by 17 times. Similar incidents occurred in Chernihiv, Sumy region, Rubizhne, and Severodonetsk, where Russian missiles hit tanks containing ammonia and nitric acid, causing dangerous chemical emissions.

The destruction of hydraulic structures also has long-term consequences, the agency emphasized. The blowing up of the Kakhovka hydroelectric power plant dam in 2023 caused a large-scale ecological and hydrological collapse in southern Ukraine and the Black Sea region. Natural complexes were destroyed, hydrology was altered, and protected areas were affected. The destruction of the Oskil Reservoir dam had similar consequences, with 76% of the water volume lost and the aquatic ecosystem destroyed.

In total, 20% of Ukraine’s nature conservation areas were affected by the war, including 2.9 million hectares of the Emerald Network. Significant damage was done to the Kinburn Spit, Oleshky Sands, Kakhovka Reservoir, Lower Dnipro, dozens of Ramsar sites, and other valuable ecosystems. Several national parks and reserves remain under occupation, including Askania-Nova and the Black Sea Biosphere Reserve.

The State Environmental Inspection has highlighted problems with Ukrainian soils. Explosions, fires, and chemicals are changing their structure, reducing fertility, and causing heavy metals and toxic compounds to accumulate. The soil contains elevated levels of copper, lead, nickel, combustion products, sulfur and nitrogen compounds. This affects the quality of agricultural products, human health, and ecosystem restoration.

Ukraine is not the only country experiencing the environmental consequences of the war. There has been a documented cross-border impact: as a result of Russian strikes, approximately 3 million tons of harmful substances have been released into the atmosphere and spread across neighboring European countries. Large-scale fires—on oil products, critical infrastructure, and forests—have caused millions of additional tons of toxic emissions.

“At the end of 2024, the environmental damage from the full-scale war amounted to 2.78 trillion hryvnia, and today it already exceeds 6 trillion. Unfortunately, this figure continues to grow every day, as does the scale of destruction of Ukrainian nature. The environmental damage caused by Russia is measured not only in trillions of hryvnias — decades are needed to restore the destroyed ecosystems. And the scale of environmental destruction will go far beyond Ukraine,” said Deputy Minister of Economy, Environment, and Agriculture Ihor Zubovych.

The Ministry of Economy, Environment, and Agriculture stated that UAH 6.01 trillion is only the confirmed losses in territories controlled by Ukraine. The final scale of environmental damage will be known after complete de-occupation and the possibility of conducting a full investigation.

Sales of new commercial vehicles (trucks and special vehicles) in Ukraine in November 2025 decreased by 10% compared to the same month in 2024, to 982 units, which is also 18% less than in October 2025, according to UkrAvtoprom on its Telegram channel.

The leader in this market in November was MAN with sales of 118 vehicles, which ranked fourth in November last year and October this year (89 and 90 units, respectively), followed by last year’s leader Renault with 117 units. (233 units last year), and FIAT came in third with 88 units, which ranked 11th last November with 42 vehicles.

Next in the ranking are Citroen with 85 units (in November 2024, it was in second place with 143 cars) and Mercedes-Benz with 79 units (last year, it had 100 cars and was in third place).

According to UkrAvtoprom, a total of 10,835 new vehicles were added to the Ukrainian fleet of trucks and special-purpose vehicles in January-November, which is 6% less than in the same period last year.

As reported, in 2024, according to UkrAvtoprom, 12,900 new commercial vehicles were registered in Ukraine, which is 14% more than in 2023.

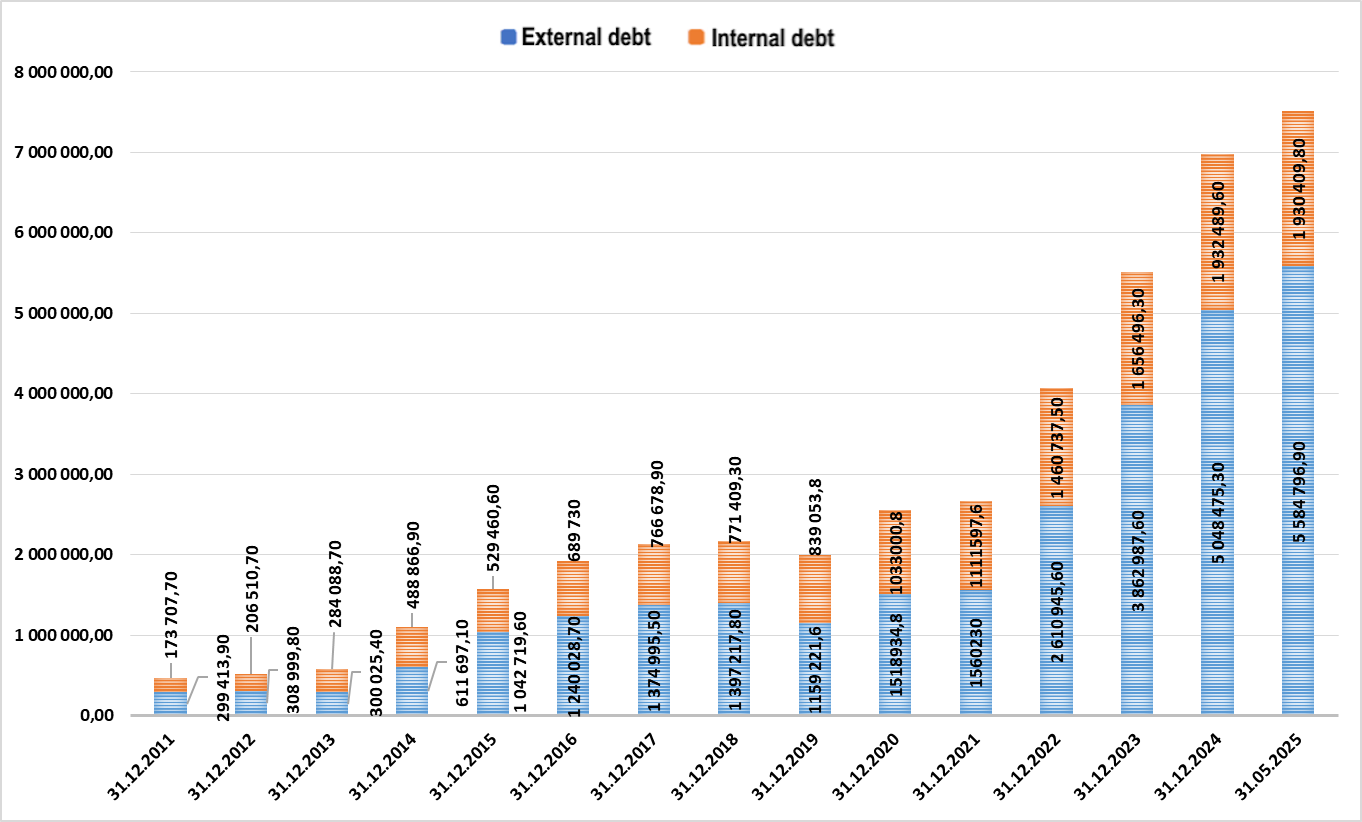

Internal and external debt of Ukraine in 2011-2025

Source: Open4Business.com.ua

The Danish government plans to cut the amount of aid provided to Ukraine by almost half, according to Danish public broadcaster DR (Danmarks Radio).

“In response to a request from the Defense Committee, Defense Minister Troels Lund Poulsen said that Denmark will provide 9.4 billion kroner next year. Last year, we provided 16.5 billion kroner, and the year before that, almost 19 billion kroner,” the report said.

Earlier, in 2023, a broad majority in the Danish parliament agreed to create the Ukraine Fund. This is an economic framework that determines how much aid Denmark will provide to Ukraine. To date, Denmark has provided Ukraine with more than 70 billion in military aid.

Denmark is currently the country that has provided Ukraine with the most support as a percentage of GDP. Therefore, according to Simon Kollerup, spokesperson for the Social Democratic Party on defense issues, it is “natural” that support is being reduced.

“We decided to be one of the countries that provided the most extensive support at the beginning of the war. I also think it is fair to say that this support is somewhat more than what one might expect given the size of our country. Therefore, I think it is quite natural that support is gradually decreasing,” he said.

Kollrup also noted that it has not yet been decided politically whether support will remain reduced, despite current decisions.

“I think we will allocate more money than is currently planned. Does this mean that we will necessarily be at the forefront, as we were before? I’m not sure,” he said.

He pointed out that politicians had long ago decided to create a model for the Ukraine Fund, where most of the billions were spent during the first three years of the war. And that the time will soon come for other countries to contribute to this fund.

“We are a small country with a healthy economy and a high capacity for decision-making, so we were actually able to find the funds in our economy to provide significant support at the beginning. But I also believe that there is room for other countries to come on the scene,” Kollrup explained.

In turn, Stinus Lindgren, defense spokesman for the Radical Left party, said that now is not the time to reduce support for Ukraine.

“The problem is that we haven’t allocated new funds for a long time. If we think it’s so important to support Ukraine, and I hear that all parties say so, then right now we need to sit down in parliament and make sure we have the money ready,” he said.

He clarified that he considers the amounts allocated in previous years to be sufficient.

“I believe that we should return to the level we were at in previous years,” he said.

Lindgren added that Ukrainians have been under intense pressure on the battlefield recently. The Kremlin claims that the strategically important city of Pokrovsk, which has been the scene of fierce fighting for a long time, has finally fallen into Russian hands.

“If you look at the situation in Ukraine right now, it is critical. Now is not the time to lower our ambitions. Neither in Denmark nor internationally,” he concluded.

According to Serbian Economist, the island hotel Sveti Stefan near Budva, which is iconic for Montenegrin tourism, may resume operations by May 1, 2026, after many years of inactivity, as the Montenegrin government and the complex’s tenant, Adriatic Properties, are close to reaching an agreement on its reopening.

According to the draft agreement, existing contracts with the tenant and Aman Resorts will remain in force, the parties waive their claims in arbitration proceedings, and each party bears its own costs in London, with the exception of Adriatic Properties’ obligation to compensate Sveti Stefan Hotels for approximately £50,800 previously paid to the arbitration court.

A key element of the project is the obligation of the tenant and Aman to prepare the complex for opening no later than May 2026, with the lease term extended for another four years to compensate for the period of downtime and lost revenue.

A separate section sets out obligations to work with the local community: priority employment for residents of Budva and Paštrovici, purchasing products from local producers, regular fairs for local goods, educational and scholarship programs for young people, and year-round tours of the region. A new advisory body, tentatively called the “Bankada Council,” will be responsible for monitoring the implementation of these points and will report annually to the government. It may be headed by Serbian tennis player Novak Djokovic, which, according to Vijesti sources, will give the project additional publicity and credibility.

According to media reports, Djokovic has been acting as an informal mediator between the Montenegrin government, Aman Resorts, and Adriatic Properties in the dispute over Sveti Stefan since early 2025 and is discussing the possibility of participating in the project as an investor and representative of the Aman hotel chain.

The Sveti Stefan complex, which includes the island hotel of the same name, the Milocer villa, and the adjacent beaches, has been closed since 2021 amid a conflict between the state and the tenant over beach access and guest privacy.

Sveti Stefan is a historic fortified island village on the Adriatic coast a few kilometers from Budva, which was transformed in the mid-20th century into an elite resort where European monarchs, world politicians, and Hollywood actors vacationed over the years. In 2007, the Montenegrin government signed a 30-year lease agreement for the Sveti Stefan-Milocer complex with Adriatic Properties, a company linked to Greek businessman Petros Stathis, and operational management was transferred to Singapore-based luxury operator Aman Resorts. In 2015, the lease was extended until 2049, with the annual rent reduced to approximately €1.1 million.

https://t.me/relocationrs/1886