State Enterprise “Forests of Ukraine” has launched an autumn forestry campaign, which will see the completion of the President’s “Green Country” program to plant a billion trees. The billionth tree is planned to be planted in a month. According to the head of the enterprise, Yuriy Bolokhovets, the main goal of the initiative is not only to achieve a quantitative indicator, but also to restore ecosystems and form a culture of responsible attitude towards nature.

“The restoration of Ukrainian forests and the increase in the area of forest reserves should unite Ukrainian society and draw attention to the problems of ecology and biodiversity conservation. Forest restoration is part of the restoration of our country,” Bolokhovets said.

During the final stage of Green Country, special attention is being paid to creating new forests in regions where they did not previously exist, or restoring areas destroyed by military operations, fires, or illegal logging.

The first autumn planting took place in the Kyiv region, in the Khotianiv Forestry (Dymerske Forestry) near the village of Nyzhnia Dubechnya. Last year, almost a hectare of young forest burned down in this area after a rocket strike. In total, since the beginning of the year, more than 60 hectares of forest have been destroyed in the Dymer Forestry due to UAV and rocket strikes.

Pupils from the Vyshedubechansky school forestry, students from the National University of Life and Environmental Sciences of Ukraine, and children of forestry workers joined in the restoration efforts.

“We are creating new forests for future generations of Ukrainians, so it is very important to instill in our children and young people a love for the forest and a responsible attitude towards it,” emphasized the head of the State Enterprise “Forests of Ukraine.”

The restoration of the destroyed area is being carried out using modern technology: rowan, birch, and viburnum are being planted along with pine trees. This combination of species promotes better seedling survival, maintains biodiversity, and reduces the risk of fires.

Pine seedlings with a closed root system are grown at the selection and seed center in Zhytomyr region.

Over the next few weeks, the autumn forestry campaign will start in all of the company’s forestry operations.

According to Bolokhovets, “Green Country” is a joint project that symbolizes the future: “We are restoring forests together with children, schoolchildren, and students — after all, this is the country in which they will live and work.”

Nova Poshta, Ukraine’s leading express delivery company, has appointed Yevhen Tafiychuk as its new CEO. Tafiychuk joined the company in 2012 as a loader and has served as Nova Poshta’s COO in both Ukraine and Europe since 2021.

“The current CEO, Oleksandr Bulba, will continue to manage the company until the end of the year. Over the next two and a half months, both top managers will work together under the selected & acting CEO model to ensure a smooth transfer of power,” the company said in a press release on Wednesday.

It is noted that the competition for the position was open: more than 20 candidates were considered, including managers from international companies.

“Three candidates made it to the final round: two external candidates and one internal candidate. We are proud that the leader we have chosen has grown with the company. Yevhen knows all the processes down to the smallest details and has an ambitious vision for the future,” said Vyacheslav Klimov, co-owner of Nova Poshta, in the release.

It is noted that under Tafiychuk’s leadership, courier delivery has been transformed, the Nova Poshta branch network has doubled, and delivery speed has become the fastest in the Ukrainian logistics market.

As reported, 2025 marks the end of a 10-year period of cooperation between Nova Poshta and CEO Oleksandr Bulba.

Nova Poshta’s main activity remains the express delivery of documents, parcels, and palletized large-sized cargo. The company is the leader in express delivery in Ukraine. Its ultimate beneficial owners are Volodymyr Poperechnyuk and Vyacheslav Klimov.

In the first half of 2025, the company increased its revenue by 23% compared to the same period in 2024, to UAH 24.6 billion. The volume of parcels and cargo delivered amounted to 238 million (7% more), its network of branches grew by 708 points to 13,985, and the number of parcel terminals increased by more than 4,000 to 28,326.

The Embassy of the Republic of Serbia held a reception to mark the return of the diplomatic mission to Kyiv and the opening of new premises at 48 Bohdan Khmelnytsky Street. The event brought together diplomats, representatives of government agencies, business and academic circles of Ukraine.

During his speech, Serbian Ambassador to Ukraine Andon Sapundzi emphasized that the opening of the embassy symbolizes “Serbia’s return to Kyiv” and the resumption of active cooperation between the two countries.

“Our workspace is not yet complete, but I wanted to share this joy with you right now — Serbia is back!” he said, addressing the guests.

In his speech, the diplomat emphasized the deep historical ties between the Ukrainian and Serbian peoples. In particular, in the 18th century, more than 50,000 Serbs settled in the territory of modern Ukraine — near Bakhmut and in the Kirovohrad region, founding Slavianoserbia and New Serbia. At the same time, as early as the 17th century, Ukrainians migrated to Serbia, mainly to Vojvodina.

The ambassador also noted that since the start of the full-scale invasion, more than 100,000 Ukrainians have found refuge in Serbia, set up companies there, and their children have begun to learn Serbian.

Serbia provides humanitarian aid to Ukraine, including projects to build underground kindergartens near the front line, supplies equipment for energy infrastructure, and organizes educational programs for children from Sumy and Kharkiv.

Special mention was made of Serbian language teachers and students who maintained scientific and cultural ties between the countries even during the most difficult years of the war.

“We are here to live, work, and share everything with you, our dear Ukrainian friends,” the ambassador concluded his speech.

Ukraine and Serbia (then SFRY) established diplomatic relations on April 15, 1994. The Serbian Embassy in Kyiv began operating in 1995, but in 2022 it temporarily suspended its activities due to the security situation. In the fall of 2025, the diplomatic mission officially resumed its work in Kyiv at 48 Bohdan Khmelnytsky Street. The Ukrainian Embassy in Belgrade has been operating since 1995.

Insurance companies Arsenal Insurance and VUSO (both based in Kyiv) paid UAH 19.9 million (UAH 9.95 million each) in insurance compensation under a co-insurance agreement for buildings against military risks.

According to the Arsenal Insurance website, two business centers belonging to the same chain were damaged after two powerful air strikes on Kyiv in June and July 2025.

On June 23, the blast wave and debris damaged the facade, window structures, glass elements, finishes, and engineering systems of one business center. And on July 10, during another massive attack on Kyiv, an explosion damaged a second business center of the same chain — the entrance, office premises, and double-glazed windows on several floors of the building were destroyed.

Arsenal Insurance is a non-life insurance company with 100% Ukrainian capital. It has been operating since 2005. At the end of 2024, it was among the top six non-life insurers in Ukraine in terms of gross premiums.

VUSO is a Ukrainian insurance company that is among the top five market leaders. It was founded in 2001.

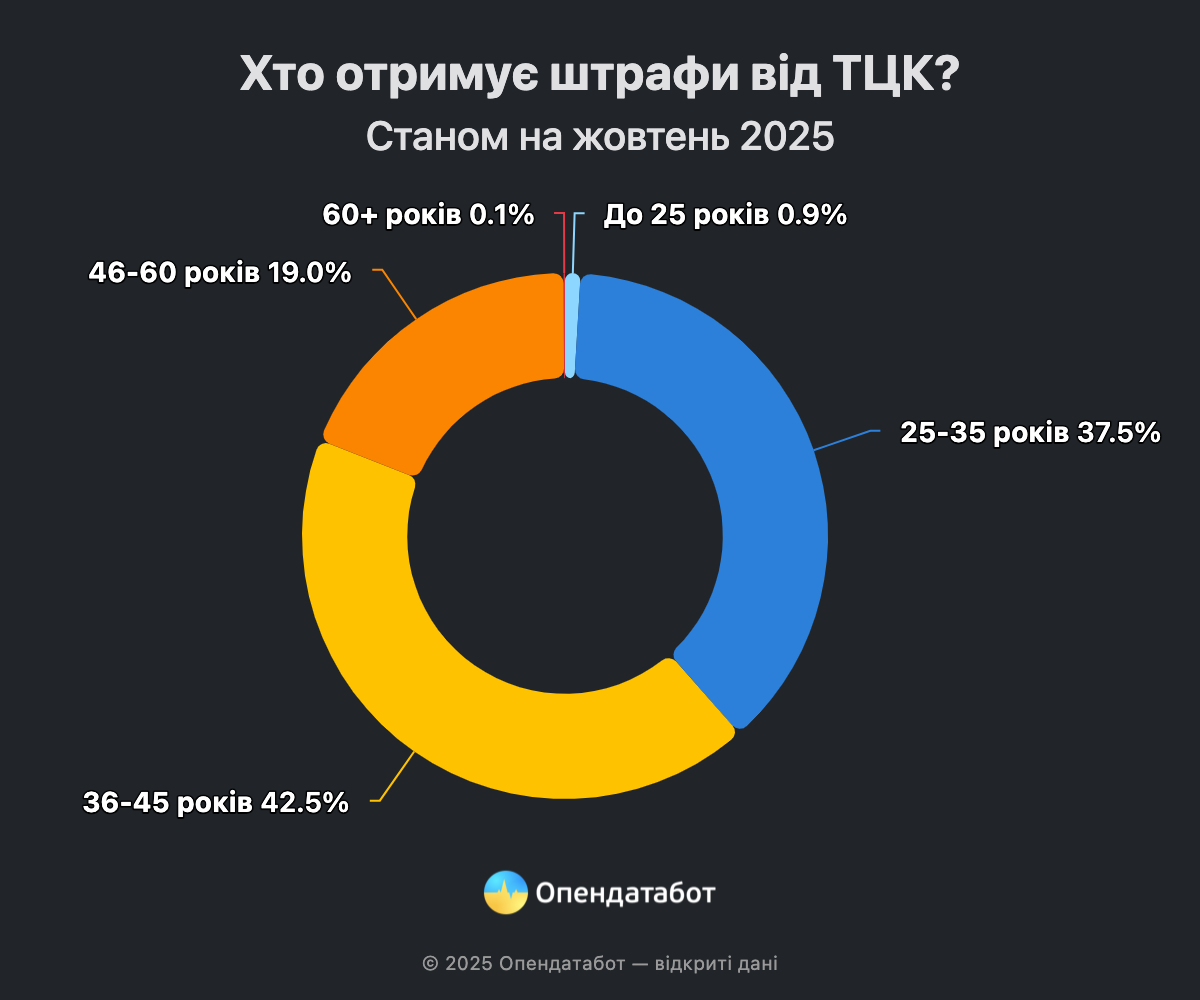

More than 47 thousand proceedings for violation of military registration rules have been opened since the beginning of 2025. A third of them have already been completed. About 4.5 thousand proceedings per month are opened by the MCC this year. Of these, 98 fines were imposed on women. A record 9 proceedings per person were opened against two men in Sumy region.

47,046 fines for violating the rules of military registration were recorded as of the beginning of October 2025. 14,454 proceedings – about a third – have already been completed.

It is worth reminding that you can check for overdue fines of the UCC in the Opendatabot.

On average, the TCC opens 4.5 thousand new proceedings every month. However, July was a record-breaking month with 7,595 openings. The lion’s share of July fines fell on the capital: 26% or 1,999 proceedings.

In total, 18 regions of Ukraine already have more than a thousand open proceedings in 2025. Kyiv is the absolute leader with 7,163 proceedings (15%). It was followed by Sumy (4,251 or 9%), Odesa (3,995 or 9%), Dnipro (3,846 or 8%), and Kharkiv (3,349 or 7%) regions.

The lowest rates are recorded in the west and in the area of active hostilities: Lviv region – 626, Rivne region – 464, Ivano-Frankivsk region – 315, Kherson region – 137, and in Luhansk region – 11 cases.

The vast majority of those fined were men aged 25 to 45 (80% of cases), while women accounted for 98 cases, which is only 0.2% of the total. It is worth noting that since July 31, 2025, a new mechanism for registering women with medical or pharmaceutical education has been in place – since then, 26 proceedings have been opened against women under the new rules.

The record holder in terms of activity was the Sumy City MCC, which opened 9 proceedings against two men this year, as well as 8 proceedings against another man. This is currently the largest number of fines per person in the country.

https://opendatabot.ua/analytics/tck-fines-2025-10

The network of bank branches in Ukraine shrank by 21 locations in the third quarter and stood at 4,913 branches at the beginning of October, according to information on the website of the National Bank of Ukraine.

According to its statistics, the reduction amounted to 98 branches over the first nine months of the year.

PrivatBank reduced the most branches in the third quarter—six—which reduced its network to 1,096, but the bank retained second place in terms of their number.

Oschadbank, despite closing five branches, remains the leader in Ukraine with 1,142 locations.

Pivdenny Bank and Radabank reduced their networks by three and two branches, respectively, in July-September, to 37 and 30 locations.

In the third quarter, Ukrgasbank (210 branches), MTB Bank (43), BIZbank (29), Industrialbank (24), MetaBank (21), RVS Bank (13), First Investment Bank (10), and Motor Bank (7) closed one branch each.

Among the banks that expanded their networks in the third quarter, PUMB, Akordbank, TAScombank, Bank Lviv, and Bank Ukrainian Capital opened one branch each—their networks grew to 220, 163, 92, 21, and 12 branches, respectively.

According to the National Bank, as of early October this year, the largest branch networks in Ukraine are traditionally held by the largest state-owned banks—Oschadbank with 1,142 branches and PrivatBank with 1,096. Raiffeisen Bank (321), PUMB (220), and Ukrsibbank (218) followed them at a considerable distance.

The second five in terms of network size were formed by the state-owned Ukrgasbank (210), A-Bank (198), Akordbank (163), the state-owned Sens Bank (137), and Credit Agricole Bank (125).

As of early October, seven banks with state ownership held a network of 2,639 branches, accounting for 53.7% of the total number of branches at the end of the third quarter.