Imports of electric generator sets and rotating electrical converters to Ukraine in January–September 2025 increased 4.2 times compared to the same period in 2024, reaching $1.209 billion, according to data from the State Customs Service (SCS).

According to the SCS, the largest suppliers of equipment were the Czech Republic (19.7% of the total volume, $238.1 million), Romania (18.5%, $223.3 million), and Poland (12.5%, $150.6 million).

For comparison, last year’s leaders were China ($69.8 million), Turkey ($61.4 million), and the Czech Republic ($31.9 million).

In September 2025, imports of generators increased almost threefold compared to September last year, reaching $191.6 million.

Exports of such equipment from Ukraine remain insignificant — $3.52 million in nine months, mainly to the Czech Republic, Latvia, and Bulgaria.

According to the State Customs Service, the sharp increase in imports is associated with the active modernization of energy infrastructure and the continuing demand for autonomous power sources.

The authorities had previously exempted generators and batteries from customs duties and VAT (Cabinet of Ministers resolution of July 2024).

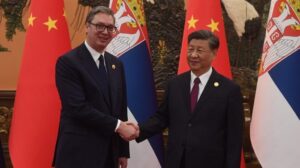

According to Serbian Economist, the Serbian government has formed a working group to negotiate and prepare a contract with the Chinese company Shandong Hi-Speed Group for the implementation of the second phase of the expansion and modernization of Constantine the Great Airport in Niš. This was reported by Serbia-Business, citing government sources.

The second phase includes the demolition of the old terminal, construction of a new terminal, major repairs to the runway, a new control tower, and expansion of the apron from the current 4 parking spaces to 9. The total cost of the project is estimated at more than €140 million.

Work is scheduled to begin in 2025, subject to the signing of the final contract.

Niš Constantine the Great Airport (INI / LYNI) is located 4 km northwest of the center of Niš, in the Medoševac and Popovac areas. It is the second busiest airport in Serbia after Belgrade.

In 2024, the airport handled 357,313 passengers, which is ~20% less than in the previous year. According to flight connection resources, the airport serves 14 cities in 10 countries directly, including Belgrade and Vienna, which account for a significant share of arrivals. In 2025, the airport received a new passenger route from Wizz Air, as well as its first cargo route to China.

The new project will allow larger aircraft to be served and increase the number of destinations, especially to countries in Europe and Asia. The participation of the Chinese company Shandong Hi-Speed Group indicates an influx of foreign investment and technological partnership, which may stimulate other infrastructure projects.

On the night of October 11, cryptocurrency markets experienced a massive crash: almost all coins from the top 100 fell by 30-60% in an hour, accompanied by record liquidations and panic selling.

According to CoinDesk, the market liquidated about $16 billion in leveraged long positions in major cryptocurrencies.

The sudden announcement by the US of a 100% tariff on imports of critical software from China heightened anxiety and triggered a massive sell-off of assets.

Bitcoin fell by about 7–8%, and Ethereum by more than 12% in a few hours.

CoinGlass recorded the liquidation of $8 billion in long positions on the cryptocurrency market in 24 hours.

Many users note that this flash crash was one of the sharpest in market history: most altcoins fell by 30-60% before the market attempted to recover.

The main reasons for the sharp collapse are:

Leveraged liquidations

Market participants often trade with leverage. When prices move sharply, the system automatically closes positions, which amplifies the downward momentum.

Macroeconomic and geopolitical shocks

The US decision to impose tariffs on Chinese technology products is perceived as an escalation in the trade war, which intensifies the outflow from risky assets.

Correlation with stock markets and the dollar

The strengthening of the dollar and the outflow of capital from risky assets is another factor of pressure.

Liquidity opacity in some assets

During a mass exit from the market, stable liquid assets (BTC, ETH) “drag down” less liquid altcoins, which “break” more strongly.

Panic and market psychology

A fall of this magnitude often triggers a chain reaction: when some start selling, others are forced to follow suit to avoid heavy losses.

Fixygen analysts suggest that a multi-process bottoming out is expected in the coming days, especially on weekends when liquidity is lower. According to some analysts, Bitcoin could rise by up to 21% during the week if the mood is favorable. The main benchmark for recovery is maintaining support in the $109-110 thousand range for BTC.

Source: https://www.fixygen.ua/news/20251011/pozhezha-na-rinku-kriptovalyut-oglyad-vid-fixygen.html

Unrealized exchange commodities, growing losses in dry milk and butter production, and falling butter prices in Europe and worldwide are holding back the growth of raw milk prices in Ukraine, according to the Association of Milk Producers (AMP).

The industry association noted that the average purchase price of extra-grade milk as of October 6 was UAH 17.45/kg excluding VAT, which is UAH 0.1 more than in the previous month, Prices for premium milk (UAH 17.15/kg excluding VAT) and first-grade milk (UAH 16.80/kg excluding VAT) remained unchanged.

“Prices also remained stable compared to the results of monitoring in the second half of September. Compared to the same period last year, the price of extra grade milk decreased by 25 kopecks,” experts noted.

According to AVM analyst Georgiy Kukhaleishvili, many factors are holding back the growth of raw milk prices in Ukraine. Currently, the supply of exchange goods on the domestic market exceeds demand. Milk processing enterprises have been working at full capacity since mid-August after the suspension of milk exports to the EU following the exhaustion of quotas. At the same time, demand on the domestic market remains low due to a decrease in the number of consumers and a reduction in the purchasing power of the population. Sales of dairy products in supermarkets are growing only when promotional discounts are offered. Warehouses in Ukraine are almost completely filled with exchange goods, which puts pressure on milk prices.

According to the ABM, the situation with butter in the EU is indicative, as it has fallen in price by 24% over the past two months due to the arrival of American butter on the European market at a price of EUR 5,000/ton. In such conditions, European traders are not interested in buying Ukrainian butter, which costs more than American butter. The increase in electricity costs affects the growth of the cost of Ukrainian products and makes it difficult to compete with Americans in the European market, analysts explain.

In Ukraine, in the second half of October, there is a possibility of a maximum price reduction for extra-grade and higher-grade raw milk due to the growing unprofitability of dry milk and butter production at milk processing enterprises and a decline in world prices for butter, they predict.

“However, on October 13, new quotas for the export of dairy products to the EU for Ukrainian companies are expected to be signed. Quotas for butter have increased from 5,000 tons to 7,000 tons, as well as for dry milk. Dairy exports to the EU are expected to resume on October 28, after the quotas come into force in 15 days, which may curb the fall in raw milk prices in Ukraine,” the ABM notes.

In January-September of this year, Ukraine increased its exports of processed cast iron in physical terms by 62.2% compared to the same period last year, to 1 million 401,147 thousand tons.

According to statistics released by the State Customs Service (SCS) on Wednesday, during the specified period, cast iron exports in monetary terms increased by 65.4% to $548.121 million.

At the same time, exports were mainly to the United States (79.62% of shipments in monetary terms), Italy (9.64%), and Turkey (3.13%).

In the first nine months of this year, the country imported 38,000 tons worth $76,000 from Germany (51.32%) and Brazil (48.68%), while in January-September 2024, 25 tons of pig iron worth $60,000 were imported.

As reported, on March 12 of this year, in accordance with President Donald Trump’s decision, the US began imposing a 25% tariff on imports of Ukrainian steel products, except for cast iron.

In 2024, Ukraine reduced its exports of processed cast iron by 3.4% in physical terms compared to 2023, to 1 million 290.622 thousand tons, and by 6.1% in monetary terms, to $500.341 million. Exports were mainly to the US (72.64% of shipments in monetary terms), Turkey (8.03%), and Italy (7.30%).

For the whole of 2024, the country imported 38 tons of pig iron worth $90 thousand from Germany, while for the same period in 2023, it imported 154 tons of pig iron worth $156 thousand.

In January-September of this year, Ukrainian mining companies reduced their exports of iron ore raw materials (IORM) by 4.4% in physical terms compared to the same period last year, from 25 million 250,417 thousand tons to 24 million 145,038 thousand tons.

According to statistics released by the State Customs Service (SCS) on Wednesday, foreign currency proceeds from iron ore exports decreased by 16.7% during this period, from $2 billion 175.032 million to $1 billion 812.831 million.

Exports of raw materials were mainly to China (44.83% of shipments in monetary terms), Slovakia (16.9%), and Poland (16.58%).

In addition, in January-September 2025, Ukraine imported mineral resources worth $80,000 in the amount of 107 tons from the Netherlands (55%), Italy (28.75%), and Norway (16.25%), while in the same period last year it imported 813 tons worth $248,000.

As reported, in 2024, Ukraine increased its exports of raw materials by 89.8% compared to 2023, to 33 million 699.722 thousand tons, and foreign exchange earnings grew by 58.7%, to $2 billion 803.223 million UAH.

In 2024, Ukraine imported mineral resources worth $414,000 in a total volume of 2,042 tons, while in 2023, 250 tons of these raw materials were imported worth $135,000.

In 2023, Ukraine reduced its exports of raw materials by 26% in real terms compared to 2022, to 17 million 753,165 tons. Foreign exchange earnings amounted to $1 billion 766,906 million (a decrease of 39.3%). A total of 250 tons of mineral resources were imported for $135,000.