The total amount of claims of foreign entities against the state of Ukraine is at least UAH 600 billion, and the volume of claims is about UAH 60 billion, according to the list of fiscal risks published by the Ministry of Finance in the annexes to the draft law No. 14000 on the State Budget for 2026.

According to the document, there are currently 25 disputes over foreign investors’ claims against the state of Ukraine with a statutory six-month period for pre-trial settlement. In most cases, this period has already expired, which means that the claimants may submit requests for arbitration to foreign jurisdictions.

As of July 1, 2025, according to the Ministry of Justice, there is a need to protect the rights and interests of the state in 64 cases that are being or will be considered in foreign jurisdictions. The government predicts that in 2026 the number of cases will be at least 53, and the number of disputes at the pre-trial stage will be at least 46.

The list of particularly significant cases that require the most effective defense includes

– the claim of the state development corporation VEB.RF for about $3.5 billion;

– claims of Emergofin B.V. and Velbay Holdings Ltd. for about $1 billion;

– a claim of OJSC Tatneft for about $200 million;

– the claim of the Republic of Tatarstan and the Ministry of Property of Tatarstan in the amount of $300 million;

– a claim of ABH Holdings S.A. (beneficiaries – Mikhail Fridman, Peter Aven, Andrey Kosogov) for about $1 billion;

– potential claims of Sberbank of Russia and Russian National Commercial Bank.

In addition, the government notes claims from Enwell Energy plc, AEROC and CTF Holdings S.A., which are associated with businessmen Vadim Novinsky, Andrei Molchanov and Mikhail Fridman, respectively.

The Ministry of Finance emphasizes that the number of investment disputes against Ukraine in connection with sanctions measures and confiscation of Russian property is likely to increase every year.

The wife of lawyer Konstantin Globa, lawyer Vitalia Globa, is asking law enforcement and the bar association to intervene in her conflict with her ex-husband. Vitalia Globa made this statement at a press conference at the Interfax-Ukraine agency on Friday. She noted that on September 10, she purchased a Mercedes car from her mother, but her ex-husband prevented her from taking it and blocked it near his office in the Pechersky district of Kyiv.

“As the owner of the vehicle, I came and tried to take it away, but my ex-husband resisted, forbade me to use it, blocked it, and climbed onto the roof of the car. He repeatedly threatened me and deprived me of the opportunity to use my property,” she said.

Globa also noted that her ex-husband “deprived me of my funds during the divorce because he had access to bank deposit boxes.

For her part, Vitalia Globa’s lawyer, Daria Koziy, noted that Vitalia purchased the car, which had previously belonged to her mother, after the divorce, and her ex-husband “had no connection to it and now has no right to this car, but continues to terrorize the family.

“At the moment when she (Vitalia Globa – IFU) decided to take the car, her car was blocked by other cars. Currently, this car is blocked by an armored Hammer vehicle, which cannot be removed by any tow truck,” the lawyer emphasized.

Kozij also reported that the day before, on September 12, unknown individuals attacked her when she asked them not to remove the license plates from her client’s car. She also noted that Konstantin Globa had filed several lawsuits against his ex-wife and her mother.

Vitalia Globa intends to prove her right to the car in court. According to Koziy, the court will consider the case regarding ownership of the car based on Vitalia Globa’s lawsuit on September 23.

The head of the Lithuanian Ministry of Foreign Affairs (MFA) Kęstutis Budrys will officially open an office of the Central Agency for Lithuanian Project Management in Kiev, Ukrainian Foreign Minister Andriy Sibiga said

“This visit is special, during it my colleague will officially open the office of the Central Agency for Lithuanian Project Management in Kiev. He will coordinate all Lithuanian reconstruction projects, in particular within the framework of the coalition of civil protection shelters, which Lithuania recently joined,” he said at a joint press conference with his Lithuanian counterpart Kęstutis Budrys in Kiev on Friday.

Sibiga noted that Lithuania was one of the first countries to launch reconstruction projects in Ukraine without waiting for the war to end. Ten projects have already been completed and six more are underway, including the construction of shelters for schools in six regions bordering the war zone.

Separately, the Ukrainian Minister noted that Lithuania is one of the leaders in the restoration of the Ukrainian energy sector, the assistance in this area exceeded EUR83 million.

This is already the fifth visit of Kęstutis Budrys to Ukraine since his appointment as the head of the Lithuanian Foreign Ministry.

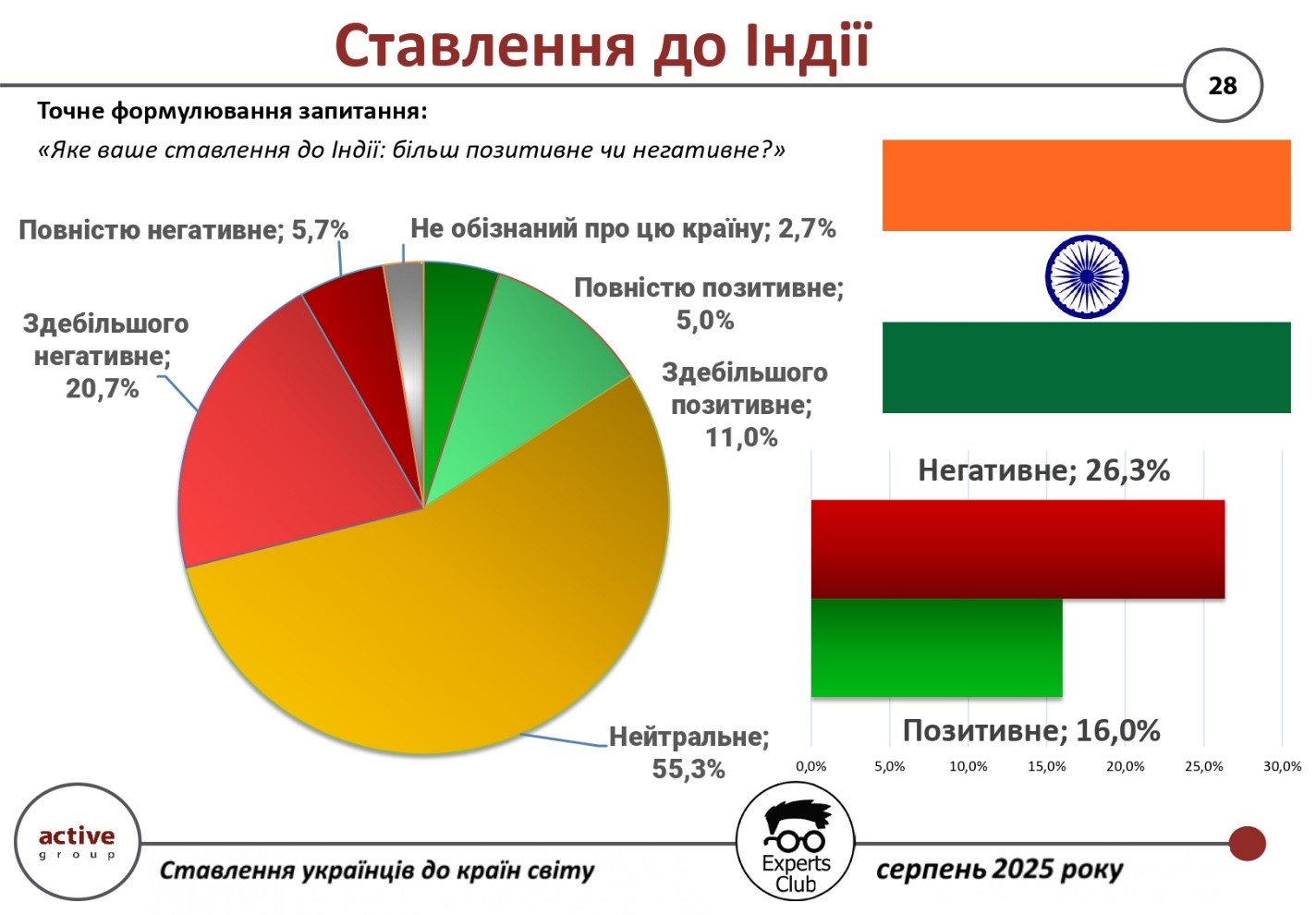

In August 2025, Ukrainians’ attitudes toward India were mostly neutral and partly negative. This is evidenced by the results of an all-Ukrainian sociological survey conducted by Active Group in cooperation with the Experts Club information and analytical center.

According to the results, only 16.0% of Ukrainian citizens demonstrated a positive attitude toward India (11.0% – mostly positive, 5.0% – completely positive). This country is negatively rated by 26.3% of respondents (20 . 7% – mostly negative, 5.7% – completely negative). At the same time, the vast majority – 55.3% – expressed a neutral attitude, and 2.7% said they did not have enough information.

“India remains one of the most important global players, but the country is not clearly defined in the public opinion of Ukrainians. This is influenced by both New Delhi’s political decisions in the international arena and limited cultural communication with Ukraine,” commented Maksym Urakin, founder of Experts Club.

He also drew attention to the economic dimension of bilateral relations:

“In the first half of 2025, the trade turnover between Ukraine and India amounted to more than $1.1 billion. At the same time, Ukrainian exports amounted to only $401.9 million, while imports from India exceeded $702 million. The negative balance of more than $300 million demonstrates a structural imbalance in trade,” Urakin emphasized.

In his turn, Active Group co-founder Oleksandr Poznyi added that these results indicate a cautious attitude of Ukrainians:

“Despite India’s economic weight and global status, the country remains remote and little understood for many Ukrainians. This explains the high level of neutral assessments and the low expression of positive emotions in society,” he emphasized.

The survey is part of a broader research program that analyzes international sympathies and antipathies of Ukrainians in the current geopolitical context.

The full video can be viewed here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, INDIA, Poznyi, SOCIOLOGY, TRADE, URAKIN

In his new book, “Cut Yourself Off Gently,” Ukrainian business coach and psychologist Maxim Romensky explores psychological separation as an important element of freedom and maturity. The author also shows how to break free from restrictive systems in order to build a life according to your own rules and scenarios. The book is the first project of the new Ukrainian non-fiction publishing house SIMIO.

At the heart of the book is the idea of ecological separation. It is about the conscious decision to let go of relationships, roles, or systems that no longer work for a person. The author analyzes dilemmas familiar to everyone: from distancing oneself from family and breaking up with loved ones to moving to another country.

Unlike Romensky’s previous books on business topics, this publication addresses everyday experiences. The book is based on real stories from clients, therapy sessions, and practical techniques that the author has been using for over 30 years. In addition, it includes questions for self-reflection, exercises, and specific phrases to help you get through separation in a constructive way.

“This book is about separation. Yes, today it has become commonplace, but it is still painful. It’s about separation from parents, friends, partners, or even adult children. And, ultimately, about parting with your own illusions. It is an experience that cannot be avoided. I want it to be not a full stop in loss, but a staircase that can be climbed from despair to clarity. And it became a reminder for all of us that there is always a way out — from any system or situation,” says Maksym Romenskyi.

The publication will be useful and supportive for anyone who feels the need to escape from difficult life scenarios and relationships. It will also be useful for professionals who work with people — psychologists, psychotherapists, coaches, and HR specialists. It is a practical tool designed for both reflection and action to help readers implement important internal decisions. The book is already available on the publisher’s website. An electronic version is also planned for release in October.

Maksym Romensky is the first author of the new Ukrainian publishing house SIMIO, which specializes in applied non-fiction. With this project, the publishing house immediately declares its mission: to be a guide and a signpost for readers.

The co-founders are Oleksandra Fidkevych, who has management experience and a background in writing, and Nataliia Podob, a journalist and editor with many years of media expertise.

SIMIO will publish books on psychology, personal growth, skill development, and entrepreneurship by contemporary Ukrainian and foreign experts. These will be carefully selected publications that will help readers expand their thinking, better understand themselves and the processes around them. And most importantly, they will provide practical guidelines for proactive action.

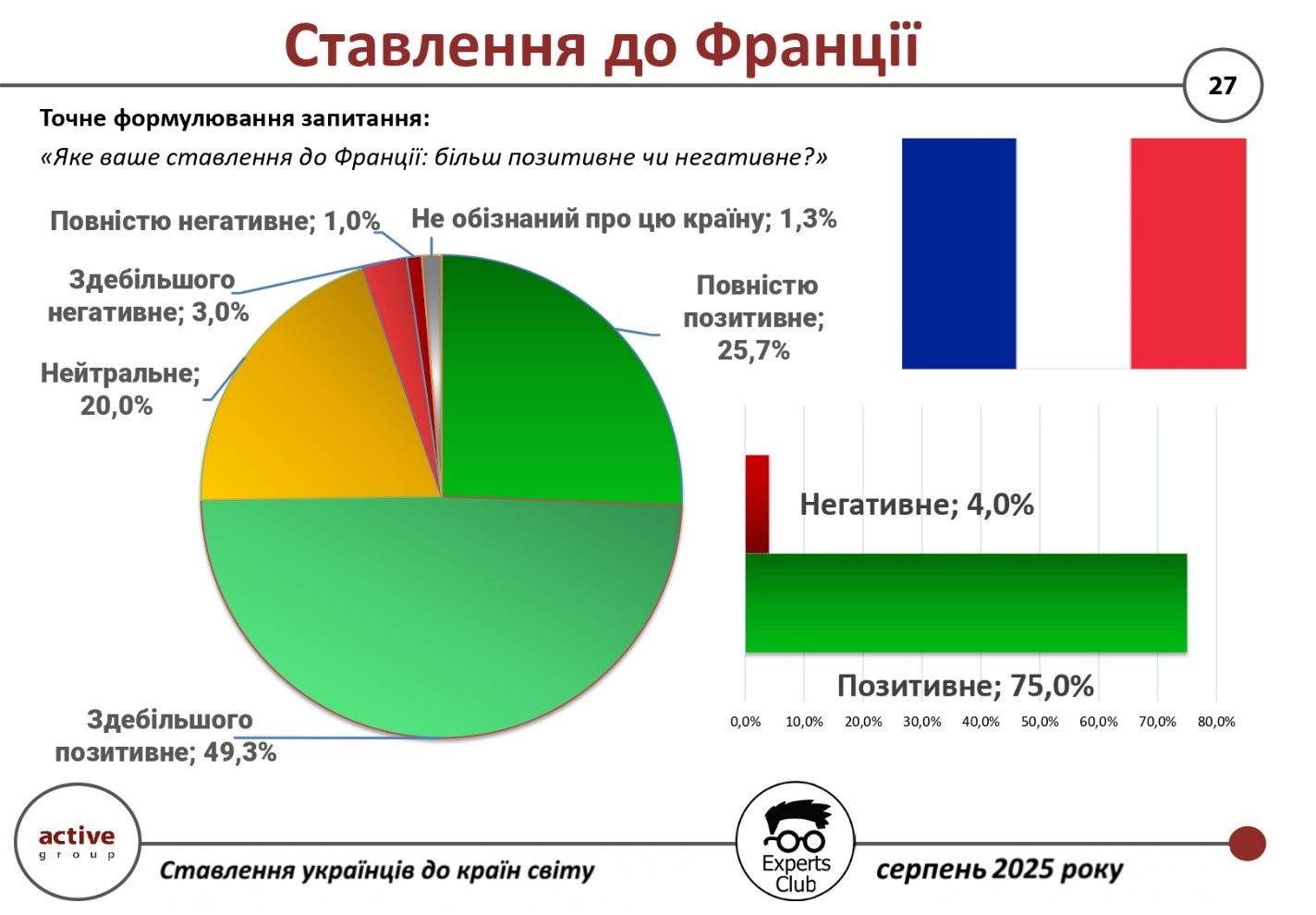

The level of sympathy for France among Ukrainians remains high. This is evidenced by the results of an all-Ukrainian sociological survey conducted by Active Group in cooperation with the Experts Club information and analytical center in August 2025.

According to the survey, 75.0% of Ukrainian citizens have a positive attitude toward France (49.3% are mostly positive, 25.7% are completely positive). Only 4.0% of respondents have a negative perception of this country (3 . 0% – mostly negative, 1.0% – completely negative). Another 20.0% remain neutral, and 1.3% said they do not have enough information about France.

“For many Ukrainians, France is a symbol of support in difficult times, as well as a cultural and political reference point in Europe. Such indicators demonstrate high trust and respect, which is largely due to the active role of Paris in European policy towards Ukraine,” said Oleksandr Poznyi, co-founder of Active Group.

In his turn, Maxim Urakin, founder of Experts Club, emphasized the importance of France in economic cooperation.

“In the first half of 2025, the trade turnover between Ukraine and France amounted to more than $1.37 billion. At the same time, exports of Ukrainian goods amounted to only $395.6 million, while imports from France reached $979.4 million. The negative balance of more than $583 million indicates a significant dependence of our market on French goods, but also the importance of France as an economic partner,” he said.

The survey is part of a broader research program that analyzes international sympathies and antipathies of Ukrainians in the current geopolitical context.

The full video can be viewed here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, FRANCE, Poznyi, SOCIOLOGY, TRADE, URAKIN