The National Bank of Ukraine (NBU) has increased the deadlines for settlements on export-import operations from 90 to 120 calendar days to expand the possibility of import and export for Ukrainian business in war conditions, the press service of the regulator reported on Tuesday.

The relevant changes were adopted by the NBU Board Resolution No. 113 dated June 7, which was published on the website of the Central Bank and comes into force on June 8

According to the announcement, the new requirements will apply to residents’ operations for the export and import of goods carried out from April 5, 2022.

It is indicated that for transactions that were carried out before April 5, the deadlines will remain at the level of 365 days.

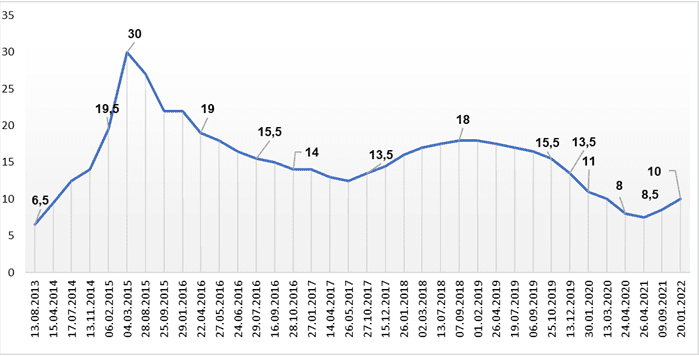

The National Bank of Ukraine (NBU), in line with market expectations, raised the discount rate by 1,500 basis points to 25% per annum from the current 10%, which is the highest level since the end of August 2015, according to the NBU website.

The National Bank of Ukraine (NBU) has excluded from the registers three insurers that do not have valid licenses and one insurance broker.

As reported on the website of the regulator, PJSC Insurance Company Ukrainian Financial Alliance, ALC Insurance Company VIP Capital (the licenses of both were canceled on January 21, 2022 at the request of insurers) and PJSC Insurance Company OSTRA were excluded from the State Register of Financial Institutions. ” (licenses canceled on February 9, 2022 as a measure of influence).

In addition, from the State Register of Insurance and Reinsurance Brokers – Subsidiary “SINKO Group (UKRAINE)” on the basis of the submitted application.

IC “Ukrainian Financial Alliance” (Kyiv), registered in 2003, specializes in providing services in the field of risk insurance.

IC “VIP-Capital” (Kyiv) was registered in 2007 and specializes in providing services in the field of risk insurance.

IC “Ostra” (Odessa) is one of the first insurance companies in Ukraine. Established in December 1990 on the basis of the regional representative office of Ingosstrakh Insurance Company (RF) in Ukraine.

The National Bank of Ukraine (NBU) lifted a restriction on May 21 that allowed authorized institutions to sell cash foreign currency to customers with a deviation from the official no more than 10%, the press service of the regulator said on Friday.

Relevant changes were adopted by the NBU Board Resolution №102 of May 20, which was published on the Central Bank’s website and comes into force on May 21.

The document also removes similar restrictions on setting the exchange rate at which banks write off hryvnia funds from customers’ accounts if customers pay with hryvnia cards abroad.

“Removing restrictions on the exchange rates at which banks sell currency to the public will improve the working conditions of legal market participants. This will increase competition, increase liquidity in the legal segment and reduce illegal transactions. All this will make the foreign exchange market more stable and reduce exchange rate amplitude. fluctuations in its cash segment, “the press service of the Deputy Head of the NBU Yuri Geletiy was quoted as saying.

Dynamics of changes in discount rate of NBU

NBU

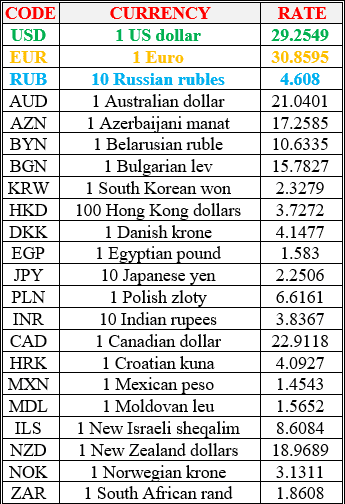

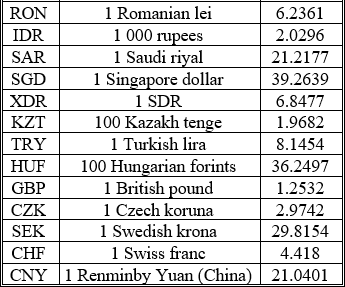

National bank of Ukraine’s official rates as of 06/05/22

Source: National Bank of Ukraine