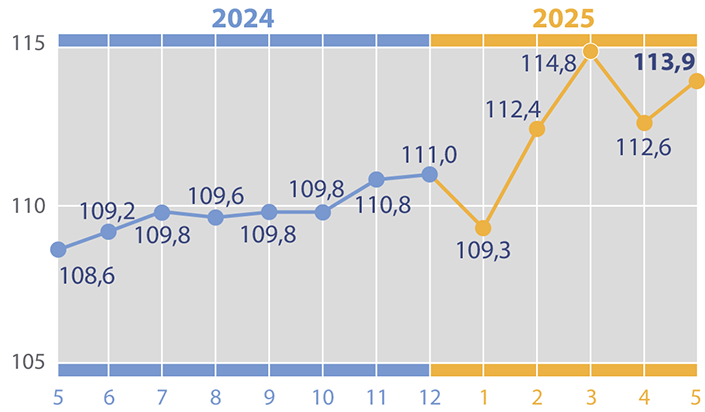

Import changes in % to previous period in 2024-2025

Source: Open4Business.com.ua

Elevator with a capacity of 40 thousand tons of storage is being built in Khmelnitsky region, reported the company “AktivProject” LLC, which is engaged in installation.

“In Khmelnitsky region the construction of another elevator continues. The customer decided to implement the project in full at once, without dividing it into queues,” the company wrote on its Facebook page.

The total storage capacity will be 40 thousand tons. The capacity of transport equipment is 100 tons/hour.

“The peculiarity of this facility is the installation of load cells on the shipping hopper, which will ensure accurate batching and simplify the process of loading grain into road transport,” – emphasized in “ActiveProject”.

OOO “AktivProject” specializes in complex design and installation of grain storage and processing facilities (elevators, feed, flour milling, oil extraction, grits plants), commodity warehouses and logistics complexes.

On October 21, the state enterprise Chuguevskyy Aircraft Repair Plant announced a tender for services of compulsory insurance of civil liability of owners of motor vehicles (OSAGO).

According to the website of the Ukrainian Universal Exchange, the expected cost of the service is UAH 188,487 thousand.

Documents are accepted until October 30.

Global spending on information technology (IT) will grow by 9.8% in 2026 and exceed $6 trillion, according to a forecast by research company Gartner.

“The pause in uncertainty that began in the second quarter of 2025 began to weaken in the third quarter, and a significant influx of funds into this segment is expected by the end of the year,” said Gartner analyst John-David Lovelock. “Generative artificial intelligence (GenAI) features are now ubiquitous in the software used by enterprises, and they are more expensive, which contributes to the influx of funds.”

By the end of 2025, experts expect IT spending to increase by 10% to $5.5 trillion.

Data center spending will grow the fastest this year, at nearly 47%. At the same time, IT services will remain the largest market, with a volume of over $1.7 trillion.

Spending on mobile phones and personal computers is expected to reach $783 billion, up 8.4% from 2024. However, next year, the growth rate is projected to slow to 6.8%, the report notes.

Over the past seven years, the number of foreign citizens legally residing in Portugal has increased almost fourfold. According to Agência para a Integração, Migrações e Asilo (AIMA), by the end of 2024, there were about 1,543,697 foreign residents registered in the country, while in 2017, this figure was about 421,802 people.

Foreign citizens now account for approximately 15% of Portugal‘s population, confirming the accelerated growth of migration in this country.

According to AIMA, the majority of foreign residents are citizens of Brazil (approximately 31.4%), India (approximately 7.4%), Angola (approximately 6.9%), and Ukraine (approximately 5.9%). Most migrants are of working age: 77% are between 18 and 44 years old, and 56.1% are men. However, no direct official breakdown by nationality has been found in open sources — these data require additional verification.

Portugal is considered one of the most immigrant-friendly countries in the EU — it has a Golden Visa program that requires an investment of €250,000 and grants the right to a residence permit and then citizenship. There are other categories as well: the D2 business visa, visas for digital nomads, and financially independent individuals.

Meanwhile, the sharp increase in the number of applications is putting a strain on AIMA: the agency reports a shortage of staff, a significant backlog of unprocessed cases, and delays in processing applications. A number of media outlets report that some cases have been pending for over two years.

The growth in the number of foreign residents in Portugal reflects a changing demographic landscape and makes the country attractive to international investors, start-ups, and migrant workers.

Key factors include relatively low investment thresholds, openness to foreign specialists, and a favorable climate. However, this dynamic is accompanied by growing challenges: increased pressure on the housing market, social infrastructure, and a migration management system in need of modernization.

For businesses, this is a signal that Portugal is a promising market for relocation and the creation of international teams, but it is important to take into account bureaucratic delays and changes in migration policy.