The article collects and analyzes the main macroeconomic indicators of Ukraine. In connection with the entry into force of the Law of Ukraine “On Protection of the Interests of Business Entities during Martial Law or a State of War”, the State Statistics Service of Ukraine suspends the publication of statistical information for the period of martial law, as well as for three months after its termination. The exception is the publication of information on the consumer price index, separate information on statistical indicators for 2021 and for the period January-February 2022. The article analyzes open data from the State Statistics Service, the National Bank, and think tanks.

Demographic indicators of Ukraine

Director of the Ptukha Institute of Demography and Social Studies of the National Academy of Sciences of Ukraine, Academician Ella Libanova, predicts that about 50% of citizens will return to Ukraine after the war ends. At the same time, Libanova believes that if the economy is restored to pre-war levels, Ukraine will not be able to return the projected 4.5 million citizens.

She also drew attention to the fact that, according to Eurostat, there are currently 4.2 million Ukrainian military migrants in the European Union.

Earlier, Libanova described depopulation and labor shortages as an inevitable scenario for Ukraine.

According to the estimates she presented at the Regional Economic Forum, as of the beginning of this year, the population in the government-controlled areas was 31.6 million people, and now it has slightly increased.

Libanova pointed out that the population forecast for the beginning of 2033 within the borders of 1991 Ukraine ranges from 26-35 million people.

Economic recovery

Ukraine’s real gross domestic product (GDP) growth slowed to 8.2% in the third quarter of 2023 compared to the same period last year.

The NBU, which has raised its overall GDP growth forecast for this year to 4.9%, estimates the direct positive contribution of a higher harvest at 1.3 percentage points.

“At the same time, the key risk for our economy remains a longer duration and intensity of the war, as well as a decrease in the volume or loss of rhythm of international assistance, the resumption of a significant electricity shortage due to further destruction of the energy infrastructure and other risks,” said Maksym Urakin.

Analysis of Ukraine’s foreign trade

Maksym Urakin also drew attention to the factor of the growing negative foreign trade balance, which has been observed since the beginning of the war.

“The negative balance of Ukraine’s foreign trade in goods in January-September 2023 increased by 3.2 times compared to the same period in 2022 – $19.402 billion. This means that the cost of purchasing the goods Ukraine needs is almost $20 billion more than the income from exporting Ukrainian goods to other countries,” said Urakin, PhD in Economics.

Ukraine’s financial situation in 2023

According to the expert, the main factors characterizing the state of the Ukrainian economy are public debt, international reserves, and inflation.

“As of September 30, 2023, Ukraine’s public and publicly guaranteed debt amounted to UAH 4,886.13 billion, or USD 133.62 billion. This is a slight decrease compared to the historical maximum set in August,” Maksym Urakin said.

The expert noted that the main risks to the economy remain the duration of the war and the instability of international aid.

“In the third quarter of 2023, Ukraine’s GDP growth slowed to 8.2%. The negative balance of foreign trade increased 3.2 times, which is an alarming signal. The public debt has slightly decreased compared to August figures, but in 2024 it may exceed the country’s GDP for the first time, which poses significant risks to economic stability,” the economist said.

Thus, the economic situation in Ukraine, according to the founder of the Club of Experts, continues to require close monitoring and adaptation of strategies in response to changing conditions. Macroeconomic indicators of Ukraine and the world were discussed in more detail in one of the video programs of the Experts club

According to preliminary estimates by the National Bank of Ukraine (NBU), Ukraine’s international reserves decreased by 4.9%, or UAH 1.98 billion, to $38.525 billion in January. “This dynamics is due to the NBU’s foreign exchange interventions to maintain exchange rate stability, the country’s debt payments in foreign currency, and lower international aid inflows compared to previous months,” the NBU explained on its website on Tuesday.

Among other factors that determine the amount of reserves, the NBU cited operations in the foreign exchange market: in January, the regulator’s net sale of foreign currency amounted to $2.53 million, which is 29% less than the previous month.

The regulator noted that in January, the Cabinet of Ministers transferred $898.9 million to the NBU account, and paid $441.6 million for servicing and repaying the public debt.

The NBU also pointed out that the current volume of reserves was positively affected by the revaluation of financial instruments, adding $86.3 million.

“The current volume of international reserves provides financing for 5.1 months of future imports,” the central bank stated.

As reported, in January, the NBU lowered its forecast for Ukraine’s international reserves at the end of 2024 to $40.4 billion from $44.7 billion and to $42.1 billion from $45 billion at the end of 2025.

Exports from Ukraine to JYSK’s distribution centers increased by 60% in 2023, Iryna Romanchuk, Purchasing Manager of the chain, told Interfax-Ukraine.

“Over the past 12 months, exports from Ukraine to JYSK distribution centers have increased by 60% compared to the same period. However, this figure could have been higher if the borders had not been blocked at the end of 2023, which extended the delivery time from a week to a month, sometimes up to two, which had a very negative impact on all Ukrainian exporters,” Romanchuk said.

The expert clarified that due to the high cost of transportation to European countries, upholstered furniture made in Ukraine is losing its competitiveness, so now mostly cabinet furniture is exported. In addition, JYSK also buys blankets, pillows and household goods in Ukraine.

“At the beginning of 2022, some manufacturers located in the east of the country were unable to resume operations quickly due to a disruption in the supply chain of both components and finished goods. Therefore, we were forced to stop working with these companies. Today, our main suppliers are located in the central and western parts of the country,” said Romanchuk.

As an example of increasing the network’s work with Ukrainian manufacturers, she cited the furniture manufacturer Akord-Import (Khmelnytsky), with whom JYSK expanded cooperation in 2023 both by transferring the production of some furniture series from Europe to Ukraine and by expanding the range with new items. In total, this manufacturer shipped more than 1200 truckloads of finished furniture to JYSK’s European distribution centers in 2023.

JYSK is a part of the family-owned Lars Larsen Group with more than 3.2 thousand stores in 48 countries. Currently, there is an online store jysk.ua and 91 classic format stores in Ukraine, and in 2024 their number will reach 100. JYSK has more than 800 employees in the country.

JYSK’s revenue in the financial year 2022/23 amounted to EUR 5.2 billion.

IMC Agro Holding has completed the harvesting of corn in 2023 and achieved a record yield of 12.4 tons/ha, which is 1.3 tons/ha higher than the previous record set in 2018, said Alex Lissitsa, SEO of the agricultural holding.

“A total of 574 thousand tons were harvested from an area of 46.3 thousand hectares, with an average corn yield of 12.4 tons/ha, a record for all years of the company’s operations, which is 1.3 tons/ha higher than the previous record set in 2018,” he wrote on Facebook.

IMC is an integrated group of companies operating in Sumy, Poltava and Chernihiv regions (north and center of Ukraine). It controls 120.3 thousand hectares (120.0 thousand hectares under cultivation). As of September 30, 2023, the group operated in two segments: crop production and elevators and warehouses.

The agroholding’s net loss in 2022 amounted to $1.1 million against a net profit of $78.7 million a year earlier, with a 37.3% decrease in revenue to $114 million. EBITDA decreased threefold to $36.2 mln.

For the 2024 harvest, IMC sowed winter wheat on 20.3 thou hectares.

In the first nine months of 2023, IMC posted a net loss of $2.25 million, compared to $4.67 million in net profit for the same period in 2022. The agroholding’s revenue increased by 59.8% to $98.78 million, including exports, which increased by 24.4% to $70.23 million. A significant increase in production costs – by 55.6% to $92.4 million – led to a decrease in gross profit by 33.3% to $29.89 million. EBITDA in the first nine months of 2023 amounted to $13.85 million, which is 2.7 times less than in the first nine months of 2022. The report notes that the reason for the decline was the decline in harvest prices in 2023.

CORN, HARVESTING, IMC, RECORD

Ukrzaliznytsia JSC is introducing additional flights between Kyiv, Lviv, and Ivano-Frankivsk on February 16-18 in response to increased demand, the company reports.

“Although February is traditionally considered a ‘low’ season of mobility, we have recorded an increase in demand for travel on February 16-18. Therefore, we are already promptly scheduling additional flights between Kyiv, Lviv, and Ivano-Frankivsk, which will consist exclusively of new cars,” Ukrzaliznytsia said in a statement on its Telegram channel on Tuesday.

Reportedly, the number of seats on the Kyiv-Lviv-Ivano-Frankivsk route will be increased by train #195/196, which will depart Kyiv on February 16 and 18 at 07:37, Lviv at 14:46-15:06, and arrive in Ivano-Frankivsk at 18:18. The train will depart back from Ivano-Frankivsk on February 16 and 18 at 19:25, Lviv at 21:54 – 23:05, arriving in Kyiv the next day at 06:19.

“On February 16 and 18, train #192/191 Lviv-Kyiv will depart from Lviv to Kyiv, departing from the city of Lviv at 11:55 a.m. and arriving in the capital at 22:09 p.m.,” Ukrzaliznytsia informs.

The year 2024 started dynamically: the labor market saw an increase in the number of job seekers, which led to increased competition. Employers responded by increasing salaries and requirements for candidates. Find out what else has changed in the labor market in the Work.ua study.

What the January statistics tell us

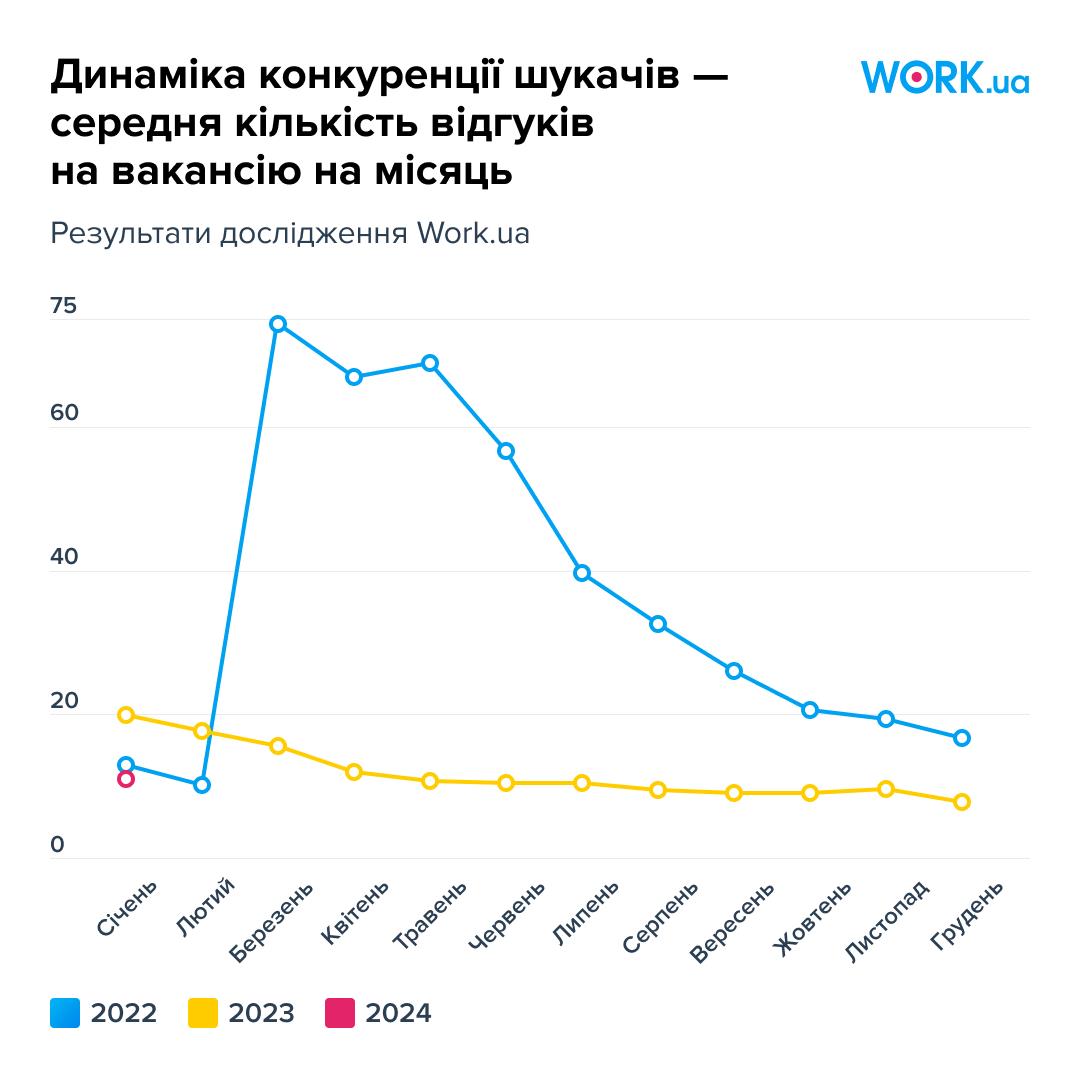

Starting a new life with the new year seems to be the strategy followed by job seekers in the labor market in January 2024. After all, competition for vacancies has increased significantly after the traditional New Year’s Eve drop. Employers, on the other hand, are not yet as active – the number of job offers on the market is lower than last month. However, both trends are normal seasonal phenomena.

In January, the upward trend in wages continued. The average salary in Ukraine is now UAH 19,500. However, along with remuneration, the requirements for job seekers are also growing – employers are increasingly mentioning expectations for English language skills in their job postings.

The labor market has recovered by 93%.

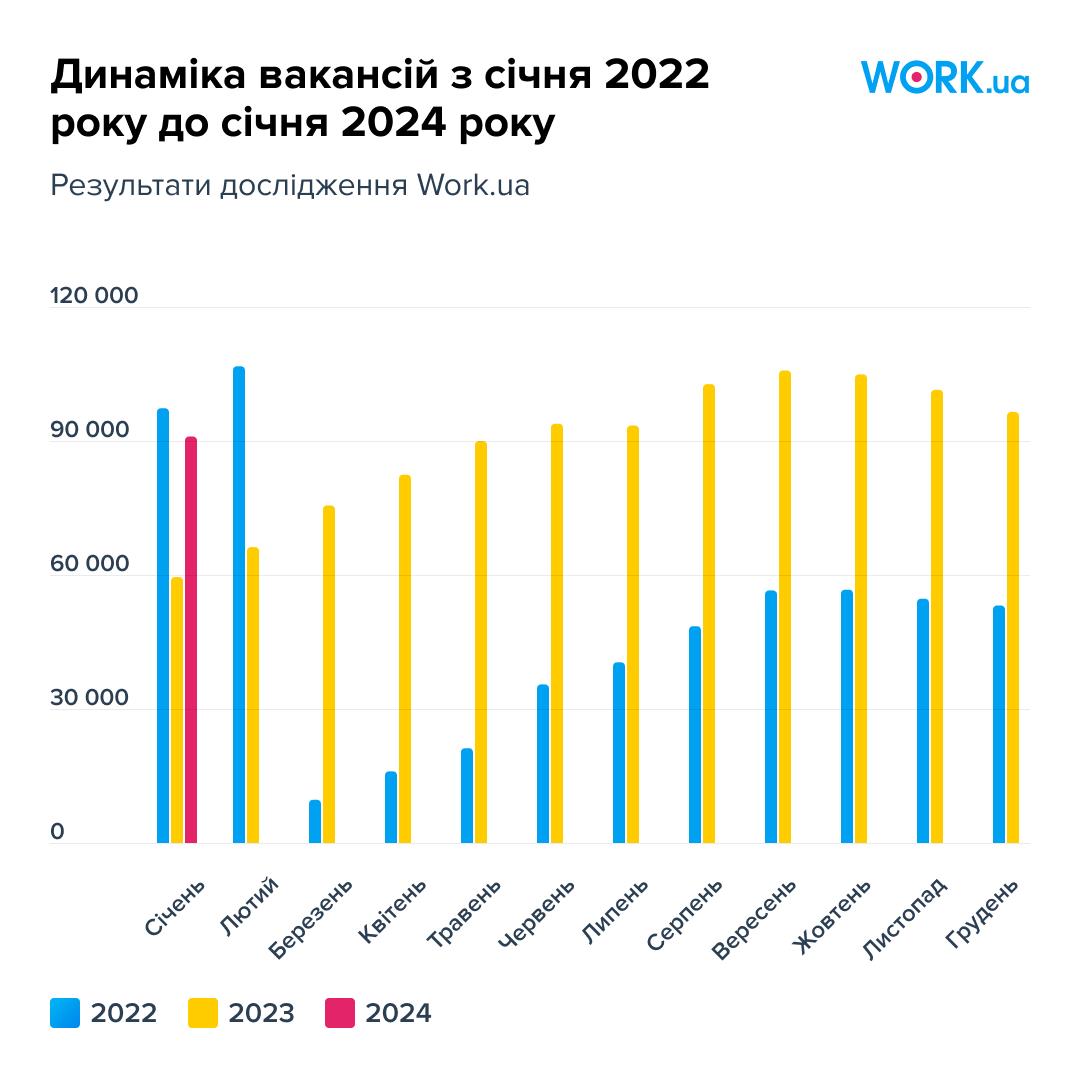

In January 2024, according to Work.ua, employers published 91,021 vacancies. This is 6% less than in December 2023 and 7% less than in January 2022. This means that the labor market has now recovered by 93% in terms of the number of job offers. But, as before, this recovery is uneven.

Compared to pre-war figures, the number of vacancies has increased the most in the following regions: Zakarpattia (155%), Ivano-Frankivsk (146%), Khmelnytsky (125%), Lviv (123%), Vinnytsia (120%), Rivne (118%), and Chernivtsi (116%).

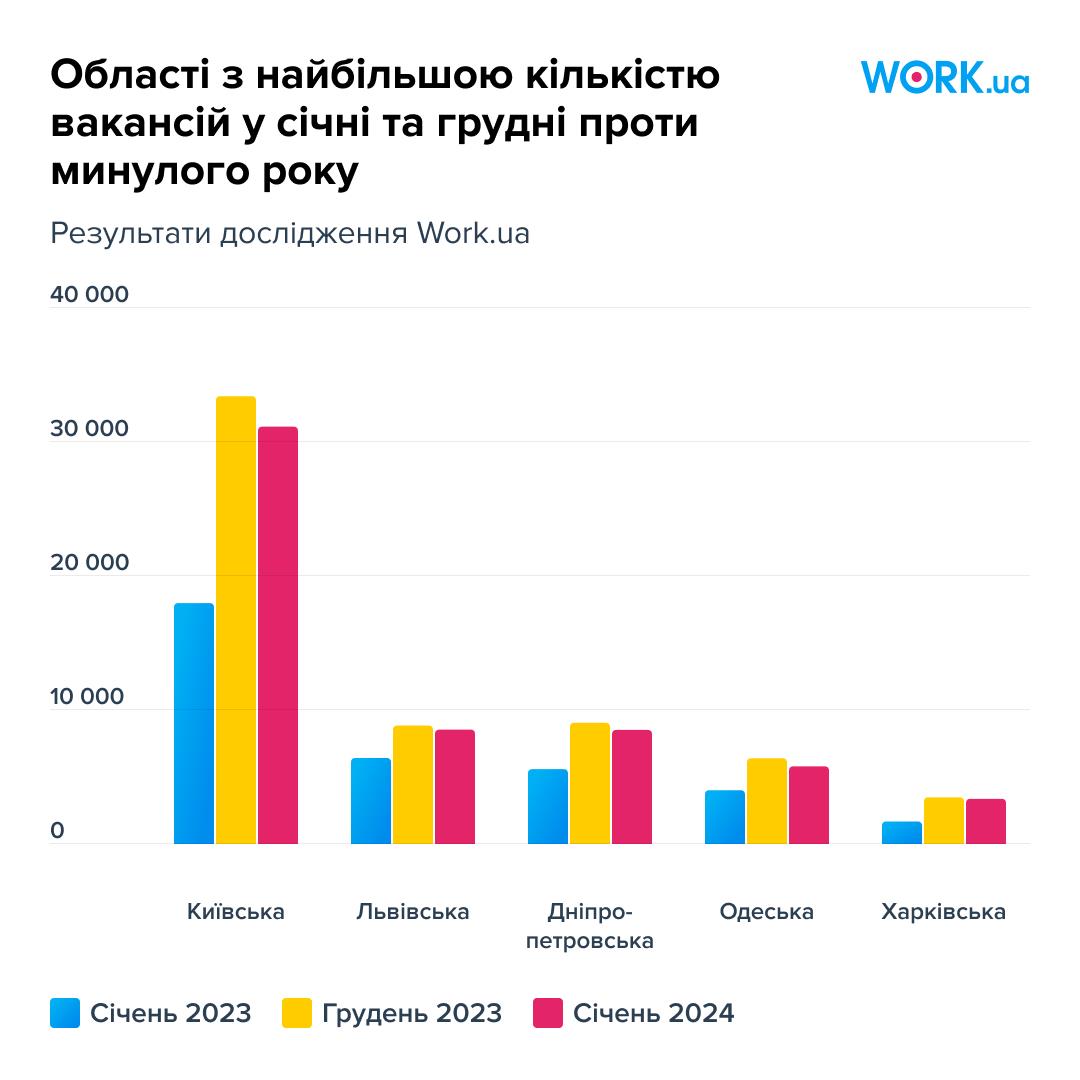

The leading regions in terms of the absolute number of job offers remain unchanged: Kyiv (30,913 vacancies), Lviv (8,473), Dnipropetrovs’k (8,452), Odesa (5,752), and Kharkiv (3,347). These regions account for 63% of all vacancies.

English language skills are required in almost every tenth vacancy

In December, the number of job offers decreased in all leading categories:

“Working specialties, production” – 14,923 vacancies, -14% compared to December;

“Service sector” – 14 674, -13%;

“Sales, purchasing” – 13,090, -1%;

“Retail trade – 10,809, -11%;

“Logistics, warehouse, foreign trade – 9,096, -10%;

“Administration, middle management – 8,340, -2%;

“Hotel and restaurant business, tourism” – 7,591, -16%;

“Transportation, automobile business – 7,214, -3%;

“Accounting, audit – 6,752, -2%;

“Medicine, pharmaceuticals – 6,326, -2%.

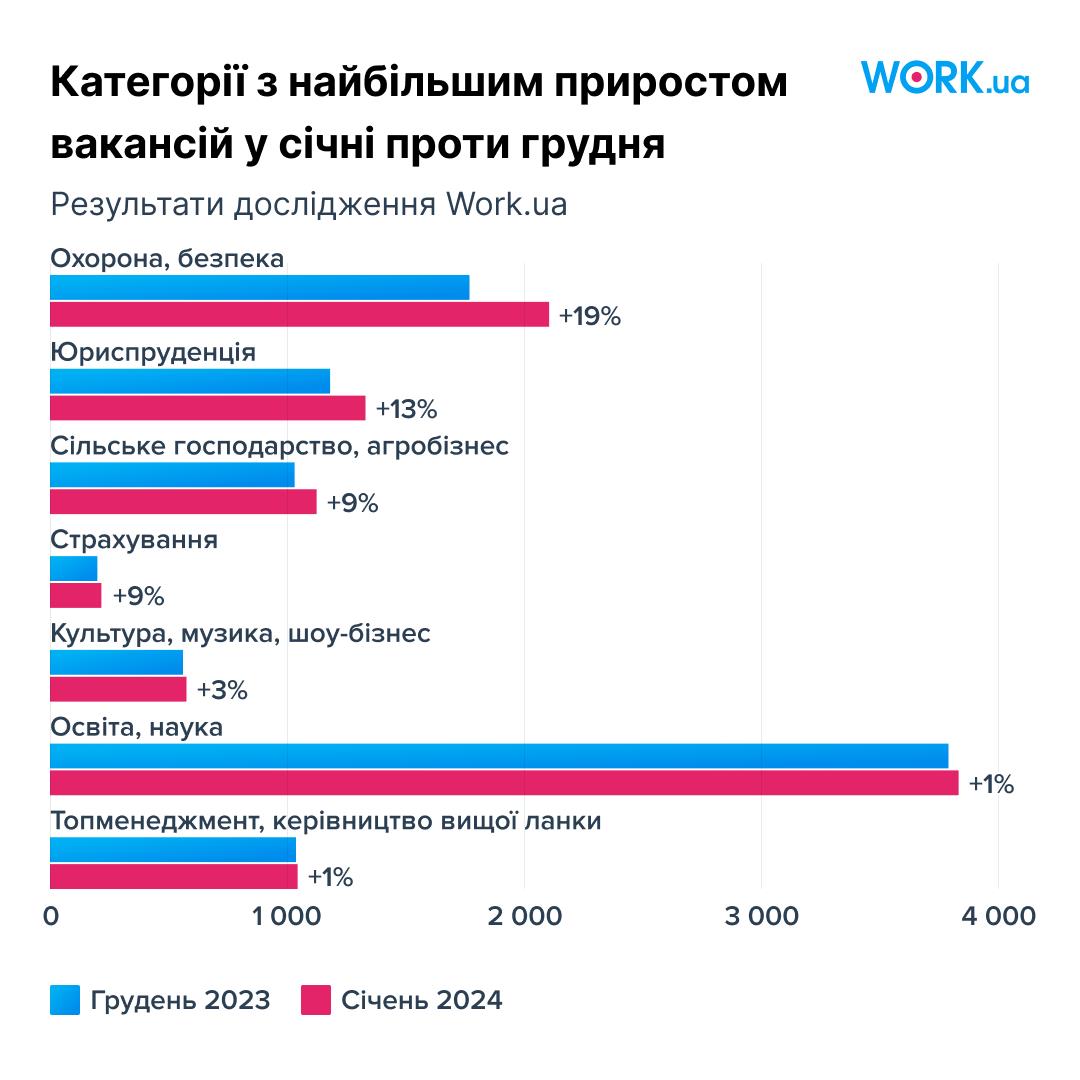

But in 7 categories, on the contrary, the number of jobs increased. The largest increase is seen in the category “Security, safety”, where vacancies are posted by the Defense Forces of Ukraine. You can learn more about them at work.ua/zsu/.

In terms of individual professions, the demand for the following specialists increased in January:

● Estimator (+21% compared to December, 138 vacancies)

● Correctional teacher (+20%, 147)

● Press secretary (+20%, 139)

● Service engineer (+20%, 324);

● massage therapist (+18%, 267)

● Financial analyst (+16%, 342);

● Turner (+16%, 200);

● graphic designer (+15%, 188);

● Florist (15%, 267);

● Project manager (+15%, 651).

In absolute terms, the labor market has the most job offers for sales consultants, sales managers, accountants, drivers, cashiers, cooks, loaders, account managers, administrators, sales representatives, and storekeepers.

The January drop in the number of vacancies affected almost all types of jobs. For example, the number of remote work offers decreased, and there were fewer vacancies for students and people without experience. Instead, employers are increasingly indicating that their vacancies are open to veterans (+6% compared to December, 6,194 job offers) and pensioners (+1%, 4,033).

Compared to December, the requirement for English language skills appears in job postings much more often. In January, this requirement was found in 7,990 vacancies, which is 19% more than in the previous month. In total, 9% of job offers require knowledge of English.

One third of job seekers want to work in Kyiv region or remotely

In January, job seekers updated or created 350,858 resumes on Work.ua. One third of all resumes indicated Kyiv region or remote employment as their preferred region of work.

Compared to December, the number of resumes increased by 24%. Obviously, job seekers have taken the idea of “new year, new job” seriously. So now employers have a better chance of finding qualified specialists. The increase in the number of candidates has also affected competition – it has increased by 42% compared to December.

In December, employers in Kyiv, Vinnytsia, Volyn, Lviv, and Kharkiv regions received the largest number of responses to their vacancies. The most difficult situation with candidate responses was in Kherson, Zakarpattia, Chernivtsi, Cherkasy, Mykolaiv, and Chernihiv regions.

In January, the competition for remote work was 5 times higher than average: Ukrainians continue to want to work online the most. The number of responses from candidates for the most competitive remote positions increased several times more. These positions include front-end developer, coder, web designer, tester, Android programmer, video editor, Python programmer, and Java programmer.

The most difficult to find are blue-collar professionals and doctors. The list of positions with the lowest competition in January included a diesel locomotive driver, train assembler, stone processing specialist, miner, oncologist, endocrinologist, otorhinolaryngologist, gastroenterologist, and hirudotherapist.

On Work.ua, not only do candidates submit resumes, but employers can also offer job openings to job seekers. In terms of the ratio of the number of offers to the number of vacancies, the most active employers were those looking for housewives, realtors, police officers, contact center operators, development managers, sales managers, customer service managers, English teachers, sales consultants, and promoters.

The number of women in the labor market is growing

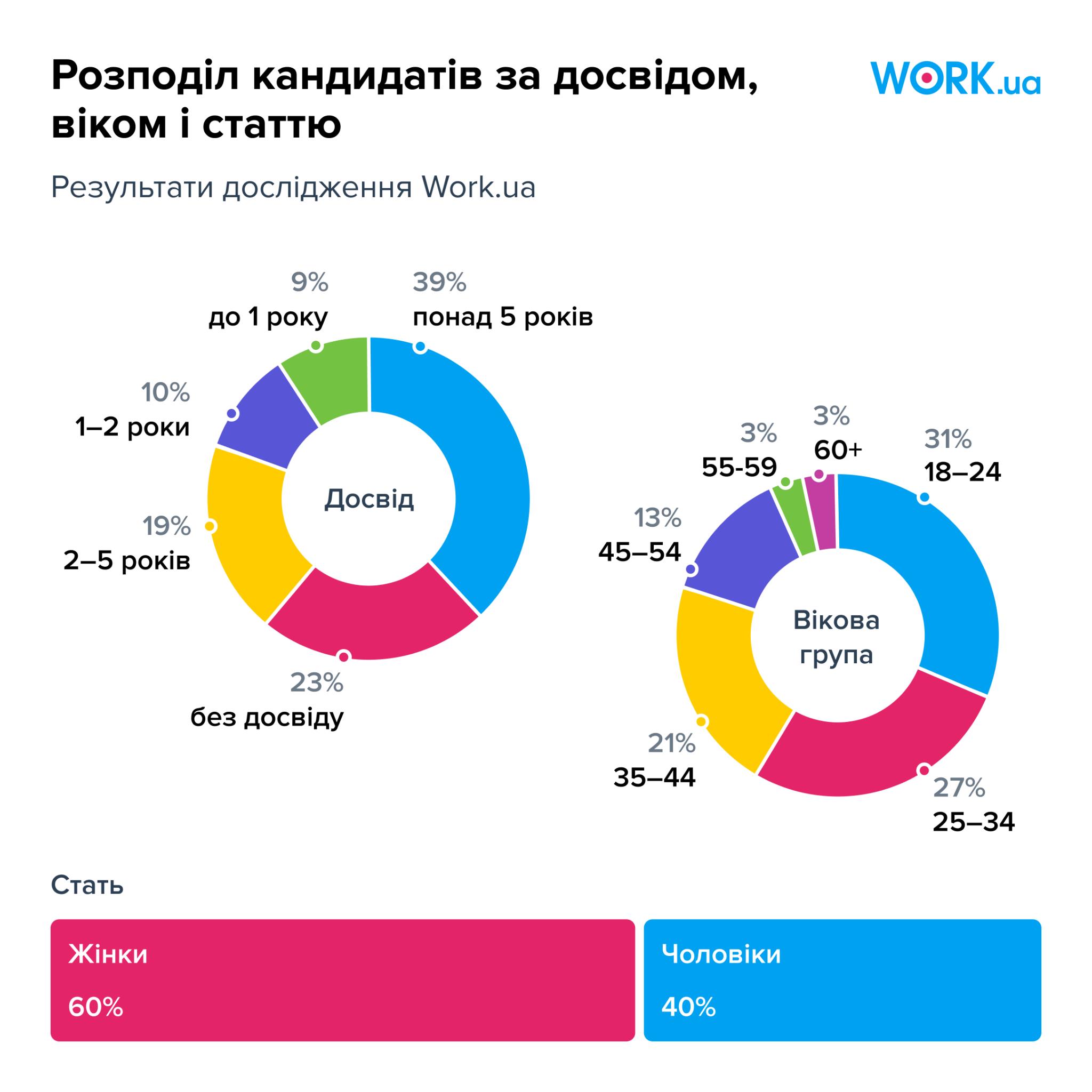

In January, job seekers updated or created 350,858 resumes on Work.ua. Among them, 60% are women and 40% are men. Compared to previous months, the share of women in the labor market has increased. However, there were no significant changes in the distribution of job seekers by age and work experience.

In January, the number of candidates for the following professions increased: embroiderer (+107% compared to December), SMM specialist (+99%), molder (+72%), insurance agent (+68%), office manager (+68%), nutritionist (+67%), tour guide (+67%), draftsman (+66%), psychiatrist (+66%), and event manager (+64%).

Vacancies in the Defense Forces are among the leaders in terms of salaries

The trend towards a gradual increase in wages, which began in 2023, continues. In January, the average salary increased by 3% to UAH 19,500. Among the leading regions, wages increased in Kyiv (+150 UAH to UAH 21,000), Lviv (+230 UAH to UAH 19,230), Odesa (+500 UAH to UAH 18,500), and Dnipro (+500 UAH to UAH 18,500). In Kharkiv region, however, the salary did not increase again and has remained at UAH 17,500 for the third month in a row.

In January, salaries of employees in some categories also increased:

● Insurance – UAH 22,000, +10% compared to December;

● Security and safety – UAH 17,500, +6%;

Agriculture, agribusiness – 21,000, +5%;

Real estate – 36,500, +4%;

Retail trade – 16,000, +3%.

In the ranking of positions with the highest salaries (except for executives and IT), we see positions of specialists for the Ukrainian Defense Forces: drone pilot, rifleman, grenade launcher, mortar operator (over UAH 70,000). To join the ranks of the Defense Forces of Ukraine, please apply for the vacancies posted at work.ua/zsu/.

Among civilian professions (except for executives and IT), the highest salaries in December were as follows:

● 47,500 UAH – media buyer

UAH 45,000 – international driver

UAH 42,500 – ceramist;

UAH 40,000 – a straightener;

● 37,500 UAH – endodontist, supermarket manager, realtor;

● UAH 36,250 – dental technician.