Генеральний директор Міжнародної організації з міграції (МОМ) Емі Поуп заявила, що Україні потрібен план залучення в країну мігрантів, навіть якщо значна кількість українських біженців повернеться, заявила вона на Конференції з відновлення України (URC2025) в Римі (Італія).

«Україні потрібен план залучення в країну мігрантів.

Тому що навіть якщо ми успішно переконаємо українців повернутися додому, я думаю, що все одно будуть потрібні мільйони працівників, щоб відбудувати Україну.

Необхідно забезпечити легальні та безпечні маршрути для міграції в країну», – заявила Поуп.

Група компаній «Аврора» відкрила перший магазин Aurora у Бухаресті в п’ятницю, 11 липня, цей магазин став 50-м у Румунії, повідомили в прес-службі компанії агентству «Інтерфакс-Україна».

“Наша бізнес-модель, яка поєднує широкий асортимент, якісний сервіс і демократичні ціни, виявилася близькою як українцям, так і європейським покупцям. Відкриття в Бухаресті – це підтвердження довіри клієнтів і вагомий крок у підкоренні європейського ринку. Ми пишаємося тим, що можемо представляти українську якість за кордоном і відкривати нові можливості для українських виробників на міжнародній арені«, – коментує співвласник групи компаній »Аврора” Тарас Панасенко.

Новий магазин Aurora (Bucuresti, Calea Cringasi nr.29 sector 6) загальною площею 200 кв. м, пропонує формат компактного магазину з широким асортиментом товарів, де можна придбати все необхідне для щоденних потреб. Для комфортного шопінгу в торговому залі розташовані прайсчекери для швидкої перевірки цін покупцями.

У прес-службі зазначили, що Aurora успішно конкурує на ринку Румунії, індекс лояльності місцевих клієнтів NPS навіть вищий за український – приблизно 80 проти 60.

Як повідомлялося, перший магазин Aurora в Румунії з’явився в жовтні 2023 року в м. Сучава, що стало початком міжнародного розвитку компанії. У 2024 році був відкритий розподільний центр в місті Бакеу, що забезпечило оптимізацію логістики.

Масштабування групи компаній «Аврора» в Румунії відкриває нові можливості як для місцевих, так і для українських виробників. На сьогодні більше 27 українських компаній вже експортують свою продукцію для реалізації в магазинах мережі Aurora в Румунії. Це не тільки стимул для зростання українського експорту, але і місток до міжнародного ринку для малого та середнього бізнесу з України.

«Аврора» – національна компанія з прямими іноземними інвестиціями від Фонду Horizon Capital, заснована в 2011 році Львом Жиденко, Тарасом Панасенком і Лесею Клименко, головний офіс розташований у Полтаві. На липень 2025 року мережа налічує понад 1 700 магазинів «Аврора» на території України та 50 магазинів Aurora в Румунії.

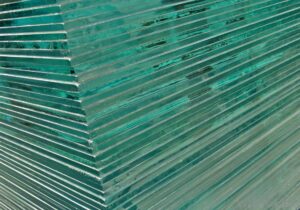

NovaSklo планує розпочати будівництво заводу з виробництва флоат-скла в Київській області в березні 2026 року.

Як повідомив агентству Інтерфакс-Україна CEO NovaSklo, засновник інвестиційної компанії EFI Group Ігор Ліскі на полях конференції з відновлення URC-2025, інвестиції в проект становлять понад 240 млн євро.

Проект реалізується за підтримки UkraineInvest та Міністерства економіки України.

Проект передбачає, зокрема, будівництво заводу потужністю 24,8 млн м2 скла на рік. Підприємство дозволить скоротити залежність від імпорту листового скла і буде виробляти продукцію на експорт.

Ліскі зазначив, що проект може окупитися за 6-7 років.

Він повідомив, що для реалізації проекту на полях конференції підписано меморандум між NovaSklo і трьома провідними європейськими виробниками обладнання – Horn Glass Industries AG (Німеччина), Zippe Industrieanlagen GmbH (Німеччина) і Bottero S.p.A. (Італія), які, зокрема, виступатимуть основними постачальниками технології та обладнання.

За словами Ліски, NovaSklo вже оформила земельну ділянку для виробництва, купила ліцензію на видобуток піску.

Коментуючи ризики, пов’язані з будівництвом промислового об’єкта в Україні, Ліски зазначив, що «це важливий символічний проект, тому що він якраз є символом відновлення України».

“Розбите скло, розбиті вікна – це завжди символ занепаду і війни. Новий завод, який виробляє скло високого рівня, – це символ того, що ми, українці, маємо майбутнє, і ми будемо відновлювати Україну з кращим склом, за кращою технологією. Ми повинні робити все, що від нас залежить, щоб Україна мала інше майбутнє”, – сказав він.

Ліскі зазначив, що проект фіналізує підписання контрактів з фінансовими інститутами щодо кредитування.

«Це хороший маржинальний проект, тому що зараз все скло імпортується, великі витрати на транспортування. Цей проект ефективний і маржинальний. Ми думаємо, що окупність буде 6-7 років», – сказав він.

Експерти прогнозують зростання цін на каву до 40% у 2025 році. Основними причинами називають посуху в Бразилії та аномальні дощі у В’єтнамі, найбільших країнах-виробниках кави, повідомили в FAO та Міжнародній організації кави.

У 2024 році вартість арабіки зросла на 69%, досягнувши рекордних рівнів і перевищивши 4,30 долара за фунт на біржі ICE на початку 2025 року. Посуха в Бразилії призвела до зниження врожаю на 10-11%, що викликало дефіцит, а у В’єтнамі врожай скоротився на 10-20% через посухи і сильні дощі. Міжнародна організація кави попереджає, що стабілізації ринку не варто очікувати до 2026-2028 років.

Очікується, що роздрібні ціни на каву зростуть на 10-20%, що призведе до подорожчання кави в кафе і в роздрібній упаковці. Це посилить інфляційний тиск, оскільки зростання цін на каву доповнює зростання вартості інших продуктів харчування. Експерти відзначають, що виробникам доведеться інвестувати в стійкі до посухи сорти і нові системи зрошення. Також фіксується зростання витрат в ланцюжку поставок, включаючи подорожчання добрив, логістики і кредитних ресурсів.

За даними FAO, у 2023 році світове виробництво кави склало близько 11 млн тонн, з яких на частку Бразилії припадає 31%, В’єтнаму – 18%, Індонезії – близько 7%. Споживання кави в світі зростає приблизно на 2% щорічно і оцінюється в 177 млн мішків на рік.

Згідно з відкритими даними, лідерами зі споживання кави на душу населення є Фінляндія (близько 12-13 кг на рік), Норвегія (близько 10 кг), Ісландія (9,8 кг), Данія (8,7 кг), Нідерланди (8,4 кг), Швеція (8,2 кг), Швейцарія (7,9 кг), Бельгія (6,8 кг), Люксембург (6,5 кг) і Канада (6,5 кг).

Зростання цін на каву в 2025 році може стати серйозним випробуванням як для виробників, так і для споживачів, а також посилить інтерес до сталого виробництва і розширення поставок з метою стабілізації ринку в умовах мінливого клімату.