According to Serbian Economist, the body of Ukrainian citizen Oleksiy Polyakov, who disappeared on September 12, has been found in Montenegro. According to unofficial information, he was found near his car in the area of the Praskvica monastery.

The police and official authorities have not yet provided detailed comments.

The police reported that the lifeless body of a man, presumably Polyakov, was found near the monastery.

The mother of the missing man, Olena Polyakova, appealed to Montenegrin Interior Minister Daniel Sharanovich and the police chief to use all available resources to investigate the case. She also stated that $26,000 was withdrawn from her son’s bank account shortly after his disappearance.

According to media reports, the preliminary version of the investigation is considering the possibility of a crime, but there is no official confirmation yet.

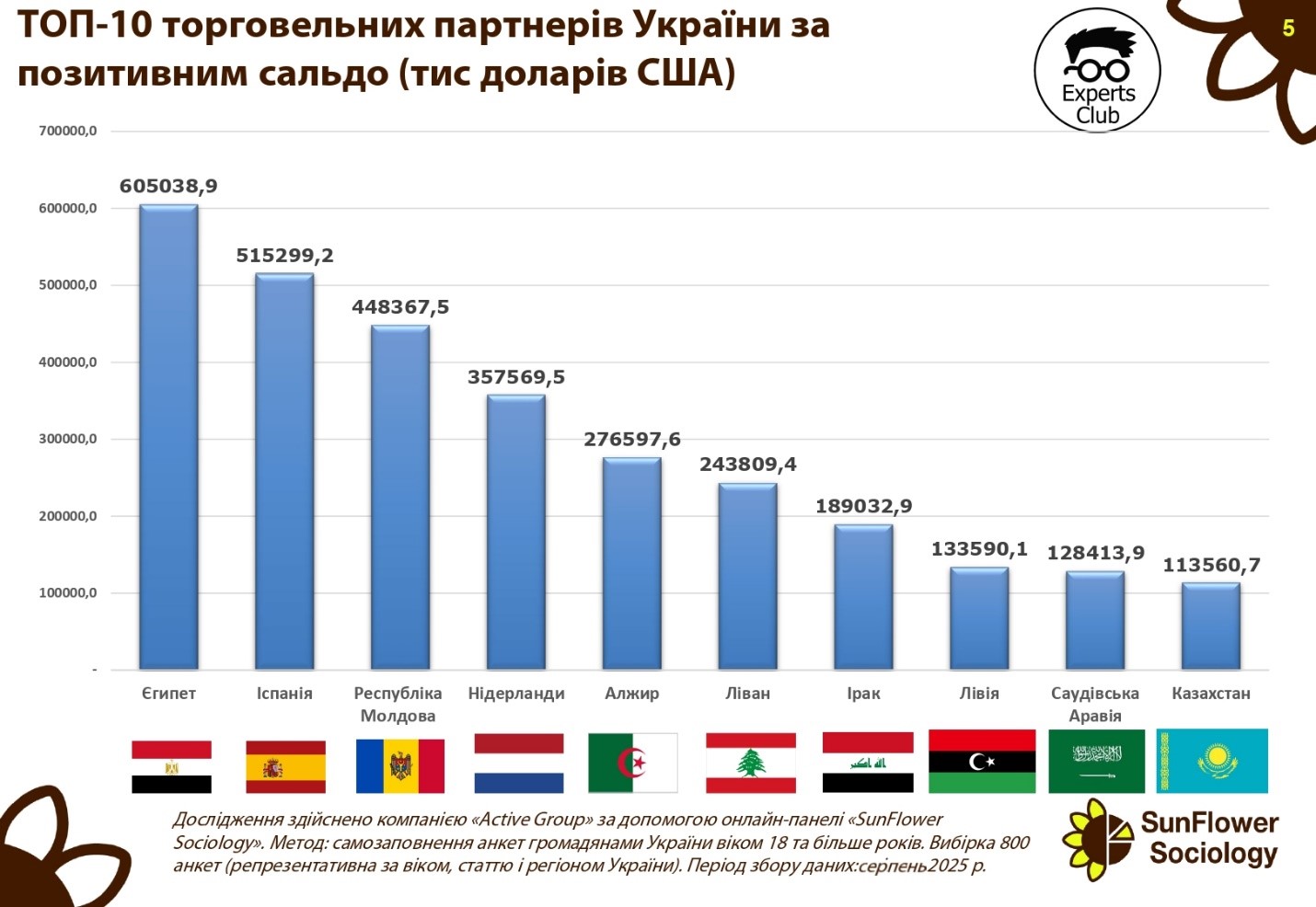

Ukraine maintains a significant positive trade balance with a number of key partners, which partially offsets the deficit in relations with China and EU countries.

The largest surplus in the first half of 2025 was recorded in trade with Egypt — $605.0 million. Spain ranks second with a balance of $515.3 million, followed by the Republic of Moldova — $448.4 million. Positive dynamics are also observed in relations with the Netherlands ($357.6 million), Algeria ($276.6 million), and Lebanon ($243.8 million).

Ukraine also has a high trade surplus with Iraq ($189.0 million), Libya ($133.6 million), Saudi Arabia ($128.4 million), and Kazakhstan ($113.6 million).

“The positive trade balance indicates that Ukraine is capable of competing effectively in international markets, especially in the agricultural sector and metallurgy. At the same time, it should be borne in mind that these markets are vulnerable to changes in the global economic situation, price fluctuations, and political factors,” emphasized Maksim Urakin, founder of Experts Club and economist.

According to him, maintaining a positive balance in relations with the countries of the Middle East and North Africa is a key element of Ukraine’s foreign trade strategy.

“Egypt, Spain, and the countries of the Arab world are stable importers of Ukrainian agricultural products. This is a strategic direction that needs to be developed further, as it creates a safety cushion for the economy against the backdrop of significant import costs,” Urakyn emphasized.

Analysts note that consolidating positions in the African and Middle Eastern markets could become a long-term factor in strengthening Ukraine’s foreign economic balance.

Agricultural exports, ALGERIA, ECONOMY, EGYPT, EXPERTS CLUB, FOREIGN TRADE, IRAQ, KAZAKHSTAN, LEBANON, LIBYA, MOLDOVA, NETHERLANDS, positive balance, SAUDI ARABIA, SPAIN, UKRAINE, МАКСИМ УРАКИН

JSC “OTP BANK” presented a range of opportunities for motorists at one of the most famous car festivals in the country KYIV CAR FEST: from a convenient online platform for searching for used cars to favorable lending conditions. The event, in which the bank was a financial partner, took place on September 20-21 in the capital’s Retroville shopping center.

“We tried to combine the world of cars and emotions with practical financial solutions, and to prove that the dream of owning a car is quite achievable. Love for cars is easily combined with real opportunities provided by OTP BANK. As you can see, modern financial instruments are gradually becoming an integral part of the automotive culture and greatly simplify the way for each of us to own a car,” said Oleg Klymenko, Member of the Management Board responsible for retail business development of OTP BANK.

The interactive zone of OTP BANK was open for two days at the outdoor location of KYIV CAR FEST, where guests got acquainted with the functionality and offers of the used car marketplace Ponova by OTP Bank, received information on bank financing and individual consultations on the most profitable instruments that help to realize the desire to have their own car. In addition, there were special drawings that allowed many attendees to receive a special offer to their loan for a used car.

KYIV CAR FEST vol.6 once again demonstrated the diversity of automotive culture – from classics to ultra-modern models, from artistic experiments to technical innovations. This time, the festival was dedicated to the philosophy of form and the materials used to create exclusive stories: extensions, body kit, carbon fiber, fiberglass, film, paint, and work with the exterior design of cars. The owners of the unique cars presented real masterpieces of their collections. Visitors had the opportunity to get acquainted with rare models and learn more about the possibilities of buying a car.

OTP BANK will continue to support events that inspire Ukrainians to move forward, open new horizons and realize their dreams.

We would like to remind you that in May 2025, OTP BANK provided financial support for KYIV CAR FEST vol.5. The guests of this atmospheric event had the opportunity not only to see exclusive cars, take pictures near iconic models, but also to get advice from the bank’s specialists on the possibilities of obtaining funds for the purchase of used cars in Ukraine or ordering cars from the USA or other countries or from OTP BANK’s partners or on the Ponova by OTP Bank used car marketplace.

DTEK Energy’s machine builders manufactured and repaired 2,050 pieces of mining equipment in January-August this year, including six new roadheaders, according to the company’s press release. In addition, 1.7 million spare parts and components were manufactured.

“We continue to consistently strengthen the reliability of thermal power generation in wartime conditions,” DTEK Energy CEO Alexander Fomenko is quoted as saying in the statement.

The press release notes that the company’s machine builders have recently begun serial production of Ukrainian electric motors for GSO, which completely replace expensive imported equipment.

The new motors, with a capacity of 75 to 200 kW, are designed for cleaning combines, belt conveyors, and pumping stations.

“They have already received certificates for climate compliance and explosion protection. In terms of quality, they are a full-fledged analogue of expensive foreign equipment. But now they are Ukrainian and more affordable. This result is the culmination of three years of work by machine builders,” the statement said.

As reported, in the first half of 2025, DTEK Energy invested UAH 2.9 billion in Ukrainian coal mining, and in 2024, investments in Ukrainian mines amounted to about UAH 7.5 billion, and over the last three years (2022-2024) – UAH 18 billion.

Since the beginning of this year, DTEK Energy miners have put seven new coal seams into operation. DTEK Energy provides a closed cycle of electricity production from coal. The company’s installed capacity in thermal generation as of January 2022 was 13.3 GW.

A complete production cycle has been created in coal mining: coal extraction and enrichment, machine building, and maintenance of mining equipment.