Vitamin D test has become one of the most demanded analyses in Ukraine, which surprises specialists, Deputy Director General of Sinevo Ukraine Mykola Skavronsky said in an interview with Interfax-Ukraine.

“I am a bit surprised by the great popularity of this expensive analysis. Moreover, it is paid for by the state through the medical guarantee program. Even many rich countries do not cover the vitamin D test at the expense of the budget,” he said.

Skavronsky noted that the popularity of the test is due to the active promotion of vitamin D preparations on the market since 2017-2018. “Pharmaceutical companies have made it part of the medical discourse, and the demand has taken hold,” he added.

“Synevo Ukraine is part of Synevo’s international laboratory network operating in more than 10 countries in Europe.”

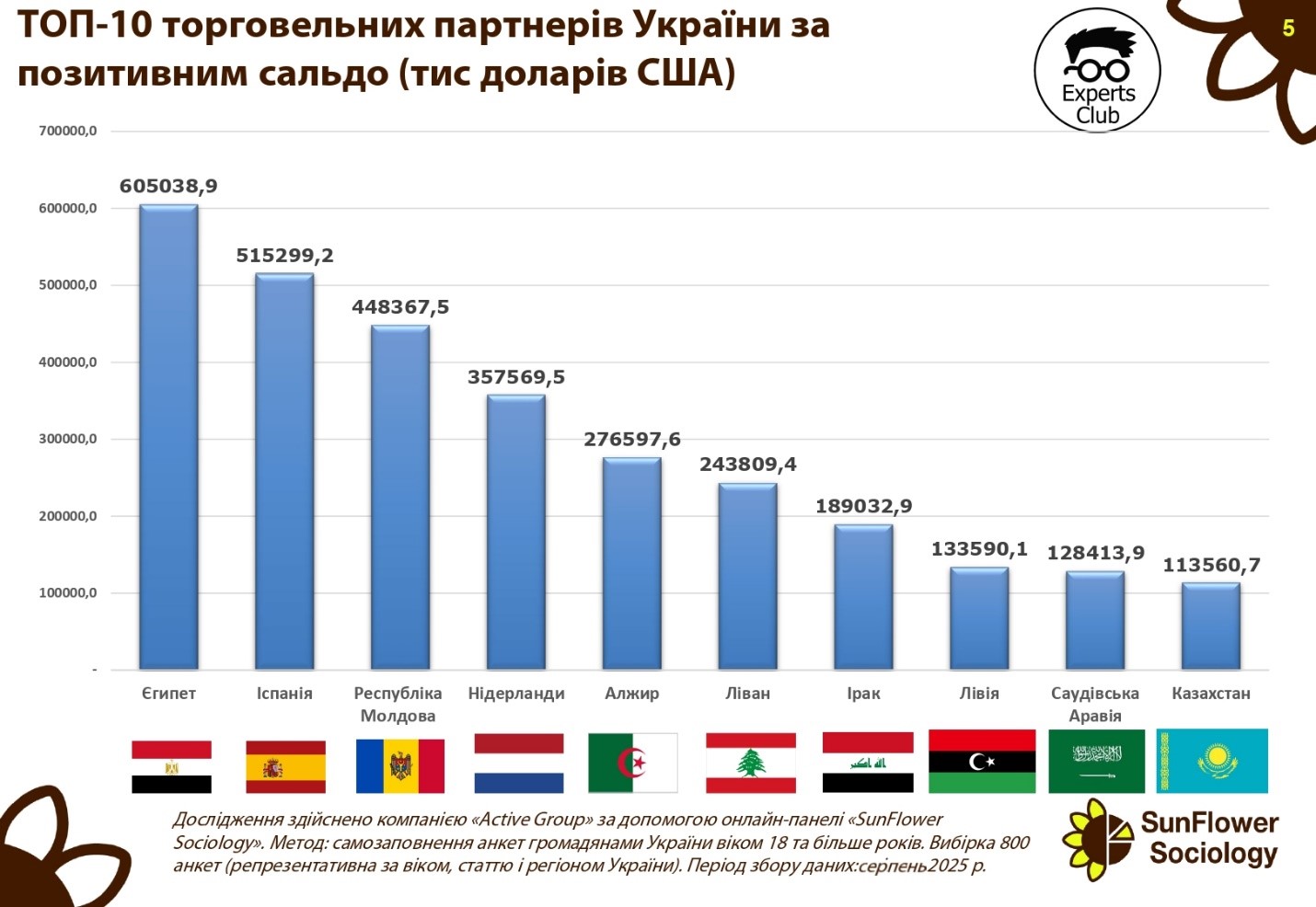

Ukraine maintains a significant positive trade balance with a number of key partners, which partially offsets the deficit in relations with China and EU countries.

The largest surplus in the first half of 2025 was recorded in trade with Egypt — $605.0 million. Spain ranks second with a balance of $515.3 million, followed by the Republic of Moldova — $448.4 million. Positive dynamics are also observed in relations with the Netherlands ($357.6 million), Algeria ($276.6 million), and Lebanon ($243.8 million).

Ukraine also has a high trade surplus with Iraq ($189.0 million), Libya ($133.6 million), Saudi Arabia ($128.4 million), and Kazakhstan ($113.6 million).

“The positive trade balance indicates that Ukraine is capable of competing effectively in international markets, especially in the agricultural sector and metallurgy. At the same time, it should be borne in mind that these markets are vulnerable to changes in the global economic situation, price fluctuations, and political factors,” emphasized Maksim Urakin, founder of Experts Club and economist.

According to him, maintaining a positive balance in relations with the countries of the Middle East and North Africa is a key element of Ukraine’s foreign trade strategy.

“Egypt, Spain, and the countries of the Arab world are stable importers of Ukrainian agricultural products. This is a strategic direction that needs to be developed further, as it creates a safety cushion for the economy against the backdrop of significant import costs,” Urakyn emphasized.

Analysts note that consolidating positions in the African and Middle Eastern markets could become a long-term factor in strengthening Ukraine’s foreign economic balance.

Agricultural exports, ALGERIA, ECONOMY, EGYPT, EXPERTS CLUB, FOREIGN TRADE, IRAQ, KAZAKHSTAN, LEBANON, LIBYA, MOLDOVA, NETHERLANDS, positive balance, SAUDI ARABIA, SPAIN, UKRAINE, МАКСИМ УРАКИН

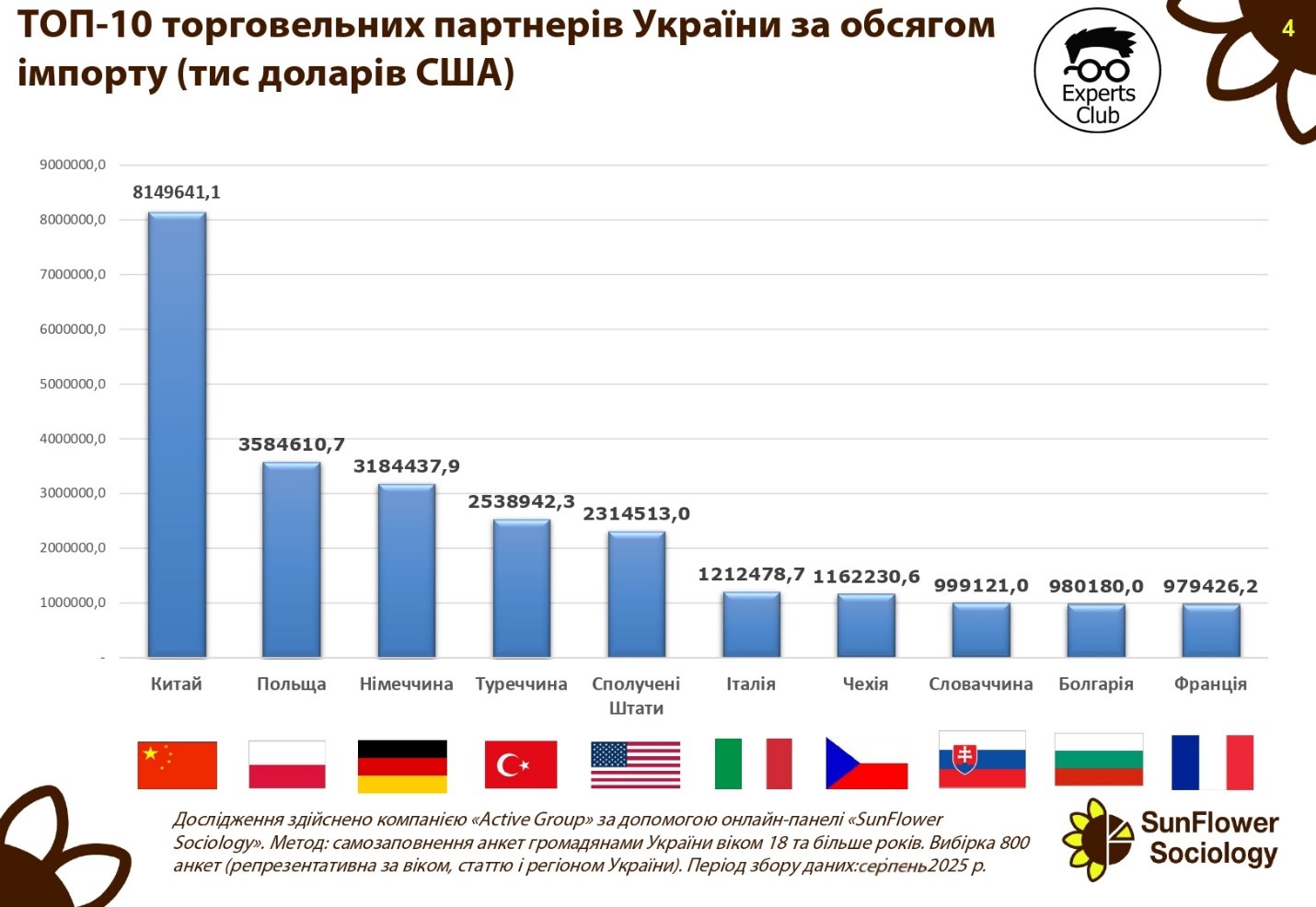

China remains the undisputed leader among Ukraine’s trading partners in terms of import volume. In the first six months of 2025, Ukraine imported Chinese goods worth US$8.15 billion. This is more than twice the figures for Poland ($3.58 billion) and Germany ($3.18 billion), which ranked second and third, respectively.

High import volumes were also recorded from Turkey ($2.53 billion) and the United States ($2.31 billion). Italy, the Czech Republic, Slovakia, Bulgaria, and France round out the top ten key suppliers with volumes ranging from $1.2 billion to $979 million.

“The formation of such an import structure indicates Ukraine’s excessive dependence on Chinese goods, especially in the electronics, technology, and industrial products segments. Such an imbalance poses risks to economic stability, as any political or logistical restrictions will immediately affect the domestic market,” emphasized Maksim Urakin, founder of Experts Club and economist.

At the same time, experts point to the diversification of supplies from European Union countries. Poland, Germany, Italy, and France together account for more than $8.5 billion in imports, forming a significant segment of the domestic consumer and industrial market.

Economists predict that, provided the hryvnia exchange rate remains stable and import flows continue at current levels, the trade deficit with China will continue to grow. This will require an adjustment of state trade policy towards stimulating domestic production and searching for alternative markets.

ACTIVE GROUP, CHINA, ECONOMY, EU, EXPERTS CLUB, GERMANY, IMPORTS, POLAND, SunFlower Sociology, TRADE BALANCE, TURKEY, UKRAINE, USA, МАКСИМ УРАКИН

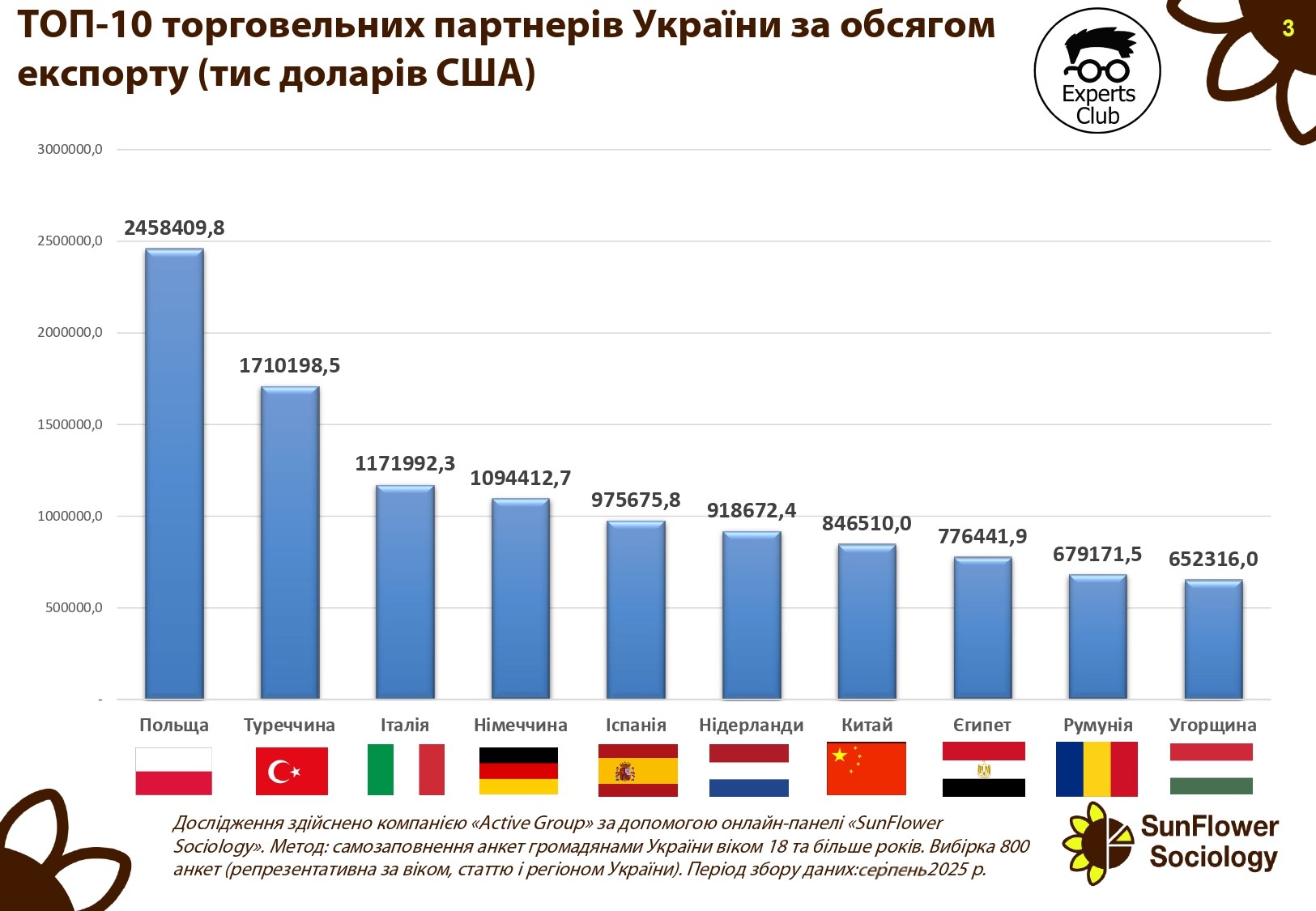

According to the results of the first half of 2025, Poland remains Ukraine’s main trading partner in terms of export volumes. According to research by Active Group and Experts Club, exports to Poland amounted to US$2.45 billion.

Turkey ranks second with USD 1.71 billion, and Italy ranks third with USD 1.17 billion. Other major partners include: Germany ($1.09 billion), Spain ($976 million), the Netherlands ($919 million), China ($847 million), Egypt ($776 million), Romania ($679 million), and Hungary ($652 million).

“The structure of Ukraine’s exports shows a clear focus on European Union countries. Poland, Italy, Germany, Spain, and the Netherlands together account for more than half of total exports. This indicates Ukraine’s strategic integration into the European economic space,” emphasized Maksim Urakin, founder of Experts Club and economist.

He also noted that Turkey remains a critically important partner for Ukrainian agricultural and metallurgical exports, while China and Egypt are key markets for agricultural products, particularly grains.

“The presence of trading partners such as Egypt and China diversifies Ukrainian exports,” Urakin added.

CHINA, ECONOMY, EGYPT, EXPERTS CLUB, EXPORTS, GERMANY, HUNGARY, ITALY, POLAND, ROMANIA, TRADE, TURKEY, UKRAINE, МАКСИМ УРАКИН

In the first half of 2025, 51,500 apartments were commissioned in Ukraine, which is 6.7% less than in the same period last year, according to the State Statistics Service. The total area of new housing was 4.27 million square meters (-6.4%).

The leaders in construction remain the Kyiv region (9,853 apartments), Kyiv (7,380), and Lviv region (5,646, +8.9%). Together, they accounted for almost half of all new construction.

The main breakthrough was in the Odesa region, where 6,570 apartments were completed, which is 56% more than a year earlier. Growth was also seen in the Cherkasy (+51.6%), Mykolaiv (+35.8%), Chernihiv (+24.4%), and Ternopil (+23.7%) regions.

At the same time, a serious decline was recorded in the Kharkiv (-40.4%), Zhytomyr (-37.7%), Zaporizhzhia (-30.6%), Sumy (-29.1%), and Volyn (-27.2%) regions. The reasons for this are proximity to the front line, population migration, and falling demand.

Experts note that the overall decline in volume does not mean a crisis: the market is becoming more multipolar. Kyiv is gradually losing its monopoly, and new construction centers are forming in Odesa and Lviv.

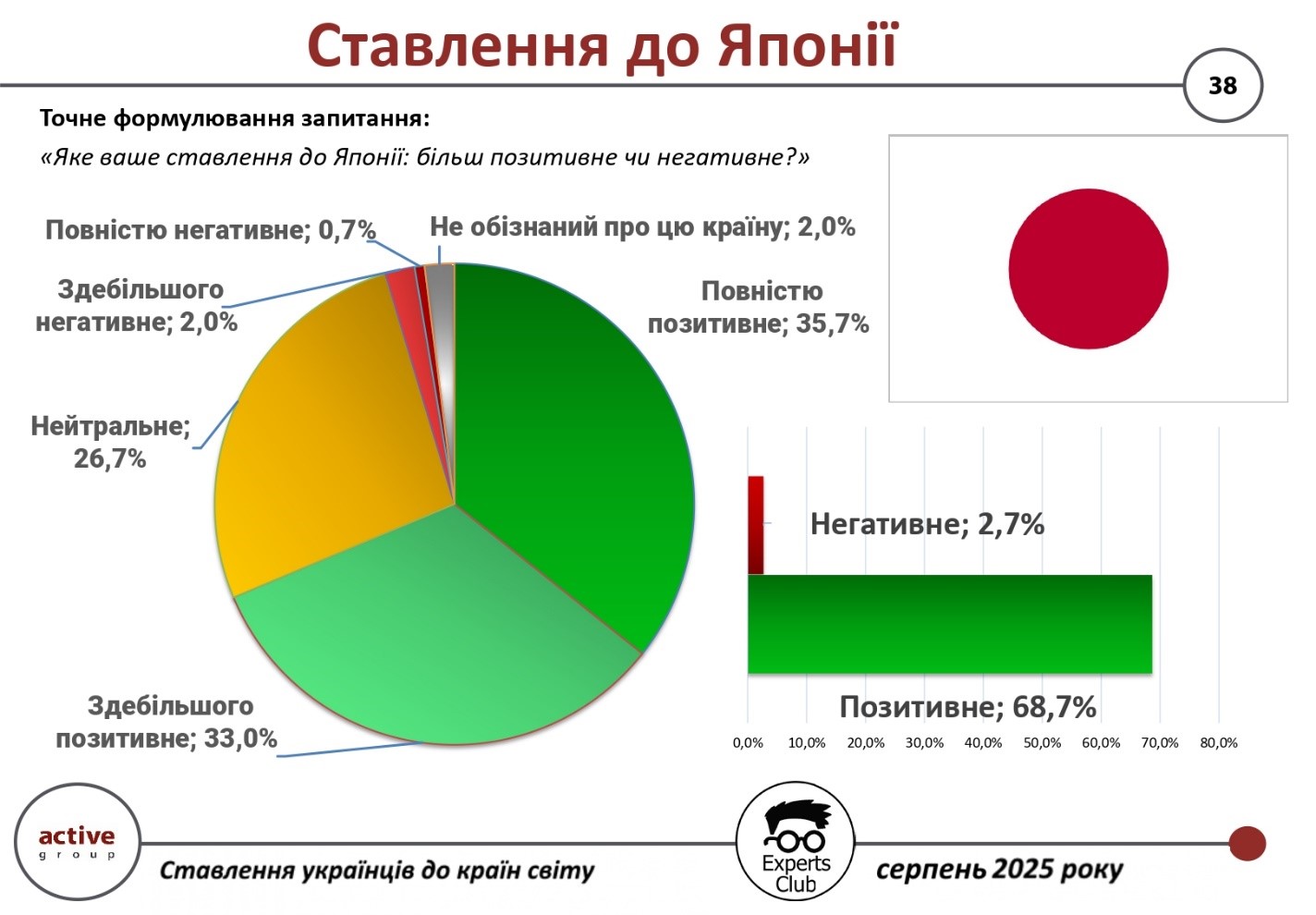

According to a survey conducted by Active Group in collaboration with Experts Club in August 2025, Ukraine has one of the most positive attitudes toward Japan among countries worldwide.

According to the study, 68.7% of Ukrainians have a positive opinion of Japan (33.0% — mostly positive, 35.7% — completely positive). Only 2.7% have a negative opinion, while 26.7% of respondents are neutral. Another 2.0% admitted that they know little about the country.

“Japan occupies a special place in the perception of Ukrainians. It is seen as an example of a country that has achieved great results through innovation, technological development, and the preservation of traditions. This level of trust can become the basis for further expansion of cooperation between our countries,” emphasized Active Group CEO Oleksandr Pozniy.

In turn, Maksim Urakin, co-founder of Experts Club, emphasized the economic dimension:

“In 2025, the total trade volume between Ukraine and Japan exceeded $521 million. At the same time, Ukrainian exports to Japan amounted to only $18 million, while imports exceeded $502 million.

This resulted in a significant negative balance of $484 million. Such an imbalance is a signal to look for new opportunities for Ukrainian goods to enter the Japanese market,” he stressed.

The study was part of regular monthly monitoring of Ukrainians’ attitudes toward key international partners.

The full video can be viewed at: https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here: https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, EXPERTS CLUB, JAPAN, Pozniy, RELATIONS, SOCIOLOGY, TRADE, UKRAINE, URAKIN